Report Overview

Timing Devices Market - Highlights

Timing Devices Market Size:

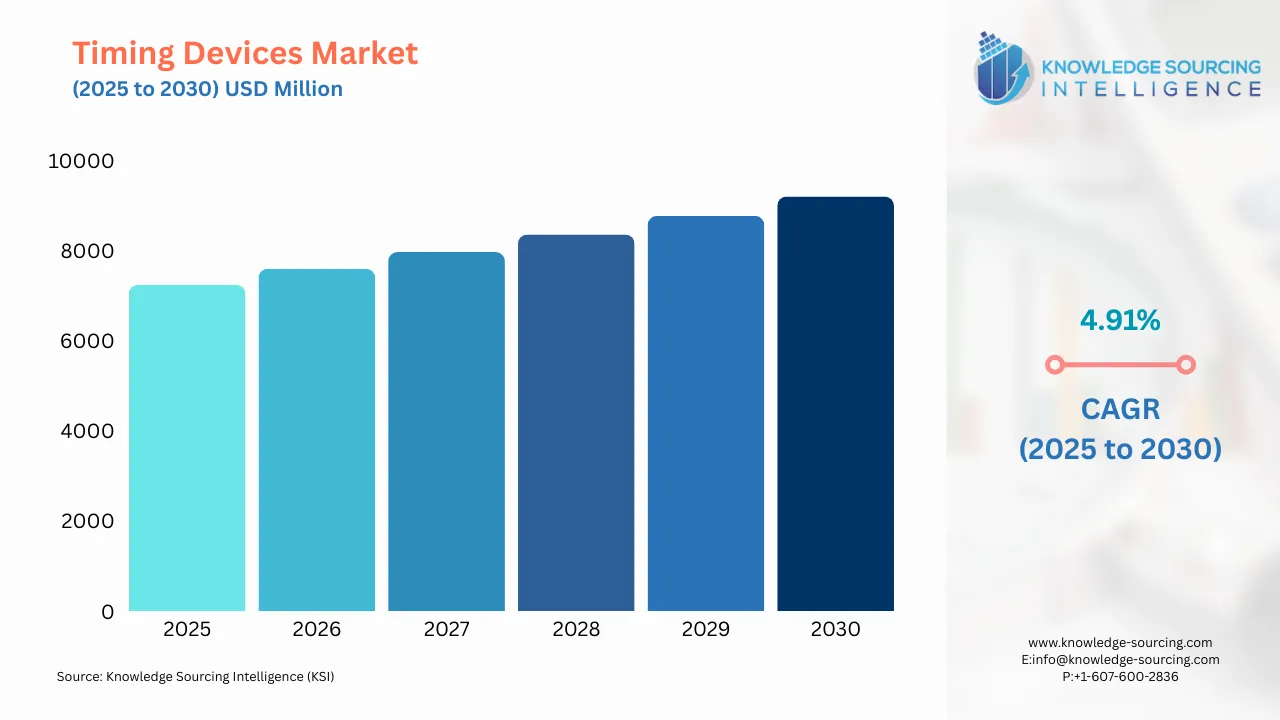

The global timing devices market is projected to grow at a compound annual growth rate (CAGR) of 4.91% to reach US$9,203.286 million by 2030, from US$7,241.143 million in 2025.

Timing Devices Market Introduction:

The timing device market, a critical segment of the global electronics industry, encompasses a range of components designed to provide precise timekeeping and synchronization for electronic systems. These devices, including oscillators, resonators, clocks, and timing modules, are integral to ensuring the seamless operation of technologies across sectors such as telecommunications, consumer electronics, automotive, aerospace, healthcare, and industrial automation. As modern technologies demand ever-higher levels of precision and synchronization, timing devices have evolved from simple timekeeping mechanisms to sophisticated systems enabling advanced applications like 5G networks, autonomous vehicles, and Internet of Things (IoT) ecosystems.

Timing devices serve as the heartbeat of electronic systems, delivering accurate frequency signals and synchronization critical for data transmission, processing, and system coordination. For instance, in telecommunications, timing devices ensure low-latency communication in 5G networks by synchronizing base stations and network nodes. In automotive applications, they enable precise coordination in advanced driver-assistance systems (ADAS) and infotainment systems, while in healthcare, they underpin the functionality of diagnostic and monitoring equipment. The increasing complexity of these applications has driven demand for timing solutions that offer high accuracy, stability, and energy efficiency, positioning the timing device market as a cornerstone of technological advancement.

The timing device market is experiencing robust growth, driven by the rapid proliferation of connected devices and the global push toward digitalization. The rise of 5G technology, for instance, has significantly increased the need for high-precision timing solutions to support ultra-reliable low-latency communications (URLLC). According to a 2024 report by the International Telecommunication Union (ITU), 5.5 billion subscribers used the Internet in 2024, underscoring the growing demand for timing devices in telecom infrastructure.

The automotive sector is another key driver, with the shift toward electric vehicles (EVs) and autonomous driving technologies amplifying the need for timing devices. Modern vehicles rely on timing components for engine control, safety systems, and vehicle-to-everything (V2X) communication, which requires microsecond-level precision. A recent press release from the Society of Automotive Engineers (SAE) highlighted that the majority of new vehicles produced in 2024 incorporated advanced timing systems for ADAS, a trend expected to grow as autonomous vehicle deployments accelerate. Additionally, the aerospace and defense sectors demand ultra-precise timing for navigation, radar, and satellite communication, further bolstering market growth.

Technological innovation is reshaping the timing device landscape, with advancements in microelectromechanical systems (MEMS) and chip-scale atomic clocks (CSACs) enhancing performance. Such innovations improve reliability and reduce power consumption, making timing devices suitable for compact, energy-sensitive applications like wearables and IoT sensors.

Recent developments highlight the market’s dynamic evolution. SiTime introduced 32 kHz oscillators for automotive applications, offering enhanced stability for ADAS and ECUs. Similarly, Microchip Technology’s 2020 acquisition of Tekron International expanded its portfolio in high-precision GPS and atomic clock solutions for smart grids. These advancements underscore the industry’s focus on innovation to meet the demands of emerging applications.

Timing Devices Market Overview:

Timing devices have multiple usages, and the demand for these is anticipated to increase due to their various benefits. Crystal-based timing devices have a wide range of safety applications, including brakes, control systems, airbags, anti-lock braking systems, and tire pressure monitoring systems.

Surging investments in the research and development of microelectromechanical systems (MEMS) devices are significantly contributing to the growth of the timing devices market. Furthermore, the expanding adoption of IoT and 5G technologies is anticipated to propel the market forward during the forecast period.

China occupies a distinctive role in the timing devices market, bolstered by its robust semiconductor manufacturing, consumer electronics industry, and strong telecommunications production capabilities. The increasing output of temperature-compensated oscillators in China is also emerging as a vital growth area within the timing devices sector. The region’s escalating demand for electronics, alongside its well-developed semiconductor and automotive industries, serves as a primary catalyst for market expansion in the Asia Pacific. India’s timing devices market is projected to experience substantial growth in the coming years.

Some of the major players covered in this report include NXP Semiconductors, Texas Instruments Incorporated, Murata Manufacturing Co., Ltd., Epson Corporation, SeikTime Creation Inc., Abracon, and STMicroelectronics, among others.

Timing Devices Market Growth Drivers:

Proliferation of 5G and IoT Technologies: The global rollout of 5G networks and the expansion of the IoT are significantly increasing the demand for high-precision timing devices. 5G networks require ultra-reliable low-latency communications (URLLC), which depend on precise synchronization to ensure seamless data transmission across base stations, edge devices, and core networks. Timing devices such as crystal oscillators and atomic clocks provide the necessary frequency stability to maintain network integrity. Similarly, IoT ecosystems, spanning smart homes, cities, and industrial applications, rely on timing solutions to synchronize data exchange among billions of connected devices. For example, smart sensors in industrial IoT setups require microsecond-level precision to coordinate real-time operations. In a recent press release, Nokia highlighted the role of advanced timing solutions in its AirScale portfolio, enabling 5G network synchronization for mission-critical applications. The growing complexity of these technologies continues to drive innovation in timing devices, with manufacturers developing compact, low-power solutions to meet the needs of next-generation networks and IoT deployments.

Automotive Advancements: The automotive industry’s shift toward EVs, ADAS, and vehicle-to-everything (V2X) communication is a major driver for the timing device market. Modern vehicles rely on timing components to synchronize complex electronic systems, such as radar, LiDAR, and camera modules in ADAS, which require precise coordination to ensure safety and performance. V2X systems, enabling communication between vehicles and infrastructure, demand high-accuracy timing to prevent latency in critical applications like collision avoidance. Additionally, the rise of autonomous vehicles amplifies the need for timing devices to support real-time decision-making. For instance, in November 2024, Murata Manufacturing introduced the XRCGE_M_F series, a MEMS-based timing device designed for automotive applications, offering enhanced stability across extreme temperatures for in-vehicle networks. As automakers continue to integrate sophisticated electronics, the demand for reliable, high-performance timing solutions is expected to grow, positioning the automotive sector as a key market driver.

Consumer Electronics Growth: The rapid adoption of consumer electronics, including smartphones, wearables, and smart home devices, is fueling demand for compact, energy-efficient timing devices. These devices require precise timing to support seamless connectivity, high-speed data processing, and power management. For instance, wearables like smartwatches rely on low-power oscillators to maintain accurate timekeeping while extending battery life. Similarly, smart home devices, such as voice-activated assistants and security systems, use timing components to synchronize data with cloud networks. The trend toward miniaturization in consumer electronics has driven innovation in timing solutions, with manufacturers developing smaller, more efficient components. SiTime launched a series of 32 kHz oscillators optimized for wearables and IoT devices, offering low power consumption and high stability. As consumer demand for connected, multifunctional devices continues to rise, the timing device market is poised for sustained growth in this sector.

Timing Devices Market Restraints:

Semiconductor Supply Chain Challenges: The timing device market faces significant challenges due to ongoing disruptions in the global semiconductor supply chain. Timing devices, which rely on semiconductor materials like silicon and quartz, are affected by shortages caused by geopolitical tensions, trade restrictions, and production bottlenecks. These disruptions increase manufacturing costs and extend lead times, impacting the ability of timing device manufacturers to meet demand. For example, the reliance on specialized fabrication processes for high-precision oscillators exacerbates supply constraints when foundries prioritize higher-volume products like microprocessors. A 2024 article from Semiconductor Engineering noted that supply chain issues continue to affect niche semiconductor components, including those used in timing devices, with lead times extending beyond 40 weeks for certain products. These challenges force manufacturers to seek alternative suppliers or invest in costly inventory buffers, restraining market growth.

Regulatory and Environmental Compliance: Stringent regulatory requirements, particularly environmental compliance standards, pose a significant restraint on the timing device market. Regulations such as the European Union’s Restriction of Hazardous Substances (RoHS) Directive mandate the use of lead-free materials and environmentally friendly manufacturing processes, increasing production costs and complexity. Compliance requires manufacturers to redesign components, adopt new materials, and invest in testing to ensure adherence to standards, which can delay product launches and raise expenses. Additionally, regulations in regions like the EU and California emphasize sustainability, pushing manufacturers to reduce energy consumption in production processes. The European Commission’s 2024 update to the RoHS Directive introduced stricter guidelines for electronic components, impacting timing device manufacturers. These regulatory pressures challenge manufacturers to balance compliance with cost-effectiveness, constraining their ability to scale production efficiently.

Timing Devices Market Segment Analysis:

By Type, Oscillators are expected to grow rapidly: Oscillators dominate the timing device market due to their critical role in generating precise, stable frequency signals for a wide range of electronic systems. These devices, including crystal oscillators, MEMS oscillators, and voltage-controlled oscillators (VCOs), are essential for applications requiring accurate timing, such as telecommunications, consumer electronics, and automotive systems. Crystal oscillators, in particular, are valued for their high stability and low phase noise, making them indispensable in 5G base stations and IoT devices. MEMS oscillators are gaining traction due to their compact size, low power consumption, and robustness, especially in automotive and wearable applications. For instance, in November 2024, Murata Manufacturing launched the XRCGE_M_F series, a MEMS-based oscillator for automotive in-vehicle networks, offering a frequency tolerance of ±40 ppm across extreme temperatures. The versatility of oscillators, coupled with ongoing innovations to reduce size and power requirements, positions them as the leading type segment. Their dominance is further driven by the increasing complexity of electronic systems, where precise frequency control is paramount for synchronization and data integrity.

By Application, the Telecommunication segment is rising rapidly: Telecommunication is the largest application segment for timing devices, fueled by the global rollout of 5G networks and the expansion of IoT ecosystems. Timing devices ensure URLLC by synchronizing base stations, network nodes, and edge devices, which is critical for high-speed data transmission and real-time applications like autonomous vehicles and smart cities. High-precision oscillators and atomic clocks are used to maintain frequency stability in 5G infrastructure, while timing modules support network synchronization in data centers. The demand for timing devices in this sector is amplified by the need for low jitter and high accuracy to meet stringent 5G standards. Nokia announced enhancements to its AirScale portfolio, emphasizing advanced timing solutions to support 5G synchronization for mission-critical applications. As telecommunications infrastructure evolves to support 6G research and IoT scalability, the reliance on sophisticated timing devices will continue to drive this segment’s dominance.

Asia Pacific is anticipated to lead the market growth: Asia Pacific leads the timing device market geographically, driven by its robust electronics manufacturing ecosystem, rapid adoption of advanced technologies, and significant investments in 5G and IoT infrastructure. Countries like China, Japan, South Korea, and Taiwan are global hubs for semiconductor and electronics production, hosting major timing device manufacturers like Murata, Kyocera, and Seiko Epson. China’s aggressive 5G rollout, with extensive base station deployments, and Japan’s focus on automotive electronics for electric and autonomous vehicles, fuel regional demand. South Korea’s leadership in consumer electronics, particularly smartphones and wearables, further strengthens the market. SiTime introduced low-power 32 kHz oscillators for Asia-based consumer electronics manufacturers, targeting wearables and IoT applications. Additionally, government initiatives, such as India’s push for smart manufacturing under the "Make in India" campaign, are increasing demand for timing devices in industrial automation. The region’s technological advancements and manufacturing capabilities solidify Asia Pacific’s position as the dominant geographic segment.

Timing Devices Market Key Developments:

May 2025: SiTime Corporation launched the Symphonic mobile clock generator, featuring an integrated MEMS resonator, which was recognized as a “Truly Innovative Electronics” product by EFY magazine. This clock generator targets mobile and IoT applications, offering high performance in compact, power-efficient designs. The Symphonic integrates clock, oscillator, and resonator technologies, reducing board space by up to 50% and addressing issues like noise and impedance matching. It is ideal for servers, switches, and acceleration cards in AI data centers, supporting the market’s shift toward miniaturized, low-power timing solutions for next-generation electronics.

November 2024: Murata Manufacturing Co., Ltd. introduced the XRCGE_M_F series, a MEMS-based oscillator designed for automotive in-vehicle networks, including advanced driver-assistance systems (ADAS) and wireless communication systems. This oscillator offers a frequency tolerance of ±40 ppm across a temperature range of -40°C to +125°C, eliminating the need for system calibration or temperature compensation. Its resin-sealed packaging and optimized crystal design ensure high reliability and stable performance, supporting applications like CAN, Ethernet IVNs, cameras, LiDAR, and wireless technologies (e.g., Bluetooth® Low Energy, NFC, ZigbeeTM, UWB).

April 2024: SiTime Corporation unveiled the Chorus family of MEMS-based clock generators, designed for AI data center applications. These devices deliver up to 10X higher performance than traditional standalone oscillators while occupying half the size. The Chorus family combines clock, oscillator, and resonator technologies into a single chip-scale system (ClkSoC), simplifying system architecture and reducing design time by up to six weeks. With low jitter and enhanced power efficiency, Chorus supports high-performance applications in servers, switches, and acceleration cards, meeting the growing demand for precise timing in AI-driven infrastructure.

January 2024: Rakon Limited launched the MercuryX product line, targeting high-growth sectors such as cloud data centers, artificial intelligence, and advanced telecommunications networks. The MercuryX IC-OCXO (oven-controlled crystal oscillator) integrates Rakon’s Mercury+ semiconductor chip with its proprietary XMEMS1 quartz crystal resonators, offering ultra-precise frequency control. This product line enhances Rakon’s portfolio for AI computing hardware and 5G infrastructure, addressing the need for high-stability timing solutions in data-intensive applications.

Timing Devices Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 7,241.143 million |

| Total Market Size in 2029 | USD 9,203.286 million |

| Forecast Unit | Million |

| Growth Rate | 4.91% |

| Study Period | 2020 to 2029 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2029 |

| Segmentation | Type, Material, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Timing Devices Market Segmentation:

By Type

Oscillators

Resonators

Others

By Material

Ceramic

Crystal

Silicon

Others

By Application

Energy Sector

Consumer Electronics

Telecommunication

Automotive

Healthcare

Others

By Geography

North America

USA

Canada

Mexico

Others

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

South Africa

Israel

Others

Asia Pacific

China

Japan

South Korea

India

Thailand

Indonesia

Taiwan

Others