Report Overview

Oxygen Scavengers Market - Highlights

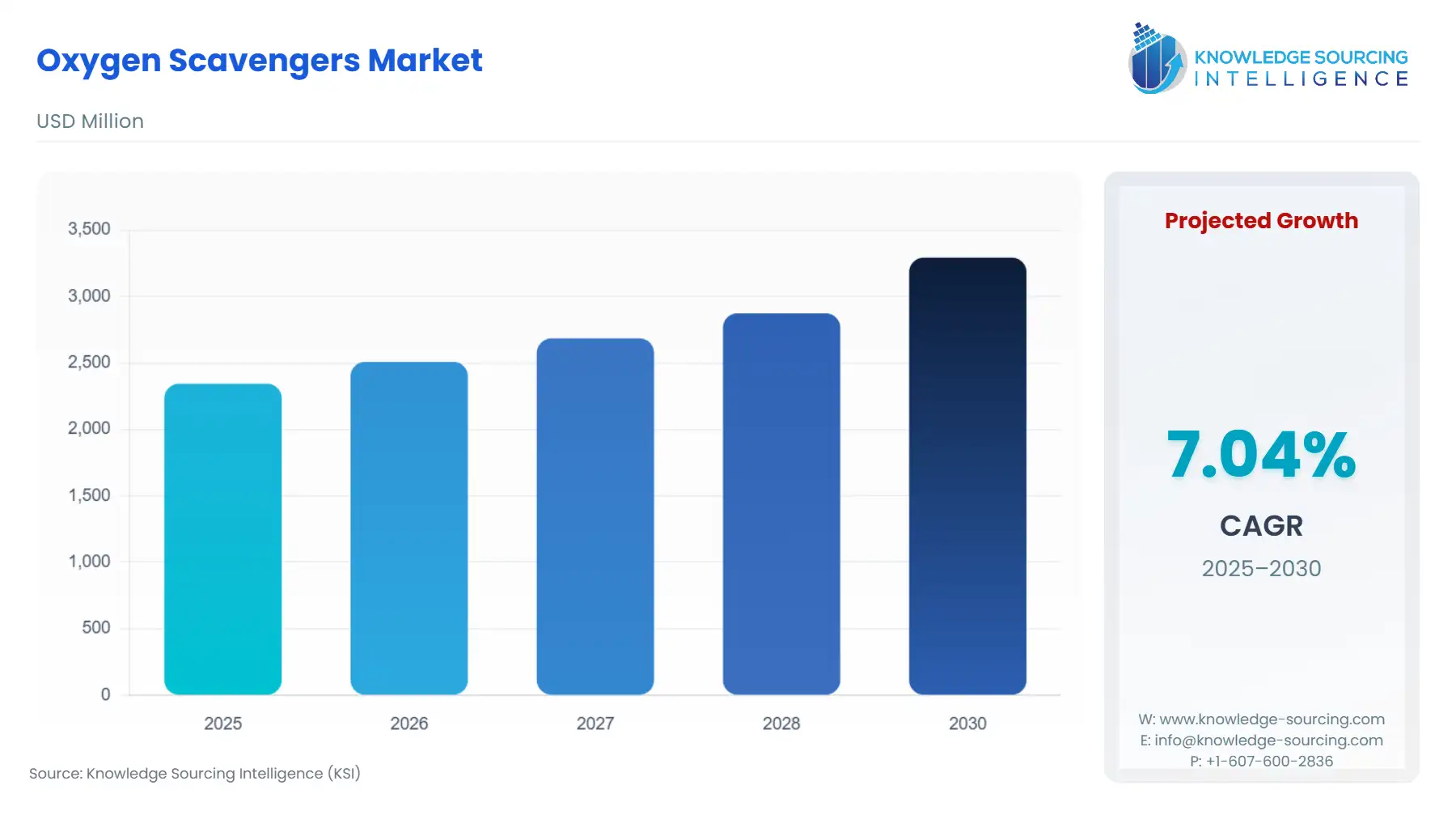

Oxygen Scavengers Market Size:

Oxygen Scavengers Market is projected to expand at a 6.83% CAGR, attaining USD 3.484 billion in 2031 from USD 2.344 billion in 2025.

Oxygen scavengers are substances added to products or systems to prevent oxygen from causing oxidation, corrosion, and other unwanted reactions. The demand for oxygen scavengers is driven by their ability to protect products and systems from the harmful effects of oxygen, including spoilage, degradation, and contamination. Oxygen scavengers are used in a wide range of industries, including food and beverage, pharmaceuticals, and oil and gas, among others. The oxygen scavengers market is highly competitive, with numerous companies offering various products and services.

The oxygen scavenger market is expected to grow during the projected period, driven by increasing demand from key industries such as food and beverage and water treatment and technological advancements in oxygen scavengers. Furthermore, factors such as increasing environmental concerns and stricter regulations regarding the use of certain chemicals may also impact the market for oxygen scavengers.

Oxygen Scavengers Market Growth Drivers:

The oxygen scavengers market is driven by the increasing demand from the food and beverage industry and the growing requirement for corrosion prevention.

The food and beverage industry is a major consumer of oxygen scavengers due to the need to preserve product quality and extend shelf life. Oxygen can cause oxidation and spoilage of food and beverages, leading to a deterioration of taste, texture, and nutritional value. Consumer preferences are shifting towards fresher and healthier products, so the demand for oxygen scavengers to maintain product integrity is expected to rise.

Further, corrosion poses a significant challenge in various industries, including oil and gas, water treatment, and manufacturing. Oxygen scavengers play a vital role in preventing corrosion by minimizing the presence of oxygen, which is a key factor in the corrosion process. As industries strive to protect their infrastructure, equipment, and pipelines from the detrimental effects of corrosion, the demand for effective oxygen scavengers is expected to increase. The National Association of Corrosion Engineers (NACE) estimates that corrosion costs the global economy billions of dollars annually. Industries such as oil and gas, water treatment, and manufacturing invest significant resources in corrosion prevention measures. Using oxygen scavengers to minimize the presence of oxygen and prevent corrosion is a recognized practice supported by industry standards and guidelines.

Oxygen Scavengers Market Segmentation Analysis:

The non-metallic oxygen scavengers segment will witness robust growth over the forecast period.

The non-metallic oxygen scavengers segment is experiencing significant growth and is expected to continue expanding over the forecast period. Non-metallic oxygen scavengers offer numerous advantages, making them increasingly popular in various industries. The pharmaceutical industry is a major contributor to the growth of non-metallic oxygen scavengers. Oxygen-sensitive drugs and medications require proper packaging to maintain their efficacy and stability. Non-metallic scavengers provide a reliable solution by actively absorbing oxygen and protecting pharmaceutical products from degradation.

Oxygen Scavengers Market Geographical Outlook:

North America accounted for a significant share of the global oxygen scavengers market.

Based on geography, the oxygen scavengers market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. North America is widely recognized for its exceptional research and development capabilities within the packaging industry. The region remains at the forefront of continuous technological advancements in oxygen-scavenging technologies, spearheading the development of novel materials and formulations. These cutting-edge innovations have significantly propelled the adoption of oxygen scavengers across various sectors, including food, pharmaceuticals, and consumer goods. The fast-paced lifestyle and demanding schedules of consumers in North America have fostered a substantial rise in the demand for convenience foods. In this context, oxygen scavengers play a pivotal role by ensuring quality preservation and extending the shelf life of packaged convenience foods. By meeting consumer expectations for freshness and taste, oxygen scavengers have become instrumental in satisfying the ever-growing demand from the convenience food sector.

Market Segmentation:

By Type

Metallic Oxygen Scavengers

Non-Metallic Oxygen Scavengers

By End-User Industry

Energy and Power

Oil & Gas

Chemical

Food & Beverage

Healthcare

Pulp & Paper

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others