Report Overview

Packaging Materials Market - Highlights

Packaging Materials Market:

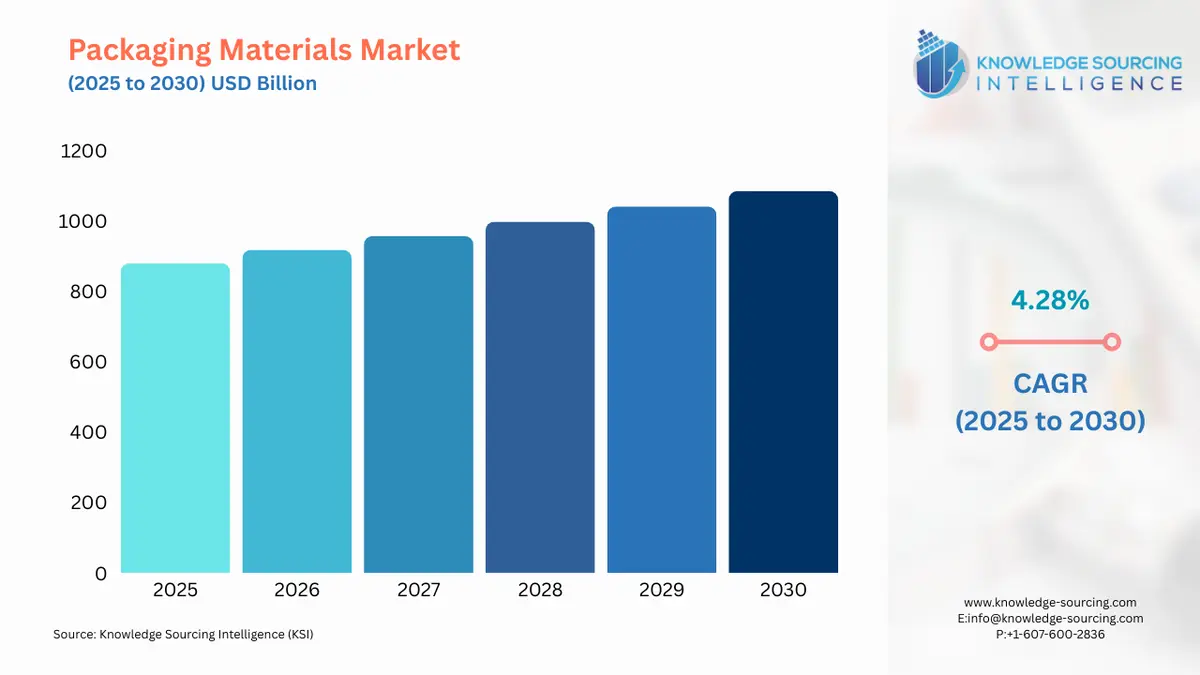

The Packaging Materials Market is expected to grow at a CAGR of 4.28%, reaching USD 1,085 billion in 2030 from USD 880 billion in 2025.

The global packaging materials market is undergoing a significant transformation, driven by an intricate interplay of consumer preferences, technological innovation, and regulatory pressures. Traditional market dynamics, once centered on cost and functionality, have evolved to prioritize sustainability, convenience, and digital integration. This shift compels manufacturers to rethink their material sourcing, production processes, and product design. The market's trajectory is no longer simply about enclosing a product; it is about creating a comprehensive solution that protects, informs, and aligns with an increasing imperative for environmental stewardship.

Packaging Materials Market Analysis

- Growth Drivers

E-commerce expansion acts as a primary catalyst for demand in the packaging materials market. The direct-to-consumer model necessitates packaging that can withstand the rigors of individual parcel shipping, driving demand for corrugated boxes, protective fillers, and specialized e-commerce solutions. This trend has directly increased the demand for paper and paperboard, as they are widely perceived as sustainable and easily recyclable materials, aligning with consumer expectations for environmentally responsible brands. The rise of online grocery delivery services further propels demand for insulated packaging and temperature-controlled materials to ensure product integrity. This is not a generalized sector growth; it is a direct increase in demand for specific types of robust and protective packaging materials, such as flexible plastic films and rigid containers designed for transit.

Consumer demand for sustainable and convenient packaging solutions directly influences material selection. As consumers become more environmentally conscious, they actively seek products with minimal or recyclable packaging. This behavioral shift creates a direct demand for materials such as recycled PET (rPET), bio-plastics, and compostable films. The trend also drives demand for resealable and single-serve packaging formats, particularly in the food and beverage sector, as they offer convenience and help reduce food waste. Manufacturers respond to this demand by innovating new material compositions and package designs, which in turn fuels the market for lightweight, flexible, and resource-efficient packaging materials.

- Challenges and Opportunities

The primary challenge facing the packaging materials market is the volatility of raw material prices. Fluctuations in the cost of pulp, plastic resins, and aluminum, influenced by geopolitical factors and supply chain disruptions, directly impact manufacturing costs and, consequently, the final price of packaging. This price instability creates a headwind for manufacturers, who must navigate a difficult balance between maintaining profit margins and offering competitive pricing to end-users. This dynamic can suppress demand from brands seeking to stabilize their own operational costs, leading to a search for more cost-effective alternative materials or a reduction in packaging use.

Simultaneously, the market presents significant opportunities rooted in technological innovation. The integration of "smart" packaging technologies, such as QR codes, RFID tags, and temperature sensors, offers a clear path for growth. These technologies increase demand for packaging materials by adding a functional, value-added layer to the physical product. Smart packaging provides real-time data on product conditions, which is crucial for sensitive goods like pharmaceuticals and fresh food, and enhances consumer engagement through interactive experiences. This creates an opportunity for manufacturers to differentiate their products and command higher prices, thereby increasing revenue. Furthermore, the development of advanced recycling technologies and the emergence of chemical recycling processes present an opportunity to address plastic waste challenges, fostering a more circular economy and meeting regulatory requirements.

- Raw Material and Pricing Analysis

The pricing of key raw materials for packaging has demonstrated a mixed and dynamic trend. In the third quarter of 2024, the price of one-side coated paper rose, driven by stronger demand for paper-based packaging solutions. This increase reflects the broader market shift towards sustainable alternatives. Conversely, prices for certain plastic films, such as BOPP (Biaxially Oriented Polypropylene) and BOPA (Biaxially Oriented Polyamide), experienced slight reductions. Aluminum foil prices remained stable at a high level. The varied price movements across different material classes highlight the complex nature of the market, where a mix of demand, logistics, and raw material availability influences pricing. For packaging manufacturers, this volatility necessitates sophisticated risk management strategies and a diversified material portfolio to mitigate cost pressures.

- Supply Chain Analysis

The global packaging materials supply chain is a complex network with distinct production hubs and logistical dependencies. A significant portion of plastic resins and paper pulp originates from a limited number of large-scale producers, creating a concentrated supply structure. This concentration can lead to vulnerabilities, as a disruption at a single major production facility or a logistical choke point can have cascading effects throughout the global chain. For instance, the production of corrugated packaging is heavily reliant on a stable supply of containerboard, which is predominantly manufactured in North America and Asia. Logistical complexities, including international shipping rates and container availability, directly impact the cost and timeline of getting raw materials to converters and finished packaging to end-users. The supply chain for recycled materials, while growing, faces its own challenges related to collection infrastructure, sorting quality, and the regulatory environment. These dependencies and complexities compel manufacturers to invest in more resilient, regional supply chains to reduce risk.

- Government Regulations

Government regulations are a critical force reshaping the packaging materials market. These policies directly impact the demand for specific materials and production practices.

- European Union: Packaging and Packaging Waste Regulation (PPWR)

The PPWR mandates that by 2030, a certain percentage of packaging must be reusable. This shifts demand from single-use materials towards durable plastics, glass, and metal containers designed for multiple cycles of use. The regulation also sets ambitious recycled content targets, directly increasing demand for post-consumer recycled (PCR) materials, particularly for plastic packaging. - United States: Plastic Packaging Tax (state-level initiatives)

States like California have implemented regulations requiring minimum recycled content in plastic beverage containers and other products. This creates a direct market for recycled resins and places a competitive disadvantage on virgin plastic producers who do not offer recycled alternatives. It also prompts brands to invest in the collection and sorting infrastructure to meet these mandates. - India: Plastic Waste Management Rules

These rules mandate Extended Producer Responsibility (EPR) for plastic packaging. This compels producers, importers, and brand owners to take responsibility for managing their post-consumer plastic waste. This regulatory framework drives demand for formal recycling partnerships, take-back schemes, and the adoption of packaging designs that are easily recyclable to lower the financial burden of EPR compliance. - Canada: Prohibition of single-use plastics

The Canadian government has banned the manufacture, import, and sale of certain single-use plastic items, including checkout bags and straws. This regulation completely eliminates demand for these specific plastic products and creates a new demand for alternative materials, such as paper, bioplastics, or reusable items, in the retail and food service sectors.

Packaging Materials Market Segment Analysis

- By Material: Paper & Paperboard

The demand for paper and paperboard packaging is experiencing a significant surge, primarily propelled by the confluence of e-commerce growth and the global push for sustainability. The expansion of online retail channels has created an immense need for protective, lightweight, and customizable shipping containers. Corrugated cardboard, in particular, has seen a direct increase in demand as it provides a robust solution for protecting goods during transit while being highly recyclable and cost-effective. Brands across all sectors, from food and beverage to electronics, are increasingly adopting paper-based packaging for its favorable environmental profile and consumer perception. This trend is further reinforced by corporate sustainability goals and regulatory incentives that favor renewable and biodegradable materials. The demand is not limited to corrugated boxes; it also extends to folding cartons, paper bags, and other paperboard formats used for primary and secondary packaging, as companies seek to replace plastic-based solutions. This segment is directly benefiting from the demand for solutions that are not only functional but also align with circular economy principles.

- By End-User: Food & Beverages

The food and beverage industry remains the single largest driver of demand for packaging materials. This demand is multifaceted, driven by shifts in consumer lifestyles, food safety regulations, and the proliferation of packaged food products. The rise of convenience culture and single-serve products, for instance, directly increases demand for flexible films, pouches, and portion-controlled containers that offer portability and extended shelf life. The industry's stringent requirements for product preservation, safety, and hygiene necessitate specialized barrier packaging, which creates a continuous demand for materials with advanced properties, such as high-barrier films for modified atmosphere packaging. Furthermore, the growth of online food delivery services and meal kits has created a new, high-volume demand stream for insulated packaging and tamper-evident solutions that maintain product integrity from preparation to final consumption. This end-user segment's persistent need for innovation to extend shelf life, ensure safety, and enhance consumer convenience will continue to fuel demand across all material types, from plastics and glass to paper and metal.

Packaging Materials Market Geographical Analysis

- US Market Analysis: The US packaging materials market is characterized by strong demand driven by robust e-commerce growth and a significant focus on consumer convenience. The US is a major e-commerce market, and this has created a powerful demand for corrugated and flexible packaging designed for direct-to-consumer shipping. The food and beverage sector, a key end-user, drives demand for single-serve and resealable packaging formats. A key factor influencing demand is the increasing adoption of sustainable packaging, propelled by consumer advocacy and state-level regulations. Companies are responding by investing in recycled content and exploring bio-based materials, which directly increases demand for these specific material types. The market is also seeing demand for smart packaging technologies, such as QR codes, that enhance consumer engagement and provide supply chain traceability.

- Brazil Market Analysis: The Brazilian packaging market is experiencing growth tied to the expansion of its domestic food and beverage industry and a growing middle class with higher disposable income. Demand for packaging materials is strong, particularly for plastic and paper-based solutions, as packaged and processed foods become more prevalent. The pharmaceutical sector is a significant growth driver, with its expansion leading to increased demand for high-quality, secure packaging. The country's e-commerce sector is also developing, which is creating a new demand for protective and efficient transit packaging. However, the market faces challenges related to infrastructure limitations, particularly in logistics and recycling, which can affect the supply chain and adoption of certain materials.

- Germany Market Analysis: Germany is a mature and highly regulated packaging market, where demand is predominantly shaped by strict environmental policies. The Packaging Act (VerpackG) compels manufacturers to take responsibility for their packaging's life cycle and meet high recycling quotas. This regulatory framework creates a powerful demand for easily recyclable mono-materials and encourages the use of post-consumer recycled content. German consumers are highly attuned to sustainability, which further reinforces the demand for eco-friendly solutions. While the market for rigid and flexible plastics remains substantial, the growth is heavily weighted towards recyclable and reusable formats. The market is also a hub for technological innovation, with demand for advanced packaging solutions that can be easily integrated into automated recycling systems.

- Nigeria Market Analysis: The Nigerian packaging market is a developing landscape with growth driven by a burgeoning Fast-Moving Consumer Goods (FMCG) sector and increasing urbanization. Demand for packaging materials, particularly flexible plastics, is high due to the widespread consumption of packaged food and beverages. The market is also seeing a rise in demand for more secure and hygienic packaging, which is being spurred by growing awareness of food safety. E-commerce is an emerging demand driver, creating a need for transit packaging solutions. However, the market faces significant headwinds, including infrastructure limitations, a fragmented supply chain, and a lack of formalized recycling programs, which constrain the adoption of sustainable packaging at scale.

- China Market Analysis: China represents one of the largest and fastest-growing packaging materials markets globally. Its sheer size is driven by massive manufacturing output across all end-user industries, from food and electronics to personal care. The demand for packaging is particularly high in the rigid plastics and paper & paperboard segments. The country's e-commerce sector is a powerhouse, necessitating a colossal volume of corrugated and flexible packaging for parcel delivery. Recent government initiatives, such as the Plastic Pollution Control Plan, are beginning to shift demand towards more sustainable alternatives, creating a growing market for biodegradable materials and recycled content. The demand for packaging is also driven by consumer demand for product safety and convenience, leading to innovative designs and materials.

Packaging Materials Market Competitive Analysis

The global packaging materials market is a landscape dominated by a few large multinational corporations that compete on a global scale through extensive product portfolios and strategic acquisitions. The competitive strategy for these firms centers on vertical integration, geographical expansion, and a strong emphasis on sustainability and innovation. These companies leverage their scale to manage raw material sourcing, optimize production, and serve a wide range of end-users.

- Amcor PLC: Amcor operates as a global leader in the development and production of responsible packaging. The company's strategic positioning is defined by its broad portfolio of both flexible and rigid packaging solutions, serving a diverse range of end-user markets, including food, beverage, pharmaceutical, and personal care. Amcor has made sustainability a core tenet of its strategy, focusing on developing packaging that is recyclable, reusable, and lighter-weight. The company's key products include a variety of plastic bottles, containers, and specialized flexible pouches and films, with a strong emphasis on high-barrier technologies that extend the shelf life of food products. Amcor's global footprint allows it to serve multinational clients and adapt to local regulatory landscapes.

- International Paper: International Paper is a major producer of fiber-based packaging and pulp products. The company’s strategic focus is on delivering sustainable, fiber-based solutions for packaging and pulp. Its primary products include containerboard, corrugated boxes, and other paper-based packaging materials. The company's strategy is to grow its presence in a world where demand for sustainable fiber-based packaging is increasing. International Paper has focused on expanding its capacity and geographic reach to meet the growing global demand from the e-commerce and food and beverage sectors. The company’s emphasis on renewable resources positions it to capitalize on the market's shift away from plastics.

- WestRock: WestRock is a provider of paper and packaging solutions. The company's strategy revolves around leveraging its integrated paper and converting operations to provide a comprehensive range of packaging solutions, from containerboard and corrugated boxes to consumer packaging and displays. WestRock’s competitive advantage lies in its ability to offer tailored packaging solutions that meet specific customer needs, particularly in the food, beverage, and consumer products markets. The company has invested in its facilities to increase efficiency and capacity, focusing on delivering sustainable packaging solutions and optimizing the supply chain for its customers.

Packaging Materials Market Developments

- June 2025: International Paper initiated a strategic exploration of a new, state-of-the-art sustainable packaging facility in Salt Lake City, Utah. The company also broke ground on a new greenfield packaging facility in Waterloo, Iowa, as part of a strategic growth initiative in North America. These projects demonstrate a commitment to increasing domestic production capacity for sustainable packaging to meet rising demand.

- April 2025: Amcor completed its all-stock acquisition of Berry Global. This acquisition was a major consolidation in the flexible and rigid packaging sectors. The deal combined Amcor's global scale in flexible packaging with Berry Global's strong position in thermoformed and rigid containers. This strategic move was aimed at expanding product offerings, creating significant cost synergies, and better serving customers with a broader range of packaging solutions across various end-markets.

- January 2025: International Paper's shareholders approved the acquisition of DS Smith for $7.2 billion USD. The acquisition, which also received approval from DS Smith's shareholders, is a strategic move to expand International Paper's footprint in Europe and create a global fiber-based packaging leader. This merger signals a major consolidation trend in the paper packaging sector.

Packaging Materials Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Packaging Materials Market Size in 2025 | USD 880 billion |

| Packaging Materials Market Size in 2030 | USD 1,085 billion |

| Growth Rate | CAGR of 4.28% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Packaging Materials Market |

|

| Customization Scope | Free report customization with purchase |

Packaging Materials Market Segmentation:

- By Material

- Plastic

- Paper & Paperboard

- Glass

- Metal

- Others

- By Type

- Rigid Packaging

- Flexible Packaging

- By End-User

- Food & Beverages

- Healthcare

- Personal Care & Cosmetics

- Industrial

- Others

- By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Our Best-Performing Industry Reports:

Page last updated on: September 19, 2025