Report Overview

Pet Food Packaging Market Highlights

Pet Food Packaging Market Size:

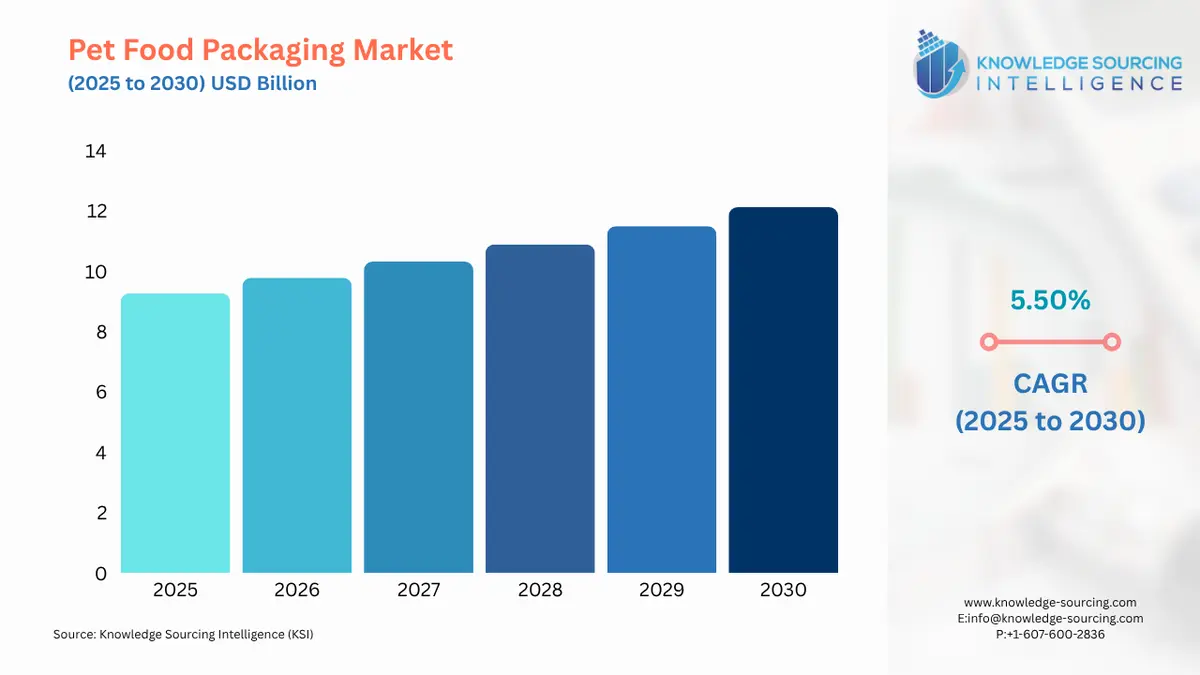

Pet Food Packaging Market is projected to expand at a 5.34% CAGR, attaining USD 12.666 billion in 2031 from USD 9.273 billion in 2025.

Pet Food Packaging Market Overview

The global pet food packaging market is experiencing tremendous growth due to increasing rates of pet ownership, greater consumer awareness of pet health, and rising demand for convenient and sustainable packaging. Packaging has an essential role in maintaining the safety, freshness, and shelf life of pet food, and is a form of marketing to attract pet owners.

The trend of rising pet ownership has had a significant impact on the pet food packaging market, as owners increasingly desire products that promote freshness, convenience, and sustainability. As a result of the growing number of pet owners, there is a demand for innovative packaging solutions that address the evolving needs of pets and their owners. According to AVMF 2024 data, the percentage of U.S. households that own dogs and own cats is 45.5% and 32.1%, respectively.

The pet food packaging market is regulated and standardised by multiple regions to ensure safety, quality, and accurate labelling of products. In the US, pet food packaging is regulated by the Food and Drug Administration (FDA) under Title 21 of the Code of Federal Regulations (CFR), which establishes requirements related to food-type materials, limits on chemical migration, and accuracy for labelling. The Federal Trade Commission (FTC) also regulates marketing claims to prevent false or misleading advertising for pet food packaging and pet food marketing. In Europe, the European Pet Food Industry Federation (FEDIAF) Guidelines provide the most comprehensive framework for pet food packaging guidelines, including specifications concerning the safety of materials, storage, shelf life, and environmental compliance.

The packaging of pet food and pet health are closely associated because packaging interacts with the safety, quality, and nutritional value of pet food. Adhering to regulatory standards and consumer demand for sustainable packaging practices is important to the health and well-being of pets globally. The average expenditure on veterinary care is $580 per household per year in the USA, with $433 for dogs and $396 for cats on average.

The global pet food packaging market’s share is held by a few main players focusing on innovation, quality, and the sustainability of packaging solutions. Companies such as Amcor PLC, American Packaging Corporation, Crown Holdings, ProAmpac LLC, Constantia Flexibles, Coveris Holdings, Polymerall LLC, Mondi PLC, Sonoco Products Company, Berry Global Inc., and Printpack deliver various packaging materials and types ranging from flexible pouches and metal cans to paperboard and plastic containers, for different kinds of pet food and animal needs. Their investment in product innovation, environmentally friendly packaging solutions, and adherence to international regulations go a long way in assuring quality, raising the attractiveness of the product on the shelf, and satisfying the changing needs of pet owners worldwide.

Pet Food Packaging Market Trends:

Pet food packaging refers to the materials and designs used to package and present pet food products. It serves multiple purposes, including preserving the freshness and nutritional value of the food, providing information about ingredients and feeding instructions, and attracting customers through appealing visuals. Pet food packaging often incorporates features like resealable closures, portion control mechanisms, and durable materials to ensure convenience and product integrity. Additionally, eco-friendly packaging options are gaining importance to address environmental concerns, with an emphasis on recyclability and sustainable materials.

The pet food packaging market refers to the industry that manufactures and supplies packaging solutions specifically designed for pet food products. It encompasses a wide range of packaging formats, including bags, pouches, cans, cartons, and more. The market is driven by factors such as the increasing demand for pet food, the growth of the pet care industry, and the rising emphasis on product safety and convenience. Key trends in the pet food packaging market include the adoption of innovative packaging designs, such as single-serve and portion-controlled options, as well as the use of eco-friendly materials to address sustainability concerns. Manufacturers in this market strive to meet the evolving needs of pet owners by offering functional, visually appealing, and reliable packaging solutions.

Pet Food Packaging Market Growth Drivers:

Increasing Pet Ownership:

The rise in pet ownership has become a major growth catalyst in the pet food packaging sector. Over the past decade, households worldwide have been bringing pets into their homes, not just as animals, but as family members. This evident shift in behaviour and culture has led product providers to experience a surge in food demand. This food requirement has driven innovation and opportunities for development in packaging solutions. Current pet owners are now more concerned with the quality, safety, and convenience of the food they provide their pets. With this change in perspective, packaging is now more than just containment: it must ensure freshness and protect against contamination, and in some cases, provide portion control that matches a pet's specific dietary requirements.

The increase in pet ownership is generally proportional to an increase in pet food consumption volume across various formats, including dry kibble, wet food, treats, and special diets. Each of these formats falls within the food category, yet requires a unique or specific packaging solution to maintain food quality. For example, dry foods may require resealable pouches to retain the crunchy quality, while wet food, packaged in cans or pouches, is sealed to protect against spoilage. As pet ownership continues to increase, food providers will also be required to provide the same quality of food in larger quantities, which will make packaging solutions more efficient, cost-effective, durable, and suitable for a family environment.

Expanding pet ownership is another growth factor, driven by the increasing variety of pets being kept. Dogs and cats remain the most common types of pets, but smaller pets, such as rabbits and birds, perhaps even some exotic pets, are becoming more popular. This increased pet ownership is promoting a greater demand for more specialized packaging, tailored not only to the types of food used for feeding pets but also to portion size. Pet ownership is also driving the development of new packaging designs and materials that are more practical for pet owners, including how they open, store, and reuse and/or reclose the packaging.

Demographics related to increasing pet ownership, such as urbanisation and rising disposable incomes, continue to foster this trend. Urbanisation leads people to live in fast-paced environments and eventually prioritising convenience. Packaging options should include easy-to-open, resealable, and portable options, appealing to city dwellers who feed their pets several times a day.

In summary, rising pet ownership is enhancing the volume of pet food sold, and this trend is changing the look of the entire pet food packaging landscape. This trend is pushing pet food manufacturers to adopt new, innovative, sustainable, and functional packaging formats. Companies that take notice of and adapt towards these growth drivers will have a better chance to gain market share and brand loyalty, as pet owners view packaging as a part of the complete product experience.

In 2023, organized retail channels, such as pet shops and superstores, in India generated 312 million USD in retail value sales for pet food, accounting for 49.6% of the total pet food market. This high percentage indicates that organized retail is the major source for pet food purchases. The growth and presence of organised retail channels influence the packaging market because manufacturers need to develop packaging that addresses consumer concerns while at the same time being within consumers’ reach on the shelves. This need will benefit formats that are larger, resealable, and/or attractive visually, as they will drive innovation and added demand in pet food packaging.

Growing Pet Care Expenditure:

Pet owners are increasingly willing to spend on high-quality pet food and related products. The pet care industry has witnessed a shift towards premium and specialized pet food, which requires attractive and functional packaging to appeal to discerning pet owners.

Focus on Health and Wellness:

Pet owners are becoming more conscious about their pets' health and well-being. They seek pet food packaging that ensures the preservation of nutritional value, freshness, and quality, allowing them to provide optimal nutrition for their beloved pets.

Convenience and Portability:

Today's pet owners lead busy lives, and they often require pet food packaging that offers convenience and portability. Packaging solutions with features such as resealable closures, easy-open mechanisms, and single-serve portions cater to the needs of on-the-go pet owners.

Product Differentiation:

With a highly competitive pet food market, manufacturers rely on packaging to differentiate their products. Unique packaging designs, materials, and branding elements help products stand out on store shelves and attract consumer attention.

Information and Transparency:

Pet owners are increasingly concerned about the ingredients and nutritional content of the food they provide to their pets. Clear and comprehensive information on packaging, such as ingredient lists, nutritional facts, and feeding guidelines, helps build trust and transparency between the brand and the consumer.

Shelf Appeal and Branding:

Visually appealing packaging plays a significant role in capturing consumer attention and creating brand recognition. Eye-catching designs, vibrant colors, and engaging graphics on packaging help products stand out among the competition and reinforce brand loyalty.

Safety and Product Integrity:

Packaging serves as a crucial factor in maintaining the safety and quality of pet food. Packaging solutions that protect against contaminants, preserve freshness, and provide proper storage and handling instructions contribute to ensuring product integrity and consumer satisfaction.

Eco-Friendly Packaging:

The growing awareness of environmental issues has prompted a demand for sustainable and eco-friendly packaging solutions. Pet owners are seeking packaging options made from recyclable or biodegradable materials, reducing their carbon footprint and contributing to a greener planet.

Regulatory Compliance:

The pet food industry is subject to stringent regulations and standards. Packaging solutions must meet food contact safety requirements, ensuring that the packaging materials do not pose any harm to pets or compromise the quality and safety of the food.

List of Top Pet Food Packaging Companies:

Open Farm, a direct-to-consumer (DTC) pet food marketer, has partnered with international recycling leader TerraCycle to offer a national pet food bag recycling program. This program allows consumers to recycle their used Open Farm pet food bags through TerraCycle's network of drop-off locations.

Mars, a leading pet food company, has partnered with SABIC and Huhtamaki to launch new recycled plastic wet pet food packaging across Europe, starting with the Sheba brand. This packaging is made from 35% recycled plastic and is fully recyclable.

Pet Food Packaging Market Segmentation Analysis:

Positive growth in the sustainable packaging segment

The segment that is experiencing rapid positive growth in the pet food packaging market is eco-friendly or sustainable packaging. With increasing environmental awareness among consumers, there is a growing demand for packaging solutions that minimize their impact on the environment. Eco-friendly packaging options made from recyclable materials or biodegradable alternatives are gaining popularity as they align with the sustainability values of pet owners. This segment's growth can be attributed to the increasing preference for environmentally conscious choices, driving brands to adopt sustainable packaging practices and meet the evolving demands of environmentally conscious consumers.

By Animal: Dog

By animal, the pet food packaging market is segmented into dog, cat, and others. Pets are now considered part of the family, which makes owners willing to spend more on specialized food and packaging that offers both function and innovation. Sustainability is becoming one of the biggest trends, with more recyclable and eco-friendly materials being used across all pet categories.

Dogs are considered one of the major companion animals due to their friendly nature, and with the growing awareness regarding their nutrition, the demand for pet foods with organic content is expected to increase. Similarly, besides food contents, the composition of packaging material also impacts the overall food quality, and with the ongoing sustainable development in packaging applications, their adoption for dog food packaging is expected to gain traction in major economies with high numbers of dog owners.

According to the American Veterinary Medical Association, in 2024, the number of US households owning dogs stood at 89.7 million, constituting 45.5% of the total US pet ownership. Cats accounted for second-best share of 32.1%, as stated by the same source. As more families choose to keep dogs, there is a rising demand for premium and health-focused foods, which has accelerated the demand for high-quality packaging in major markets.

Moreover, the steady growth in the global urban population has increased the scope for pet ownership, especially for dogs, driving demand for packaging materials offering high durability and tear resistance. Major market players, such as Mondi PLC, have established collaborations with dog pet food manufacturers, such as Saga Nutrition, which provides an extensive range of dog foods.

Pet Food Packaging Market Geographical Outlook:

The North American region is expected to hold a significant pet food packaging market share

The North American region is expected to dominate the pet food packaging market. This is primarily due to several factors, such as a high pet ownership rate, a strong pet care industry, and a well-established market for premium and specialized pet food products. Additionally, the region's emphasis on product safety, convenience, and sustainability aligns with the evolving needs and preferences of pet owners. The presence of key players in the packaging industry and their focus on innovation further contribute to North America's dominance in the pet food packaging market.

Pet ownership in the United States is experiencing considerable growth, fuelled by demographic shifts and increased urbanization, which has positively impacted the demand for companion animals. Similarly, this increased frequency has further accelerated expenditure on pet food products. For instance, according to the data provided by the American Pet Products Association, in 2024, the total expenditure of the US pet industry stood at USD151.9 billion, with food constituting 43.3% of the total expenditure.

Additionally, the same source specified that the projected expenditure for 2025 will reach USD157 billion, with expenditure on food products & treats reaching USD67.8 billion. With this growing food expenditure, the demand for convenient, performance-oriented and easily accessible packaging is anticipated to grow in the US market.

Moreover, the e-commerce sector is flourishing in the United States, and with the increasing frequency of online purchases, the demand for customized packaging that displays necessary nutritional information and labeling is projected to grow. Major organizations, such as Packaging Corporation of America, are investing in meeting the personalized packaging concepts, which have created new growth prospects for the pet food packaging market.

Major market players, namely American Packaging Corporation, Amcor PLC, Mondi Plc, and Sonoco Products Company, have established regional centers in the United States to optimize the growing market potential in the pet food segment. The companies are investing to promote sustainability in their packaging material. For instance, in December 2024, Amcor’s subsidiary Berry Global Group Inc. formed a collaboration with VOID Technologies to commercialize high-density PET films specifically designed for pet food packaging. The material will offer higher-strength, tear resistance, and store drop-off recycling.

Pet Food Packaging Market Major Products

Flexible Pouches and Bags: Amcor offers flexible pouches and bags designed for pet food packaging. These solutions provide convenience and protection, ensuring the freshness of pet food products.

Rigid Containers: Rigid containers from Amcor are used for packaging pet food, offering durability and protection during transportation and storage. These containers help maintain the integrity of the product.

Trays and Lidding Films: Amcor provides trays and lidding films for pet food packaging, suitable for both wet and dry food products. These solutions ensure product safety and extend shelf life.

Pet Food Packaging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Pet Food Packaging Market Size in 2025 | USD 9.273 billion |

Pet Food Packaging Market Size in 2030 | USD 12.119 billion |

Growth Rate | CAGR of 5.50% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Pet Food Packaging Market |

|

Customization Scope | Free report customization with purchase |

Pet Food Packaging Market Segmentation:

By Material

Paper and Paperboard

Metal

Plastic

By Packaging Type

Pouches

Folding Cartons

Metal Cans

Bags

Others

By Type of Food

Dry Food

Wet Food

By Animal

Dog Food

Cat Food

Other

By Distribution Channel

Online

Offline

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others