Report Overview

Pick to Light Market Highlights

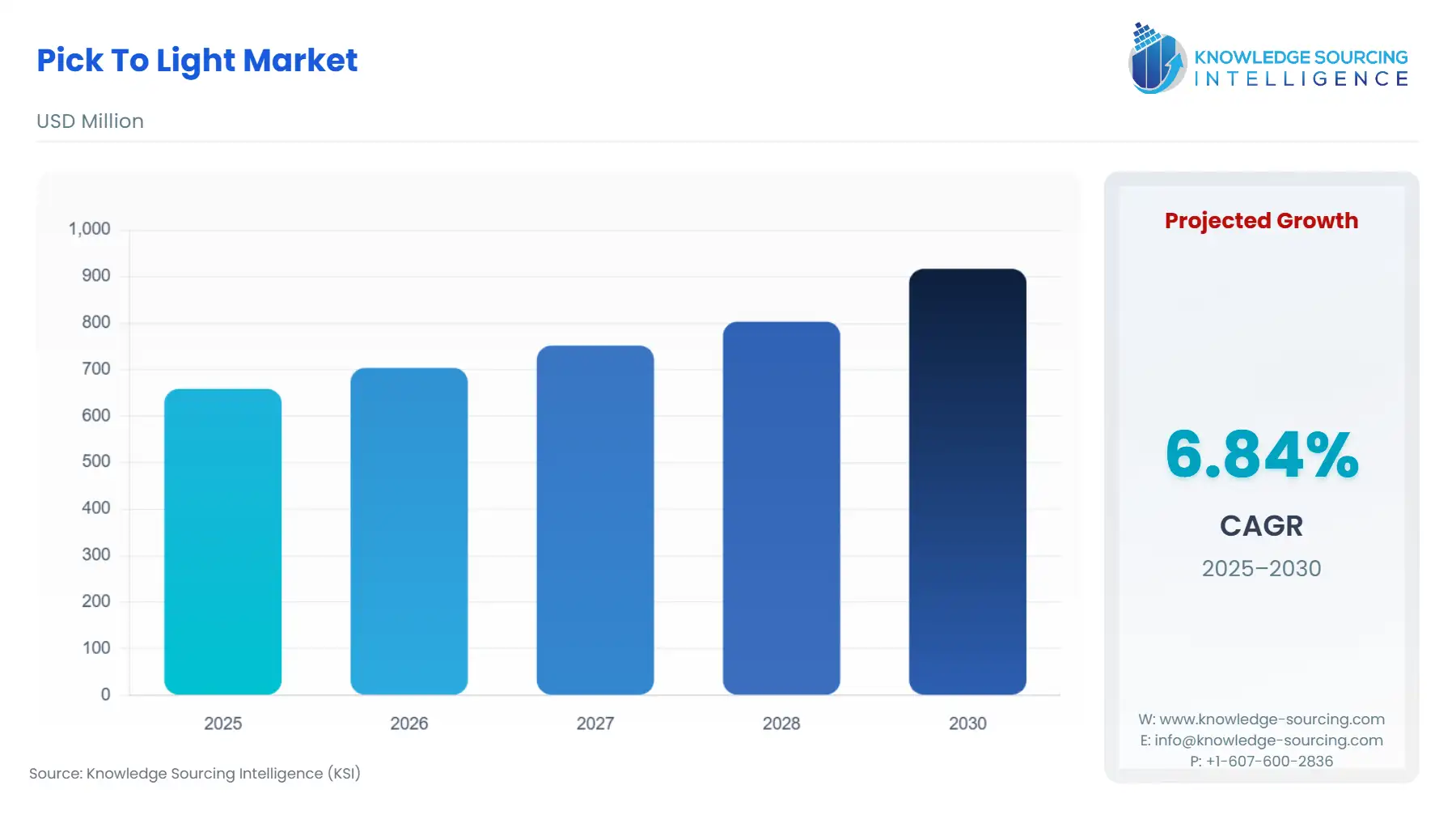

Pick To Light Market Size:

The pick to light market is expected to grow from US$658.663 million in 2025 to US$916.854 million in 2030, at a CAGR of 6.84%.

The rise of highly automated warehouses and the expansion of the e-commerce sector coupled with the globalization of supply chain networks is significantly propelling the pick to light market growth. Pick to light procedures are error-free and better in productivity, with enhanced labor utilization. The retail and e-commerce industries are likely to grab the substantial shares of the market owing to the necessity for rapid and efficient delivery of goods in this industry. The expanding online shopping trend is motivating warehouses to adopt pick to light systems to assure the timely and accurate delivery of goods. Several companies have launched products to enhance customer experience in addition to collaborating with other firms to broaden their market spectrum.

Pick To Light Market Growth Driver:

- The pick to light market is driven by rising e-commerce trend.

The worldwide pick to light industry is expanding as e-commerce advances, automated warehouses boost efficiency, and the online shopping trend rises. With pick to light technology, e-commerce order fulfilment become significantly more effective and operator mistakes are decreased. This form of supply chain technology is quite popular in terms of order-picking efficiency and warehouse management. The market for pick-to-order items is expected to grow as warehouse management becomes more popular because of fast worldwide e-commerce development. Due to this, the growth of the e-commerce segment is anticipated to boost market sales during the projected period.

Trade Port 2, a Radial eCommerce fulfilment center in Louisville, KY, provides world-class fulfilment services for a prominent worldwide specialty retailer in the health and beauty industry. The Radial team at Trade Port 2 used automated unit sorters, packing, and SLAM machines to automate the distribution of products across the warehouse. Radial needed an AI-first robotic system that could learn and adapt to a wide range of SKUs while achieving the Trade Port 2 facility's throughput needs. They also required a solution that could be easily linked with their existing warehouse management system (WMS) and pick to light systems, as well as their upstream and downstream material handling operations. The Radial team has a clear competitive edge, as do their clients, with the launch of 12 Covariant U-Shaped Putwalls in January 2023 and completely integrated into Trade Port 2's operations. At maximum capacity, each robot can perform around 100,000 picks per month and 425 putts per hour (PPH).

Moreover, in September 2022, Instacart and Good Food Holdings collaborated to create the first Instacart Platform-powered Connected Store in Irvine, California, at Bristol Farms. Retailers may use Carrot Tags to link electronic shelf labels to the Instacart Platform, allowing them to add features like pick to light capabilities, which enable consumers, associates, or Instacart shoppers to pick a product on their mobile and flash a light on the accompanying shelf tag.

Pick To Light Market Key Developments.

- In August 2022, Softeon, a worldwide supply chain software supplier with the finest client success record in the industry, introduced new features to its market-leading software solutions for third-party logistics (3PL) providers, resulting in new customer relationships. Flexible "select route" configuration, a built-in package management system, labeling, and document printing capabilities, a pick to light feature, and many other special attributes are key Softeon solution elements for 3PLs.

- In September 2022, FastFetch, a supplier of warehouse fulfillment systems such as pick to light and place-wall solutions, established cooperation with Singapore-based A-Plus Automation. The firm engages in and provides warehouse completion and sorting systems to the regional Southeast Asia e-commerce market, and the company plans to collaborate with FastFetch to bring revolutionary pick to light, Put Wall, and WCS technologies to end customers. With FastFetch's extensive experience in warehouse fulfillment, this collaboration’s objective is to improve the customer experience and allow A-Plus to reach Asian industries.

Pick To Light Market Geographical Outlook:

- North America accounts for major shares of the pick to light market.

The North American pick to light market is segmented into the United States, Canada, and Mexico. The pick to light market in the USA is estimated to account for a decent share of the market owing to the increasing prevalence of automation in the country.

The United States pick to light market is being augmented by the increasing number of warehouses in the country, as these pick to light systems make warehouses work more efficient. According to the Bureau of Labor Statistics, the US warehousing and storage sector saw an increase of 13.6% in the workforce from April 2020 to April 2021, due to an increase in the number of warehouses in the country. This increase is attributable to the growing retail and e-commerce activities in the country, which is likely to significantly propel the market growth during the forecast period.

With the growing retail industry in the country, the market is likely to be driven considerably. According to the US Department of Commerce, retail sales are forecasted to show positive growth in the coming years. This growth of the retail sector is thus expected to conversely increase the demand for pick to light systems as well, since with this technology, the picking efficiency and accuracy are enhanced, while lowering the labor costs.

Pick To Light Market Segmentation Analysis:

- Based on sales channel, the pick to light market is expected to witness positive growth through online segment.

The online segment will witness promising growth since the expansion of distribution channels and growing internet penetration, particularly in developing economies which are supporting the growth of this segment during the given time frame. The key factors supplementing the growth of this segment include the inclination of consumers to make purchases online coupled with the booming penetration of the internet primarily in developing economies such as India and China among others. Moreover, the expansion of sales channels and the growing availability of these products on online platforms also play a significant role in shaping market expansion.

Pick To Light Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | US$658.663 million |

| Total Market Size in 2031 | US$916.854 million |

| Growth Rate | 6.84% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Components, Method, Module, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Pick To Light Market Segmentation:

- By Components

- Hardware

- Software

- By Method

- Manual

- Automatic

- By Module

- Wireless

- Wired

- By End-User

- Retail & E-Commerce

- Manufacturing

- Logistics

- Automotive

- Pharmaceuticals

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America