Report Overview

Privileged Identity Management Market Highlights

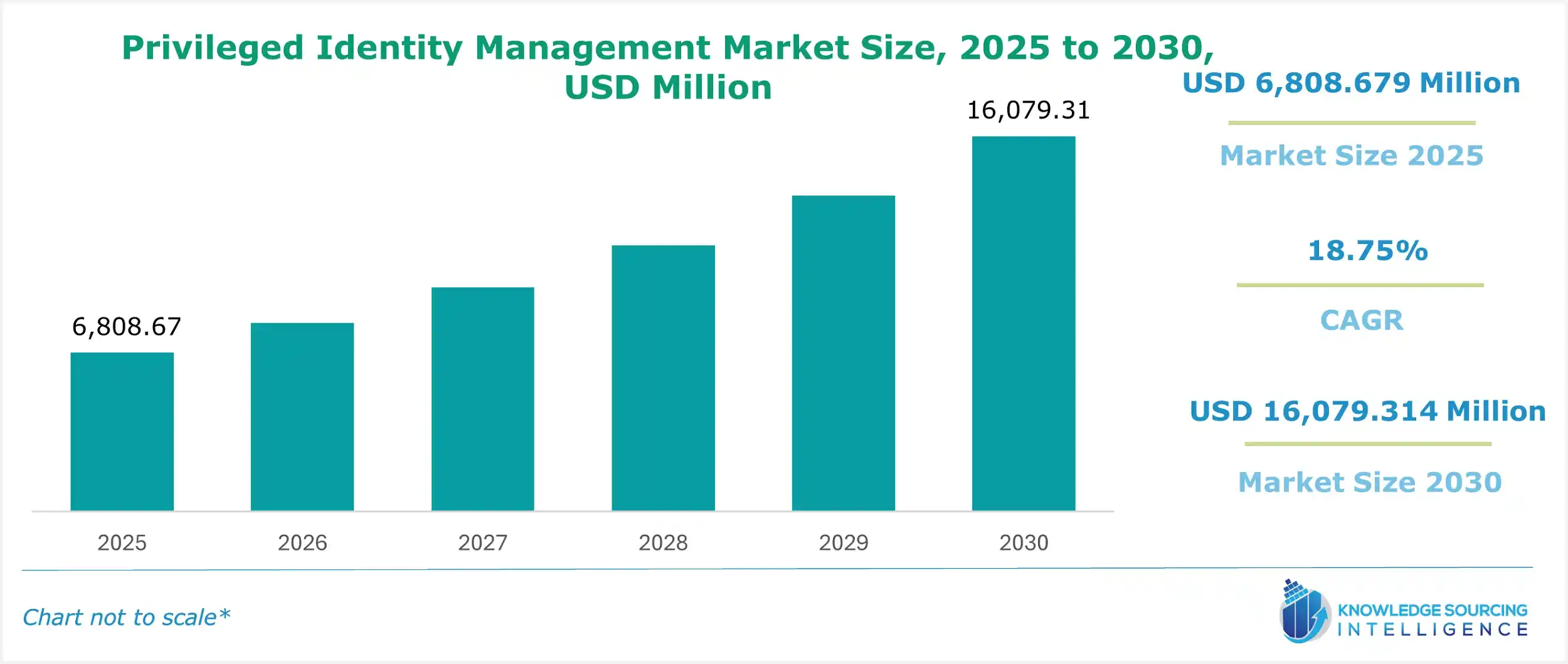

Privileged Identity Management Market Size:

The Privileged Identity Management Market is expected to increase from USD 5.736 billion in 2025 to USD 10.336 billion in 2030, at a CAGR of 12.50%.

The Privileged Identity Management (PIM) market is a pivotal segment within the global cybersecurity landscape, dedicated to securing, managing, and monitoring privileged accounts that possess elevated access to an organization’s critical systems and sensitive data. These accounts, often used by IT administrators, system operators, or automated processes, are prime targets for cybercriminals due to their extensive permissions, making robust PIM solutions essential for mitigating risks. PIM technologies encompass identity governance, access control, multi-factor authentication (MFA), and session monitoring, while services include implementation, consulting, and ongoing support.

The PIM market is vital in securing enterprise environments through privileged access management (PAM). It emphasizes safeguarding privileged account security by utilizing strong identity security platforms. Advanced credential management ensures secure storage and rotation of sensitive credentials, while session monitoring provides real-time oversight of privileged activities to detect anomalies. Access governance ensures compliance with regulatory standards, mitigating risks of unauthorized access. As cyber threats escalate, innovations in PAM solutions enhance scalability and integration with cloud and hybrid systems. This market empowers organizations to safeguard critical assets, ensuring secure and efficient management of privileged identities.

The market is segmented by account type (attended, unattended), component (solution, services), deployment model (on-premise, cloud), enterprise size (small, medium, large), end-user (Banking, Financial Services, and Insurance (BFSI), retail, government, communication & technology, others), and geography (North America, South America, Europe, Middle East and Africa, Asia Pacific). Fueled by escalating cyber threats, stringent regulatory requirements, and the rapid shift to cloud-based infrastructures, the PIM market is experiencing significant growth.

Privileged Identity Management Market Overview:

Privileged Identity Management focuses on safeguarding accounts with elevated permissions, which are critical to organizational operations but vulnerable to exploitation. Attended accounts are managed by human users, such as IT administrators, while unattended accounts support automated processes like scripts or IoT devices. PIM solutions provide tools for credential management, access restriction, and real-time monitoring, while services ensure seamless deployment and maintenance. On-premise deployments offer greater control, whereas cloud-based solutions provide scalability and flexibility, catering to diverse enterprise needs. The market serves small, medium, and large enterprises across industries like BFSI, retail, government, and communication & technology, addressing unique security challenges in each sector.

In 2024, the global PIM market was valued at approximately $7 billion, with projections estimating growth to $15 billion by 2030 at a compound annual growth rate (CAGR) of 13.5%. This growth is driven by the increasing sophistication of cyberattacks, the need for regulatory compliance, and the proliferation of cloud and IoT technologies. Leading companies, such as CyberArk Software Ltd., BeyondTrust Corporation, and Microsoft, are advancing the market with AI-driven analytics and cloud-native PIM solutions. The market’s expansion reflects the critical need to protect against insider threats, external breaches, and compliance violations, positioning PIM as an essential component of modern cybersecurity frameworks.

Privileged Identity Management Market Trends:

The PIM market is advancing with AI-driven PIM, utilizing ML for cybersecurity to detect threats in real-time. Just-in-time (JIT) access and zero trust security PIM minimize attack surfaces, ensuring dynamic access control. Cloud-native PIM and SaaS PIM solutions enhance scalability for hybrid environments. Non-human identity management and API security PIM address risks from bots and integrations. DevOps secrets management streamlines secure development pipelines. Passwordless PIM, incorporating biometric authentication PIM, strengthens security while improving user experience. Risk-based access control adapts to threat levels, driving innovation in securing privileged identities across industries.

Privileged Identity Management Market Growth Drivers:

Several factors are driving the PIM market’s growth:

- Escalating Cyber Threats: The rise in cyberattacks targeting privileged accounts fuels demand for PIM solutions. In 2023, the Cybersecurity and Infrastructure Security Agency (CISA) reported a 40% increase in breaches involving privileged credentials, underscoring the need for robust access controls.

- Regulatory Compliance Mandates: Strict regulations, such as the EU’s General Data Protection Regulation (GDPR) and the U.S. Sarbanes-Oxley Act (SOX), require organizations to secure privileged accounts, driving adoption of PIM solutions to meet compliance standards.

- Cloud and Digital Transformation: The shift to cloud-based infrastructures and digital transformation initiatives, including IoT and remote work, increases the need for PIM to secure distributed environments. In 2024, 60% of enterprises planned to expand cloud workloads, boosting demand for cloud-based PIM.

- Growing Enterprise Complexity: The increasing complexity of IT environments, with diverse applications and devices, necessitates scalable PIM solutions to manage privileged accounts and mitigate risks.

Privileged Identity Management Market Restraints:

The PIM market faces several challenges:

- High Implementation Costs: Deploying PIM solutions, especially on-premise systems, involves significant costs for software, hardware, and integration, which can be prohibitive for small and medium enterprises (SMEs).

- Shortage of Cybersecurity Expertise: The complexity of PIM systems requires skilled professionals, and a global shortage of cybersecurity talent hinders effective implementation and management.

- Integration with Legacy Systems: Integrating PIM solutions with outdated IT infrastructure can be challenging, slowing adoption in organizations with legacy systems.

Privileged Identity Management Market Geographical Analysis:

- North America

North America holds the largest share of the PIM market, accounting for approximately 40% of global revenue in 2024, driven by its advanced cybersecurity infrastructure, widespread cloud adoption, and stringent regulatory environment. The U.S. leads due to its concentration of large enterprises, technology firms, and government agencies, with significant investments in cybersecurity. In 2023, the U.S. government allocated $2.6 billion to enhance federal cybersecurity, including PIM solutions for securing government networks. The BFSI segment dominates in North America, as financial institutions face heightened risks from cyberattacks and must comply with regulations like SOX and the Payment Card Industry Data Security Standard (PCI DSS).

The cloud deployment model is also prominent, with 65% of U.S. enterprises adopting cloud-based security solutions in 2024, driven by platforms like Amazon Web Services (AWS) and Microsoft Azure. Canada and Mexico contribute through growing digital transformation efforts, particularly in the communication & technology sector, where cloud-based PIM solutions are increasingly adopted.

- Asia Pacific

Asia Pacific is the fastest-growing region for PIM, with a projected CAGR of 15.8% from 2024 to 2030, fueled by rapid digitalization, increasing cyber threats, and supportive government policies. China and India are key contributors, with China’s cybersecurity market valued at $12 billion in 2024, driven by its expansive IT sector and mandates under the Cybersecurity Law. India’s Digital India initiative, backed by a $1.5 billion investment in 2023 for cybersecurity enhancements, promotes PIM adoption across industries. The communication & technology segment dominates, as tech companies and startups in Japan, South Korea, and India prioritize securing privileged accounts in cloud and IoT environments. The cloud deployment model also leads, with 60% of Asia Pacific enterprises adopting cloud-based PIM solutions in 2024, driven by scalability and cost efficiency. Emerging economies like Thailand and Indonesia further bolster growth through SME-driven digital transformation and increasing cybersecurity awareness.

Privileged Identity Management Market Segment Analysis:

- Cloud Deployment Model

The cloud deployment model accounted for approximately 55% of the PIM market in 2024, driven by its scalability, flexibility, and ability to support distributed IT environments. Cloud-based PIM solutions enable organizations to manage privileged accounts across multi-cloud and hybrid environments, catering to the needs of remote workforces and IoT ecosystems. In February 2023, Procyon launched a cloud-based Privileged Access Management (PAM) solution tailored for multi-cloud environments, simplifying identity management for enterprises.

The segment’s growth is fueled by the rapid rise in cloud adoption, with 60% of enterprises planning to increase cloud workloads in 2024, according to IT management trends. Cloud-based PIM solutions also facilitate compliance with regulations like GDPR by providing automated updates and real-time monitoring, making them ideal for BFSI and communication & technology sectors. The segment’s dominance is expected to persist as organizations prioritize agile and cost-effective security solutions.

- BFSI End-User Segment

The BFSI segment is the largest end-user category, representing 25% of the PIM market in 2024, driven by the sector’s need to protect sensitive financial data and comply with stringent regulations. Financial institutions are prime targets for cyberattacks, with a 40% increase in identity fraud incidents reported by the Federal Trade Commission (FTC) in 2023, a trend continuing into 2024. PIM solutions in BFSI enable secure access management, MFA, and session monitoring to prevent unauthorized access to critical systems like payment gateways and customer databases. In March 2024, Delinea enhanced its PIM offerings for financial institutions by integrating identity governance and access controls, following its acquisition of Fastpath. The segment’s growth is supported by the rise of digital banking and mobile payments, with global online payment transactions reaching $6.7 trillion in 2023, necessitating robust PIM solutions to secure privileged credentials.

Privileged Identity Management Market Key Developments:

- In April 2025, Delinea and Microsoft Partner for PIM Transition. With the announcement of Microsoft phasing out its Entra Permissions Management by October 2025, Delinea announced a partnership to assist customers transitioning from its Privilege Control for Cloud Entitlements (PCCE) offering which is cloud-native. A sensible move to manage human and machine identities securely across Azure, AWS, and GCP.

- In April 2025, Inetum Partners with Delinea in Belgium. Inetum Belgium entered into a co-operation with Delinea to provide cloud-native Privileged Access Management (PAM) solutions to organisations in Belgium - simplifying the privileged access management experience, while improving the security posture for organisations at scale.

- In July 2025, Palo Alto Networks officially announces plans to acquire CyberArk. Palo Alto Networks announced its intention to acquire CyberArk with an approximate value of $25 billion, which will timestamp into the identity-first security space in light of the threats of AI-generated events occurring.

List of Top Privileged Identity Management Companies:

- BeyondTrust Corporation

- CyberArk Software Ltd.

- Thycotic

- One Identity LLC

- Delinea Inc.

Segmentation

- By Account Type

- Attended

- Unattended

- By Component

- Solutions

- Services

- By Deployment Model

- On-Premise

- Cloud

- By Enterprise Size

- Small

- Medium

- Large

- By End-User

- BFSI

- Retail

- Government & Defense

- IT & Telecommunication

- Healthcare

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America

Privileged Identity Management Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Privileged Identity Management Market Size in 2025 | US$6,808.679 million |

| Privileged Identity Management Market Size in 2030 | US$16,079.314 |

| Growth Rate | CAGR of 18.75% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Privileged Identity Management Market |

|

| Customization Scope | Free report customization with purchase |