Report Overview

Identity and Access Management Highlights

Identity And Access Management (IAM) Market Size:

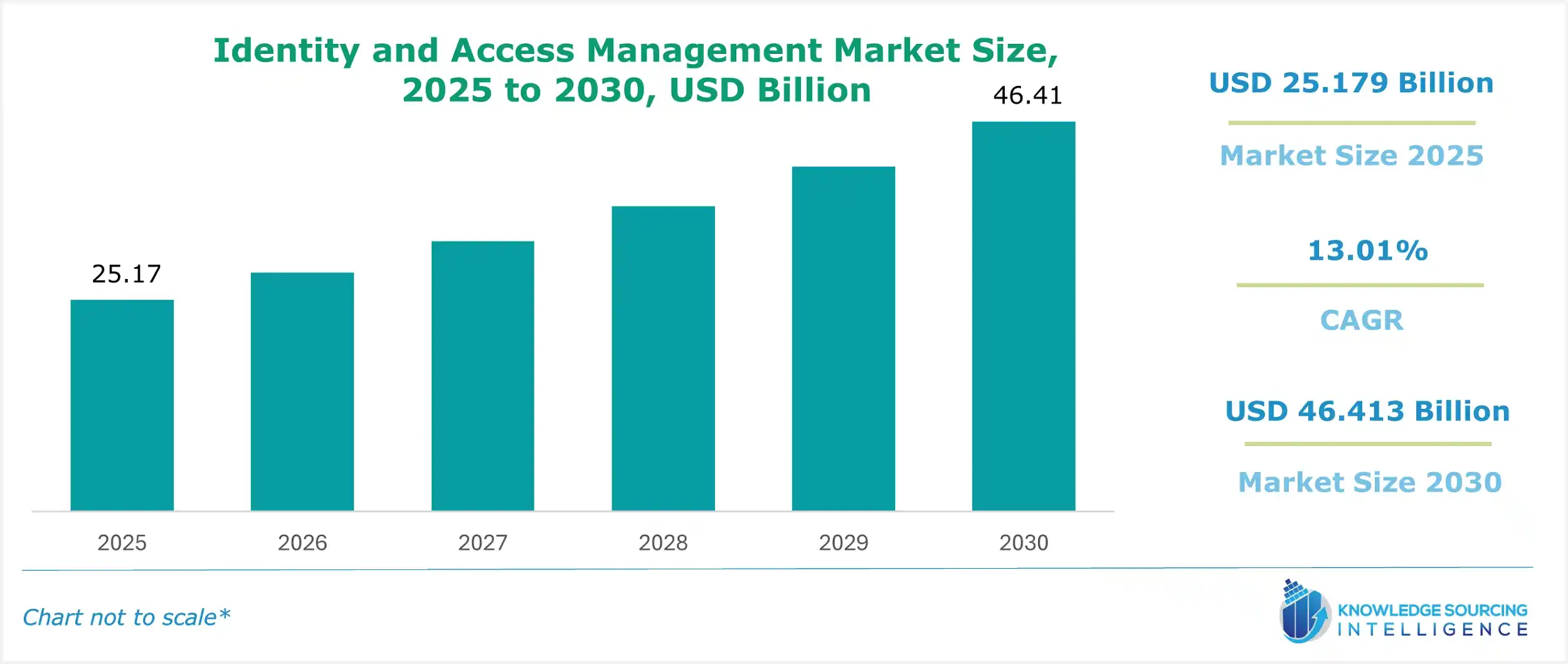

The Identity and Access Management (IAM) Market is expected to grow from USD 25.179 billion in 2025 to USD 46.413 billion in 2030, at a CAGR of 13.01%.

Identity And Access Management (IAM) Market Overview:

The Identity and Access Management (IAM) market is critical for securing digital ecosystems, driven by innovations like Zero Trust IAM, passwordless authentication, and multi-factor authentication (MFA). These technologies enhance user experience while ensuring robust cybersecurity. Single sign-on (SSO) simplifies access, privileged access management (PAM) secures critical systems, and identity governance and administration (IGA) ensures compliance. Customer identity and access management (CIAM) enables seamless consumer interactions, while workforce IAM optimizes employee access. Emerging decentralized identity (DID) and verifiable credentials promote secure, user-centric authentication, addressing evolving cyber threats across enterprises, cloud environments, and consumer platforms.

IAM technology manages digital identities by enforcing corporate policies, enabling IT managers to restrict access to sensitive information. It ensures secure identity storage and supports data governance, sharing only essential data. The rise of digitalization in industries like finance, healthcare, and retail drives market growth, as organizations prioritize security governance to combat increasing cyberattacks.

Advanced technologies like blockchain enhance IAM by providing transparency and secure access control, gaining traction across sectors. Artificial intelligence (AI) and machine learning (ML) improve IAM systems by detecting anomalies and enhancing authentication processes. The growing complexity of dispersed systems, poor security services, and regulatory compliance demands fuel IAM adoption. The Asia-Pacific (APAC) region is witnessing rapid growth due to digital transformation, while North America and Europe lead due to stringent data protection regulations like GDPR and CCPA.

Challenges include data security risks and high implementation costs, particularly for smaller enterprises. However, companies are innovating with cost-effective solutions and integrating AI-driven analytics to address these issues. The IAM market is poised for sustained growth, driven by cloud adoption, remote work, and the need for secure access management. As cybersecurity threats evolve, IAM solutions will remain essential for protecting digital assets and ensuring regulatory compliance globally.

Identity And Access Management (IAM) Market Trends:

The Identity and Access Management (IAM) market is central to digital transformation, bolstering cybersecurity against advanced cyber threats. Supply chain security and non-human identity management address vulnerabilities in interconnected ecosystems, including IoT identity and AI agent identity for secure device and bot interactions. Data privacy compliance drives adoption of robust IAM frameworks to meet global regulations like GDPR and CCPA. Hybrid work security ensures safe access for distributed workforces, while API economy security protects dynamic integrations. Innovations like Zero Trust IAM, passwordless authentication, and multi-factor authentication (MFA) enhance user experience and security governance.

The Asia-Pacific region sees rapid growth due to digitalization, while North America and Europe lead with stringent compliance mandates. Despite challenges like high costs, AI-driven analytics and blockchain integration offer scalable, cost-effective solutions. The IAM market continues to evolve, safeguarding enterprises, cloud environments, and emerging technologies in a dynamic digital landscape.

Identity And Access Management (IAM) Market Growth Drivers:

- One of the prime reasons driving the demand for IAM technology is the growing demand and adoption of sophisticated technology, which facilitates effective and efficient working in the organization.

IAM-technology-based software, such as blockchain, machine learning & AI, and others, has witnessed a significant surge in penetration across different industry verticals. The increase in internet penetration and surge in adoption of cloud computing are anticipated to support the market, driving significant growth. Machine learning & AI have witnessed robust adoption over the years owing to their lucrative yield and promising prospects. Moreover, the onset of the COVID-19 pandemic, the implementation of lockdown, and the adoption of a work-from-home culture have notably increased the adoption of AI. An article published by Harvard Business Review states that an internal survey revealed that 55% of companies accelerated their AI technology in 2020. By 2021, the ratio had increased to 67%. The trends are projected to continue in 2022 and 2023.

Identity And Access Management (IAM) Market Company Offerings:

Oracle offers identity and access management solutions for both cloud and on-premise deployment. The IAM technology is effective in managing enterprise workload by providing flexible protection, integrating highly scalable identity management software, and having built-in IAM technology. The solution comes in 6 variations, which are reframed as per the client's requirement. Yielding promising results, in August 2020, the city and county of San Francisco contracted with Oracle to provide its IAM solution.

One of the leading companies operating in the market is IBM. The company’s Identity Governance and Administrative (IGA) Services simplify access requests and approvals. Furthermore, the solution has an inbuilt feature that launches periodic access rectification. Other key perks of the solution include efficiency in managing roles and segregation of duties, the effective institution of provisioning and remediating, the use of advanced integration, and having on-board applications reliably.

By introducing the ForgeRock Identity Cloud in November 2019, ForgeRock®, the industry leader in digital identity, announced a significant development in the Identity and Access Management domain. It comprises two products: ForgeRock Identity Cloud Express, a developer-focused SaaS solution for integrating contemporary identity functionalities into apps, and the first IDPaaS in the market, a comprehensive digital identity system provided as a service.

Identity And Access Management (IAM) Market Geographical Outlook:

The Identity and Access Management (IAM) market is witnessing robust global growth, driven by increasing demand for cybersecurity solutions and digital transformation. The market is segmented geographically into North America, South America, Europe, the Middle East and Africa (MEA), and Asia-Pacific (APAC), with each region contributing uniquely to its expansion through technological advancements and security needs.

North America holds a significant share of the IAM market, fueled by its advanced technology infrastructure and high cybersecurity adoption. The United States and Canada lead due to stringent data protection regulations, such as the General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA), which mandate robust identity management systems. Enterprises in finance, healthcare, and government sectors prioritize IAM solutions to safeguard sensitive data against cyber threats. Major players like Microsoft, Okta, and Ping Identity drive innovation, offering cloud-based IAM and zero-trust security models, reinforcing the region’s dominance.

Asia-Pacific is expected to experience the fastest growth, propelled by rapid digitalization and technological advancements. Countries like China, India, Japan, and Singapore are adopting new technologies at an unprecedented pace, driven by urbanization, e-commerce growth, and government initiatives like India’s Digital India program. The region’s increasing internet penetration and cloud adoption necessitate IAM systems to manage user access and protect against data breaches. SMEs and large enterprises in APAC are investing in multi-factor authentication (MFA) and single sign-on (SSO) solutions to enhance security.

Europe follows closely, with GDPR compliance driving demand for IAM solutions in Germany, France, and the UK. MEA and South America are emerging markets, supported by digital infrastructure investments. Challenges like implementation costs persist, but cloud-based IAM and AI-driven security are mitigating these issues. The IAM market thrives on cybersecurity demands, digital transformation, and regional innovation, with North America and Asia-Pacific leading the charge.

List of Top Identity and Access Management (IAM) Companies:

- Centrify Corporation

- Microsoft Corporation

- Dell

- Micro Focus

- Oracle

Identity and Access Management (IAM) Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Identity and Access Management Market Size in 2025 | USD 25.179 billion |

| Identity and Access Management Market Size in 2030 | USD 46.413 billion |

| Growth Rate | CAGR of 13.01% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Identity and Access Management Market |

|

| Customization Scope | Free report customization with purchase |

Identity And Access Management (IAM) Market Segmentation:

- By Deployment Model

- On-Premise

- Cloud

- By Service

- Integration & Implementation

- Consulting

- Others

- By Vertical

- Travel and Transport

- Government

- Media & Entertainment

- Retail

- BFSI

- Communication and Technology

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America