Report Overview

Propylene Glycol Monomethyl Ether Highlights

Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Size:

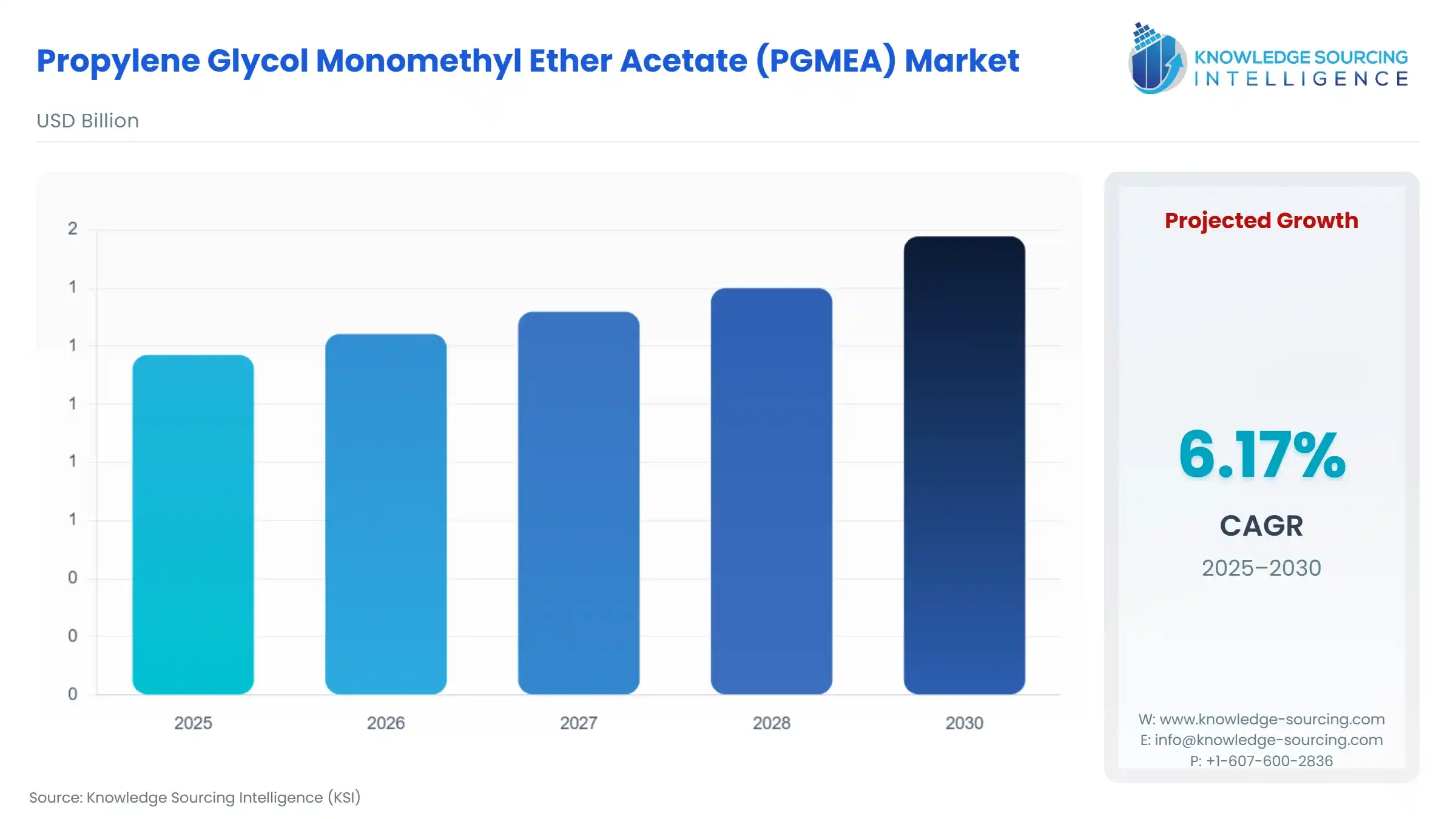

Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market, sustaining a 6.17% CAGR, is forecasted to grow from USD 1.170 billion in 2025 to USD 1.578 billion by 2030.

Propylene glycol monomethyl ether acetate (PGMEA), also known as PMA or 1-methoxy-2-propanol acetate, is a colorless, hygroscopic liquid with a faint ester-like smell. It is a P-type glycol ether derivative and has wide applicability as a solvent in different industries owing to its good solvency properties, non-toxicity, and controlled evaporation rate. The demand for PGMEA is growing across industries for diverse applications, like in coatings, paints, inks, cleaning agents, and electronics, particularly in semiconductors, where it is used in photoresist formulations and edge bead removal. The global Propylene Glycol Monomethyl Ether Acetate (PGMEA) market is seeing stiff competition due to the work being put in to keep up with the demand for high-performance coating materials from the automotive and construction industries; semiconductors, in turn, produce photoresist and cleaning agents for liquid crystal displays; and shifting trends favor environmentally conscious low-VOC solvents. Technological queries in solvent manufacturing, such as the synthesis of PGMEA of high purity and bio-based PGMEA, are considered market drivers to meet the requirements of very high purity, along with environmental concerns.

Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Overview & Scope

The Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market is segmented by:

- Type: The ≥99.5% segment is expected to hold a major market share in the type segment, driven by the increasing utilization in multiple applications such as coating and inks, and industrial solvents. The type offers increased consistency and reliability, making it suitable for industries such as electronics, semiconductors, and pharmaceuticals that need to comply with strict industrial standards. The growing priority towards sustainability and growing regulation for low-VOC also make it ideal for industrial use.

- Application: The industrial solvents segment is expected to hold a significant share in the application due to its demand in the ink, adhesives, and paint and coating sectors, due to its low volatility and compatibility with several materials. The rise in the construction and automotive industries is promoting the demand for high-performance industrial solvents like PGME for improving the levelling, drying, and flow characteristics of the paints. Along with this, the growing urbanization and infrastructure development are also promoting a requirement for industrial and building coatings.

- End User: The electronics segment is projected to be the fastest-growing segment in the end-user of the PGMEA market. This is promoted by the increase in the production of electronic components and LCDs, and the manufacturing of semiconductors, in all of which the high-purity grade PGMEA is critical. Moreover, the growing investment by countries in semiconductor advancement and production, along with increasing adoption of consumer electronics, will also boost the PGMEA usage in the manufacturing process, promoting the semiconductor expansion.

- Region: The Asia Pacific region is estimated to witness significant growth in the PGMEA market because of the growing urbanization and government investment in semiconductors and domestic electronic manufacturing, which demand solvents in cleaning and photolithography applications. Moreover, the growing construction activities and infrastructure projects in countries like China, India are also boosting the market growth in the region in the coming years.

Top Trends Shaping the Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market

- Shift Toward Bio-Based and Sustainable PGMEA Variants

The countries globally are shifting towards eco-friendly alternatives, which is leading to companies focusing on research and development on bio-based PGMEA to decrease their environmental impact, along with meeting the regulatory standards. - Adoption of Digitalization and Business Integration Models

The industries globally are moving towards digitalization to improve their supply chain, customer engagement, and production processes, along with a reduction in costs and an enhancement of efficiency. This will lead to integration of backward and forward integration models for securing more innovative low-odor, high-purity, and low-toxicity PGMEA formulation for requirements in applications such as advanced electronics and coatings.

Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Growth Drivers vs. Challenges

Drivers:

- Demand for High-Performance Coatings: PGMEA is a solvent employed in high-performance coatings for automotive, industrial, and architectural applications. It dissolves different materials for application with smoothness, better flow, leveling, and drying characteristics. A coating that requires uniform performance and emission of low VOCs is best suited for PGMEA since its volatility is low, thereby making this property ideal for such coatings. Rising trends in sustainability, in fact, have kept PGMEA on the list of preferred substances for modern coating technologies due to its complementarity with advanced formulations. Its low volatility and moderate evaporation rate are vital to coatings that require durability and eco-compliant levels. In addition to this, PGMEA provides the automotive sector with high-performing coatings for vehicle paints and protective layers that increase durability, corrosion resistance, and aesthetic appeal. The growing automobile production across the globe, especially in developing countries, has driven up demand for PGMEA. Rapid infrastructure development in these emerging economies also bodes well for the demand for architectural and industrial coatings that dilute materials such as cement, sand, and concrete, thereby making the construction process. For instance, the National Highways Authority of India (NHAI)reported that in FY2025, the country spent Rs. 2,50,000 crores on the construction of national highways, which was 21 percent more than FY2024 and about a 45 percent increment from 2023.

- Growing Expansion in Electronics and Semiconductor Manufacturing: There is a continuous growth in consumer electronics such as computers, smartphones, and smart devices, along with the demand for advanced fabrication of semiconductors. This leads to an increase in demand for PGMEA, which is essential in cleaning agents, along with acting as a photoresist solvent utilised in semiconductor production. The demand for PGMEA is expected to increase to support the manufacturing of semiconductors, displays, and electronic devices. According to Semiconductor Industry Association (SIA) data of July 2025, the global semiconductor sales reported a year-on-year increase to 19.8 percent with sales of $59.0 billion in May 2025, which was $57.0 billion in April 2025 and $49.2 billion in May 2024. Moreover, this is supported by the growing advancement in AI, 5G, and IoT technologies, which is promoting the semiconductor electronics sales globally, and will offer an opportunity for the market to expand during the forecasted period.

Challenges:

- Fluctuating Raw Material Prices and Supply Chain Disruptions: The production of PGMEA depends on raw materials like acetic acid and propylene, whose processes are unstable due to diverse factors such as global supply chain issues, energy cost, political instability, and geopolitical factors. This could lead to hindrances in the production cost and profitability of the manufacturers, making it difficult for them to maintain a stable cost of the product. The unreliable supply chain and unstable price of raw materials can lead to companies adopting other strategies, hampering market growth.

Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Regional Analysis

- United States: The United States is expected to hold a substantial share of the market, due to the growing automotive industry in the country, which will lead to demand for PGMEA for adhesive and coating applications. Further, the EPA's stringent regulation over the utilization of low-VOC material will also promote the market adoption as an eco-friendly component. The rise in domestic semiconductor production is another factor that will increase the necessity of the PGMEA in the country.

- China: China witnesses steady growth in the PGMEA market with the growing semiconductor and electronic manufacturing in the country, along with the growing investment by the industries in the high-quality grade PGMEA to increase the production speed while decreasing the dependency on imports, which is also expected to enhance the regional market.

- South Korea: South Korea is a major region for electronics and semiconductor dominance. It has the presence of semiconductor industry companies such as Samsung and SK Hynix, which is leading to the fueling of the requirement for PGMEA in the manufacturing of advanced chips. According to the Invest Korea data report, the country's memory semiconductor market shares of major producers in the world were 1,440, while that of South Korea alone was 872 units. According to SEMI 2023 data, South Korea is the second major semiconductor manufacturer with a share of 17.9 percent.

Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Competitive Landscape

The market is fragmented, with many notable players, including Merck KGaA, Eastman Chemical Company, Ataman Kimya, Dow, Eastman Chemical Company, Shell Chemicals, KH Neochem Co., Ltd., Daicel Corporation, Chang Chun Group, and Shiny Chemical Industrial Co., Ltd., among others.

- Eastman™ PM Acetate: It is manufactured by Eastman Chemical Company, which has significant resin availability, along with attributes like high assay, high purity, and low trace metals and viscosity control. It is utilized in diverse applications such as electronic chemicals, LCDs, and process solvents. This solvent is a slowly evaporating type and is colorless with a mild odor, and provides for formulation in photoresists.

Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Size in 2025 | USD 1.170 billion |

| Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Size in 2030 | USD 1.578 billion |

| Growth Rate | CAGR of 6.17% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market |

|

| Customization Scope | Free report customization with purchase |

Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Segmentation:

- By Type

- ≥99.5%

- ≥99%

- By Application

- Electronic Chemicals

- LCD Displays

- Process Solvents

- Printing Inks

- Others

- By End-User

- Electronics

- Automotives

- Paints and Coatings

- Chemicals

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America

Our Best-Performing Industry Reports:

Navigation:

- Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Size:

- Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Key Highlights:

- Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Overview & Scope

- Top Trends Shaping the Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market

- Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Growth Drivers vs. Challenges

- Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Regional Analysis

- Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Competitive Landscape

- Propylene Glycol Monomethyl Ether Acetate (PGMEA) Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 8, 2025