Report Overview

Polypropylene Market - Strategic Highlights

Polypropylene Market Size

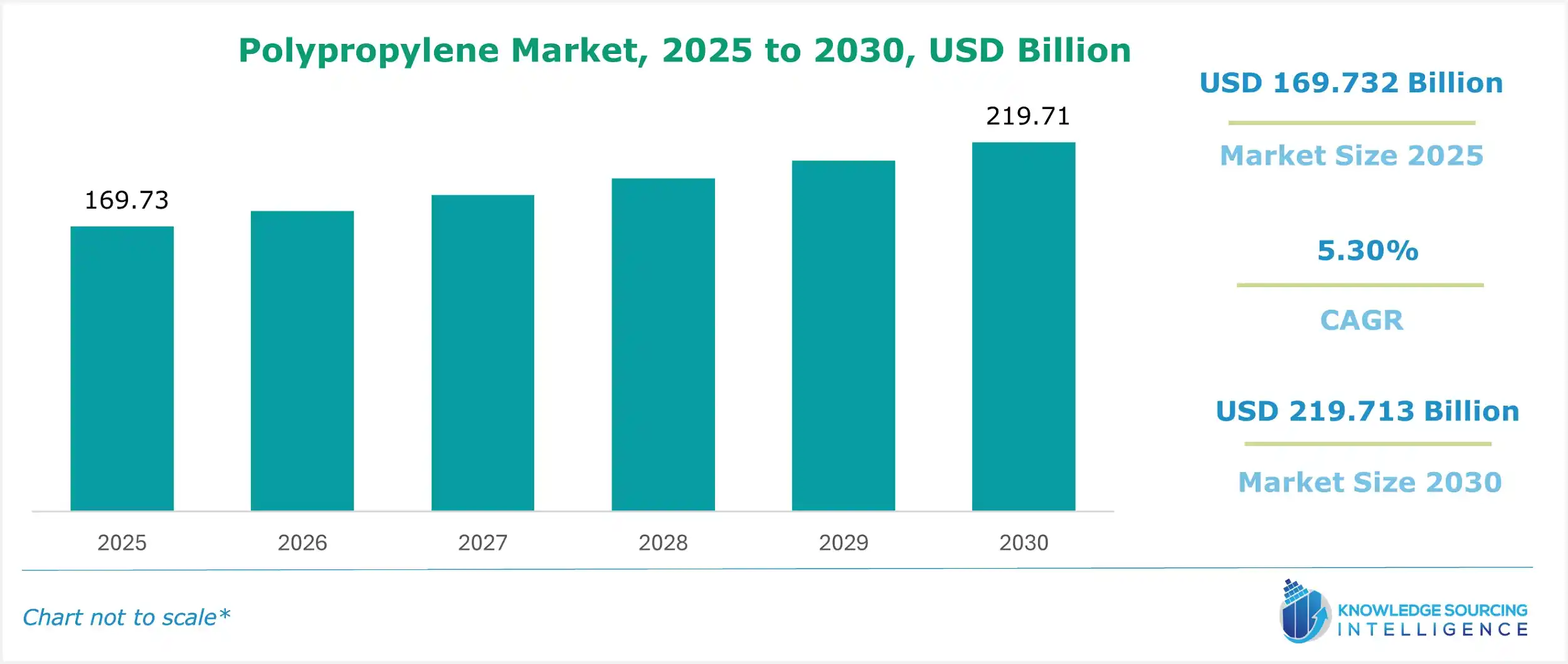

The polypropylene market is estimated to grow from US$169.732 billion in 2025 to US$219.713 billion in 2030 at 5.30% CAGR.

Polypropylene Market Introduction:

Polypropylene (PP) is one of the most widely used thermoplastics globally. Its applications range from plastic packaging and parts for machinery and equipment. It is a rigid, semi-crystalline thermoplastic that was first polymerized in 1951 and is widely used in various domestic and industrial applications.

Polypropylene also has high insulation properties, making it safe for use in the plastic casing of electrical goods and cables. In its fiber form, polypropylene is useful for tote bags and encompasses a much wider range of products, including ropes, twine, tape, carpets, upholstery, clothing, and camping equipment. Its waterproof properties make it especially effective for the marine sector. Polypropylene is widely used in the automotive industry for battery casings, trays and drink holders, bumpers, interior details, instrument panels, and door trims.

The propylene market, a key segment of the global polypropylene industry, drives innovation within the polyolefin market. As a vital component in thermoplastic polymers, polypropylene resins and polypropylene compounds are essential for applications in packaging, automotive, and textiles. PP market trends highlight growing demand for lightweight, durable materials, fueled by advancements in polymer processing and recycling technologies. Propylene’s versatility supports high-performance compounds tailored for diverse industries. As sustainability and efficiency gain priority, the market delivers scalable solutions, addressing evolving regulatory and consumer demands. Propylene has a critical role in shaping high-quality, innovative polymer products.

The polypropylene (PP) market is poised for significant growth, driven by steadily increasing demand from various end-user industries, as it remains one of the most widely used thermoplastics globally. While the market is currently experiencing price declines compared to historical trends, primarily due to crude oil price volatility and ongoing geopolitical tensions, it is still expected to climb the growth ladder in the coming years, supported by robust consumption and expanding application areas.

The market is witnessing a rise in new product launches and circular economy initiatives, with many companies investing in eco-sustainable solutions. While the global polypropylene market remains fairly consolidated with a few dominant players, its wide range of applications presents low entry barriers for specialized and niche-use providers, enabling new entrants to tap into emerging opportunities. Asia-Pacific is emerging as a key region for market entry, driven by strong manufacturing growth, expanding end-user industries, and increasing demand for cost-effective, high-performance materials like polypropylene.

Polypropylene Market Overview:

Polypropylene is a thermoplastic polymer widely used in various industries due to its versatility, durability, low cost, lightweight, appearance, easy molding, high insulating properties, easy compounding properties, and chemical resistance features, among others. It is a by-product of petroleum refining and natural gas processing.

The material finds key applications across a range of industries such as packaging, automotive, healthcare and medical, construction, consumer products, and thus in almost every major industry. Hence, the growth in demand from all these industries is significantly driving the market, poised to grow at a CAGR of 5.30% during the forecast period.

The polypropylene market experiences price fluctuations due to factors such as raw material costs like crude oil and natural gas, supply-demand imbalances, and geopolitical influences. Over the past month, from early June to July, polypropylene's price has risen by 1.53%, but it is still 8.56% lower than a year ago, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity.

However, the market is showing a positive outlook driven by rising demand, technological advancements in environmentally friendly solutions, and growth in emerging markets. For example, Japan Polypropylene Corporation’s NOVAORBIS offers low impact on the environment, as opposed to conventional products made from fossil fuels.

The growing production of polypropylene fiber is contributing significantly to the overall expansion of the polypropylene market. As per the data by the World Integrated Trade Solution, in 2023, Top exporters of Polypropylene, in primary forms are Saudi Arabia ($6,827,800.38K), Korea, Rep. ($2,824,047.12K, 2,040,690,000 Kg), United States ($2,070,547.76K, 917,173,000 Kg), Germany ($2,025,757.95K, 1,123,410,000 Kg), China ($1,856,092.43K, 1,267,280,000 Kg). While, in the same year, op importers of Polypropylene, in primary forms are China ($2,792,875.67K, 2,697,210,000 Kg), Turkey ($2,249,309.43K, 2,035,500,000 Kg), European Union ($1,643,896.92K, 1,297,870,000 Kg), India ($1,375,622.38K, 1,327,210,000 Kg), Germany ($1,300,321.15K, 812,322,000 Kg).

Players in the market are expanding production capacity, innovating with advanced recycling technologies, supporting circular economy initiatives, and developing advanced polypropylene grades to meet growing demand and sustainability goals.

Polypropylene Market Trends:

The polypropylene market is experiencing significant growth, driven by a strong emphasis on sustainability and innovation. Key trends include the adoption of sustainable polypropylene, particularly recycled polypropylene (PP) and bio-based polypropylene, to address environmental concerns and meet stringent regulatory requirements. The demand for circular polypropylene is rising, with post-consumer recycled PP (PCR PP) and chemically recycled PP gaining traction due to their enhanced resource efficiency and alignment with circular economy principles. These materials reduce waste and promote recycling, catering to eco-conscious industries like packaging, automotive, and textiles.

Green polypropylene, including ISCC PLUS certified PP, ensures compliance with global sustainability standards, offering transparency and traceability in supply chains. Additionally, low-carbon-footprint PP is increasingly prioritized, leveraging advanced manufacturing processes to minimize environmental impact. Innovations in recycling technologies, such as chemical and mechanical recycling, alongside the development of bio-based feedstocks, are transforming the market. These advancements enable the production of high-performance, eco-friendly polypropylene that meets diverse application needs, from flexible packaging to automotive components.

The global push for decarbonization and sustainability is reshaping the polypropylene industry, with companies investing in renewable feedstocks and energy-efficient production methods. Bioplastics and recyclable polymers are becoming integral to product portfolios, driven by consumer demand for environmentally responsible materials. The market is also seeing increased collaboration across value chains to enhance plastic circularity and develop closed-loop systems. These trends underscore the industry’s commitment to delivering innovative, high-performance polypropylene solutions that align with evolving global market demands for sustainability, performance, and regulatory compliance.

Polypropylene Market Drivers:

Increasing Demand in Packaging

The main drivers of the rising demand for polypropylene in the packaging industry are its versatility, cost-effectiveness, and suitability for both flexible and rigid packaging applications. Polypropylene's lightweight, durable, moisture-resistant, and chemically stable properties make it suitable for a wide range of packaging products, including food, beverages, personal care items, and e-commerce shipments. A significant rise in flexible packaging, particularly in pouches and wraps, and rigid packaging, such as containers and bottles, has been a result of polypropylene offering better strength, protection, and shelf life.

As the packaging industry stands as the fifth-largest industry in India, the government plans to adopt several initiatives that focus on sustainable manufacturing methods, minimization of plastic packaging, and adoption of sustainable materials for the packaging industry.

Moreover, consumers' growing interest in eco-friendly solutions has enhanced the demand for recyclable PP, which is seen as a sustainable alternative to other plastics. The polypropylene market is rising due to e-commerce expansion and because consumers prefer convenient, tamper-proof packaging. It is also a recyclable material and is being used in ways that support the global move toward plastic waste reduction.

Advancements in Technology

Technological advances and innovation are strongly shaping the PP market’s growth by opening up more applications and enhancing performance across industries. Developing new catalysts and polymerization techniques has improved the production processes, making them more efficient, cost-effective, and environmentally friendly. New grades of PP, such as high-crystalline polypropylene (HCPP) and several copolymers, possess better mechanical and thermal properties that allow them to be used in more demanding applications, such as automotive and medical devices.

Moreover, the new technologies in recycling, especially chemical recycling, are improving the sustainability of PP by making it easier to recycle and creating a circular economy for the material. Advances in the development of bio-based polypropylene, sourced from renewable feedstocks, continue to push forward sustainability by lowering the carbon footprint of PP. Technological innovations that broaden PP's applications and alleviate environmental concerns make it a more sustainable and versatile material for the future.

Surge in demand for lightweight and durable materials

The global shift toward lightweight materials is a key factor in modern manufacturing, especially in industries like packaging, automotive, and consumer goods. Using lightweight components and high-efficiency engines enabled by advanced materials in one quarter of the U.S. fleet could save more than 5 billion gallons of fuel annually by 2030.

Moreover, PP is popular due to its low density and high strength-to-weight ratio. It often replaces heavier materials like glass, metal, or traditional plastics. In packaging, this leads to lower shipping costs, easier handling, and reduced carbon emissions during transport. As companies seek better logistics and eco-friendly supply chains, the lightweight nature of polypropylene becomes a strong advantage, leading to its extensive use.

The table below highlights the mass reduction potential of various lightweight materials used in engineering and manufacturing, with carbon fiber and magnesium offering the highest weight savings (up to 70%), followed by aluminum, titanium, and fiber composites, while advanced and high-strength steels provide moderate reductions ranging from 10% to 28%.

Durability is also crucial, particularly in packaging, where materials need to handle physical stress, moisture, and chemical exposure. Polypropylene is known for its strong resistance to wear, impact, and environmental damage. This makes it an ideal choice for long-lasting packaging solutions like containers, caps, closures, and multilayer films. Unlike some other materials, PP retains its quality even in extreme temperatures or high humidity. This ensures product safety throughout the supply chain. Its durability also supports the growing trend for reusable and refillable packaging systems, boosting polypropylene's market position.

The combination of lightweight and durable features fits well with broader sustainability goals. By allowing manufacturers to use less material without giving up strength, PP helps improve resource efficiency and reduce waste. Its ability to be recycled adds to its attractiveness in a circular economy. Governments and businesses are investing in infrastructure and innovation to support recyclable packaging, with polypropylene being central to these efforts. As environmental concerns and consumer demand for sustainable packaging rise, the need for materials like PP that deliver both performance and environmental benefits keeps increasing.

Polypropylene Market Restraints:

The PP market’s growth is under considerable challenges, such as environmental concerns, price volatility, recycling limitations, and competitiveness from alternative materials. Inadequate recycling infrastructure and low recycling rates in several regions limit polypropylene’s sustainability potential. Moreover, because polypropylene is derived from oil-based feedstocks, variations in world oil prices mean price fluctuations that increase both production costs and market volatility. Additionally, PP is competing for newly discovered biodegradable plastics and plant-based alternatives known as PLA. All these factors present significant threats to the polypropylene market’s expansion.

Polypropylene Market Segmentation Analysis:

Automotives are gaining significant market share

By end-user industry, the polypropylene market is segmented into packaging, automotive, consumer products, electrical and electronics, and others. One of the main reasons for using polypropylene (PP) in the automotive industry is the growing focus on lightweighting to boost fuel efficiency and cut emissions. As global rules and regulations regarding vehicle emissions and fuel use become stringent, automakers are seeking materials that provide strength without adding weight. Polypropylene is a lightweight yet tough thermoplastic, commonly used in making bumpers, interior trims, battery cases, and door panels. Its low density helps cut the overall vehicle weight, which directly influences fuel economy and lowers CO? emissions.

Moreover, with growing automobile production, the demand for polypropylene is increasing. In line with this, data from the Society of Indian Automobile Manufacturers (SIAM) shows a steady rise in automobile production in India. Total production, including passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles, reached 2,30,40,066 units in 2021–22, increased to 2,59,40,344 units in 2022–23, and further climbed to 2,84,34,742 units in 2023–24.

Another important factor is that polypropylene is cost-effective and allows for flexible designs. This helps manufacturers streamline production and lower overall vehicle costs. PP works well with injection molding, supporting complex shapes and high-volume production with consistent quality. It also allows for a variety of surface finishes and colors, eliminating the need for extra steps like painting or coating. This versatility makes it ideal for both style and functional parts in vehicle interiors and under-the-hood applications. In a highly competitive industry, where managing production costs and time to market is vital, polypropylene stands out as a smart choice.

Apart from this, growing advancements and new product launches are significantly contributing to the polypropylene market’s expansion in the automotive sector. Manufacturers are launching advanced polypropylene grades with enhanced mechanical, thermal, and aesthetic qualities in response to changing vehicle design specifications and growing consumer demand for lightweight, affordable materials. These advancements enable broader applications in battery enclosures, door panels, dashboards, and under-the-hood components.

Polypropylene Market Geographical Outlook:

The polypropylene market is segmented into five regions worldwide

Geography-wise, the polypropylene market is divided into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The Asia Pacific polypropylene market is driven by rapid industrialization and increasing demand in the packaging, automotive, and healthcare sectors. For instance, in India, the Packaging Market was US$50.5 billion in 2019 and is projected to grow at a compound annual growth rate (CAGR) of 26.7% to reach US$204.81 billion by 2025.

Economic growth and urbanization boost the demand for polypropylene in consumer goods and food packaging, while the automotive industry appreciates its lightweight properties. Low production costs and accessible raw materials are also boosting the market further. Escalating sustainability efforts, with recycling initiatives and regulations, fuel the adoption of recyclable polypropylene. A strong regional manufacturing base ensures a steady supply of PP and is an important growth driver.

Apart from this, the North American polypropylene market is being driven by strong demand from the packaging, automotive, and healthcare sectors. In the food and beverage industry, the growth of e-commerce and the need for affordable, durable packaging materials have boosted polypropylene usage. Automotive applications benefit from fuel efficiency and environmental standards, supported by its lightweight properties. In line with this, in 2022, Canadian imports of automotive parts and components totaled US$15.4 billion, close to 2020 levels. The United States share in the total Canadian automotive import market remains dominant at approximately 62%.

Moreover, technological developments in polypropylene grades and recycling technologies are opening up new avenues for its use, whereas the growing demand for medical products, including PPE, has increased its use in the healthcare sector. In addition, environmental regulations and sustainability measures are becoming increasingly stringent, thus driving the adoption of recyclable polypropylene in the region.

Polypropylene Market Recent Developments:

In June 2025, Premix, LyondellBasell (LYB), and Maillefer collaborated to deliver a technically advanced and recyclable power cable system, combining high-performance polypropylene materials, state-of-the-art compounding, and leading cable manufacturing technology.

In May 2025, Borealis advanced its growth strategy by focusing on sustainable solutions that are reshaping the polymer industry. At its facility in Burghausen, Germany, the company is significantly increasing production capacity for Daploy High Melt Strength polypropylene (HMS PP), an innovative polymer foam solution. With an investment of over EUR 100 million, this expansion aims to meet the rising global demand for recyclable, high-performance foam materials.

On April 30, 2025, JGC Corporation and Japan Polypropylene Corporation (JPP) announced the start of a joint study to develop a carbon-neutral, CO2-circular polypropylene production process. This initiative aims to integrate JGC’s and JPP’s technologies to enable polypropylene production using carbon-recycled methanol derived from hydrogen and CO2, contributing to a circular economy and carbon neutrality in the polypropylene life cycle.

In March 2025, PureCycle Technologies, Inc., a U.S.-based leader in advanced polypropylene recycling, announced a strategic collaboration with Landbell Group, a global provider of closed-loop recycling solutions, to accelerate the upcycling of polypropylene (PP) waste into high-purity recycled PP suitable for demanding applications across Europe.

On January 16, 2025, Japan Polypropylene Corporation (JPP) introduced NOVAORBIS™, a new brand of polyolefin products developed in collaboration with Japan Polyethylene Corporation. NOVAORBIS™ focuses on raw materials with reduced environmental impact and supports the company’s commitment to a carbon-neutral and circular economy.

In 2025, SABIC launched a new polypropylene pipe solution made with a random copolymer. The product, called SABIC VESTOLEN P9421, offers enhanced properties at high pressures and temperatures with improved durability and reliability.

In September 2024, Braskem, the largest polyolefins producer in the Americas, as well as a global market leader and pioneer producer of biopolymers on an industrial scale, launched its innovative bio-circular PP, which it sells under the brand name WENEW. WENEW is a groundbreaking advancement in sustainability for the restaurant and snack food industries.

In July 2024, Sumitomo Chemical supplied Noblen® Meguri®, a polypropylene material made with its material recycling technology, for the front grille of the new N-VAN e electric vehicle from Honda Motor Co., Ltd.

In November 2022, Lummus Technology, a global provider of process technologies and value-driven energy solutions, launched its Novolen® PPure ™ polypropylene portfolio, a new grade range of polymers suitable for supporting the production of high-quality products for automotive, healthcare components, and food packaging materials. The new non-phthalate process technology saves a lot of energy and provides an improved hydrogen response with the catalyst.

List of Top Polypropylene Companies:

Palmetto Industries

HMC Polymers Co., Ltd.

Pinnacle Polymers, LLC

Jam Polypropylene Co.

Braskem S.A.

Polypropylene Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 169.732 billion |

| Total Market Size in 2029 | USD 219.713 billion |

| Forecast Unit | Billion |

| Growth Rate | 5.30% |

| Study Period | 2020 to 2029 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2029 |

| Segmentation | Type , Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Polypropylene Market Segmentation:

By Type

Small-sized organization

Medium-sized organization

Large-sized organization

By Application

Injection Molding

Fiber, Film and Sheet

Others

By End-User

Packaging

Automotive

Consumer Products

Electrical and Electronics

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Rest of South America

Europe

United Kingdom

Germany

France

Italy

Spain

Rest of Europe

Middle East and Africa

Saudi Arabia

UAE

Rest of the Middle East and Africa

Asia Pacific

China

India

Japan

South Korea

Taiwan

Thailand

Indonesia

Rest of Asia-Pacific