Report Overview

Push Buttons And Signaling Highlights

Push Buttons And Signaling Devices Market Size:

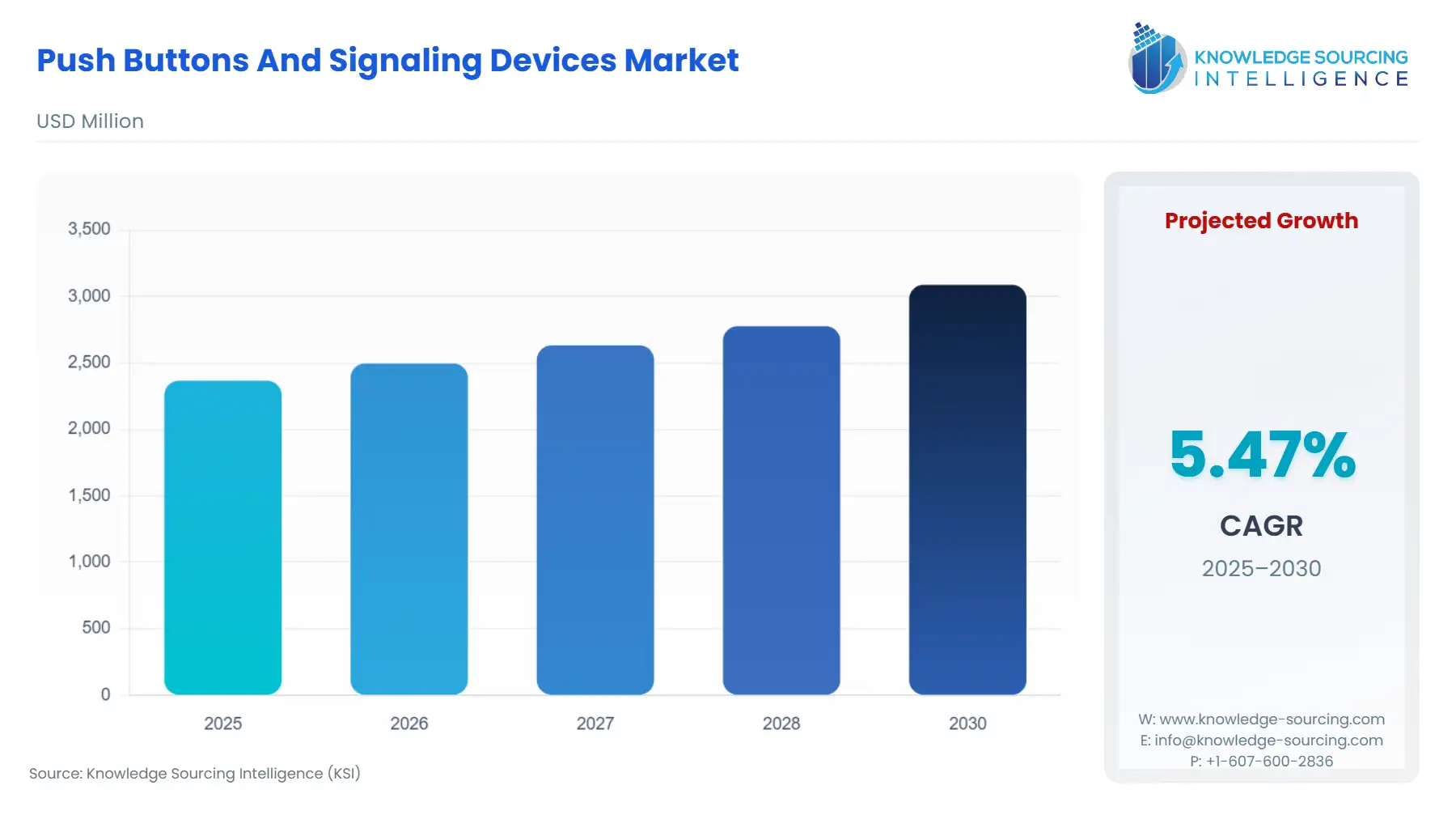

Push Buttons And Signaling Devices Market is projected to expand at a 5.31% CAGR, reaching USD 3.228 billion in 2031 from USD 2.367 billion in 2025.

Push Buttons And Signaling Devices Market Trends:

Push buttons and signaling devices are essential parts of industrial control frameworks. They are used to control machines, conveyors, and other equipment. Push buttons are simple switches that are used to turn equipment on or off while Signaling devices are used to indicate the status of the equipment. They include a broad spectrum of operators such as toggle switches, pendant stations, indicator lights, assembled operator stations, and operator station enclosures. Push buttons and signaling devices are available in a variety of sizes, shapes, and colors to meet the needs of different applications. They are designed to be durable and reliable, and they can withstand harsh environments. Push buttons and signaling devices are also available with audible and visual alarms to alert operators of potential problems. Audible devices include general and high-performance electronic horns, panel mount signaling alarms, and hazardous location horns and beacons, while visual devices include indicator lights and status indicators.

The push buttons and signaling devices market deals with the manufacturing and distribution of devices that are used to control machines and equipment in various industries. These devices are used to turn equipment on or off and indicate the status of the equipment. The market includes a broad spectrum of operators such as toggle switches, pendant stations, indicator lights, assembled operator stations, and operator station enclosures. The push buttons and signaling devices market is segmented by products, type, end-user industry, and geography.

Push Buttons And Signaling Devices Market Growth Drivers:

Increasing demand for automation: As industries continue to automate their processes, the demand for push buttons and signaling devices is likely to increase. These devices are essential components in industrial control systems, and their demand is directly proportional to the level of automation in the industry.

Growing safety concerns: Safety is a top priority in industrial settings, and push buttons and signaling devices play a critical role in ensuring safe operations. As safety regulations become more stringent, the demand for these devices is likely to increase.

Advancements in technology: The push buttons and signaling devices market is highly competitive, with manufacturers continually innovating to maintain their edge. Technological advancements, such as the integration of IoT and wireless communication, are poised to drive market growth.

Increasing adoption of Industry 4.0: Industry 4.0 is a new paradigm in manufacturing that emphasizes the use of automation, data exchange, and IoT to create smart factories. As more industries adopt Industry 4.0, the demand for push buttons and signaling devices is likely to increase.

Rising demand from emerging markets: Emerging markets, such as India and China, are rapidly industrializing, and the demand for push buttons and signaling devices is likely to increase in these regions. The growth of these economies is expected to drive the overall growth of the market.

List of Top Push Buttons And Signaling Devices Companies:

ABB Ltd. offers conservative pilot gadgets made for straightforwardness and efficiency, without settling for less on quality. It has an across-the-board reasonable plan, customized to meet the most well-known modern prerequisites on a push-button switch. The whole usefulness is consolidated into one unit.

Schneider Electric offers Agreement XB4 the particular scope of Ø 22 mm metal control and signaling units consolidates straightforwardness of establishment, current norm and flush mounted plan, adaptability, and vigor, an elevated degree of customization to meet most modern applications.

Rockwell Automation offers press buttons, flip switches, pendant stations, marker lights, collected administrator stations, and administrator station nooks.

Push Buttons And Signaling Devices Market Segmentation Analysis:

Prominent growth in the non-lighted push button segment within the push button and signaling devices market:

The non-lighted push button segment is experiencing prominent growth within the push button and signaling devices market. The rise of one-handed, tool-free push button installation is driving their popularity in industrial operations. Furthermore, accessible push buttons offer drag-and-drop options, making the installation process much simpler and smoother. The replacement cycle is expected to be a major driving factor for the growth of the push buttons and signaling devices market. The push buttons and signaling devices market is segmented by products, type, end-user industry, and geography. The non-lighted push button segment is one of the products that are driving the growth of the market.

Push Buttons And Signaling Devices Market Geographical Outlook:

The Asia Pacific region is expected to hold a significant share of the push button and Signaling devices market:

The Asia Pacific region is expected to hold a significant share of the push button and Signaling devices. The growth of the market in the Asia Pacific region can be attributed to several factors, including the increasing demand for automation in various industries, the growing safety concerns, and the rapid industrialization in emerging economies such as India and China. The region is home to several key players in the push button and Signaling devices market, and these companies are investing in research and development to develop innovative products. The Asia Pacific region is also expected to witness significant growth in the non-lighted push button segment, which is driving the overall growth of the push button and Signaling devices market.

Push Buttons And Signaling Devices Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Push Buttons And Signaling Devices Market Size in 2025 | USD 2.367 billion |

Push Buttons And Signaling Devices Market Size in 2030 | USD 3.089 billion |

Growth Rate | CAGR of 5.47% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Push Buttons And Signaling Devices Market |

|

Customization Scope | Free report customization with purchase |

Push Buttons and Signaling Devices Market Segmentation

By Product Type

Body Type

Push Button

Signaling Devices

By Type

Audible

Visible

Others

By End User

Automotive

Energy and Power

Manufacturing

Food and Beverage

Transportation

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Indonesia

Thailand

Others