Report Overview

Retinal Disorder Treatment Market Highlights

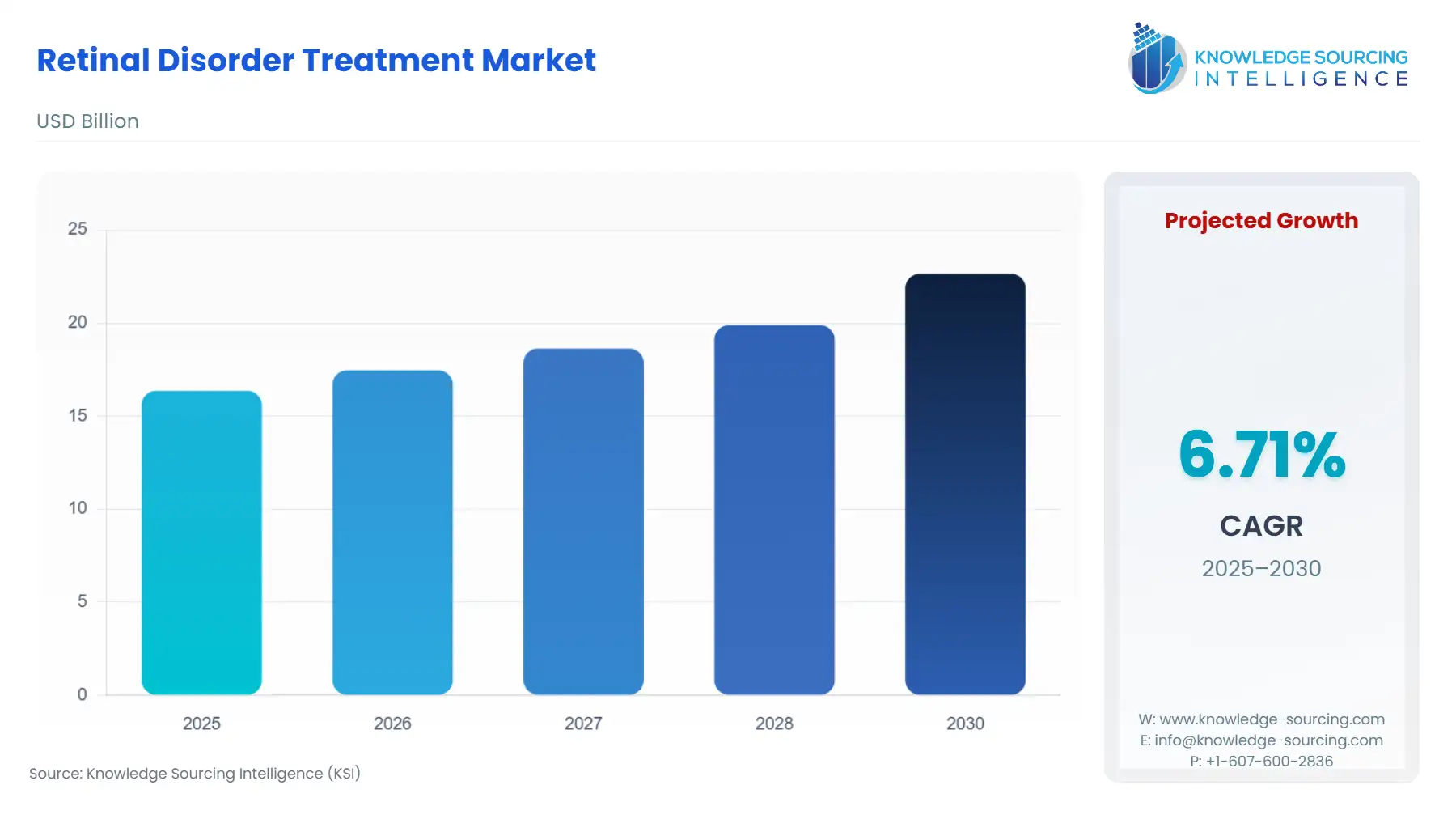

Retinal Disorder Treatment Market Size:

Retinal Disorder Treatment Market is set to grow at a 6.51% CAGR, growing from USD 16.368 billion in 2025 to USD 23.895 billion in 2031.

Retinal Disorder Treatment Market Trends:

The retinal disorder treatment market is focused on developing treatments for various retinal diseases, including age-related macular degeneration, diabetic retinopathy, and retinitis pigmentosa. Several companies are investing heavily in research and development to develop treatments for vision loss diseases, which can cause blindness. These treatments aim to halt or slow the progression of the disease and preserve, improve, or restore vision. Treatment options include laser therapy, anti-angiogenic therapy, and drug discovery. Early detection is important, and patients are encouraged to seek support from their doctors and other resources. The market is expected to continue to grow as new treatments are developed and as the prevalence of retinal diseases increases with an aging population.

The retinal disorder treatment market encompasses the development and commercialization of therapies for retinal diseases, that include age-related macular degeneration, diabetic retinopathy, and retinitis pigmentosa. The retinal implant market is driven by the rising prevalence of retinal diseases and the need for effective treatments to prevent vision loss or blindness. The market can be segmented based on treatment type, disease type, and geography. Treatment options include laser therapy, anti-angiogenic therapy, and drug discovery. The market is expected to continue to grow as new treatments are developed and as the prevalence of retinal diseases increases with an aging population. The market players are increasingly focusing on R&D to develop treatments for these diseases, which can result in severe vision loss or blindness in many cases if not treated.

Retinal Disorder Treatment Market Growth Drivers:

Increasing Prevalence of Retinal Diseases: The rising power of retinal contaminations, for instance, age-related macular degeneration, diabetic retinopathy, and retinitis pigmentosa, is driving the improvement of the retinal issue treatment market.

Advancements in Technology: The headways in innovation are driving the advancement of new and imaginative medicines for retinal illnesses. This incorporates the improvement of new medications, quality treatments, and careful strategies.

Rising Demand for Personalized Medicine: The rising interest in customized medication is driving the development of the retinal problem treatment market. This is because of the rising spotlight on creating medicines that are custom-made to the singular patient's requirements.

Government Initiatives: The public authority drives pointed toward further developing medical care framework and expanding mindfulness about retinal illnesses are driving the development of the retinal problem therapy market. This incorporates drives pointed toward further developing admittance to medical care benefits and expanding financing for innovative work.

Increasing Investments: The rising interest in innovative work by market players is driving the development of the retinal issue treatment market. This remembers speculations for growing new medications, quality treatments, and careful strategies.

List of Top Retinal Disorder Treatment Companies:

Maculaser offers a range of laser treatments for retinal disorders, including macular degeneration and diabetic retinopathy. The company's laser treatments are designed to be minimally invasive and provide effective results.

Novartis offers a range of treatments for retinal disorders, including anti-VEGF and steroid injections, focal and pan-retinal lasers, and vitrectomy surgery. The company's treatments are designed to be personalized to the individual patient's needs and disease severity.

Medibuddy offers a range of services for retinal disorders, including consultations with retina specialists to discuss treatment options as well as also develop personalized treatment plans for each patient. The company also provides support throughout the treatment process.

Retinal Disorder Treatment Market Segmentation Analysis:

Prominent growth in the macular degeneration segment within the retinal disorder treatment market:

The macular degeneration segment is a prominent segment within the retinal disorder treatment market, accounting for a significant share of the market. The rising prevalence of macular degeneration is expected to propel the growth of the global macular degeneration treatment market over the forecast period. The market growth is driven by the increasing burden of retinal disorders worldwide, which is expected to increase the demand for effective treatments for macular degeneration.

Retinal Disorder Treatment Market Geographical Outlook:

The Asia Pacific region is expected to hold a significant share of the retinal disorder treatment market:

The Asia Pacific region is expected to hold a significant share of the retinal disorder treatment market, according to various reports. The region is likely to be a highly lucrative market for retinal disorders and is expected to expand at a high CAGR during the forecast period. The growth is being driven by various factors, including the increasing prevalence of retinal diseases, the increasing elderly population in countries such as China and India, and the rising demand for effective treatments for retinal disorders. The market can be segmented based on treatment type, disease type, and geography. Macular degeneration is a prominent segment within the retinal disorder treatment market, accounting for a significant share of the market. The rising prevalence of macular degeneration is expected to propel the growth of the global macular degeneration treatment market over the forecast period.

Retinal Disorder Treatment Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Retinal Disorder Treatment Market Size in 2025 | USD 16.368 billion |

Retinal Disorder Treatment Market Size in 2030 | USD 22.652 billion |

Growth Rate | CAGR of 6.71% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Retinal Disorder Treatment Market |

|

Customization Scope | Free report customization with purchase |

Retinal Disorder Treatment Market Segmentation

By Retinal Condition Type

Macular Degeneration

Diabetic Retinopathy

Others

By Treatment Type

Pharmacological Therapies

Laser Therapies

Others

By Distribution Channel

Hospital Pharmacy

Retail Pharmacy

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Indonesia

Thailand

Others