Report Overview

Satellite Navigation System Market Highlights

Satellite Navigation System Market Size:

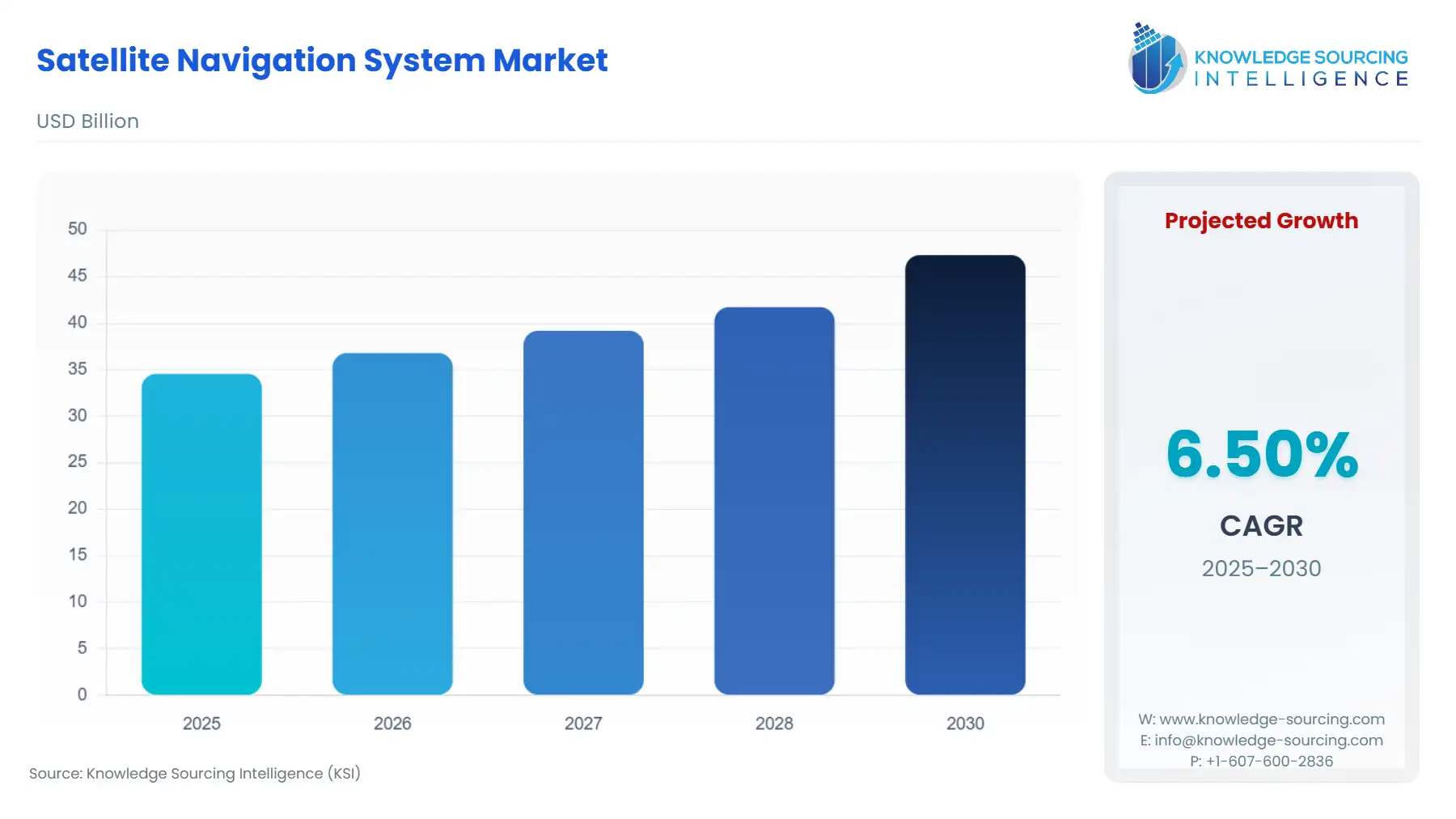

The Satellite Navigation System Market is projected to grow at a CAGR of 6.50% from 2025 to 2030, reaching a market size of US$47.322 billion by 2030 from US$34.546 billion in 2025.

Satellite Navigation System Market Trends:

The growing demand for autonomous vehicles and advanced driver-assistance systems in the automotive industry, increasing adoption in precision agriculture, and growing demand from the aviation and maritime industries are some of the key factors driving the satellite navigation system market. Additionally, there is a huge demand due to the high adoption of smartphones, growing adoption of wearables and IoT devices, requiring satellite-based services. The traditional requirements from transportation, construction, defense and military, with the increasing trend in demand for them, will be propelling the market to grow.

Satellite Navigation System Market Overview & Scope:

The Satellite Navigation System Market is segmented by:

- By Type of System: The satellite navigation system market is segmented into Global Navigation Satellite Systems (GNSS), which include GPS (USA), GLONASS (Russia), Galileo (EU), and BeiDou (China), and Regional Navigation Satellite Systems (RNSS), such as NavIC (India) and QZSS (Japan). GNSS have a global reach, while RNSS offer tailored services for specific regions.

- By Component: Based on component, the market is categorized into three main areas: the Space Segment, which involves satellites and launch systems; the Ground Segment, which includes control centers, monitoring stations, and uplink facilities; and the User Segment, comprising receivers, antennas, and related software that enable satellite navigation services across various platforms.

- By End-User Industry: By end-user industry, the market is segmented into transportation, defense and security, consumer electronics, automotive, industrial and other, which includes surveying, geospatial applications, construction, and agriculture.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa and Asia-Pacific. The market is dominated by North America and Europe, due to the advanced GNSS infrastructure and higher adoption of satellite navigation technologies. However, Asia-Pacific is the emerging market with the fastest CAGR growth, driven by China, Japan and India.

Top Trends Shaping the Satellite Navigation System Market:

1. Technological advancement in GNSS technology

- One of the most influential trends shaping the market is the significant advancement in GNSS technology in the past few years, such as multi-frequency signals, for example, in GPS III and Galileo, which is enhancing the accuracy and satellite-based navigation.

- Additionally, the expansion of satellite constellations and multi-constellation GNSS is driving accuracy, availability and increasing the reliability.

- Also, countries like South Korea is developing its regional GNSS system, driving the market while BeiDou, China’s GNSS, is gaining market in developing nations, particularly in Africa.

2. Growing integration of AI in Satellite Navigation Systems

- The market is also shifting towards increasing integration of AI technologies. Machine learning and deep learning are helping the ground segment to enhance the data processing and error detection more accurately.

- AI is being integrated into ground equipment and monitoring systems for processing the data at a fast rate and enabling real-time signal monitoring and detecting anomalies. For example, in April 2025, Spetentrio launched AsteRx RB3 and RBi3 ultra-rugged GNSS receivers that leverage machine learning to mitigate the multipath errors and ionospheric disturbances.

Satellite Navigation System Market Growth Drivers vs. Challenges:

Opportunities:

- Growing demand from consumer electronics: The growing use of smartphones, wearables and IoT devices is growing the demand for GNSS-enabled units. The data by the IDC Corporation highlights that global smartphone shipments increased 2.4% year-over-year (YoY) to 331.7 million units in the fourth quarter of 2024 (4Q24), marking the sixth consecutive quarter of shipment growth, closing the whole year with 6.4% growth and 1.24 billion shipments in 2024. As the demand for consumer electronics is growing, it is also driving the demand for satellite navigation services, as the vast majority of consumers access the GNSS via their smartphones.

- Geo-marketing, e-commerce tracking and ride-sharing are driving the demand: As per the data by the International Trade Administration, global B2C ecommerce revenue is expected to grow to USD$5.5 trillion by 2027 at a steady 14.4% compound annual growth rate. These data highlight the growth in the e-commerce industry, which will drive the satellite navigation services for e-commerce tracking, fuelling the market to grow.

Challenges:

- High cost: One of the major factors that restrains the market entry into satellite navigation systems is the high cost. Also, as precise GNSS receivers are expensive, it restrains the high adoption in the mass market. Low-cost receivers, such as from u-blox and smartphone-level GNSS chips, are helping overcome these challenges to overcome.

Satellite Navigation System Market Regional Analysis:

- North America: The North American region will constitute a major share of the satellite navigation system market, driven by the widespread use of GNSS-enabled consumer electronics, growing demand from automotive and ADAS, advancements in satellite technologies, and increased research and development focused on modernizing GPS infrastructure.

- Asia-Pacific: The Asia-Pacific will be growing at the fastest rate during the forecast period, driven by countries like China, India, Japan and South Korea. The growing emphasis by these countries, such as South Korea’s regional satellite navigation development, China’s BieDou, India’s NacIC and Japan’s QZSS are driving the market. Additionally, the demand from e-commerce, automotive, and consumer electronics is propelling the market.

Satellite Navigation System Market Competitive Landscape:

The market is moderately fragmented, with some important key players such as Garmin Ltd., Thales Group, Airbus SE, Northrop Grumman Corporation, Septentrio N.V., Lockheed Martin Corporation, Trimble Inc., RTX Corporation, Hexagon AB, Broadcom Inc. and Qualcomm Technologies Inc.

- Launch: In December 2024, Lockheed Martin launched GPS III Space Vehicle 07 (SV07) from Cape Canaveral Space Force Station, Florida, at 7:52 p.m. ET. It enhances the U.S. Space Force’s GPS constellation modernization with improved accuracy, anti-jamming, and M-Code (Military Code) capabilities, marking an advancement in GPS infrastructure.

- Product Launch: In February 2025, STMicroelectronics introduced the Teseo VI family of GNSS receivers for precise positioning use in automotive and industrial applications. This receiver integrates multi-constellation and quad-band signal processing on a single die. It also features dual-Arm Cortex-M7 core for safety.

Satellite Navigation System Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Satellite Navigation System Market Size in 2025 | US$34.546 billion |

| Satellite Navigation System Market Size in 2030 | US$47.322 billion |

| Growth Rate | CAGR of 6.50% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Satellite Navigation System Market |

|

| Customization Scope | Free report customization with purchase |

Satellite Navigation System Market Segmentation:

By Type of System

- Global Navigation Satellite Systems (GNSS)

- GPS

- GLONASS

- Galileo

- BeiDou

- Regional Navigation Satellite Systems (RNSS)

- NavIC

- QZSS

By Component

- Space Segment

- Ground Segment

- User Segment

By End-User Industry

- Transportation

- Defense and Security

- Consumer Electronics

- Automotive

- Industrial

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others