Report Overview

Saudi Arabia Advanced Battery Highlights

Saudi Arabia Advanced Battery Market Size:

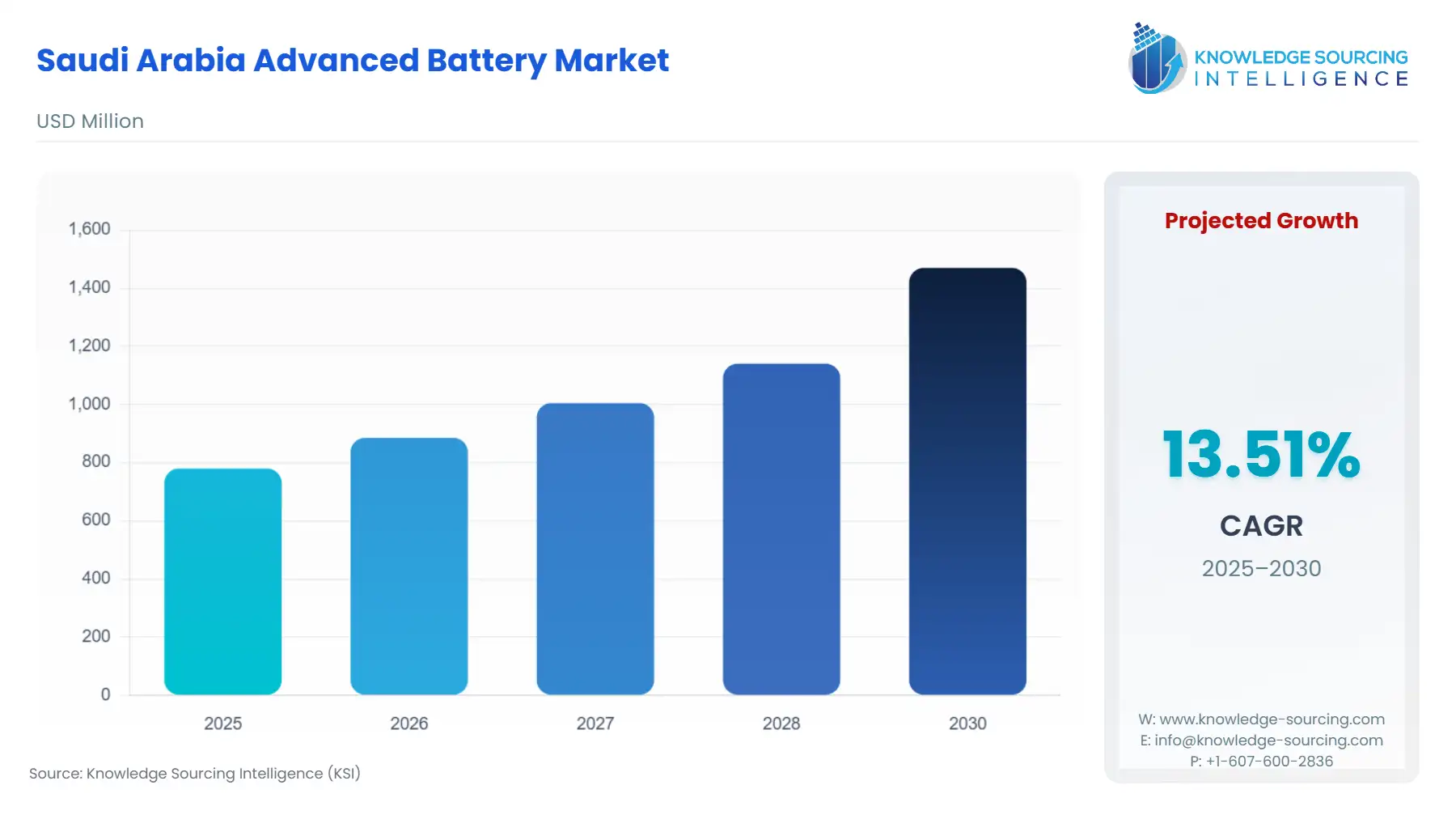

The Saudi Arabia Advanced Battery Market is expected to grow at a CAGR of 13.51%, reaching USD 1.47 billion in 2030 from USD 0.78 billion in 2025.

Saudi Arabia is emerging as a key player in the advanced battery market, spurred by its ambitious renewable energy initiatives, investment in electric vehicles, and focus on grid stability. As part of its Vision 2030 strategy, the Kingdom is transforming its energy landscape, aiming to become a leader in clean energy production and sustainability. This transformation is directly influencing the demand for advanced batteries across sectors such as automotive, energy storage, and industrial applications.

Saudi Arabia Advanced Battery Market Analysis:

Growth Drivers:

Several key factors are driving the rapid growth of the advanced battery market in Saudi Arabia.

- Vision 2030 and Renewable Energy Initiatives: Saudi Arabia's Vision 2030 aims to reduce the country's dependency on oil and diversify its energy sources, with a significant focus on renewable energy. As part of this initiative, Saudi Arabia has set aggressive targets for solar and wind power generation. To manage the variability of renewable energy, the demand for energy storage systems (ESS), which rely heavily on advanced batteries, is increasing. ESS are crucial for stabilizing the grid and ensuring the reliable delivery of renewable energy. This directly enhances the demand for advanced batteries, such as lithium-ion and flow batteries.

- Electric Vehicle (EV) Adoption: The Saudi government is pushing for the adoption of electric vehicles (EVs) as part of its sustainable transportation strategy. Policies such as subsidies for EV purchases and infrastructure development, including charging stations, are expected to propel the demand for batteries, particularly lithium-ion batteries, used in EVs. The increasing shift towards electrification of public transportation, including buses and taxis, is further boosting the need for high-performance batteries.

- Government Regulations and Incentives: Government policies aimed at reducing carbon emissions and promoting green energy are pivotal in creating demand for advanced batteries. The Kingdom has also launched initiatives for local battery manufacturing and recycling, incentivizing both domestic and international players to invest in battery production facilities.

- Industrial Demand for Batteries: Industrial sectors in Saudi Arabia, particularly in mining, manufacturing, and logistics, are increasingly incorporating advanced battery systems to power autonomous machines and improve energy efficiency. These applications are contributing to the overall growth in demand for specialized batteries.

Challenges and Opportunities:

Despite the significant growth prospects, the Saudi Arabian advanced battery market faces several challenges.

- Supply Chain and Raw Material Constraints: Saudi Arabia’s reliance on imports for key raw materials such as lithium, cobalt, and nickel poses a major challenge to the local battery manufacturing industry. Volatility in global commodity prices and supply chain disruptions can impact the availability and cost of essential battery components. However, the government's push for mining operations and local production of key materials offers an opportunity to mitigate these risks over time.

- Technological Barriers: The development of next-generation battery technologies, such as solid-state batteries, remains a challenge. While companies like NEOM Investment are investing heavily in research and development, Saudi Arabia’s market is still heavily reliant on established technologies, such as lithium-ion batteries. The transition to more advanced technologies could take time and requires significant investment in infrastructure and R&D.

- Competition from International Players: The Saudi Arabian battery market is becoming increasingly competitive, with key global players such as LG Energy Solution, Tesla, and BYD entering the market. This international presence increases competition for local companies and poses a challenge in securing market share. However, the rising demand for EVs and energy storage systems presents ample opportunities for all players to grow in the expanding market.

Raw Material and Pricing Analysis:

The Saudi Arabian advanced battery market relies heavily on imported raw materials, such as lithium, cobalt, nickel, and graphite. Lithium, in particular, is crucial for the production of high-performance lithium-ion batteries. The global supply chain for these materials is dominated by countries like Australia, Chile, and the Democratic Republic of Congo.

Recent geopolitical tensions and trade disruptions have led to fluctuations in the prices of these materials, affecting the cost structure of battery manufacturers. In response, Saudi Arabia is exploring domestic mining opportunities, particularly for lithium and cobalt, to reduce reliance on foreign suppliers and stabilize prices.

Supply Chain Analysis:

The global supply chain for advanced batteries is highly complex, involving multiple stages including raw material extraction, manufacturing, and final assembly. Key hubs for battery production and raw material processing include China, South Korea, Japan, and several European nations. In Saudi Arabia, battery manufacturers are dependent on these international supply chains for the procurement of materials and technology.

However, the Saudi government’s push to develop local manufacturing capacity for batteries and critical raw materials presents opportunities to enhance the resilience of the supply chain. The development of specialized logistics infrastructure to support the transportation of raw materials and finished batteries will be crucial for ensuring the smooth functioning of the market.

Saudi Arabia Advanced Battery Market Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Saudi Arabia | Vision 2030 and the National Renewable Energy Program | Encourages the growth of the energy storage market, driving demand for batteries in renewable energy projects. |

| Saudi Arabia | Electric Vehicle Policy and Infrastructure Development | Stimulates demand for EV batteries through financial incentives and infrastructure development. |

| Saudi Arabia | Local Battery Manufacturing and Recycling Incentives | Supports the growth of domestic battery production, reducing dependence on imports. |

Saudi Arabia Advanced Battery Market Segment Analysis:

- By Technology – Lithium-ion Batteries: Lithium-ion (Li-ion) batteries are the dominant technology in Saudi Arabia’s advanced battery market, primarily due to their application in electric vehicles (EVs) and energy storage systems (ESS). These batteries offer high energy density, long life cycles, and rapid charging capabilities, making them ideal for both automotive and grid stabilization applications. The increasing adoption of EVs, supported by government policies, directly impacts the demand for Li-ion batteries, especially in the automotive sector. Additionally, the growing investment in renewable energy sources, such as solar and wind, has created a surge in demand for Li-ion batteries for ESS, as they provide an efficient solution for storing intermittent renewable energy.

- By Application – Energy Storage Systems (ESS): Energy Storage Systems (ESS) are crucial to Saudi Arabia’s energy transition, driven by the Kingdom’s heavy investments in renewable energy. ESS technologies, such as Li-ion and flow batteries, are essential for stabilizing the grid and ensuring a continuous power supply from renewable sources. As Saudi Arabia aims to generate a significant portion of its energy from renewables, the need for ESS will continue to rise. These systems are particularly critical for managing peak demand and providing backup power. Furthermore, Saudi Arabia’s drive to establish a green hydrogen economy is expected to further increase the demand for large-scale ESS as a means to store hydrogen energy for future use.

Saudi Arabia Advanced Battery Market Competitive Analysis:

The competitive landscape in Saudi Arabia’s advanced battery market is defined by a combination of local and international players.

- NEOM Investment: NEOM is positioning itself as a leader in advanced battery technologies by investing in both energy storage and EV infrastructure projects. The company’s efforts to develop a futuristic city powered by sustainable energy are driving demand for next-generation battery solutions.

- ACWA Power: ACWA Power is a significant player in the renewable energy sector, with substantial investments in solar and wind energy projects. The company’s focus on integrating large-scale energy storage solutions into its renewable energy projects has made it a key player in the Saudi advanced battery market.

Saudi Arabia Advanced Battery Market Developments:

- August 2025: Hithium, a leading Chinese battery energy storage firm, clinched a major 4 GWh supply contract for two utility-scale projects in Saudi Arabia's Tabuk and Hail regions, valued at over $362 million. The deal includes O&M services and construction by local partner Alfanar. This follows Hithium's 2024 joint venture with Saudi firm MANAT to build a 5 GWh BESS factory, bolstering the Kingdom's renewable integration amid Vision 2030. The projects enhance grid stability, supporting Saudi Arabia's goal of 50% renewable energy by 2030, with deployment expected by late 2026.

- February 2025: BYD Energy Storage partnered with Saudi Electricity Company (SEC) to deploy 15.1 GWh of battery systems across five sites, marking the globe's biggest grid-scale energy storage initiative. Valued at billions, it integrates with Saudi Arabia's transmission network to manage peak demand and renewables surge. This aligns with the Kingdom's 130 GW renewable target by 2030, reducing fossil fuel reliance. BYD's Blade batteries ensure safety and longevity in desert conditions, with full rollout by 2027, positioning Saudi as a storage leader.

Saudi Arabia Advanced Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 0.78 billion |

| Total Market Size in 2031 | USD 1.47 billion |

| Growth Rate | 13.51% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Capacity, Material, Sales Channel |

| Companies |

|

Saudi Arabia Advanced Battery Market Segmentation:

- BY TECHNOLOGY

- Lithium-ion Batteries

- Lead-acid Batteries

- Solid-state Batteries

- Nickel-metal Hydride (NiMH) Batteries

- Flow Batteries

- Sodium-ion Batteries

- Others

- BY CAPACITY

- Low Capacity (<50 Ah)

- Medium Capacity (50-200 Ah)

- High Capacity (>200 Ah)

- BY MATERIAL

- Cathode Material

- Anode Material

- Others

- BY APPLICATION

- Automotive

- Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Energy Storage Systems

- Residential

- Commercial & Industrial - Utility-scale

- Consumer Electronics

- Industrial

- Motive Power

- Stationary

- Medical

- Aerospace & Defense

- Others

- Automotive

- BY SALES CHANNEL

- OEM

- Aftermarket