Report Overview

Skid Steer Loader Market Highlights

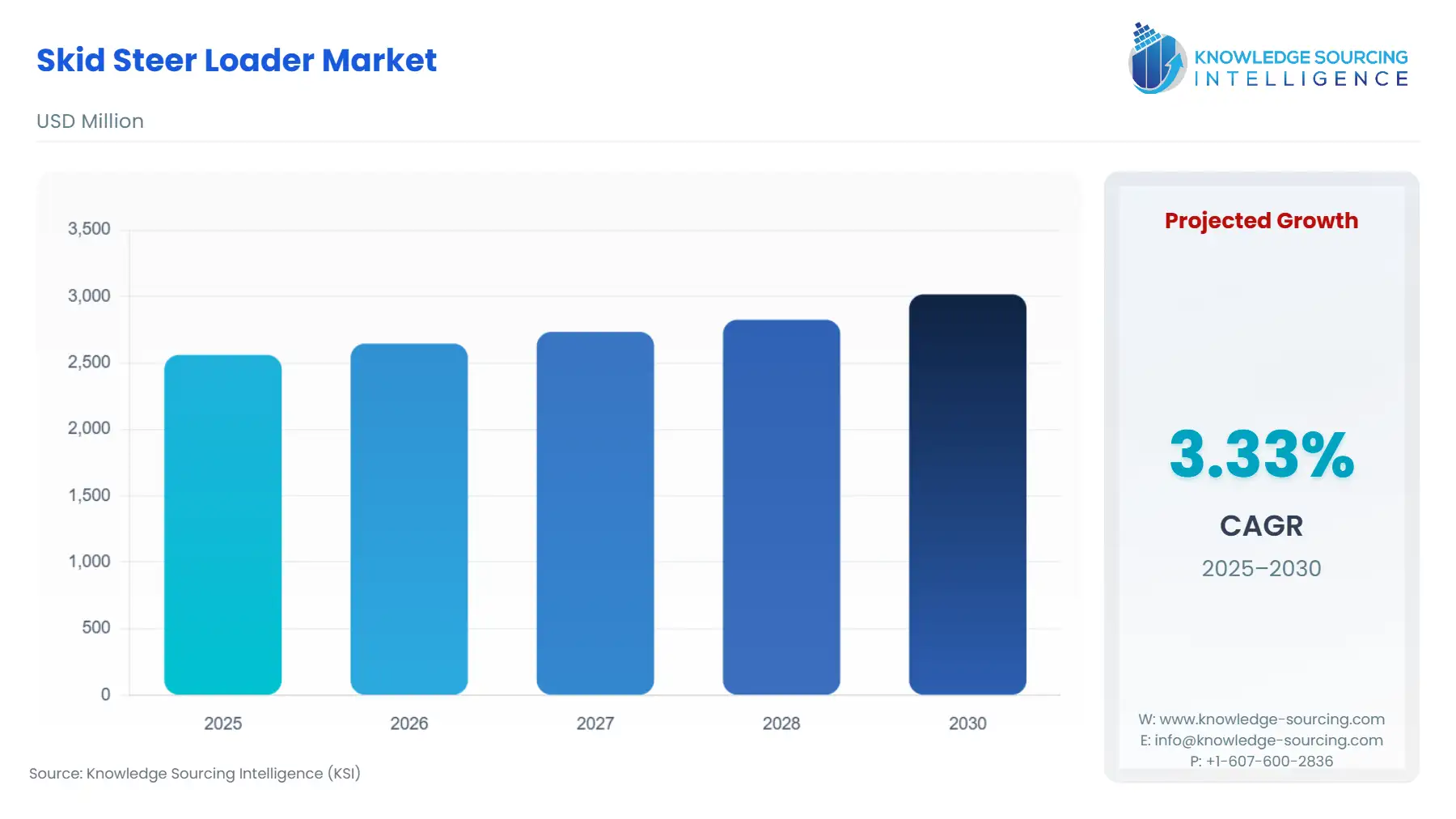

Skid Steer Loader Market Size:

The Skid Steer Loader Market is expected to grow from US$2.561 billion in 2025 to US$3.017 billion in 2030, at a CAGR of 3.33%.

Skid steer loaders serve as compact, versatile machines integral to material handling across construction, agriculture, and maintenance sectors. These units, characterized by their zero-turn radius and attachment compatibility, enable operators to navigate confined spaces while executing tasks like excavation, grading, and loading. Demand stems from their adaptability to evolving site requirements, where space limitations and regulatory pressures favor equipment that minimizes environmental footprints without sacrificing productivity.

Today, with global infrastructure investments surpassing billions annually, hence these loaders underpin efficiency in projects demanding precision over brute force. Likewise, the growing transition towards sustainable fuel has accelerated the electric variants, demand, further propelled by EPA Tier 4 emissions standards, which is reflecting a pivot toward sustainable operations amid rising fuel costs. This transition not only mitigates environmental penalties but also lowers long-term ownership expenses, appealing to fleet managers optimizing total cost of ownership.

Skid Steer Loader Market Analysis

- Growth Drivers

Residential construction surges have catalyzed demand for skid steer loaders by necessitating compact equipment capable of maneuvering in densely packed sites. The Committee for European Construction Equipment's annual report documents how such builds stimulated sales of compact machines, including skid steers, as developers prioritize units that accelerate material movement without extensive site preparation. In the US, where urban expansion mirrors this trend, the Environmental Protection Agency's off-road vehicle assessment notes rising ownership of medium-sized skid steers among property managers, driven by their utility in grading and debris clearance. This direct linkage elevates procurement rates, as contractors replace outdated fleets to match project timelines compressed by housing shortages.

Agricultural mechanization further propels loader adoption, particularly in regions transitioning from manual to automated operations. The US Department of Agriculture's data on farm equipment trends underscores how skid steers facilitate precise tasks like hay handling and soil tilling, reducing labor needs amid workforce declines. In Brazil, government-backed agribusiness expansions have amplified this effect, with loaders enabling efficient crop residue management on smaller plots. Manufacturers respond by engineering models with interchangeable attachments, which extend usability across seasons and crop types, thereby justifying investments that yield measurable productivity gains. This mechanization imperative sustains demand, as farmers weigh the loaders' versatility against rising input costs.

Rental market expansion underpins sustained demand, as economic uncertainty prompts contractors to lease rather than purchase. This model directly incentivizes demand for durable, multi-attachment units, as renters prioritize uptime to maximize return on investment. In response, distributors like United Rentals Inc. have stocked more configurations inclusive of vertical-lift for high-reach pallet handling. According to the company’s 2024 annual report, United Rentals Inc. generated USD 15,355 millions in revenue from which the general rental business which included renting heavy machinery inclusive of skid steer loader generated USD10,845 million thereby accounting for 70.67% of the total turnover.

- Challenges and Opportunities

Stringent emissions standards pose a core challenge by elevating compliance costs, which in turn dampen demand for non-upgraded diesel skid steers. The Occupational Safety and Health Administration's 1926.602 standard mandates rollover protections and stability features, but integrating these with Tier 4 Final engines increases upfront prices. Operators in agriculture delay purchases, opting for extended maintenance on legacy units, which fragments market growth in regions. This headwind particularly affects smaller end-users, who face financing barriers amid rising interest rates, ultimately constraining overall unit volumes.

Supply chain volatilities, exacerbated by raw material price swings, further erode affordability and predictability. US International Trade Commission data on steel imports reveal tariff-induced hikes that cascade through loader assemblies, prompting manufacturers to ration production. In regions like South America, logistical bottlenecks in ports delay component deliveries, forcing reliance on domestic alternatives that compromise quality. These disruptions reduce order fulfillment rates, shifting demand toward leasing models as buyers hedge against ownership risks.

Opportunities emerge from zero-emission mandates, which unlock grants and tax credits that directly stimulate electric skid steer acquisitions. The California Air Resources Board's 2024 fleet rules offer vouchers for compliant purchases, enabling public entities to modernize without budget strains. This framework extends to private sectors via federal incentives under the Inflation Reduction Act, where electric loaders qualify for deductions that offset premiums over diesel equivalents. Demand intensifies as operators capitalize on these, particularly in construction, where reduced downtime from regenerative braking enhances ROI.

Technological integrations present another avenue, with telematics enabling predictive maintenance that appeals to fleet managers seeking uptime assurances. Urban landscaping and maintenance needs round out the drivers, with municipal budgets allocating for versatile units that handle everything from turf installation to snow removal. Major regions like Europe identifies such technological innovations as a growth lever, with subsidies for digital upgrades drawing in landscapers. These features not only expand market penetration but also foster loyalty through data-driven efficiencies.

- Raw Material and Pricing Analysis

Steel constitutes the predominant raw material in skid steer fabrication, accounting for chassis, booms, and buckets, with pricing dynamics heavily influenced by global trade policies. The recent February 2025 announcement by the US government of imposing 25% tariff by on imported steel and aluminum slabs from Europe will directly inflate the domestic loader costs by embedding surcharges in supply contracts. This escalation curtails demand among price-sensitive agricultural buyers, who defer expansions until material stabilization.

- Supply Chain Analysis

Global skid steer production centers in the US, Japan, and South Korea anchor the supply chain, with assembly lines drawing steel from North American mills and electronics from East Asian clusters. Logistical complexities arise from trans-Pacific shipping, where container shortages extended lead times, and the rising port congestion led to ship rerouting which further increased the operational cost thereby simultaneously impacting the freight charges.

Recent reciprocal tariffs imposed by the Trump administration on steel and aluminum, enacted under Section 232 in June 2025, have imposed 50% duties on derivative imports. These measures target Chinese components, raising loader prices by 8-12% and disrupting flows to South American assemblers reliant on Asian intermediates. Dependencies on single-source suppliers for hydraulics amplify vulnerabilities

Skid Steer Loader Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

OSHA 1926.602 - Material Handling Equipment |

Mandates stability and rollover protections, increasing retrofit costs but elevating demand for compliant new units in construction, where non-adherence risks fines up to $15,000 per violation. |

|

European Union |

Stage V Emissions - European Commission |

Enforces particulate limits on off-road engines, spurring uptake of hybrid skid steers in major nations like Germany as non-compliant models face import bans, redirecting demand to certified electric alternatives. |

Skid Steer Loader Market Segment Analysis

- By Type: Vertical Lift

Vertical lift skid steers command demand through their superior reach in stacking and loading applications, particularly where overhead clearance constraints traditional radial designs. OSHA guidelines under 1926.602 emphasize load stability at height, positioning vertical models as essential for compliance in multi-story construction phases. In the US, Federal Highway Administration project specs frequently specify these for bridge undercarriage work, where lift heights exceeding 10 feet enable efficient material placement without auxiliary lifts. This capability directly correlates with procurement spikes during infrastructure bids, as contractors minimize equipment swaps to control costs.

Likewise, the demand surges from construction's need for overhead utility avoidance, and vertical models offer higher rated capacity that aligns with FEMA's Schedule of Equipment Rates, thereby prompting rentals to favor them for elevated tasks, cutting cycle times. In agriculture, they facilitate silage stacking in dairies where height efficiency trims labor by two hours daily. Regulatory tailwinds, like EPA's vibration limits under Tier 4, embed sensors in vertical arms, enhancing operator feedback and sustaining demand growth in safety-focused fleets.

- By End-User: Construction

Construction represents the dominant end-user, where skid steers drive site productivity through providing assistance in rapid earthmoving and demolition operations. The ongoing development in digging technology followed by investment of telematics and GPS features in heavy equipment has improved the technological landscape for skid steer loaders for construction application. Furthermore, the Emissions mandates intensify construction-specific uptake, as EPA Tier 4 compliance necessitates low-emission hydraulics that sustain high-pressure operations without refueling interruptions. Infrastructure renewals followed by strategic investments for same further anchor demand for skid steer loader.

Skid Steer Loader Market Geographical Analysis

The skid steer loader market analyzes growth factor across following regions

- North America: The infrastructure development is booming in major regional economies namely the United States and Canada fuelled by high investment in private and public construction. For instance, according to the US Census Bureau, in August 2025, the total construction spending at seasonally adjusted rate stood at USD 2,169.5 billion from which private construction accounted for USD 1,652.1 billion. Moreover, major market layers namely Caterpillar Inc. and John Deere has established their base in the USA and the companies are investing in development of skid steer loader development that are compliant with net-zero emission policies.

- Europe: The regulatory framework in European region is favoring development of next-generation heavy equipment machinery with major regional economies such as Germany, the United Kingdom, and France aiming to transform their material handling capabilities. Hence, polices like Germany's “Energiewende” aims to drive demand via green procurement.

- Asia Pacific: Urban development in Asia Pacific region has picked up pace and with current market trends that favors automation and precision-operation handling machinery, countries like China and India are investing in such technological adoption for warehousing, construction and landscaping application.

- South America & MEA: Rapid industrialization and investment in new infrastructure projects has provided new growth prospects in the South America where favorable policies like “Vision 2030” of Saudi Arabia has impacted the construction output in the country which is driving the market expansion in MEA.

Skid Steer Loader Market Competitive Environment and Analysis

The landscape features entrenched players leveraging scale for innovation, with Caterpillar, John Deere, and Kubota Corporation working to garner a wide customer share through their integrated ecosystems.

- Caterpillar Inc. positions as a performance leader, emphasizing hydraulic power in its skid steer loader to penetrate construction fleets. Offering an extensive product portfolio including models like the 270 with 100 hp engines and 3,557-lb capacities, designed for high-flow attachments that enhance breakout forces.

- John Deere strategizes around operator-centric designs, with skid steer loaders inclusive of P-series featuring dynamic design and controls that covers varied application including moving landscaping materials as well as rebelling of stones. The company has invested in launched new products are per the regional market which has enabled it to garner a wide customer base across different countries. For instance, the launnh of 325G Tracked Skid Steer in June 2025 enabled John Deere to mark its presence in African soil.

Skid Steer Loader Market Developments

- June 2025: John Deere launched its “325 G Tracked Skid Steer” which id first of its kind tracked steer in Africa. Offering exceptional stability at uneven terrain and power breakout forces with hydraulic capabilities makes the machine an ideal choice for high-traffic workspace.

- February 2025: Komatsu. Ltd launched its 4-ton skid steer loader at the Bauma 2025 international exhibition for construction and infrastructure. The loader is specifically designed to match the European market demand of high material handling capacity at low emission and maintenance. Its 53.7 kW Stage V diesel complaint engine provides high traction force and breakout pull.

- January 2025: Caterpillar introduced five next-generation skid steer and compact track loaders including three Cat SSLs and two CTL line in the Latin America. The launch enabled the company to showcase its technical advancements which matches the heavy material handling requirement in major sectors such as construction.

Skid Steer Loader Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Skid Steer Loader Market Size in 2025 | US$2.561 billion |

| Skid Steer Loader Market Size in 2030 | US$3.017 billion |

| Growth Rate | CAGR of 3.33% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Skid Steer Loader Market |

|

| Customization Scope | Free report customization with purchase |

Skid Steer Loader Market Segmentation:

- By Type

- Vertical Lift

- Radial Lift

- By Capacity

- Up to 700 Kg

- 700 to 1,000 Kg

- Greater than 1,000 Kg

- By Power Output

- Up to 20 Hp

- 20 to 40 Hp

- Greater than 40 Hp

- By Fuel Type

- Electric

- Conventional Fuel

- Gasoline

- Diesel

- By End-User

- Construction

- Agriculture

- Landscaping & Ground Maintenance

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- North America