Report Overview

Off Highway Vehicles Market Highlights

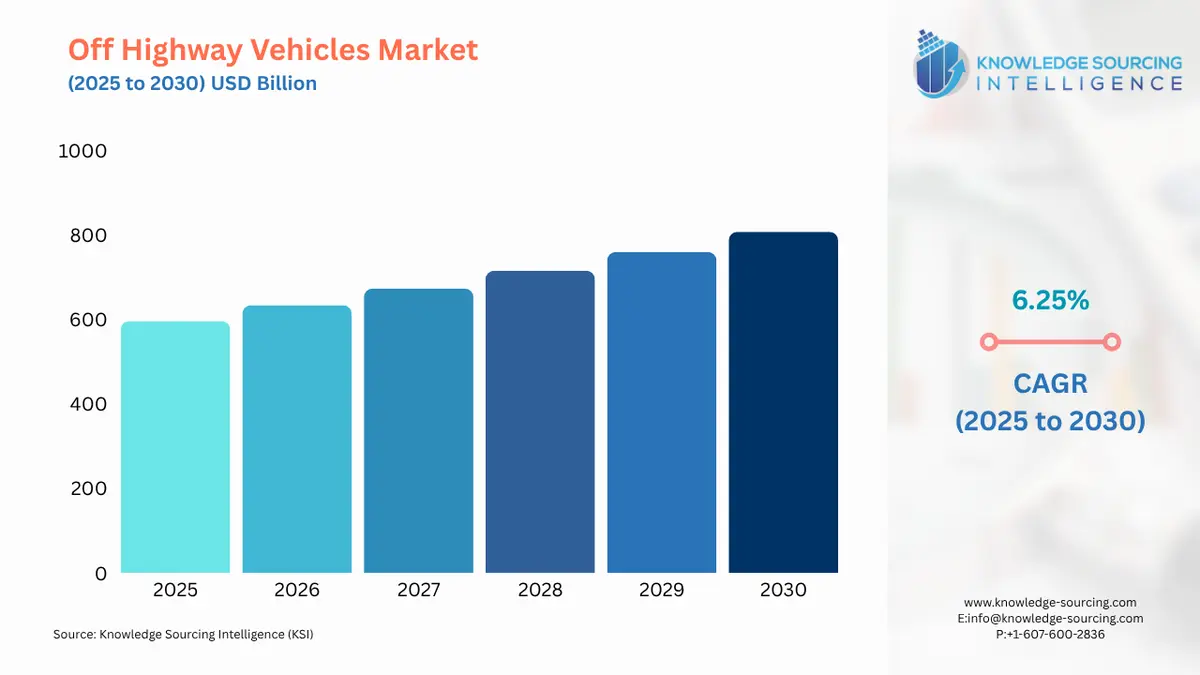

Off Highway Vehicles Market Size:

The Off Highway Vehicles Market is expected to grow at a CAGR of 6.25%, reaching USD 807.419 billion in 2030 from USD 596.400 billion in 2025.

The off-highway vehicles market is a fundamental pillar of the global industrial economy, encompassing a diverse range of equipment from agricultural tractors to heavy-duty mining trucks. These machines are essential for core economic activities such as agriculture, construction, and resource extraction. The market's evolution is a reflection of major macroeconomic trends, including urbanization, infrastructure development, and the global push toward sustainable practices. While traditionally dominated by internal combustion engine (ICE) vehicles, the industry is now in a period of transition, with a growing emphasis on alternative powertrains and intelligent technologies.

Off Highway Vehicles Market Analysis:

- Growth Drivers

The primary market drivers of off-highway vehicles are directly tied to large-scale, capital-intensive global industries. Infrastructure development stands as a potent catalyst. As countries invest in new roads, bridges, railways, and urban infrastructure, the demand for construction equipment such as excavators, bulldozers, and loaders increases directly. For example, large-scale government-backed projects, like the US RAISE program, which allocated significant funding to road and bridge modernization, create a direct and immediate demand for earthmoving and material-handling equipment.

The mechanization of agriculture, particularly in developing economies, is another critical driver. As agricultural sectors strive for greater efficiency, higher yields, and reduced labor costs, the adoption of modern tractors, combine harvesters, and sprayers becomes a necessity. This shift from manual labor to machine-based farming directly propels the demand for advanced agricultural equipment. China's achievement of a high mechanization rate in crop cultivation and harvesting, for instance, reflects a broader global trend that compels farmers to upgrade their machinery to improve efficiency and competitiveness.

Technological advancements, including telematics and automation, also create new demand. The integration of these technologies into off-highway vehicles improves productivity, reduces operational costs, and enhances safety. Telematics systems, which provide real-time data on machine performance, enable predictive maintenance and more efficient fleet management. This technological evolution increases the replacement demand for older, less efficient models and creates a new market for connected and data-enabled machines. Similarly, the development of autonomous equipment for mining and construction is a direct response to labor shortages and the need for continuous, safe operation, thereby creating a demand for these highly specialized, high-value vehicles.

- Challenges and Opportunities

The off-highway vehicle market faces significant challenges, primarily related to environmental regulations and high initial costs. Stringent emission standards, such as the European Union's Stage V, impose tight limits on particulate matter and nitrogen oxide (NOx) emissions for non-road mobile machinery. This necessitates substantial investment in new engine technologies and after-treatment systems, which increases the production cost for manufacturers and, in turn, the purchase price for end-users. This can serve as a constraint on demand, particularly for smaller businesses and in markets where cost sensitivity is high.

However, these challenges are simultaneously creating transformative opportunities. The push for lower emissions is a powerful catalyst for the adoption of electric and hybrid off-highway vehicles. Manufacturers are responding by developing new product lines with alternative powertrains, which creates an entirely new market segment. For instance, the market share for electrically-chargeable commercial vehicles, while still small, is increasing, signaling a shift in demand towards these more sustainable options. This trend is a direct opportunity for companies that can innovate and scale the production of battery-electric and hybrid-electric equipment. The opportunity is also tied to government incentives and subsidies for electric vehicle adoption, which can offset the higher initial costs for end-users.

Furthermore, the need for enhanced operational efficiency and safety in hazardous environments, such as mining and construction, has created a clear opportunity for the integration of autonomous and telematics technologies. The demand for these features is driven by a desire to reduce human error, minimize downtime, and operate in a more productive manner. The collaboration between manufacturers and technology companies to develop software-defined vehicles and advanced driver-assistance systems (ADAS) directly addresses these needs and positions these firms to capture a new, high-value market.

- Raw Material and Pricing Analysis

The production of off-highway vehicles is heavily dependent on key raw materials, with steel, iron, aluminum, and copper being foundational components. The pricing of these materials is subject to global commodity markets, which are volatile and can directly impact the cost of manufacturing. For example, a surge in the price of steel, a primary material for chassis and structural components, increases the total cost of production for a tractor or an excavator. This cost can be passed on to the consumer, potentially affecting demand, particularly for large, capital-intensive equipment. The supply chain for these materials is complex and global, with key mining and processing hubs located in regions like China, Brazil, and Australia. Fluctuations in geopolitical stability and trade policies can disrupt this flow, leading to supply chain constraints and price volatility. Manufacturers must manage these risks by securing long-term supply contracts and diversifying their sourcing to maintain consistent production schedules and predictable pricing for their customers.

- Supply Chain Analysis

The global supply chain for off-highway vehicles is intricate and highly integrated. It begins with the extraction and processing of raw materials, followed by the manufacturing of components such as engines, transmissions, hydraulic systems, and axles. Major component suppliers, often Tier 1 companies, operate a global network of factories that feed into the assembly plants of major OEMs. Key production hubs for the final assembly of off-highway vehicles are concentrated in North America, Europe, and the Asia-Pacific.

Logistical complexities arise from the size and weight of the finished products, which require specialized transportation. Intercontinental shipping and a dense network of dealerships and service centers are essential for delivering and maintaining the equipment. The supply chain's dependencies are stark; a shortage of a single critical component, such as a semiconductor for telematics or an engine from a key supplier, can halt the production of an entire line of vehicles. The industry is also increasingly dependent on a "reverse logistics" supply chain to manage the repair and remanufacturing of components, which helps to reduce waste and lower the total cost of ownership for end-users.

- Government Regulations

Government regulations are a powerful external force that directly influences the demand and design of off-highway vehicles. The most impactful regulations are those related to environmental emissions and safety. Regulatory bodies in different jurisdictions set standards for air and noise pollution, compelling manufacturers to develop and implement new engine technologies.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis

- European Union: Stage V Emission Standards (EU Regulation 2016/1628). These regulations set stringent emission limits for Non-Road Mobile Machinery (NRMM). Manufacturers must integrate advanced engine and exhaust after-treatment technologies, such as Diesel Particulate Filters (DPF) and Selective Catalytic Reduction (SCR), to comply. This directly increases the production cost of new vehicles but also creates a demand for cleaner, more efficient models and can decrease the demand for older, non-compliant equipment in regulated markets.

- United States: Environmental Protection Agency (EPA) Tier 4 Final Emission Standards. Similar to the EU, the EPA's Tier 4 Final standards for off-highway diesel engines mandate a significant reduction in emissions of particulate matter and NOx. Compliance requires manufacturers to invest heavily in research and development, which translates into higher vehicle prices. This regulatory framework drives demand for new, technologically compliant equipment and has compelled companies to phase out older engine models.

- China: China IV Emission Standard. China has implemented its own stringent emission standards for non-road mobile machinery. These regulations compel both domestic and international manufacturers operating in the Chinese market to produce equipment with advanced engine and exhaust technologies to reduce emissions. This policy not only improves air quality but also directly influences the type of equipment demanded by the world's largest consumer and producer of off-highway vehicles.

Off Highway Vehicles Market Segment Analysis:

- By Technology: Conventional

The conventional segment, which comprises off-highway vehicles powered by internal combustion engines, remains the dominant force in the market. The need for these vehicles is primarily driven by their robust performance, proven reliability, and the extensive support infrastructure, including a readily available supply of diesel fuel and a vast network of trained technicians. The demand for conventional vehicles is directly linked to the scale of operations in end-user industries like construction, agriculture, and mining, where high torque, extended operating hours, and the ability to operate in remote locations are critical. For example, a large-scale construction project or a massive agricultural farm requires the power and durability of a conventional machine to handle heavy loads and demanding terrain. While facing headwinds from environmental regulations, the segment continues to be a cornerstone of the market due to its cost-effectiveness, well-established technology, and familiarity among operators. The demand for conventional vehicles is expected to persist in many parts of the world, especially in markets where the infrastructure for electric vehicles is not yet fully developed.

- By End-User Industry: Agriculture

The agriculture end-user industry is a foundational growth driver for off-highway vehicles, with tractors and combine harvesters being the primary products. This growth is a direct result of the global push for increased food production and farm efficiency. As the world population grows, farmers are under pressure to produce more with less land, which necessitates the use of advanced, high-productivity machinery. The shift from subsistence farming to commercial agriculture in developing countries creates a strong need for basic to mid-range equipment. Concurrently, in developed nations, the demand is for high-tech, precision agriculture equipment that incorporates GPS, telematics, and automation to optimize planting, spraying, and harvesting. The need to reduce labor costs and improve crop yields directly compels farmers to invest in new machinery. The industry's demand is also influenced by commodity prices; when crop prices are high, farmers have greater capital to invest in new equipment, thereby driving market growth.

Off Highway Vehicles Market Geographical Analysis:

- US Market Analysis

The US off-highway vehicle market is one of the most significant globally, characterized by its mature agricultural and construction sectors and a strong emphasis on technology adoption. Large-scale farming operations and a steady pipeline of infrastructure projects drive the market. The agricultural segment in the US is a major consumer of off-highway vehicles, with farmers often investing in high-horsepower tractors and advanced combine harvesters to improve efficiency. The demand for these machines is supported by the availability of financing options and the robust aftermarket services provided by major manufacturers. The US market is also a key player in the development and adoption of precision agriculture and autonomous technologies, with companies and academic institutions collaborating to bring innovations to the field.

- Brazil Market Analysis

Brazil's off-highway vehicle market is the largest in Latin America, primarily propelled by its vast agricultural sector and an expanding mining industry. The country is a global agricultural powerhouse, and the need for modern machinery to handle large-scale soybean, corn, and sugarcane operations drives sustained demand for high-horsepower tractors and harvesters. The market is closely linked to commodity prices and agricultural exports. The construction sector also contributes to demand, with public and private investments in infrastructure projects creating a need for a full range of earthmoving and construction equipment. The Brazilian market is a mix of domestic production and imported machinery, and its health is directly impacted by local economic stability and trade policies.

- Germany Market Analysis

Germany's off-highway vehicle market is a leader in Europe, with a focus on high-quality, high-performance equipment. The market is driven by its advanced manufacturing base, particularly in the construction and agricultural sectors. The country's strict environmental regulations and commitment to sustainability have created a market for efficient, low-emission vehicles. German engineering and a strong focus on innovation mean that companies operating in this market are at the forefront of developing electric and hybrid off-highway machines. The necessity is for technically sophisticated equipment that offers superior performance, durability, and a lower total cost of ownership. The German market is a bellwether for technological trends, with an increasing focus on digitalization, automation, and telematics in off-highway applications.

- Saudi Arabia Market Analysis

The off-highway vehicle market in Saudi Arabia is heavily influenced by its massive construction and mining sectors. The market is tied to large-scale, long-term government infrastructure projects, such as the NEOM city and other Vision 2030 initiatives. The oil and gas sector also generates demand for specialized heavy-duty equipment. Given the harsh operating conditions, there is a strong need for durable, robust machinery. The market relies heavily on imports from international manufacturers. There is an increasing call for large, powerful machines capable of earthmoving, material handling, and mining operations. The government's strategic focus on economic diversification and infrastructure development is a direct driver of the market's growth.

- Japan Market Analysis

Japan's off-highway vehicle market is mature and technologically advanced. The market is concentrated in the construction and agricultural sectors, with a particular emphasis on compact and mini-excavators due to limited space and urban density. The country is a leader in the development of automated and robotic construction equipment, which addresses labor shortages and improves efficiency on job sites. The necessity is for innovative, high-tech solutions. Japanese manufacturers are also at the forefront of developing machines that comply with the country's strict emission and safety standards. The market's expansion is shaped by a focus on productivity, precision, and the integration of advanced technologies like telematics and remote monitoring.

Off Highway Vehicles Market Competitive Analysis:

The global off-highway vehicle market is a highly concentrated landscape dominated by a few major international manufacturers. Competition is based on a combination of factors, including product performance, technological innovation, global distribution networks, and aftermarket support. Companies compete by offering a full range of products, from entry-level to high-end, and by integrating advanced technologies to create a clear value proposition for customers.

- Caterpillar: A global giant in the construction and mining equipment sectors. Caterpillar's competitive advantage is its extensive product portfolio, which includes everything from small skid steer loaders to massive mining trucks. The company's strategy is centered on providing comprehensive, integrated solutions, including not only the machine but also financing, telematics (through its Cat Connect suite), and a massive global dealer network for service and parts. Caterpillar is also a leader in autonomous mining technology, with its autonomous haulage system a key offering to large mining customers, which directly addresses the demand for increased productivity and safety.

- Komatsu Ltd.: A major competitor with a strong global presence, particularly in Asia-Pacific. Komatsu's strategic positioning is focused on technological innovation and a comprehensive product line that spans construction, mining, and forestry. The company's "Smart Construction" initiative integrates data, drones, and intelligent machines to provide a complete solution for job sites. Komatsu's collaboration with technology companies, such as its recent partnership with Applied Intuition, is a core part of its strategy to develop software-defined vehicles and next-generation autonomous systems, directly meeting the market requirement for smarter, more efficient equipment.

- Deere & Company: A global leader in agricultural machinery, with a growing presence in the construction sector. Deere's competitive strategy is built on its brand recognition, the power of its dealership network, and its pioneering role in precision agriculture. The company’s products, like the 8RX series tractors and X9 series combines, are a response to the demand for higher productivity and data-driven farming. Deere has also expanded its offerings to include a digital self-repair tool, which provides customers with an enhanced ability to maintain and diagnose their machines, directly addressing the growing demand for greater autonomy and repairability among equipment owners.

Off Highway Vehicles Market Developments:

- September 2025: Komatsu announced a strategic technology collaboration with Applied Intuition to accelerate mining innovation. The partnership is aimed at co-developing a unified software-defined vehicle and autonomy platform, which will enhance the performance of Komatsu's mining equipment and directly address the demand for increased productivity and safety through automation.

- August 2025: Caterpillar and Hunt Energy Company, L.P. signed a strategic agreement to provide power solutions for data centers. This collaboration marks a significant expansion of Caterpillar's reach beyond traditional off-highway applications into the rapidly growing data center market, creating a new avenue for demand for its power generation products.

- July 2025: John Deere launched an enhanced digital self-repair tool for equipment owners. This development is a direct response to the demand from customers for greater control over equipment maintenance and repairs. The tool enhances the ability of owners to use, diagnose, and protect their equipment, thereby increasing customer satisfaction and loyalty.

Off Highway Vehicles Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Off Highway Vehicles Market Size in 2025 | USD 596.400 billion |

| Off Highway Vehicles Market Size in 2030 | USD 807.419 billion |

| Growth Rate | 6.25% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Off Highway Vehicles Market |

|

| Customization Scope | Free report customization with purchase |

Off Highway Vehicles Market Segmentation:

- By Type

- Agricultural Equipment

- Construction Equipment

- Mining Equipment

- Others

- By Application

- Construction

- Agriculture

- Mining

- Forestry

- Others

- By Technology

- Conventional

- Electric

- Autonomous

- Telematics

- By End-User Industry

- Construction

- Agriculture

- Mining

- Oil & Gas

- Others

- By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa