Report Overview

Heavy Duty Truck Market Highlights

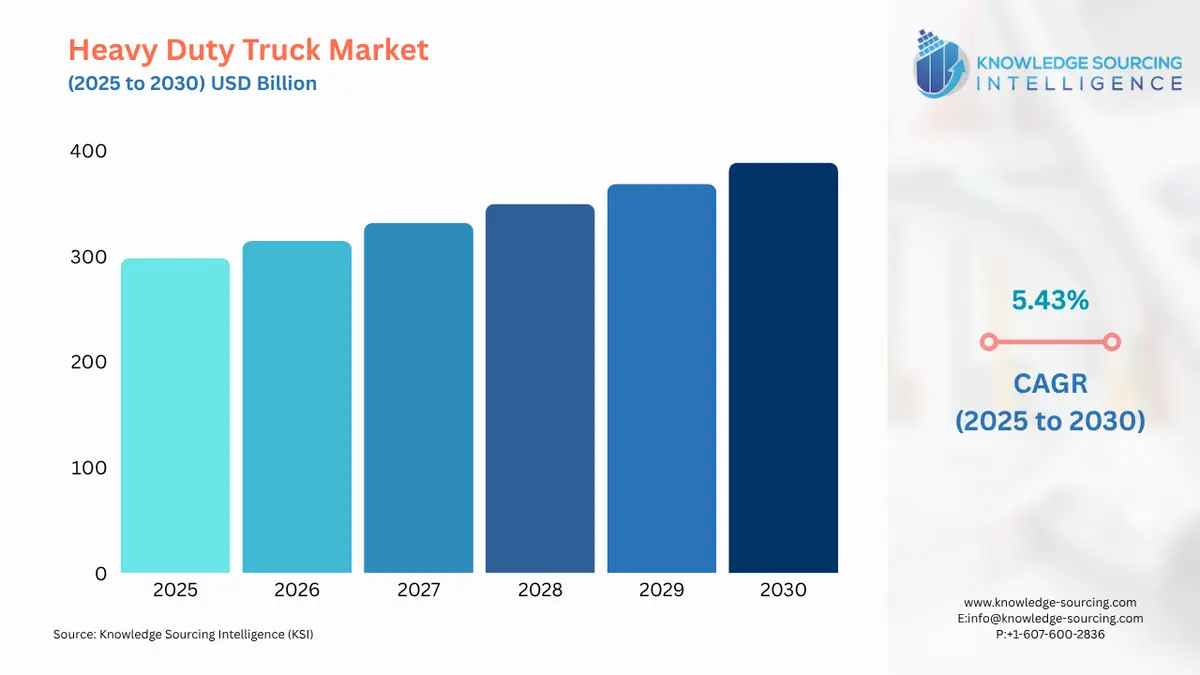

Heavy Duty Truck Market Size:

The Heavy Duty Truck Market is expected to grow at a CAGR of 5.43%, reaching USD 388.517 billion in 2030 from USD 298.200 billion in 2025.

The heavy-duty truck market is a foundational pillar of the global economy, providing the critical infrastructure for the movement of goods and materials across a diverse range of industries. The market's performance is intrinsically linked to macroeconomic conditions, including economic growth, industrial production, and trade flows. Historically, demand for these vehicles has been a reliable indicator of industrial activity, as new truck acquisitions are a direct result of capital expenditure by trucking fleets, construction companies, and other end-users. The sector is currently navigating a complex period of transition, marked by both cyclical economic pressures and a fundamental technological shift toward sustainable power.

Heavy Duty Truck Market Analysis:

- Growth Drivers

The heavy-duty trucks market is a direct function of economic activity and the evolution of global supply chains. A key growth driver is the expansion of the logistics and transportation sector, which relies on a vast network of heavy-duty trucks to transport goods from ports and manufacturing facilities to distribution centers and, ultimately, to consumers. The rise of e-commerce has acted as a powerful catalyst, creating a new and specific market profile. E-commerce logistics require a more extensive and flexible fleet to manage a higher volume of last-mile and middle-mile deliveries, thereby increasing the replacement rate and overall demand for trucks. Infrastructure development, a priority in both developed and emerging economies, is another critical driver. Large-scale construction projects for roads, bridges, and commercial buildings directly increase demand for specialized trucks such as dump trucks and concrete mixers. Governments worldwide are investing in modernizing their road networks, and these initiatives create sustained demand for the vehicles essential to these projects. Furthermore, the mining and agricultural sectors, especially in resource-rich nations, drive consistent demand for heavy-duty trucks designed to operate in challenging environments and transport heavy loads.

Technological advancements also aid in reshaping the market landscape. The introduction of new technologies, such as advanced driver-assistance systems (ADAS), telematics, and improved fuel efficiency, compels fleet operators to upgrade their vehicles. These technologies directly increase a fleet's operational efficiency, safety, and profitability, making new truck models a compelling investment for companies aiming to reduce their total cost of ownership. The imperative for fleet renewal is also driven by the need to meet increasingly stringent emissions standards, which makes older, less-efficient vehicles less viable.

- Challenges and Opportunities

The heavy-duty truck market faces significant challenges, primarily from economic uncertainty and the high capital expenditure required for technological transitions. In mature markets like North America and Europe, demand has recently softened due to macroeconomic pressures and trade policy uncertainty. This creates a headwind for manufacturers, as fleet operators may defer new purchases in favor of maintaining their existing vehicles. Furthermore, the high upfront cost of new zero-emission trucks, whether battery-electric or fuel cell, represents a significant barrier to widespread adoption. While these vehicles offer long-term operational cost savings and environmental benefits, the initial investment is substantial and can be a constraint for smaller trucking companies.

These challenges, however, present a powerful set of opportunities. The global push for decarbonization and the implementation of strict emissions regulations create a new market segment for zero-emission vehicles. Companies that can effectively scale their production of electric and hydrogen trucks and build the necessary charging and refueling infrastructure are positioned to capture this emerging demand. The high cost of new technology also provides a competitive opportunity for leasing and financing models, making these expensive vehicles more accessible to a broader range of customers. In addition, the shift toward cleaner technology is driving innovation in the entire supply chain, from component manufacturing to vehicle design. Companies that invest in these areas and provide comprehensive solutions, including maintenance and energy infrastructure, can establish a long-term competitive advantage. The focus on sustainability is also creating opportunities for market differentiation and for strengthening brand reputation among environmentally conscious customers and investors.

- Raw Material and Pricing Analysis

The heavy-duty truck market is a manufacturing industry with a complex raw material supply chain. Steel, aluminum, copper, and various polymers are the foundational materials. The pricing of these materials is subject to global commodity market fluctuations, which can directly influence the cost of truck production. For instance, a surge in steel prices can increase the cost of chassis and cab construction, which may be passed on to the end consumer. Manufacturers must manage these input costs while maintaining competitive pricing for their finished vehicles. The transition to electric trucks introduces new dependencies, with raw materials for batteries, such as lithium, cobalt, and nickel, becoming increasingly critical. The supply and pricing volatility of these battery materials pose a new challenge to the industry, as their cost directly impacts the final price of electric vehicles. This dynamic is a significant factor in the total cost of ownership for a fleet, influencing a customer's purchasing decision between a traditional diesel and a new electric truck.

- Supply Chain Analysis

The global heavy-duty truck supply chain is a sophisticated, multi-tiered network that spans continents. It begins with the sourcing of raw materials from mining and metallurgy sectors, which are then processed into components such as engines, transmissions, axles, and cab assemblies by a global network of suppliers. These components are then delivered to a limited number of major truck manufacturers' assembly plants, which are often concentrated in North America, Europe, and Asia. Logistical complexities arise from the just-in-time nature of modern manufacturing, which requires a highly synchronized flow of parts from a global supplier base. Dependencies on specific suppliers for critical components, such as semiconductors and advanced electronic systems, can create vulnerabilities, as demonstrated by recent global supply chain disruptions. The supply chain is now undergoing a fundamental transformation to support the production of electric vehicles, which requires new partnerships and supply networks for batteries, electric motors, and power electronics.

- Government Regulations

Government regulations play a decisive role in shaping the heavy-duty truck market, directly impacting product design, manufacturing costs, and customer demand. The most significant regulations relate to emissions and fuel efficiency. These policies compel manufacturers to invest heavily in research and development to create cleaner and more efficient vehicles, and they directly influence the purchase decisions of fleet operators.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis

- United States: Environmental Protection Agency (EPA) - Greenhouse Gas Emissions Standards for Heavy-Duty Engines and Vehicles. The EPA's regulations, including the "Phase 2" standards, compel manufacturers to improve the fuel efficiency and reduce greenhouse gas emissions of new trucks. This drives demand for newer, more compliant vehicles and penalizes the operation of older, less-efficient models. These standards create a clear imperative for technological innovation and fleet turnover.

- European Union: Euro VI Emissions Standards. The Euro VI standards for heavy-duty vehicles set strict limits on emissions of nitrogen oxides (NOx), particulate matter (PM), carbon monoxide (CO), and hydrocarbons. These regulations necessitate the use of advanced exhaust after-treatment systems (e.g., Selective Catalytic Reduction - SCR), which increases the complexity and cost of trucks. The regulations directly reduce the demand for less compliant vehicles and accelerate the shift toward cleaner diesel, hybrid, and electric powertrains.

- China: China VI Emissions Standards and New Energy Vehicle (NEV) Mandates. China's national China VI emissions standard, modeled on Europe's Euro VI, forces manufacturers to adopt advanced technologies to curb pollution. Additionally, government initiatives and subsidies for New Energy Vehicles (NEVs), including electric and hydrogen trucks, are creating a strong, government-supported demand signal for zero-emission commercial vehicles. This combination of regulations and incentives is rapidly reshaping the domestic market and incentivizing a shift away from traditional diesel trucks.

Heavy Duty Truck Market In-Depth Segment Analysis:

- By Application: Freight & Logistics

The freight and logistics application segment is the largest consumer of heavy-duty trucks, with demand directly driven by the need to transport goods efficiently and over long distances. The increasing volume of global trade and the growth of e-commerce have intensified this demand. E-commerce platforms, in particular, have created a more fragmented and rapid delivery network, requiring a significant number of trucks for both long-haul distribution and regional delivery. The necessity is not just for new vehicles but for a suite of services, including telematics and fleet management solutions, that enable logistics companies to optimize routes, monitor driver performance, and improve fuel efficiency. The advent of electric and autonomous technologies is beginning to reshape this segment. While the initial demand for new electric trucks is low, it is growing as logistics firms, particularly those serving urban centers, seek to meet corporate sustainability goals and comply with low-emission zone regulations. The demand for these new technologies is also influenced by the need to address a persistent driver shortage, as autonomous trucks are seen as a long-term solution to operational constraints.

- By End-User Industry: Construction

The construction industry's demand for heavy-duty trucks is highly cyclical and is directly linked to government and private sector investment in infrastructure and real estate development. The demand is specialized, focusing on vehicles designed for rugged environments and specific tasks. Dump trucks, concrete mixers, and articulated haulers are essential for transporting materials to and from construction sites. The need for these vehicles is propelled by government-led infrastructure projects, such as highway construction and port expansions, and by private residential and commercial building booms. The market profile is changing as construction firms seek more fuel-efficient and environmentally friendly equipment to meet sustainability targets and comply with new regulations. This has led to a nascent but growing demand for electric and hybrid dump trucks and concrete mixers, particularly for projects in urban areas with strict noise and emission limits. The demand for these vehicles is a key indicator of economic health, as new construction activity signals confidence in future growth.

Heavy Duty Truck Market Geographical Analysis:

- US Market Analysis

The US heavy-duty truck market is a mature and highly competitive landscape, with demand primarily influenced by freight volumes, economic growth, and the replacement cycle of aging fleets. The market is dominated by Class 8 trucks used for long-haul transportation. A key local demand driver is the vast, interconnected highway system that makes trucking the dominant mode of freight transport. The market is currently facing headwinds due to a normalization period following years of robust sales. Economic slowdown and trade policy uncertainty have led to a decrease in new orders. However, the long-term demand remains solid, underpinned by a persistent need to replace older, less fuel-efficient vehicles and to meet increasingly stringent federal and state emissions standards, such as those from the California Air Resources Board (CARB). The US market is also a hotbed for technological innovation, with strong demand for advanced safety features, telematics, and emerging electric powertrains.

- Brazil Market Analysis

Brazil's heavy-duty truck market is the largest in Latin America, closely tied to the country's economic performance, agricultural exports, and infrastructure projects. The vast size of Brazil and its reliance on road transportation for freight movement make heavy-duty trucks indispensable. Large-scale construction projects and mining operations fuel the dump trucks and mixers segment. The agricultural sector, a cornerstone of the Brazilian economy, also generates significant demand for trucks to transport goods from farms to ports and processing centers. The market is subject to economic volatility and currency fluctuations, which can impact purchasing decisions. However, government investment in infrastructure and the continued growth of agricultural and mining exports provide a strong, underlying demand signal. The local market is also a key battleground for international manufacturers, who often adapt their product lines to suit local conditions and regulations.

- Germany Market Analysis

Germany’s heavy-duty truck market is a cornerstone of the European industry, with demand characterized by a focus on engineering excellence, fuel efficiency, and a rapid transition to sustainable transport. The market is heavily driven by the country's robust manufacturing sector and its position as a central logistics hub within Europe. German transport companies require trucks with high uptime and low total cost of ownership, which fuels demand for technologically advanced and reliable vehicles. The country’s stringent environmental regulations and government incentives for electric vehicles are powerful growth drivers. Germany is a frontrunner in developing and adopting alternative fuels, with a growing demand for hydrogen and battery-electric trucks. The German market is a key testbed for new technologies, and manufacturers often launch their latest innovations here to showcase their capabilities and gain a competitive edge.

- South Africa Market Analysis

The South African heavy-duty truck market is a key regional hub, driven by mining, construction, and long-haul transportation across the southern African region. The country's extensive mining industry, which includes platinum, gold, and coal, creates a consistent and specialized demand for heavy-duty dump trucks and haulers. The demand for freight and logistics trucks is also strong, as South Africa serves as a gateway for goods entering and leaving the African continent. The market's performance is sensitive to commodity prices and government investment in infrastructure. A key market driver is the need for durable and reliable vehicles that can withstand the demanding operating conditions of the region's road networks. The market is also a significant consumer of used trucks, which provides a challenging environment for new vehicle sales but also creates a robust aftermarket parts and service industry.

- China Market Analysis

China is the world’s largest and most dynamic heavy-duty truck market, driven by rapid industrialization, urbanization, and a massive logistics sector. The government’s extensive infrastructure development projects, including the Belt and Road Initiative, create enormous demand for dump trucks, mixers, and other construction-related vehicles. The country’s vast and growing e-commerce market has created an unprecedented need for logistics and long-haul trucks to support an increasingly complex and rapid delivery network. Government policies are the most significant demand catalysts. Stricter emissions standards, such as the China VI, and aggressive promotion of new energy vehicles (NEVs) are forcing a rapid fleet transition. This has created a bifurcated market, with a strong need for both new, compliant diesel trucks and a rapidly growing, government-subsidized demand for electric and hydrogen-powered trucks. The sheer scale of China's market and the pace of its technological adoption make it a critical focal point for global truck manufacturers.

Heavy Duty Truck Market Competitive Analysis:

The heavy-duty truck market is an oligopoly dominated by a few multinational conglomerates that control key global and regional brands. Competition is intense and focuses on product innovation, total cost of ownership, and comprehensive service and parts networks. Companies compete not just on the sale of vehicles but on the ability to provide a complete solution, including financing, maintenance, and telematics services.

- Daimler Truck AG: A global leader in the commercial vehicle market, with a portfolio of brands including Freightliner, Mercedes-Benz, and Fuso. Daimler Truck's strategic positioning is rooted in its global footprint and a balanced approach to powertrains, investing in advanced diesel, battery-electric, and hydrogen fuel cell technologies. The company is actively focusing on digitalization and connectivity to provide holistic solutions to fleet operators. Daimler Truck's recent definitive agreement with Mitsubishi Fuso and Hino Motors to integrate operations in Asia is a strategic move to consolidate its market position in that high-growth region.

- Volvo Group: A leading global manufacturer of trucks, buses, construction equipment, and marine and industrial engines. Volvo Group’s competitive advantage is its strong emphasis on safety, quality, and environmental care. The company has a well-defined strategy to lead the transition to zero-emission vehicles, with a focus on battery-electric and hydrogen fuel cell technologies. Volvo's product development is centered on providing a complete ecosystem for its customers, including charging infrastructure and customized service contracts, which directly impacts customer demand by lowering the barriers to entry for new technologies.

- PACCAR Inc.: The company behind the Kenworth and Peterbilt brands, PACCAR is a dominant force in the North American heavy-duty truck market. Its strategic focus is on delivering high-quality, customer-centric products with superior fuel efficiency, durability, and a strong brand legacy. PACCAR's competitive positioning is enhanced by its robust parts and aftermarket service business, which provides a stable revenue stream and fosters customer loyalty. The company is actively expanding its zero-emission product portfolio and investing in the charging infrastructure to support these new electric vehicles.

Heavy Duty Truck Market Developments:

- September 2025: International Motors, LLC (Navistar International Corporation) announced the launch of customer fleet trials for its second-generation autonomous vehicles. This development signals a clear focus on future-ready technology and directly addresses the demand for solutions to the ongoing driver shortage in the logistics and transportation sectors.

- June 2025: Daimler Truck AG, Mitsubishi Fuso Truck and Bus Corporation, and Toyota Motor Corporation signed definitive agreements to integrate Mitsubishi Fuso with Hino Motors. This strategic acquisition is a clear move to consolidate operations and streamline development in Asia, directly addressing the competitive landscape and securing a stronger position in a high-growth region.

- April 2025: International Motors, LLC introduced the International eRH, a new all-electric Class 8 regional haul tractor. This product launch directly expands the company's electric vehicle lineup and provides a new option for customers seeking to electrify their fleets, thereby creating new demand pathways in the zero-emission segment.

Heavy Duty Truck Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Heavy Duty Truck Market Size in 2025 | USD 298.200 billion |

| Heavy Duty Truck Market Size in 2030 | USD 388.517 billion |

| Growth Rate | 5.43% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Heavy Duty Truck Market |

|

| Customization Scope | Free report customization with purchase |

Heavy Duty Truck Market Segmentation

- By Type

- Rigid Trucks

- Articulated Trucks

- Dump Trucks

- Tanker Trucks

- Refrigerated Trucks

- Flatbed Trucks

- Tractor-Trailers

- Concrete Mixer Trucks

- Others

- By Fuel Type

- Diesel

- Electric

- Natural Gas

- Hybrid

- Fuel Cell

- Others

- By Application

- Construction & Mining

- Freight & Logistics

- Long Haul

- Others

- By End-User Industry

- Logistics & Transportation

- Construction

- Mining

- Agriculture

- Retail & Distribution

- Government & Public Sector

- Others

- By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa