Report Overview

Smart Fridge Market Size:

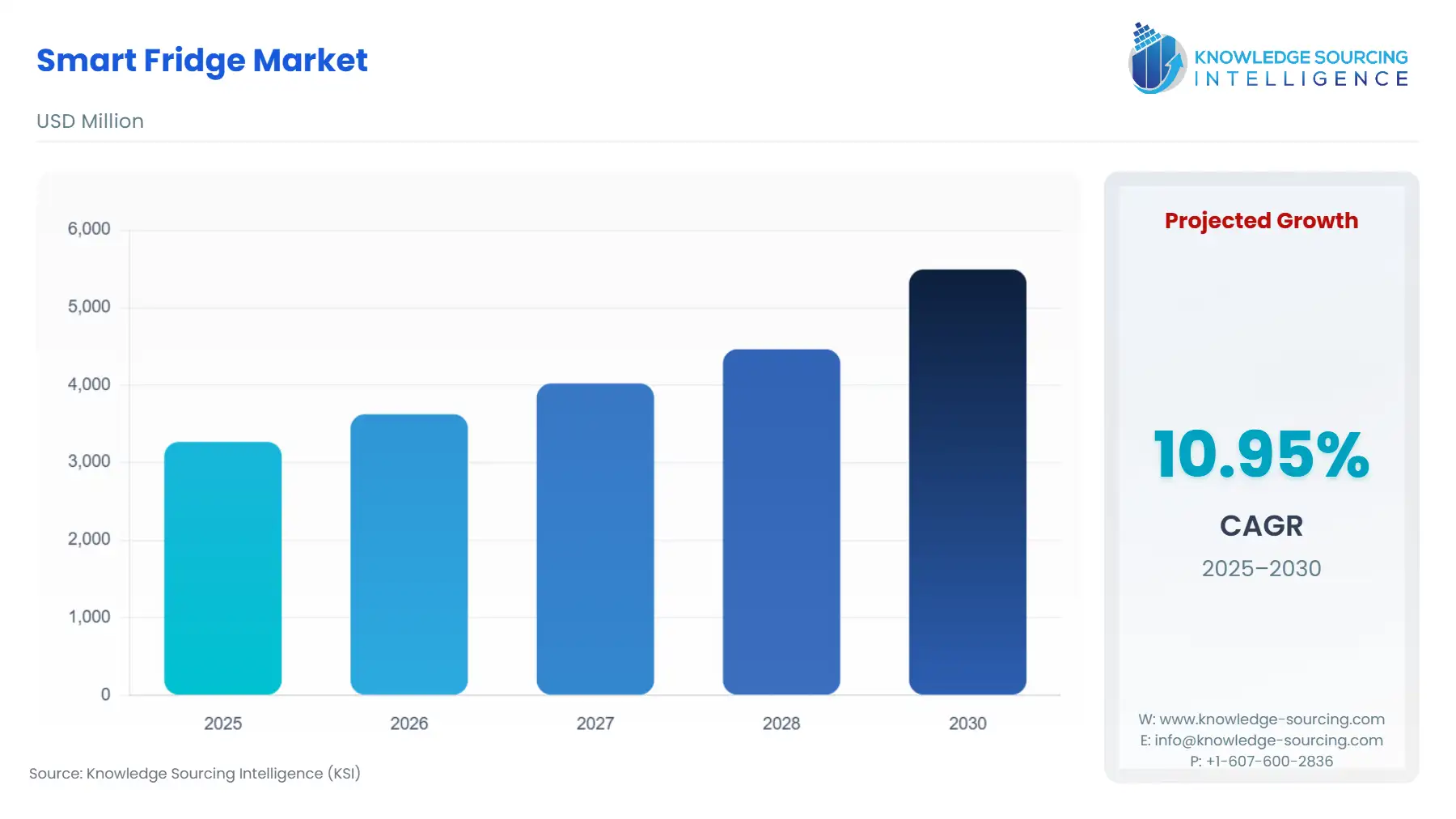

The smart fridge market is expected to grow at a CAGR of 10.95%, reaching a market size of US$5,493.978 million in 2030 from US$3,268.148 million in 2025.

A smart fridge or smart refrigerator is programmed to sense the products that are stored inside and also helps to keep track of the stock via RFID scanning. The refrigerator also helps the user in knowing about the food items that require replenishment. The monitoring of this smart appliance can be easily managed through any remote location and can be controlled in case of any unauthorized access.

In the booming consumer electronics industry, the global market for smart refrigerators is expanding as a result of rising consumer preferences for individualization and customization. Additionally, as an outcome of enhanced lifestyle conditions, soaring disposable income and buying power are further expected to encourage the ownership of smart refrigerators.

Region-wise, North America and Europe are expected to hold a significant market share due to the adoption of innovative technologies while the Asia Pacific is considered the fastest growing.

Smart Fridge Market Growth Drivers:

- Advancement of technology

Due to bettering lifestyle conditions, an increase in purchasing power due to the increasing disposable income is also likely to contribute to the adoption of these smart refrigerators. The millennial generation's affinity for technology is also a significant driver of the increase in demand for smart refrigerators.

The latest types of smart refrigerators can connect to the web and may be used to place orders for goods with just a few voice commands or button presses. For instance, Samsung unveiled a model that allowed customers to quickly shop and pay for the items they require using the "Groceries" Mastercard mobile app by connecting to their smart refrigerators.

- Need for monitoring for wastage of food

A lack of monitoring and timely use of refrigerated foods leads to wastage which is a very common problem for the end-users. The UNDP (United Nations Development Program) stated that in India, around 40% of food is wasted and about 20% of the purchased food is discarded.

Therefore, the need for effective food management in the residential, as well as commercial sectors, is expected to result in the rising adoption of smart refrigerators. The ability of these products to monitor and control the quality as well as the shelf life of the food and generate user alerts is projected to drive the market.

Manufacturers are continuously developing and innovating these products to aid in easing the lifestyles of tech-savvy consumers. For instance, Samsung introduced a refrigerator integrated with cameras, a 21-inch touchscreen display, and speakers, to provide a smart user experience.

Apart from the normal cooling and retaining the freshness of the food items, this product also allows users the provision of listing out shopping items, read out schedules, and stream video clips.

Smart Fridge Market Restraints:

- High cost as the barrier

Smart fridges come with a notably higher price tag compared to conventional models, presenting a hurdle for consumers who prioritize budget considerations. Certain functionalities may entail recurring subscription fees for services such as food management apps or extended warranties, contributing to the overall expense. Utilizing smart features and establishing Wi-Fi connectivity can prove to be challenging for individuals less adept with technology.

Smart fridge market segmentation by product type into side-by-side refrigerators, bottom freezer refrigerators, double-door refrigerators, and single-door refrigerators.

The smart fridge market is segmented by product type into side-by-side refrigerators, bottom freezer refrigerators, double-door refrigerators, and single-door refrigerators. Side-by-side refrigerators typically offer advanced features such as touchscreens, water dispensers, and ice makers.

Bottom freezer refrigerators come with a range of features including smart displays, water dispensers, and ice makers. Double-door refrigerators often feature basic smart capabilities like temperature control and remote monitoring. Single-door refrigerators are typically the most budget-friendly option among smart fridge choices.

Smart Fridge Market Geographical Outlook:

The market for smart refrigerators can be divided into five regions based on geography: North America, South America, Europe, Asia-Pacific, and the Middle East and Africa. Because of the rapid advancement of technology, the market in the North American region is well-developed in comparison to markets in other regions.

Being a developing region, the Asia-Pacific region's smart fridge market is anticipated to experience the highest potential growth during the forecast period. Over the course of the projection period, the market in this region is anticipated to expand due to rising personal disposable income. Additionally anticipated to experience positive growth during the forecast period is the smart fridge market in Europe.

Smart Fridge Market Key Developments:

- September 2023- LG Electronics India launched its groundbreaking Wi-Fi Convertible Side-by-Side Refrigerator, offering users the ability to convert the freezer section into a fridge from any location using the LG ThinQ App. This innovative appliance is a new era of convenience and control in home appliances, promising enhanced user experience and flexibility.

- January 2023- Samsung, unveiled its latest top-of-the-line, premium Side-by-Side Refrigerator range. Equipped with Samsung’s proprietary technologies, including Convertible 5-in-1 and Curd Maestro+, the range also featured the innovative FamilyHub™. The Family Hub 7.0 feature facilitated efficient food management by offering meal suggestions to users and providing a view of the refrigerator's contents, among other functionalities.

Smart Fridge Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Market Size Value in 2025 | US$3,268.148 million |

| Market Size Value in 2030 | US$5,493.978 million |

| Growth Rate | CAGR of 10.95% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segments Covered |

|

| Companies Covered |

|

| Regions Covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Customization Scope | Free report customization with purchase |

The Smart Fridge Market is analyzed into the following segments:

- By Product Type

- Side-by-side refrigerators

- Bottom freezer refrigerators

- Double-door refrigerators

- Single-door refrigerators

- By Technology

- RFID

- WiFi

- Bluetooth

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Thailand

- Australia

- Others

- North America