Report Overview

Global Kitchen Appliances Market Highlights

Kitchen Appliances Market Size:

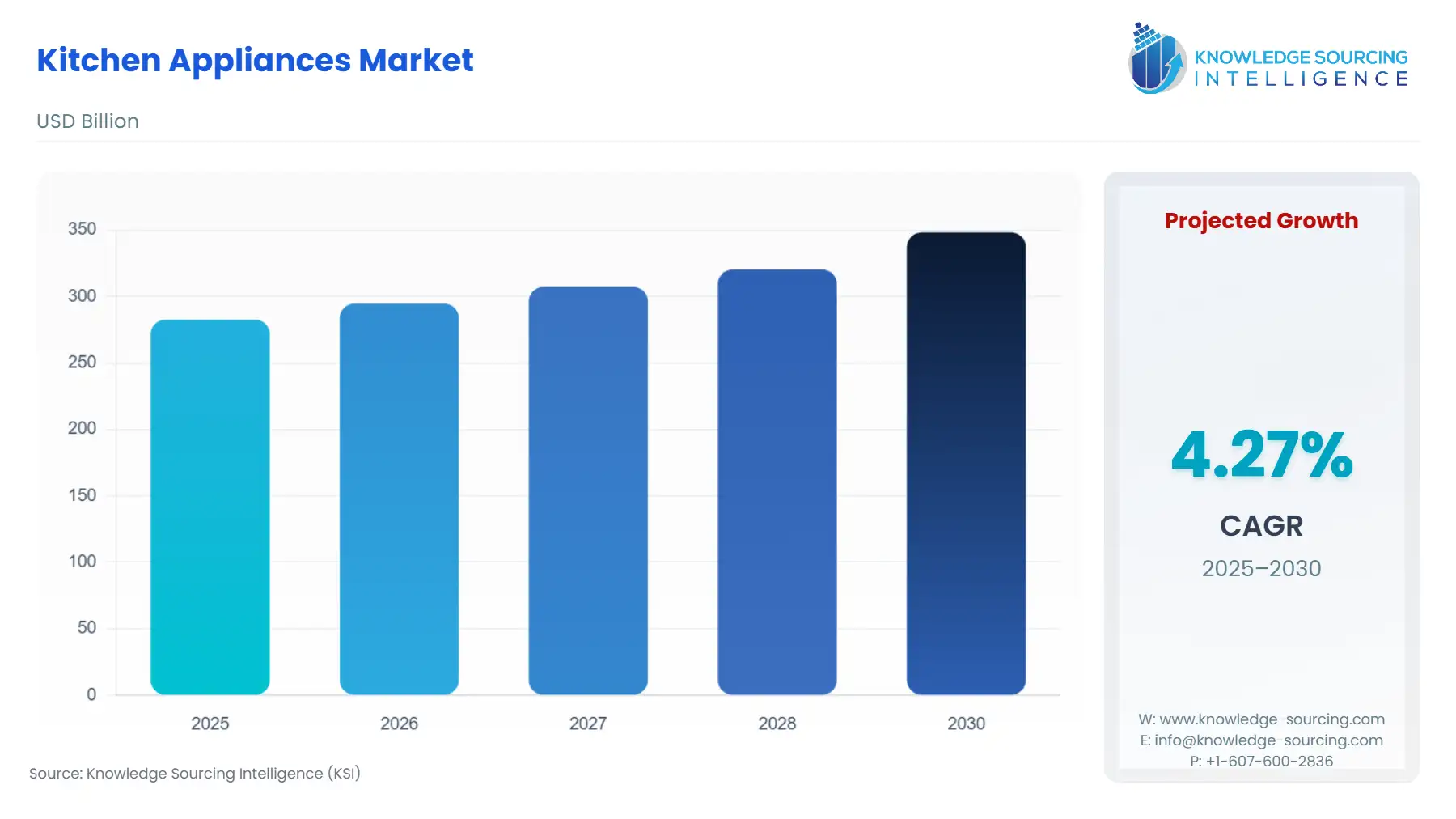

The Kitchen Appliances Market is anticipated to expand at a CAGR of 4.27% throughout the forecast period, from US$282.615 billion in 2025 to US$348.274 billion in 2030.

Kitchen Appliances Market Trends:

Kitchen appliances have major applications in cooking, storage, and cleaning. The primary growth factors for the kitchen appliances market include rapid urbanization and changing lifestyles due to rising disposable income, which amplifies the demand for numerous appliances, especially in developing economies.

Furthermore, key players' growing innovations have led to the development of new and advanced products to cater to burgeoning consumer requirements, which is also one of the major factors showing the potential for market growth during the given period.

Likewise, demand for energy-efficient appliances has made market players adopt modern technological options to offer low-energy-consuming devices, which has provided more growth opportunities for the appliance market.

Consumer lifestyles tend to change according to external factors such as ongoing market trends and product preferences. It has become necessary for the major firms to make new additions to their appliance portfolio to cater to diverse needs. This is also projected to support market growth in the coming years.

Kitchen Appliances Market Growth Drivers:

- Rapid urbanization is significantly driving the demand for kitchen appliances globally.

Urbanization plays an integral role in driving appliance demand. The shift towards urban or private housing and improved living standards has created a demand for appliances with unique designs and energy-efficient performance. This, in turn, is significantly driving innovation in their development, especially in major economies, including the USA, EU, India, and China.

A notable surge in the urban population is driving market growth for kitchen appliances in the next five years. For instance, according to the World Bank’s data, in 2022, the urban population accounted for 57% of the total global population. In major economies, namely the United States, the percentage share went up to 83%, while in China, it stood at 64% of the total population at the country level.

- The increasing residential construction is anticipated to boost the kitchen appliance market growth.

The establishment of new residential units creates demand for appliances that match the kitchen appeal, and the construction of new housing units is further leading to an increase in the number of kitchens, thereby anticipating the demand for these appliances over the given course of time. For instance, according to the Office for National Statistics, in January 2023, the construction output of new housing experienced a 7.7% growth over the preceding year for the same month.

Moreover, the smart city initiative has led to the development of kitchens equipped with modern features and wireless technology. This has elevated the standard of the appliance to be used. With the ongoing integration of modern technologies such as Artificial Intelligence and the Internet of Things (IoT), the market is set to expand constantly, with major firms investing in such technology. In April 2024, Samsung showcased its smart home appliance product “BeSpoke Appliance”, which features AI chips and is compatible with the SmartThings application.

Kitchen Appliance Market Segment Analysis:

- Online sales are expected to show notable growth.

The global kitchen appliances market, by distribution channel, has been analyzed online and offline. The former is poised for remarkable growth in the given time frame due to the booming internet penetration. This bolstered e-commerce retail sales, especially in major economies of the world. Moreover, online channels are much more convenient. During special occasions or seasonal sales, various discounts and schemes are offered, which help the customer get a relatable value for their purchase.

However, due to their greater reliability, the offline segment is anticipated to hold a significant share throughout the forecast period since many people still purchase these products from exclusive retail stores.

- Built-in appliances are expected to show the quickest growth during the given period.

The global kitchen appliance market, by structure type, is divided into standalone and built-in appliances. The latter is expected to hold a noteworthy market share and is anticipated to show significant growth during the forecast period, fuelled by the growing adoption of these appliances on account of the rising trend of modular kitchens in developing economies. The standalone is expected to hold a considerably larger share due to a significant proportion of the global population using this type of appliance.

Kitchen Appliances Market Geographical Outlook:

- Asia Pacific is estimated to hold a considerable market share.

The global kitchen appliance market is analyzed region-wise in North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The Asia Pacific region is projected to hold a noteworthy share on account of its comparatively large population base.

Furthermore, rapid urbanization in major APAC economies is supporting market growth in the APAC region, and the presence of a large manufacturing base in countries like India, China, Korea, and Vietnam is bolstering market growth in the Asia Pacific region during the next five years. Additionally, the well-established presence of major players, namely Panasonic, LG, Samsung, Philips, and Whirlpool, is acting as an additional driving factor. This is because these companies are constantly involved in making innovations to garner a larger consumer base.

Kitchen Appliances Market Key Developments:

Kitchen Appliances Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

Kitchen Appliances Market Size Value in 2025 |

US$282.615 billion |

|

Kitchen Appliances Market Size Value in 2030 |

US$348.274 billion |

| Growth Rate | CAGR of 4.27% from 2025 to 2030 |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Kitchen Appliances Market |

|

| Customization Scope | Free report customization with purchase |

Kitchen Appliances Market is analyzed into the following segments:

- By Product

- Food Preparation

- Cooking Appliance

- Large Kitchen Appliance

- Others

- By Distribution Channel

- Online

- Offline

- By Structure Type

- Built-In

- Stand Alone

- By Application

- Residential

- Commercial

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

- North America