Report Overview

Solar Control Window Films Highlights

Solar Control Window Films Market Size:

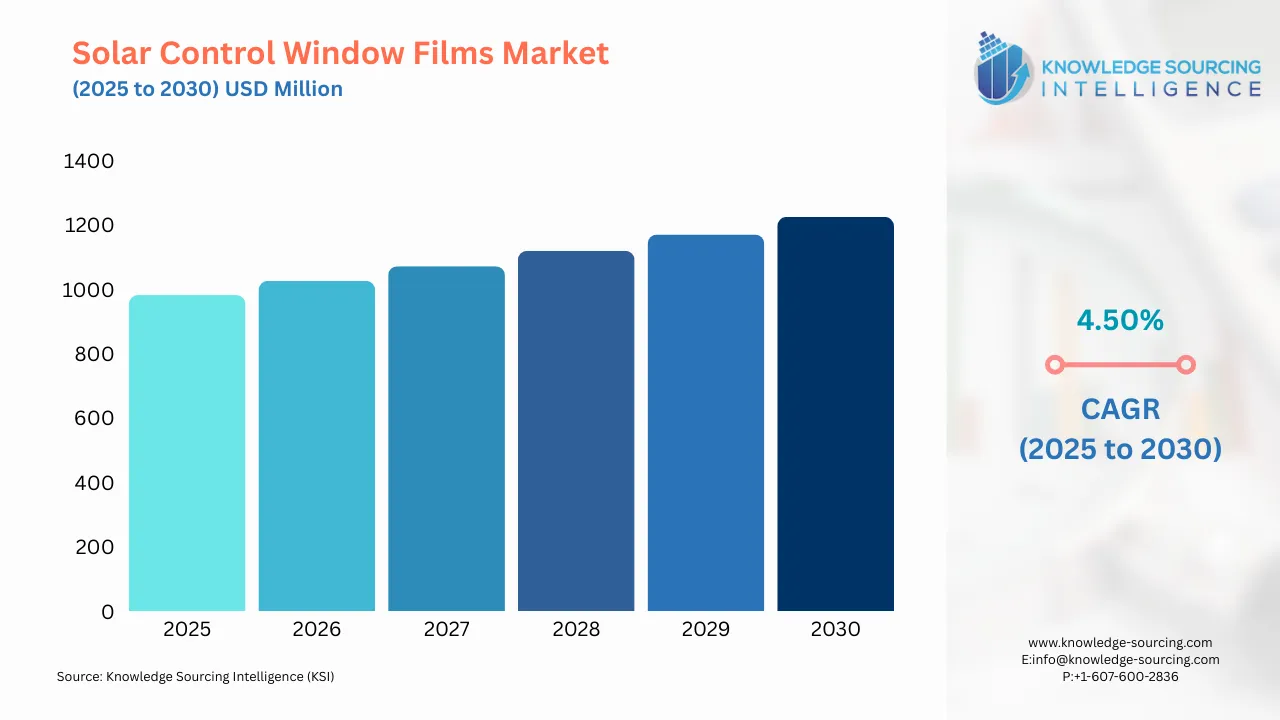

The Solar Control Window Films market is anticipated to grow at a CAGR of 4.50% over the forecast period to reach US$1,224.951 million by 2030, increasing from an estimated value of US$981.511 million in 2025.

Solar Control Window films are usually made from polyethylene terephthalate (PET) and are applied over windows in the construction and automotive industries. These films protect against UV rays, help reduce glare, and save energy. The demand for these films is anticipated to rise due to increased green construction activity.

Moreover, solar control window films are gaining traction in the residential and commercial sectors as they help improve the occupant's comfort by maintaining the indoor temperature. Apart from temperature control, these films also help provide privacy without obstructing visibility and help minimize glare.

Solar Control Window Films Market Growth Drivers:

- Increasing skin cancer cases due to regular exposure to UV rays in the car or at homes or offices is a major reason boosting the market for solar control window films in the projected period. Rising cases of conditions such as skin cancer and melanoma are expected to increase the demand for these films in the coming years. For instance, according to the International Agency for Research on Cancer (IARC), in 2022, skin cancer was one of the most common cancer diagnosed worldwide. More than 1.5 million new cases of skin cancer were estimated in 2022. Moreover, in 2022, an estimated 3,30,000 new cases of melanoma were diagnosed worldwide, and approximately 60,000 people died from it. Hence, the rising number of cancer cases is expected to impact the solar control window films market in the forecasted period.

- The increasing global temperature has accelerated solar control window film usage because it significantly reduces the amount of solar energy that enters buildings, thereby helping to minimize energy consumption. These films are created to manage heat and light coming from the sun to decrease air conditioning requirements and, thus, energy use in residential and commercial buildings. As climate change conditions call for more energy efficiency solutions, solar control window films are expected to become one of the effective ways to minimize excessive energy consumption and further reduce utility costs.

- The use of air-conditioning is also identified as a disadvantage to the environment, while using solar window films is likely to benefit energy saving. For instance, according to Our World in Data, air-conditioners account for around 3% of greenhouse gas emissions. Furthermore, according to the International Energy Agency (IEA), approximately 2 billion air conditioners are present worldwide, and this number is projected to increase to 5.5 billion by 2050. Hence, such drastic environmental effects due to air conditioners are expected to positively impact the market for solar window films in the coming years.

- Lastly, the increasing demand for solar control window films from the construction sector will fuel the market in the projected period. The rising commercial and residential construction in developed and developing countries is impacting this market. For instance, according to the U.S. Department of Commerce, the total construction spending in the United States in July 2024 was US$2,162.7 billion, which was 6.7% higher than that of 2023, where the construction spending was US$2,027.4 billion. Hence, the increasing use of these films in various industries is expected to drive market growth in the coming years.

Solar Control Window Films Market Segmentation Analysis:

- By product type, the Vacuum-Coated segment is expected to hold a significant share of the solar control windowfilms market.

By product type, the solar control window film market is segmented into clear, dyed, and vacuum-coated. The vacuum-coated solar control films are expected to hold a significant share in the projected period, as these films are known for blocking a significant amount of solar rays, thereby helping in a cooler interior environment. Additionally, the rising environmental concerns and stringent government regulations are expected to aid market growth in the coming years.

- By technology, the tinted segment is expected to grow at the fastest pace in the solar control windowfilms market.

The tinted solar window films are expected to grow exponentially in the projected period, owing to the tinted manufactured solar control films' affordability, looks, and conveniences. Moreover, these tinted films have a higher capacity to absorb sun rays, which helps in keeping the interior cooler than the outside temperature.

Solar Control Window Films Market Geographical Outlook:

- Asia Pacific’s solar control window films market is anticipated to grow suggestively.

The APAC region is anticipated to grow suggestively in the coming years, owing to increasing construction and growing production and sales of automotive vehicles in countries such as India and China. For instance, according to the National Bureau of Statistics of China, the construction sector in China grew by 22% in 2023 compared to 2022. The increasing commercial and residential construction plans from the Chinese government and stringent government regulations are expected to fuel the market for solar control window films in the region.

The North American region is also expected to bolster steadily in the forecasted period, owing to the growing automotive sector and the presence of global players such as 3M and Avery Dennison Corporation. For instance, according to the International Organization of Motor Vehicle Manufacturers (OCIA), the number of passenger cars manufactured in the US in 2022 was 17,51,736, which was a 10% increase compared to 2021, where the car production was only 15,63,060. Hence, growth in end-use sectors is expected to propel the market for solar control windows in the coming years.

Solar Control Window Films Market Key Developments:

- In April 2023, Saint Gobain obtained the verified Environmental Product Declaration (EPDs) for their Solar Grad range. The Solar Gard Solar Control Window Films help in balancing light transmission and heat rejection, which helps in reducing energy consumption and improving both winter and summer comfort. Additionally, solar-grade safety and security films help reduce the risk or damage of glass injury.

List of Top Solar Control Window Films Companies:

- 3M

- Avery Dennison Corporation

- Solar Screen International SA

- Recon Blinds

- Madico, Inc.

Solar Control Window Films Market Growth Scope:

| Report Metric | Details |

| Solar Control Window Films Market Size in 2025 | US$981.511 million |

| Solar Control Window Films Market Size in 2030 | US$1,224.951 million |

| Growth Rate | CAGR of 4.50% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the the Solar Control Window Films Market |

|

| Customization Scope | Free report customization with purchase |

Solar Control Window Films Market Segmentation:

- By Product Type:

- Clear

- Dyed

- Vaccum Coated

- By Technology:

- Tinted

- Polymer Dispersed Liquid Crystal

- Suspended Particle Device

- Others

- By Application:

- Automotive

- Construction

- Others

- By Geography:

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America