Report Overview

Solar PV Glass Market Highlights

Solar PV Glass Market Size:

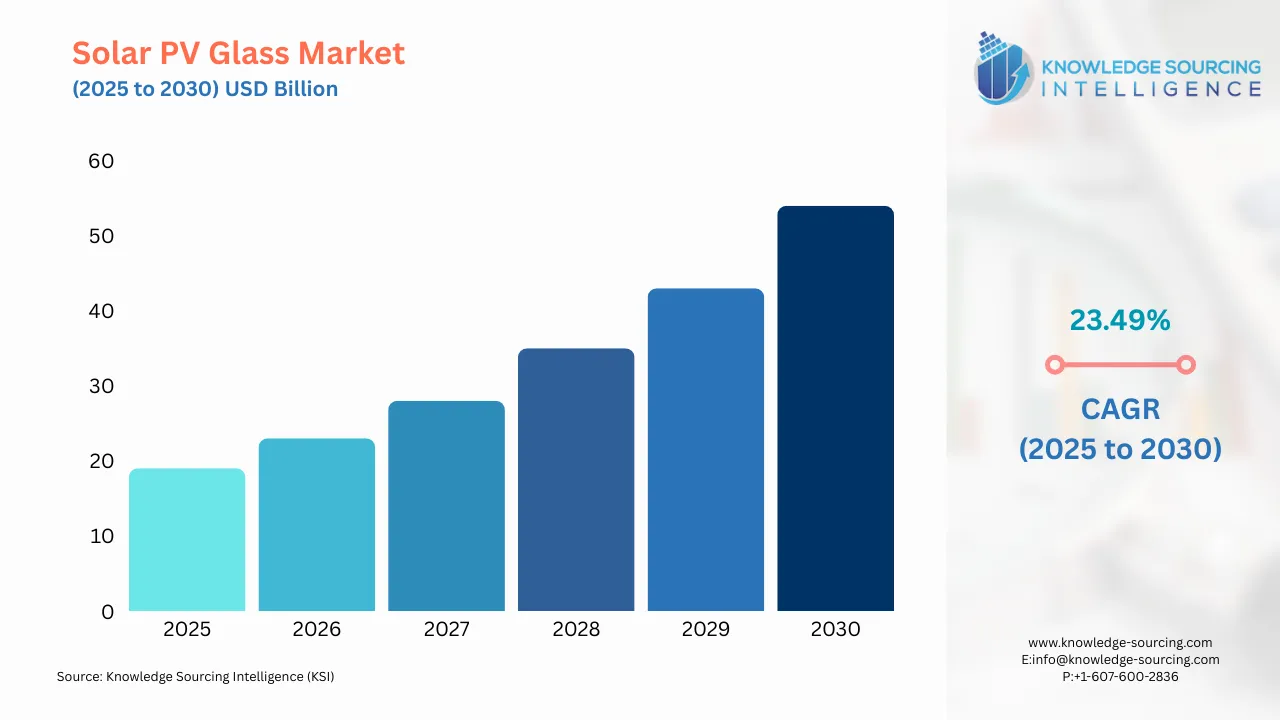

The Solar PV Glass Market is set to increase from USD 18.639 billion in 2025 to USD 53.528 billion by 2030, at a CAGR of 23.49%.

Solar PV glasses are built into the structure of the building in order to convert solar light into electricity. The governments of various countries around the world have been supporting the installation of solar PV glass, due to the rising concerns regarding climate change and to complete their targets of net zero emissions, which is anticipated to propel the growth of the solar PV glass market during the forecast period. Also, the increasing investments in solar energy are also a major contributing factor to the rise of solar PV glasses and are further expected to boost the market growth of solar PV glass in the coming years. However, the high cost associated with the installation of solar PV glass is expected to hinder the growth of the solar PV glass market.

The solar PV glass market has been classified on the basis of type, application, and geography. By type, the market has been classified on the basis of Tempered, Anti-Reflective (AR) Coated, Transparent Conductive Oxide (TCO) Coated, and others. On the basis of application, the segmentation has been done into Residential, Commercial, and Utility. Geographically, the market for solar PV glass has been distributed into North America, South America, Europe, the Middle East, and Africa, and the Asia Pacific.

Solar PV Glass Market Growth Drivers:

- Government policies and incentives

Owing to the rising environmental pollution and climate change concerns, governments of various countries around the world have been providing support for the development of solar PVs in their respective countries, which is anticipated to people the growth of the solar PV glass market during the forecast period. Recently, the German government has raised the expansion targets for solar PV in 2022 and the solar PV auctions are to rise three-fold, from 1.9 GW to 6 GW. Reformed Germany’s Renewables Energy Act 2021 aims to increase the solar PV capacity of the country from the current 52GW to 100GW by 2030.

In India, as per the Ministry of New and Renewable Energy, the Government of India pays 30% of the benchmarked installation cost for rooftop PV systems. And a subsidy of up to 70% is provided in some states. Also, priority sector loans up to an amount of 10 lakh rupees are available to be provided by the national banks for rooftop PV systems. In the US government in December 2020 extended the production and investment tax credits by one more year for solar PV. The Dutch government allocated on average half of the available budget of SDE+, the subsidy scheme for the promotion of renewable energy, to solar PV in the period 2017-2020. The government expanded its subsidy scheme from SDE+ to SDE++ and now not only stimulates sustainable energy production but also CO2 reduction. China’s Ministry of Finance set up a subsidy for solar PV for the year 2020 of 1.5 billion Yuan, out of which 1 billion Yuan was given to bidding projects like distributed PV and utility PV projects, and 500 million Yuan to residential rooftop PV. The government of Sweden, which has already devoted approximately $570 million to its solar rebate program so far for the 2009-21 period, announced in April 2020 to allocate another $30.8 million to PV rebates for homeowners. The UK government proposed to re-include solar PV in the 2021 contracts for difference (CfD) auction. These measures and support by the governments of various countries are anticipated to surge the growth of the solar PV glass market during the forecast period.

- Increase in investments in solar energy

The rising interest of companies to invest in solar energy is one of the major factors anticipated to surge the growth of the solar PV glass market in the coming years. In January 2020, Solar Provider Group (SPG) announced its plans to invest $250 million in the Brazilian solar market in the coming five years. In July 2020, Brazil’s Ibitu Energia, owned by U.S.-based asset manager Castlelake LP, announced its plans to invest in new solar and wind projects totaling 1.2 gigawatts. In Canada, DP Energy has proposed a 300 MW solar PV project named Saamis Solar Project, to be started in 2022 with an estimated investment of $450 million.

Similarly, Greengate Power Corporation has proposed a Travers Solar Project, which will be Canada’s largest solar facility, producing 400 MW in Vulcan County. The project is expected to start in December 2021 with an investment of $376 million. In June 2020, Danish solar photovoltaic manufacturer European Energy announced to invest €800m ($897m) in the next five years to develop solar projects in Italy, after investing a significant amount in a 103MW solar farm near Foggia, Italy, which is the largest solar farm in the country. These rising investments in many countries around the world are anticipated to propel the growth of the solar PV glass market during the forecast period.

Solar PV Glass Market Geographical Outlook:

- The Asia Pacific to dominate market share

Geographically, the Asia Pacific region is anticipated to hold a significant market share and is expected to witness substantial growth owing to the presence of China which is the major producer of solar panels globally. Also, the rising government support from the government of the countries is projected to have a positive impact on the market growth in the region. The government initiatives and policies in various countries in the region like China, India, and Vietnam are boosting the adoption of solar energy. For example, under the National Solar Mission, the Indian government aims to boost solar energy for power generation with a goal of adding 20,000 MW of grid-connected solar power by 2022, creating measures like solar-specific RPOs under the National Tariff Policy, and plans to implement solar parks in various cities across the country.

Solar PV Glass Market Competitive Insights:

Prominent/major key market players in the solar PV glass market include Borosil Renewables Limited, Targray Technology International, and Onyx Solar Group LLC[1], among others. The players in the solar PV glass market are implementing various growth strategies to gain a competitive advantage over their competitors in this market. Major market players in the market have been covered along with their relative competitive strategies and the report also mentions recent deals and investments of different market players over the last few years. The company profiles section details the business overview, financial performance (public companies) for the past few years, key products and services being offered along with the recent deals and investments of these important players in the solar PV glass market.

List of Top Solar PV Glass Companies:

- Onyx Solar Group LLC

- AGC Glass Europe

- ViaSolis

- Polysolar

- Canadian Solar

Solar PV Glass Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Solar PV Glass Market Size in 2025 | USD 18.639 billion |

| Solar PV Glass Market Size in 2030 | USD 53.528 billion |

| Growth Rate | CAGR of 23.49% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Americas, Europe Middle East and Africa, Asia Pacific |

| List of Major Companies in Solar PV Glass Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation:

- By Product Type

- Floated Glass

- Rolled Glass

- Patterned Glass

- Others

- By Technology

- Crystalline Silicon PV Modules

- Amorphous Silicon PV Modules

- By End-User

- Residential

- Commercial

- Industrial

- By Geography

- Americas

- USA

- Others

- Europe Middle East and Africa

- Germany

- France

- United Kingdom

- Spain

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Others

- Americas

Navigation

- Solar PV Glass Market Size:

- Solar PV Glass Market Key Highlights:

- Solar PV Glass Market Growth Drivers:

- Solar PV Glass Market Geographical Outlook:

- Solar PV Glass Market Competitive Insights:

- List of Top Solar PV Glass Companies:

- Solar PV Glass Market Scope:

Page last updated on: September 16, 2025