Report Overview

South Africa Additive Manufacturing Highlights

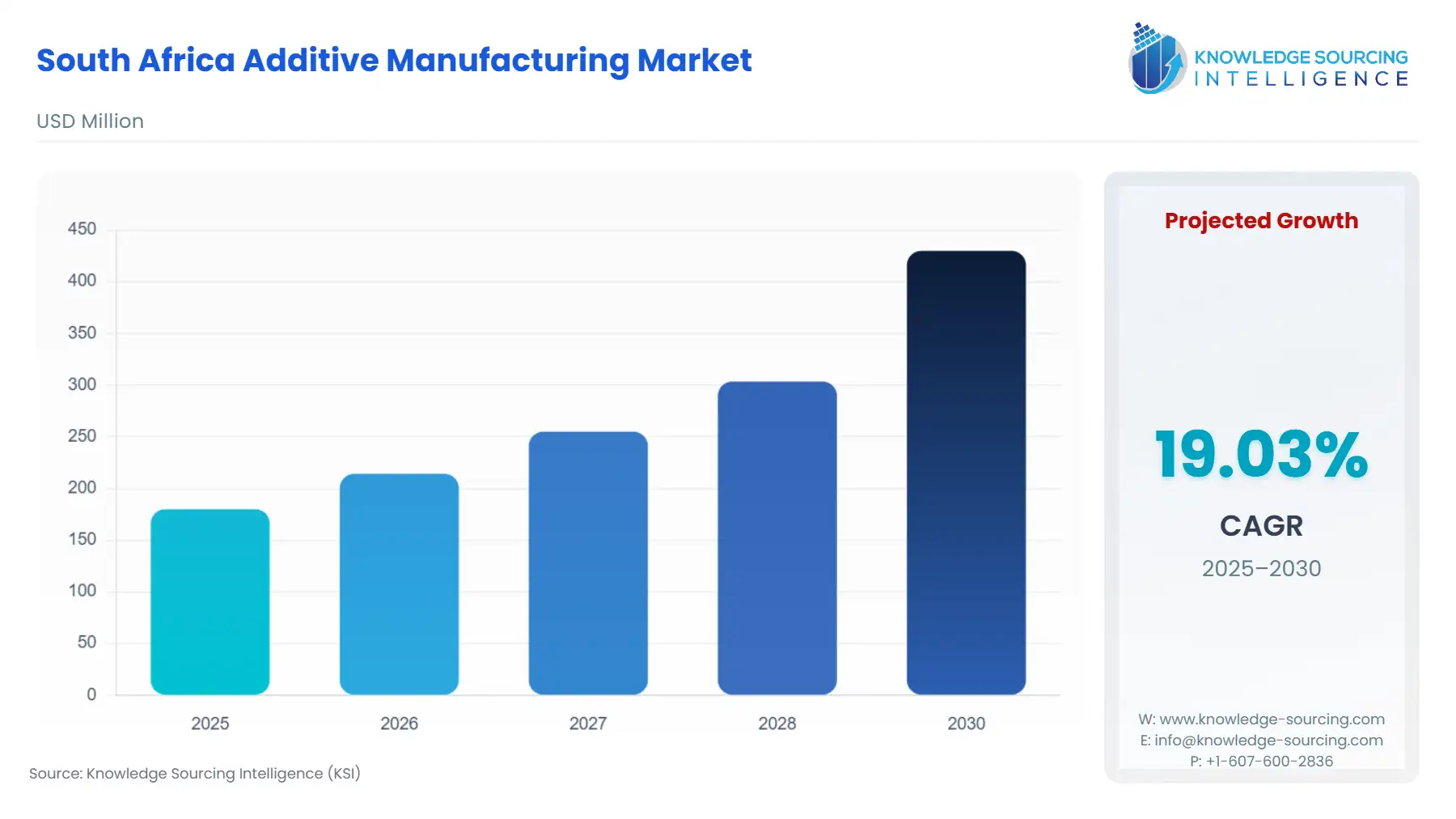

South Africa Additive Manufacturing Market Size:

The South Africa Additive Manufacturing Market is projected to grow at a CAGR of 19.03%, reaching USD 0.43 billion in 2030 from USD 0.18 billion in 2025.

The South African Additive Manufacturing market has progressed from a focus on rapid prototyping to a strategic technology for producing functional, end-use parts, underpinned by a concerted national effort. This evolution is central to the country’s broader industrialization and advanced manufacturing agenda, particularly in high-value sub-sectors like medical devices and aerospace. The foundational investments in research infrastructure, notably by the Department of Science, Technology and Innovation (DSTI) and associated institutions, are translating into commercial and localized capabilities, setting the stage for increased industrial adoption and diversified demand across the manufacturing base.

South Africa Additive Manufacturing Market Analysis:

- Growth Drivers

The imperative for supply chain resilience directly propels demand for localized AM capacity. Industries such as mining and rail, which historically contend with expensive, protracted international lead times—often reaching six months for crucial spare parts—are increasingly adopting AM for on-demand production. This shift directly generates demand for AM services, hardware, and specialized materials capable of producing durable, high-integrity functional components. Furthermore, the government’s consistent investment in research and development, exemplified by the funding of the Aeroswift platform at the CSIR, demonstrates a commitment to establishing local expertise in advanced metal AM, which in turn acts as a magnet for industrial projects requiring complex, customized solutions. This investment directly fuels the demand for high-end Selective Laser Melting (SLM) and Electron Beam Melting (EBM) technologies.

- Challenges and Opportunities

A primary challenge facing the market is the slow diffusion of AM technology adoption within the broader manufacturing cluster, where poor information or misinformation about the technology’s capabilities remains a significant barrier. This knowledge gap constrains the immediate demand for AM services from small and medium enterprises. Simultaneously, a key opportunity exists in developing a robust local supply chain for specialized AM materials. The reliance on imported, high-quality metal powders elevates input costs. The pilot-scale production of 316L stainless-steel powder by the CSIR, utilizing a recently commissioned ultrasonic atomiser, presents a crucial opportunity to localize feedstock supply. This localization is expected to stabilize and potentially reduce material costs, thereby increasing the economic viability of metal AM and stimulating broader demand for AM hardware and processes.

- Raw Material and Pricing Analysis

Additive Manufacturing is a physical product market, necessitating analysis of its material components. The South African AM market faces a cost constraint due to its high dependence on imported metal powders, particularly high-performance alloys like titanium and specific stainless steels. This import dependency subjects local AM service bureaus to international pricing volatility, freight charges, and currency fluctuations, significantly increasing the final component price compared to materials sourced in regions with established domestic powder production. However, strategic state-led initiatives are working to counter this. The CSIR's successful production of 316L stainless-steel powder at a pilot scale introduces an initial domestic alternative. The ultimate success and pricing impact of this domestic material will depend on scaling production to meet industrial volume requirements and establishing competitive price points against global suppliers, which would fundamentally alter the cost structure and increase demand for metal AM services by improving their competitive edge.

- Supply Chain Analysis

The global AM supply chain is complex, characterized by concentrated production hubs for high-end industrial hardware (primarily in Europe and North America) and a distinct global material supply chain. South Africa’s supply chain for AM hardware is heavily reliant on international vendors for industrial-grade Selective Laser Sintering (SLS), EBM, and Stereolithography (SLA) machines, creating dependencies on foreign technical support and spare parts. Logistical complexities, including customs duties and shipping lead times for hardware and specialized polymer/metal powders, introduce considerable friction. The local value chain focuses primarily on the service and application layer, utilizing imported hardware and materials for domestic production. Key local dependency reduction efforts center on government-backed research institutions, which function as national hubs to develop indigenous hardware (such as the locally designed Hyrax printer) and material capabilities.

South Africa Additive Manufacturing Market Government Regulations:

The regulatory environment's primary impact on the AM market in South Africa centers on intellectual property (IP) and advanced materials policy.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

South Africa |

Companies and Intellectual Property Commission (CIPC) |

The robust registration framework for patents and designs is critical. It provides legal exclusivity for novel AM designs and processes, which directly incentivizes companies to invest in AM's core benefit: customized, high-value part design. |

|

South Africa |

Department of Trade, Industry and Competition (DTIC) - Advanced Materials Policy |

Policy emphasis on the development of new knowledge and IP in advanced materials aligns with the needs of AM. This focus on local material innovation directly supports the reduction of import reliance, increasing the market’s economic independence and long-term demand for localized AM services. |

|

South Africa |

Rapid Product Development Association of South Africa (RAPDASA) |

As a non-profit organization, RAPDASA promotes collaboration and sets informal industry standards. Its role in increasing industry participation and knowledge directly addresses the challenge of slow technology diffusion, stimulating broader demand adoption. |

South Africa Additive Manufacturing Market Segment Analysis:

- By Technology: Electron Beam Melting (EBM)

EBM technology is a high-growth segment in South Africa, driven almost entirely by the uncompromising performance requirements of the aerospace and medical end-user industries. This metal AM process, characterized by its ability to process refractory metals like titanium alloys under vacuum conditions, directly facilitates the manufacture of lightweight, complex, and high-strength components. For the aerospace sector, the ability to produce large-format titanium parts, evidenced by the large-area EBM systems hosted at the CSIR's Aeroswift platform, creates explicit demand for this technology to manufacture structural airframe components. Similarly, in the medical field, EBM is the preferred technology for customizing porous, biocompatible titanium implants and prosthetics. The high initial capital cost and stringent operational requirements of EBM create a high barrier to entry, channeling much of the domestic demand toward specialized, institutionally supported service providers.

- By End-User Industry: Aerospace & Defense

The Aerospace and Defense sector is the most significant catalyst for high-end AM demand in South Africa. The industry's fundamental need for weight reduction, complex geometries, and superior material properties aligns perfectly with the core benefits of AM. Specifically, the production of complex, often low-volume components for aircraft and defense systems—where inventory obsolescence and long-term sparing are critical issues—spurs the need for on-demand AM production. This application of AM moves beyond prototyping to manufacturing functional, flight-critical parts, which necessitates the use of premium metal materials (e.g., titanium) and highly regulated, traceable processes. Government investment through entities like the DSTI has strategically targeted this sector, effectively creating a captive high-end demand market and fostering a localized center of excellence that draws on international partnerships.

South Africa Additive Manufacturing Market Competitive Analysis:

The competitive landscape for the South African Additive Manufacturing market is bifurcated, comprising global hardware manufacturers and local service bureaus/research institutions. The market for industrial hardware is dominated by international players. The local competitive intensity centers on the service provision, material development, and strategic partnerships.

- EOS GmbH

EOS is a major global vendor in the South African market, specializing in industrial metal and polymer AM solutions, particularly Selective Laser Sintering (SLS) and Direct Metal Laser Sintering (DMLS). EOS's strategic positioning involves establishing partnerships with local research and academic institutions, such as the joint partnership with the Central University of Technology (CUT) via the eManufacturing program. This strategy directly drives demand for their hardware by facilitating technology transfer, academic research, and skilled workforce development. Their offering focuses on high-precision, end-use manufacturing applications for sectors like tooling and medical devices.

- Council for Scientific and Industrial Research (CSIR)

While not a purely commercial entity, the CSIR functions as a critical competitive player and national technology driver. Its strategic positioning is to develop sovereign AM capability and reduce import dependency. Key activities include hosting the high-speed, large-area Aeroswift titanium AM platform, which is an industry collaboration for aerospace component manufacturing. Furthermore, the CSIR's material science group recently commissioned an ultrasonic atomiser machine to locally produce 316L stainless-steel powder. This move directly challenges the imported material supply chain and is designed to create a stable, local feedstock source, thereby making domestic AM more economically competitive.

South Africa Additive Manufacturing Market Developments:

- September 2025: The South African government's Council for Scientific and Industrial Research (CSIR) and local producer Filament Factory jointly introduced a new nano-reinforced polymer composite material to the market. This advanced material, designed for additive manufacturing and other processes like injection molding, offers significant capabilities, including enhanced electromagnetic interference (EMI) shielding and high electrical conductivity. This material launch targets critical industries such as aerospace, electronics, and healthcare in South Africa, opening new local supply chain opportunities for high-performance components like radar-absorbent coatings and advanced medical implants.

- May 2025: The CSIR announced the successful production of 316L stainless-steel powder utilizing its recently commissioned ultrasonic atomiser machine. Co-funded by the National Research Foundation (NRF), this development aims to supply high-quality powder, specifically for powder bed fusion techniques, to the local market, directly addressing the national dependence on imported AM feedstocks.

South Africa Additive Manufacturing Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 0.18 billion |

| Total Market Size in 2031 | USD 0.43 billion |

| Growth Rate | 19.03% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Technology, End-User Industry |

| Companies |

|

South Africa Additive Manufacturing Market Segmentation:

- BY COMPONENT

- Hardware

- Software

- Services

- Material

- BY TECHNOLOGY

- Selective Laser Sintering (SLS)

- Laser Sintering (LS)

- Electron Beam Melting (EBM)

- Fused Disposition Modeling

- Stereolithography (SLA)

- BY END-USER INDUSTRY

- Aerospace & Defense

- Healthcare

- Automotive

- Construction

- Consumer

- Others