Report Overview

Steam Boiler System Market Highlights

Steam Boiler System Market Size:

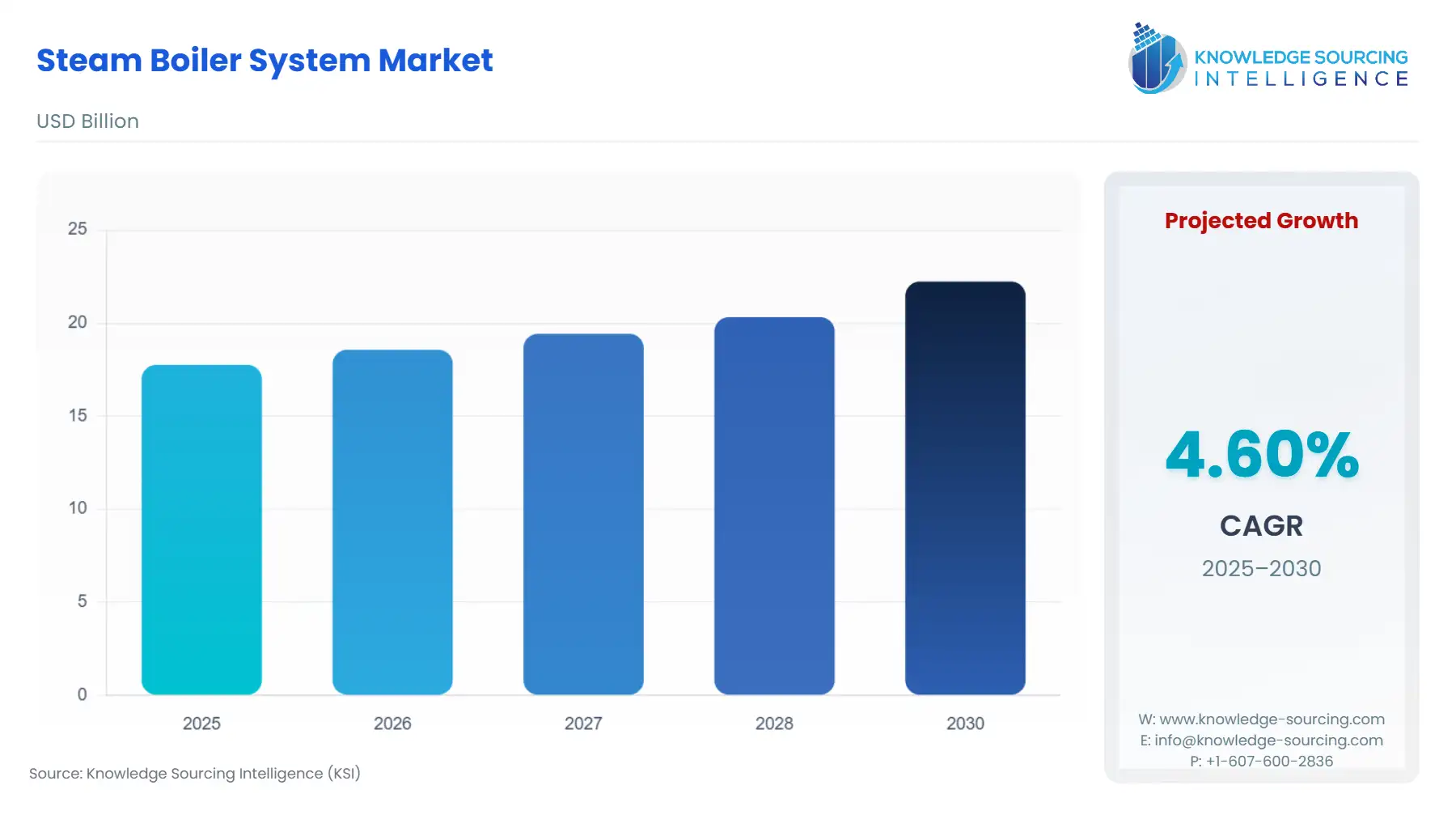

The Steam Boiler System Market is anticipated to rise from USD 17.758 billion in 2025 to USD 22.236 billion by 2030, with a 4.60% CAGR.

The Steam Boiler System Market is a foundational element of global industrial and energy infrastructure, delivering critical steam generation for power production, process heating, and diverse industrial applications. Steam boilers transform thermal energy from various fuels or electricity into steam, powering turbines for electricity or supporting processes in industries such as oil & gas, chemicals, and power generation.

The market is segmented by product type (fire tube, water tube, electric, condensing, superheater boilers), fuel type (coal, oil, gas, biomass, others), pressure (high-pressure, medium-pressure, low-pressure), end-user (oil & gas industry, chemical industry, power generation, others), and geography (North America, South America, Europe, Asia Pacific, Middle East and Africa). Driven by surging energy demands, industrial growth in emerging economies, and a shift toward sustainable fuels, the market is set for steady expansion.

Steam Boiler System Market Overview:

Steam boiler systems are essential for industries requiring consistent heat and power. Fire tube boilers, known for their simplicity, suit low-pressure applications, while water tube boilers are preferred for high-pressure settings like power plants. Electric boilers provide emission-free operation, condensing boilers focus on energy efficiency, and superheater boilers generate high-temperature steam for specialized uses. Fuels include coal, oil, natural gas, and renewable biomass, with pressure levels—high, medium, and low—catering to varied industrial needs. Key end-users are oil & gas for refining, chemical industries for process heating, and power generation for electricity production.

In June 2025, the global Steam Boiler System Market was valued at approximately $18 billion, with projections estimating growth to $25 billion by 2030 at a compound annual growth rate (CAGR) of 4.5%. This growth is propelled by rising electricity demand, industrial expansion, and the adoption of cleaner fuels like biomass and natural gas. Leading companies, such as Bosch Industrial Boilers, Babcock & Wilcox Enterprises, Inc., and General Electric, are advancing the market with innovations in efficiency and low-emission technologies. The market’s trajectory reflects its critical role in supporting global industrial and energy demands amid a shift toward sustainability.

Steam Boiler System Market Growth Drivers:

Several factors are driving the Steam Boiler System Market:

-

Growing Global Energy Demand: Industrialization and population growth fuel electricity consumption, increasing steam boiler demand in power generation. In 2024, global electricity demand grew by 3.4%, led by emerging economies.

-

Industrial Growth in Emerging Markets: Expansion in manufacturing, chemicals, and oil & gas in Asia Pacific and the Middle East boosts boiler installations. India’s chemical sector grew by 8% in 2024, driving steam boiler demand.

-

Transition to Sustainable Fuels: Regulatory pressures and sustainability goals promote biomass and natural gas boilers. In 2023, the EU invested €2 billion in biomass energy projects, supporting cleaner boiler technologies.

-

Technological Innovations: Advances in condensing and electric boilers improve efficiency and reduce emissions. In January 2024, Rialto launched the RESIDENCE HM condensing boiler, boosting efficiency by 15%.

Steam Boiler System Market Restraints:

The market faces several challenges:

-

High Capital and Maintenance Costs: Steam boiler systems require significant upfront investment and ongoing maintenance, limiting adoption by smaller enterprises.

-

Stringent Environmental Regulations: Strict emission standards, such as the EU’s Industrial Emissions Directive, increase compliance costs for coal and oil-fired boilers.

-

Competition from Renewable Energy: The rise of solar and wind power reduces reliance on fossil fuel-based steam boilers, particularly in developed economies.

Steam Boiler System Market Geographical Analysis:

- Asia Pacific

Asia Pacific dominates the Steam Boiler System Market, accounting for approximately 42% of global revenue in 2025, driven by rapid industrialization and energy demand. China leads with its extensive coal-based power generation, operating 1,200 coal-fired plants in 2024. India’s power generation capacity expanded by 7% in 2024, supported by the Saubhagya Yojana initiative for universal electrification. The power generation segment is dominant, as 70% of regional electricity relies on steam turbines. The coal fuel segment prevails, with China consuming 4.8 billion metric tons of coal in 2024. Japan and South Korea are shifting to biomass and natural gas, with Japan’s biomass energy capacity reaching 5 GW in 2024. The region’s growth is fueled by infrastructure investments and manufacturing growth in chemicals and oil & gas.

- North America

North America holds a 25% market share in 2025, driven by its diverse industrial base and energy infrastructure. The U.S. leads with a thriving chemical industry, which invested $90 billion in new facilities in 2024, increasing steam boiler demand. The natural gas fuel segment dominates, supported by a 3-million-mile pipeline network supplying 29.2 trillion cubic feet of gas in 2024. The high-pressure boiler segment is significant in power generation, with 60% of U.S. electricity derived from steam turbines. Canada and Mexico contribute through oil & gas and manufacturing, with Mexico’s oil refining capacity reaching 1.6 million barrels per day in 2024. The region’s growth is driven by energy efficiency mandates and infrastructure modernization.

- Europe

Europe accounts for 20% of global revenue in 2025, driven by sustainability initiatives and industrial upgrades. Germany and the UK lead due to their decarbonization efforts, with Germany’s net-zero target by 2045 accelerating cleaner boiler adoption. The biomass fuel segment is prominent, with 90% of Sweden’s steam boilers using biofuels in 2024. The chemical industry dominates, as Europe’s chemical sector invested €50 billion in green technologies in 2024. The condensing boiler segment is growing, with 80% of new installations prioritizing energy efficiency under the EU’s Ecodesign Directive. The region’s growth is supported by regulatory incentives and sustainable industrial processes.

Steam Boiler System Market Segment Analysis:

- Water Tube Boiler

The water tube boiler segment held the largest share in 2025, accounting for 35% of the market, due to its high-pressure capabilities and efficiency in power generation and industrial applications. Water tube boilers generate steam at pressures up to 250 bars, which is ideal for power plants and chemical processing. In June 2022, Superior Boiler received a U.S. patent for innovations enhancing water tube boiler efficiency by 10%. The segment’s dominance is driven by demand from energy-intensive industries, with 65% of global power plants using water tube boilers in 2024.

- Natural Gas Fuel

The natural gas fuel segment accounted for 34% of the market in 2025, driven by its efficiency, lower emissions, and widespread availability. Natural gas boilers emit 50% less CO2 than coal-fired systems, aligning with decarbonization goals. In 2024, the U.S. supplied 29.2 trillion cubic feet of natural gas, supporting industrial and power generation applications. The segment’s growth is fueled by expanding pipeline infrastructure and regulatory incentives, with 70% of new boiler installations in North America using natural gas in 2025.

- High-Pressure Boiler

The high-pressure boiler segment represented 40% of the market in 2025, driven by its critical role in power generation and heavy industries. High-pressure boilers operate above 80 bars, delivering superheated steam for steam turbines and refining processes. In 2024, 80% of global power plants relied on high-pressure boilers for electricity production. The segment’s dominance is supported by infrastructure upgrades in Asia Pacific, where 60% of new power plants installed high-pressure systems in 2024.

- Power Generation End-User

The power generation segment accounted for 45% of the market in 2025, as steam boilers remain essential for global electricity production. Steam turbines driven by boilers generate 70% of global electricity, with coal and natural gas as primary fuels. In November 2022, Mitsubishi Heavy Industries and PLN Indonesia Power signed an MoU to explore co-firing sustainable fuels in Indonesian power plants, boosting boiler demand. The segment’s growth is driven by rising electricity consumption and capacity additions, particularly in the Asia Pacific.

Steam Boiler System Market Key Developments:

-

Rialto RESIDENCE HM Condensing Boiler: In January 2024, Rialto, a Carrier Global subsidiary, launched the RESIDENCE HM condensing boiler, improving efficiency by 15%.

-

Superior Boiler Patent: In June 2022, Superior Boiler received a U.S. patent for water tube boiler innovations, enhancing efficiency by 10%.

-

Mitsubishi Heavy Industries MoU: In November 2022, Mitsubishi Heavy Industries and PLN Indonesia Power signed an MoU to study sustainable fuel co-firing in Indonesian power plants.

-

Nouryon Biofuel Boiler in Sweden: In May 2023, Nouryon partnered with Adven to install a biofuel-based steam boiler in Sweden, reducing CO2 emissions by 90%.

-

Bosch ELSB Electric Boiler: In 2022, Bosch Industrial Boilers launched the ELSB electric steam boiler, generating 350–7,500 kg of steam per hour emission-free.

List of Top Steam Boiler System Companies:

- Thermax Limited

- GE (General Electric)

- Alfa Laval

- Bosch Industriekessel GmbH

- Cleaver-Brooks

Steam Boiler System Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Steam Boiler System Market Size in 2025 | US$17.655 billion |

| Steam Boiler System Market Size in 2030 | US$21.607 billion |

| Growth Rate | CAGR of 4.12% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Steam Boiler System Market |

|

| Customization Scope | Free report customization with purchase |

Steam Boiler System Market Segmentation:

- By Product Type

- Fire Tube Boiler

- Water Tube Boiler

- Electric Boiler

- Others

- By Fuel Type

- Coal

- Oil

- Biomass

- Other

- By Pressure

- High-Pressure

- Medium-Pressure

- Low-Pressure

- By End-User

- Oil & Gas

- Chemicals

- Power & Energy

- Food & Beverage

- Manufacturing

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America