Report Overview

Surge Protection Devices Market Highlights

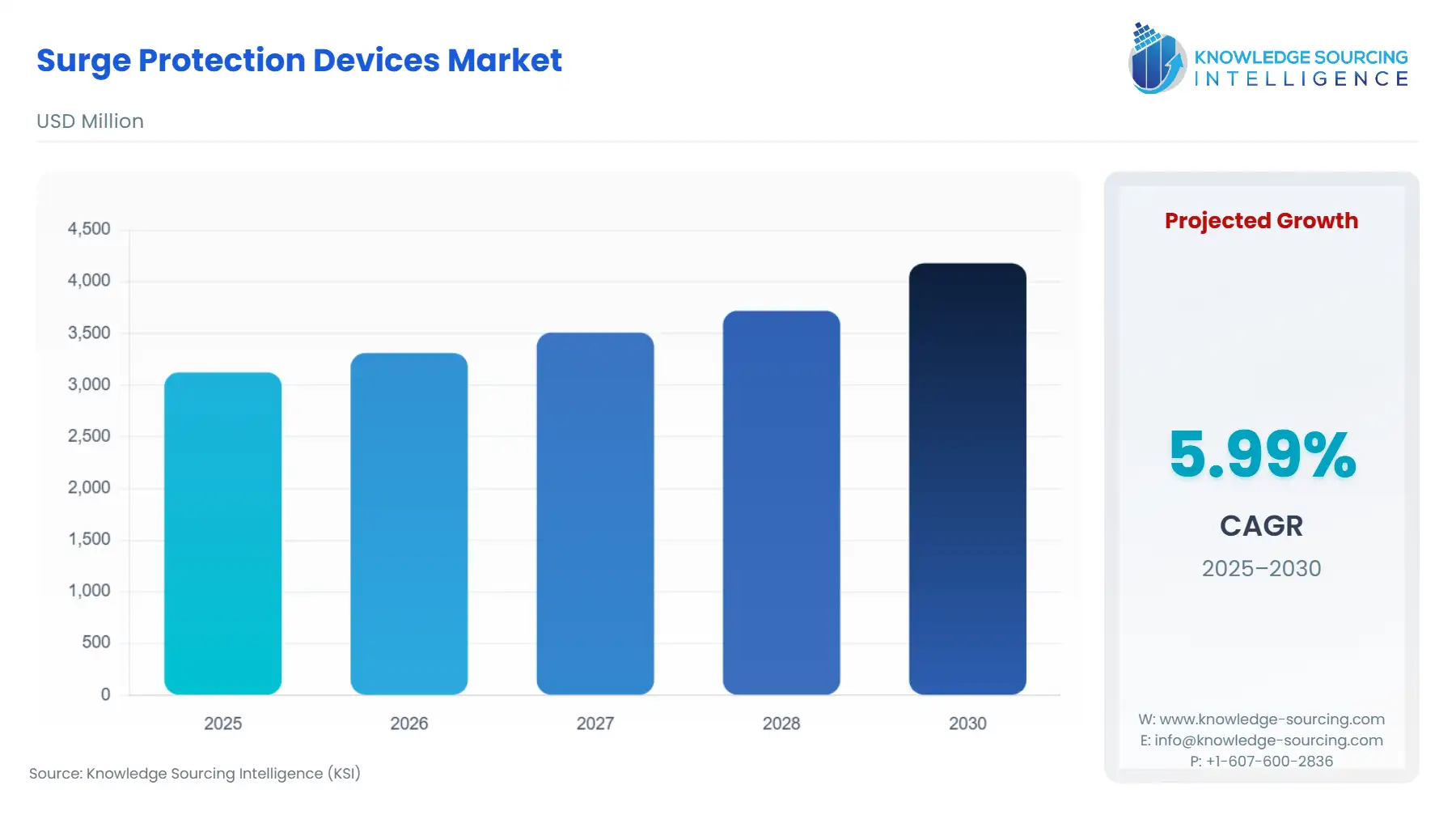

Surge Protection Devices Market Size:

The surge protection devices market is projected to rise at a 6.00% CAGR, achieving USD 4.179 billion in 2030 from USD 3.124 billion in 2025.

Surge Protection Devices Market Key Highlights

The Surge Protection Devices (SPD) market is fundamentally an insurance market, securing electrical and electronic assets against transient voltage events that can originate from external sources like lightning and utility grid switching, or from internal events such as motor cycling and circuit breaks. The sector's operational mandate is to ensure the continuity and longevity of increasingly sensitive digital infrastructure across all end-user segments. This pervasive requirement for electrical resilience has evolved the SPD from a niche protective accessory to an integral, code-mandated component of modern power distribution systems. The demand dynamic is directly tethered to the global push for digitalization and the resulting vulnerability of microelectronic circuits to voltage spikes, compelling manufacturers and builders to adopt superior, multi-tiered protection strategies.

Surge Protection Devices Market Analysis

- Growth Drivers

The global push for grid modernization directly increases the demand for high-capacity SPDs. Utilities in North America and Europe, investing in smart grid infrastructure and decentralized renewable energy, require SPDs to manage the increased switching operations and lightning exposure inherent to these complex, widely distributed systems. Furthermore, the mandatory inclusion of SPDs in the US National Electrical Code (NEC) 2020, specifically for new one- and two-family dwellings, directly mandates product procurement in the residential construction pipeline. This regulatory action establishes a non-negotiable demand volume within a significant, previously optional, segment.

- Challenges and Opportunities

The primary challenge constraining market adoption is the persistent lack of comprehensive awareness, particularly within smaller commercial and older residential end-user segments, regarding the total cost of ownership benefits of SPDs versus equipment replacement and operational downtime. This knowledge gap translates to price sensitivity and reluctance to invest in premium, high-Joule rated solutions. The core opportunity lies in the rapid expansion of EV charging infrastructure and solar PV systems; these installations operate in exposed environments and contain sensitive power electronics that inherently demand DC-side and AC-side SPDs, representing a concentrated and high-growth segment for specialized product deployment.

- Raw Material and Pricing Analysis

Surge protection devices are physical electronic hardware, primarily utilizing Metal Oxide Varistors (MOVs) and Gas Discharge Tubes (GDTs) as key surge-diverting components. MOVs rely on zinc oxide, a commodity material whose pricing can fluctuate based on global metal and chemical market volatility. The core of the device's cost structure is heavily influenced by the cost and stability of the semiconductor and ceramic supply chains required for MOVs and GDTs. Pricing dynamics often reflect the SPD's rating; high-capacity Type 1 and Type 2 devices command a premium due to higher material purity and component volume required to meet stringent international standards (e.g., IEC 61643 series) for maximum discharge current and protection voltage rating.

- Supply Chain Analysis

The global SPD supply chain is characterized by a high dependency on specialized electronic component manufacturing, with major production hubs concentrated in East Asia, particularly China, for core components like MOVs and GDTs. The procurement of these components, which are foundational to device performance, dictates the final product manufacturing cycle. Logistical complexities stem from the global distribution of finished SPDs to diverse markets, each with its own regional certification and electrical standards (e.g., UL in the US, IEC in Europe). This regional standard fragmentation requires complex inventory management and tailored manufacturing lines, introducing dependencies on specific component specifications across the distribution channel.

Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

National Electrical Code (NEC) Article 230.67 (2020 Edition) |

Direct Demand Increase: Mandates the installation of a Type 1 or Type 2 SPD in or adjacent to the service equipment for all new dwelling units, establishing a compulsory, high-volume installation requirement across the residential construction sector. |

|

European Union |

IEC 60364-4-44 & BS 7671 (UK Wiring Regulations) |

Protection Depth Mandate: Requires SPDs where overvoltage could result in danger to human life, interruption of public services, or significant financial loss, compelling multi-level, coordinated protection (Type 1, 2, and 3) in commercial and industrial facilities. |

|

India |

Bureau of Indian Standards (BIS) / IS/IEC 62305 |

Critical Infrastructure Focus: Mandates SPD installation for critical facilities, including server rooms, telecommunication centers, and government buildings, driving demand for industrial-grade protection to ensure uninterrupted operation in high-lightning-incidence zones. |

In-Depth Segment Analysis

- By End-User: Industrial Sector

The Industrial segment is a critical growth driver for SPDs due to the high financial risk associated with process interruption. Modern industrial operations are fundamentally reliant on highly sensitive electronic control systems, including Supervisory Control and Data Acquisition (SCADA) systems, Variable Frequency Drives (VFDs), and networked sensors, which are easily degraded or destroyed by transient over-voltages. A single power surge can halt an entire manufacturing line, resulting in massive operational losses. This extreme cost of downtime, coupled with the frequent internal surges generated by large-scale motor and capacitor switching within industrial plants, compels system designers to implement a robust, coordinated, multi-stage surge protection strategy from the service entrance down to the point-of-use equipment. This requirement is not cost-driven but resilience-driven, prioritizing high-performance Type 1 and Type 2 hard-wired SPDs and DC-side protection in critical processing environments.

- By Product Type: Hard-wired SPDs

Hard-wired SPDs constitute the foundational layer of protection for any facility, installed permanently at the service entrance, distribution panels, or dedicated branch circuits. This segment’s growth is directly proportional to new construction and major electrical renovation activity across all end-user categories, particularly where regulatory mandates, such as the NEC 2020 residential requirements, apply. Hard-wired solutions, including Type 1 and Type 2 devices, possess superior surge current capacity (kiloamps) compared to plug-in units, making them the imperative choice for mitigating large external transients, like direct and indirect lightning strikes. The growing need to protect building-level control systems, such as Building Management Systems (BMS) and HVAC controllers in large commercial properties, further solidifies the demand for reliable, permanently installed hard-wired SPDs at their dedicated panels.

Geographical Analysis

- USA Market Analysis (North America)

The US market for SPDs is driven heavily by the National Fire Protection Association (NFPA) and the adoption of the NEC 2020 by various states and municipalities. This mandatory inclusion of SPDs in new residential construction has significantly standardized demand volume. Furthermore, the massive investment into modernizing the US power grid and the proliferation of utility-scale solar farms and energy storage systems necessitate high-performance, high-voltage SPDs and surge arresters for utility-level protection and reliable power transmission.

- Brazil Market Analysis (South America)

Brazil's SPD demand is influenced by frequent and intense lightning activity, which is among the highest globally, translating into a constant, critical need for protection across the residential, commercial, and utility sectors. The ongoing expansion of infrastructure, coupled with an often less stable and older power distribution network, amplifies the threat of external power transients. This creates robust demand for Type 1 and Type 2 SPDs to safeguard both legacy and new electrical installations against severe, weather-related surges.

- Germany Market Analysis (Europe)

The German market is characterized by a strong emphasis on industrial automation (Industry 4.0) and high-quality, precise manufacturing. This environment mandates the use of highly reliable, certified SPDs to protect complex machinery and control logic from internal and external disruptions. Adherence to stringent IEC/EN standards, which are often adopted as national mandates, drives demand toward premium, certified SPD products integrated into electrical distribution boards within both commercial buildings and manufacturing plants.

- Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market is strongly tied to large-scale, strategic government projects, particularly in oil & gas, critical infrastructure, and the construction of new mega-cities. Protecting this high-value, mission-critical infrastructure from grid instability and environmental factors (e.g., extreme temperatures) is paramount. This environment necessitates robust, often custom-engineered, SPDs and surge arresters for industrial and utility-grade applications to ensure continuity of vital national assets.

- China Market Analysis (Asia-Pacific)

China represents a high-growth market, propelled by rapid urbanization, massive data center construction, and extensive investment in electrical vehicle infrastructure. The sheer volume of new construction and industrial expansion directly translates into large-scale procurement of SPDs for both residential use and to protect new, technologically advanced commercial facilities and manufacturing centers. Domestic production capability is also significant, focusing on both satisfying internal demand and acting as a global supply hub for component-level MOVs and GDTs.

Competitive Environment and Analysis

The competitive landscape for Surge Protection Devices is dominated by large, diversified industrial technology conglomerates that leverage their existing global distribution networks and comprehensive electrical component portfolios. Competition centers on product certification, surge capacity ratings, modularity, and integration with broader power quality and control solutions.

- ABB Ltd

ABB positions itself strategically by offering a comprehensive range of surge protection devices for both IEC and UL markets, including High-capacity (Service entrance), Medium-capacity (Mid-Level distribution), and Light-capacity (Panel Board distribution) SPDs. Its product line, such as the OVR series, is integrated into its broader electrification and power quality portfolio, allowing the company to target large industrial and utility-scale projects where coordinated protection across the power grid and facility is required. ABB emphasizes compliance with international standards and high discharge capacity.

- Schneider Electric SE

Schneider Electric's strategic positioning focuses on integrated, end-to-end power management and digitalization, with SPDs forming a core component of its critical power and building automation solutions. The company offers a wide array of surge protection products under its Square D and PowerLogic brands, covering residential, commercial, and data center applications, including rack-level protection. By offering solutions that integrate SPDs with Uninterruptible Power Supplies (UPS) and energy management software, Schneider Electric drives demand for its products as part of complete, intelligent building electrical systems.

- General Electric Company (GE Vernova)

General Electric, specifically through its GE Vernova Grid Solutions division, focuses heavily on the utility-grade and high-voltage segments of the market. Its TRANQUELL surge arrester products are designed for transmission and distribution substations, emphasizing reliability and performance for EHV (Extra High Voltage) applications up to 612kV. GE Vernova's positioning is rooted in advanced Metal Oxide Varistor (MOV) technology and adherence to ANSI/IEEE C62.11 standards, targeting power generation, transmission, and heavy industrial users where high-reliability surge arresters are mission-critical.

Recent Market Developments

- March 2025: Schneider Electric announced a collaboration with Tata Power to deploy SF6-free Ring Main Units (RMUs) for power distribution in India. While focused on broader grid technology, this development drives demand for compatible power quality components, including surge protection devices, that must integrate seamlessly with newer, sustainable, and digitized power distribution infrastructure. The collaboration indicates a strategic move toward modernizing distribution networks, which inherently requires new surge protection deployments.

- August 2024: Littelfuse, a major provider of circuit protection devices, launched the SMBLCE-HR/HRA, SMCLCE-HR/HRA, and SMDLCE-HR/HRA High-Reliability Low Capacitance TVS Diode Series. This product introduction is specifically targeted at avionics equipment, protecting sensitive digital systems from lightning and transient overvoltage threats. The launch represents a strategic focus on the specialized high-reliability, low-capacitance segment within the transportation and defense end-user vertical.

Surge Protection Devices Market Segmentation

BY TYPE

- Type 1

- Type 2

- Type 3

- Type 4

BY PRODUCT TYPE

- Hard-wired

- Plug-in

BY END-USER

- Residential

- Commercial

- Industrial

- Data centres

- Medical

- Others

BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others