Report Overview

Wireless Power Transmission Market Highlights

Wireless Power Transmission Market Size:

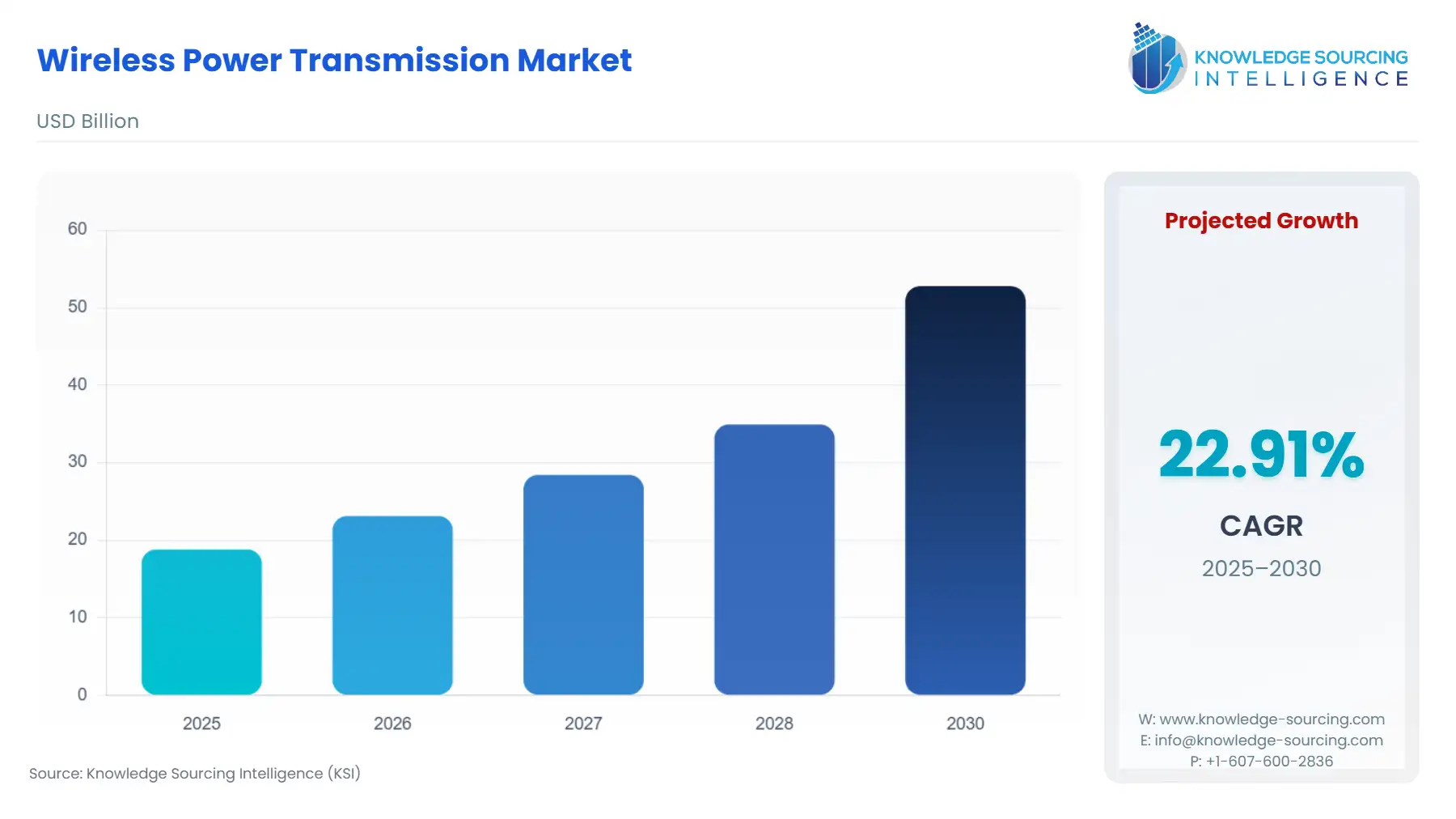

The wireless power transmission market is expected to grow at a CAGR of 22.92%, reaching a market size of US$52.771 billion in 2030 from US$18.811 billion in 2025.

The Wireless Power Transmission market is advancing beyond its initial niche application in low-power consumer electronics to become a foundational technology across the industrial, healthcare, and automotive sectors. This transition is predicated on two primary factors: the resolution of efficiency and misalignment issues through resonant magnetic coupling, and the industry-wide move towards universal, high-power transfer standards. The imperative for a truly seamless, autonomous power transfer experience, eliminating the physical and maintenance costs associated with connectors and cables, is now driving strategic investment. Original Equipment Manufacturers (OEMs) are shifting their focus from basic inductive charging at 5W to magnetic resonant systems capable of 100W+ for power tools, medical devices, and, critically, 11kW+ for Electric Vehicles (EVs), thereby expanding the market scope into high-value, high-safety applications that demand industrial-grade reliability and verifiable performance benchmarks.

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 18.811 billion |

| Total Market Size in 2030 | USD 52.771 billion |

| Forecast Unit | Billion |

| Growth Rate | 22.92% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Component, Technology, Range, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Wireless Power Transmission Market Analysis

Growth Drivers

The market expansion is overwhelmingly propelled by the convergence of mobility electrification, and the imperative for factory automation. The global push for Electric Vehicles (EVs) mandates a ubiquitous and convenient charging ecosystem; resonant inductive technology, which eliminates connection downtime and human error, directly increases the demand for high-power (11kW-22kW) WPT solutions, specifically in public parking, taxi fleets, and autonomous shuttle depots. Simultaneously, the manufacturing sector’s drive for Industry 4.0 necessitates autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) that require continuous power without manual intervention. This operational need creates substantial demand for WPT systems capable of high-speed charging in ruggedised, often contaminant-prone industrial environments, directly stimulating the demand for medium-range WPT hardware and specialised magnetic materials. The imposition of US tariffs on electronic components, particularly those imported from China, affects the overall cost structure of finished WPT products, compelling global WPT manufacturers to diversify their component supply chain and invest in automated domestic capacity, a structural change reflected in TDK's acquisition of QEI Corporation’s RF power business to strengthen its North American presence.

Challenges and Opportunities

The WPT market faces a significant headwind in the form of regulatory fragmentation and the persistent challenge of thermal management at high power levels. Inconsistent global standards outside of the harmonised Qi ecosystem—particularly for medium- and long-range solutions—create protracted compliance cycles and impede manufacturers' ability to achieve economies of scale, directly decreasing the demand for universal, globally deployable products. However, this constraint simultaneously presents a major opportunity for high-efficiency, standardised component providers. The commercialisation of Magnetic Resonant WPT for industrial and EV applications, which can transfer power over greater distances with higher tolerance for misalignment than traditional inductive coils, unlocks new demand. This technology is the critical enabler for smart road infrastructure and medical device integration (e.g., hermetically sealed implants, surgical robotics), offering a demand vector into high-margin segments where cable elimination is a safety or operational necessity, thereby justifying the higher system cost.

Raw Material and Pricing Analysis

The WPT component ecosystem is highly dependent on the stability and pricing of key magnetic materials, primarily ferrite cores (Manganese-Zinc and Nickel-Zinc ferrites) and high-purity copper for coil windings. The manufacturing of these specialised ferrites is concentrated heavily within East Asia, creating a substantial supply chain vulnerability and logistical complexity. Price volatility is a constant factor; for instance, the price of manganese oxide, a precursor to ferrite, exhibited an approximate 19% increase in 2023, while iron oxide, another key raw material, faced supply availability constraints due to mining disruptions in key regions. This component price instability necessitates that WPT manufacturers maintain a competitive imperative on system-level cost-efficiency, driving demand toward integrated solutions, such as Texas Instruments' two-chip transmitter/controller sets, which reduce component count and simplify Bill of Materials (BOM) management. The pricing strategy, therefore, centres on compensating for input material inflation through design simplification and higher component integration levels.

Supply Chain Analysis

The global supply chain for WPT is structured in a tiered, asymmetrical architecture, bifurcating into a high-volume consumer segment and a low-volume, high-specification automotive/industrial segment. Tier 1 suppliers (e.g., TDK, Murata, Renesas) dominate the upstream component provision, supplying integrated circuits, specialised magnetic sheets, and high-Q factor coils. Production hubs are centred in Japan, South Korea, and Mainland China, leveraging the established electronics manufacturing infrastructure. Logistical complexities arise from the bulk and weight of the magnetic and copper components, coupled with the need for high-precision manufacturing processes to ensure the consistency of resonant frequency, especially for mid-range systems. The automotive WPT supply chain exhibits a significant dependency on the geographic location of the final EV assembly plants, requiring localised JIT (Just-in-Time) delivery for high-power coils and ground assemblies. This dependency creates a logistical challenge, forcing component suppliers to establish regional warehousing and final assembly capacity close to automotive OEMs, as exemplified by WiTricity's strategic capacity addition in Japan.

Government Regulations

WPT regulatory mandates impose critical constraints and structural demands on product design, directly shaping the market for compliant hardware.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

China | Ministry of Industry and Information Technology (MIIT) Provisional Regulations on Radio Management of Wireless Charging (in force since Sept. 2024) | Directly constrains design specifications by restricting mobile/portable WPT transmission power to a maximum of 80W and mandating specific frequency bands (e.g., 100-148.5 kHz). This creates immediate demand for hardware certified for this national standard. |

United States | Federal Communications Commission (FCC) Part 18 (Industrial, Scientific, and Medical Equipment) and Part 15 (Radio Frequency Devices) | Governs the emission of radio frequency (RF) energy. Compliance requires rigorous testing (Certification or SDoC), increasing compliance costs and time-to-market. Devices must demonstrate safety concerning Specific Absorption Rate (SAR) and Maximum Permissible Exposure (MPE), directly impacting the viability and power output of medium- to long-range WPT systems. |

Europe | European Telecommunications Standards Institute (ETSI) and Radio Equipment Directive (RED) 2014/53/EU | Mandates that WPT devices not cause harmful interference and meet health protection requirements. The RED requires manufacturers to ensure electromagnetic compatibility (EMC) and spectrum efficiency, fostering demand for WPT chips that incorporate advanced filtering and noise suppression capabilities. |

Wireless Power Transmission Market Segment Analysis

By Technology: Resonant Inductive Coupling

Resonant Inductive Coupling represents a foundational shift in WPT technology, moving beyond the physical contact limitations and low efficiency of traditional inductive methods. This technology operates by tuning the transmitter and receiver coils to the same magnetic resonant frequency, enabling highly efficient power transfer over distances of up to several dozen centimetres and maintaining efficiency even with significant misalignment. The key demand driver for this segment is the technology's inherent ability to support high-power, high-tolerance applications across the automotive and industrial sectors. For Electric Vehicle (EV) charging, the resonant approach is non-negotiable as it enables high-power transfer (11 kW+) with ground clearance and positional freedom, substantially improving the user experience and enabling autonomous charging in parking garages and public roads. In manufacturing, the technology drives the demand for sealed, position-agnostic charging stations for AGVs, eliminating connector wear and contamination risk. This demand is further propelled by the standardisation efforts of organisations like the SAE International (J2954 standard), which formalises the technical requirements for resonant EV charging, compelling manufacturers to procure resonant-specific components, such as high-Q capacitors and magnetic components designed to operate efficiently at the required 85 kHz band. Resonant technology is thus the core catalyst for WPT penetration in segments where efficiency, distance, and safety are paramount.

By Application: Automotive

The Automotive application segment is rapidly emerging as the most significant high-value vector in the WPT market, driven by the global mandate for vehicle electrification and the advent of autonomous driving. Demand for WPT solutions is primarily fueled by the compelling operational benefits it provides for the Electric Vehicle (EV) user and the structural advantages it offers for fleet operators. WPT eliminates the cumbersome and often wet or dirty process of physically plugging in a cable, thereby increasing the willingness of consumers and fleet managers to adopt EVs. Crucially, in the autonomous vehicle ecosystem, WPT is an enabling technology; a driverless car cannot plug itself in, making automated, coil-to-coil resonant magnetic charging the only viable solution for energy replenishment. This structural link between WPT and vehicle autonomy directly increases the demand for specialised automotive-grade hardware, including integrated power electronics and ruggedised ground assemblies compliant with standards such as the SAE J2954. The push towards Vehicle-to-Grid (V2G) capabilities in markets like Germany, where charging infrastructure is being adapted to allow two-way power flow, further creates demand for sophisticated WPT systems with high-reliability power control and robust communication protocols to manage bidirectional energy transfer, positioning WPT as a strategic necessity rather than a mere convenience feature.

Wireless Power Transmission Market Geographical Analysis

US Market Analysis

The US market for WPT is characterised by strong demand in the consumer electronics and a nascent but high-growth trajectory in the automotive sector. Demand is fundamentally driven by the robust penetration of smartphones and wearables that adhere to the Qi standard, creating a massive installed base of compatible receiving devices. This high-volume demand compels retailers and accessory manufacturers to integrate certified WPT transmitters into furniture, charging mats, and automotive cabin surfaces, directly boosting the hardware component market. The primary local factor impacting demand acceleration is the Federal Communications Commission (FCC) regulatory framework. While ensuring safety, the rigorous certification process for medium and long-range systems under FCC Part 18 acts as a structural filter, favouring component suppliers like Texas Instruments that offer verified, pre-certified integrated circuits, thus lowering the barriers to market entry for device OEMs. Furthermore, government initiatives and tax credits aimed at accelerating EV adoption are translating into increased infrastructure spending, creating a future demand imperative for standardised, high-power (TBD by new SAE standards) wireless charging pads in commercial parking and highway rest areas.

China Market Analysis

The China WPT market is a demand powerhouse, uniquely shaped by definitive, top-down regulatory action and the massive scale of its domestic electronics and EV manufacturing ecosystem. The most critical local factor is the implementation of the MIIT’s Provisional Regulations on Radio Management, effective September 1, 2024. This regulation immediately creates a massive, time-bound demand for all WPT manufacturers to redesign and certify their products to meet the non-negotiable 80W power limit for portable devices and the specified frequency bands for both mobile and EV WPT. This mandatory compliance cycle drives immediate procurement of compliant hardware and ICs. Simultaneously, China’s aggressive policy on New Energy Vehicles (NEVs) and its dominance in electric bus and taxi fleets create unparalleled demand for high-power, medium-range wireless charging infrastructure for commercial vehicles. The local competitive landscape, where domestic champions compete intensely, propels innovation in material science and system integration (e.g., maximising efficiency within the strict 80W power ceiling), which, in turn, fuels demand for advanced passive components like TDK's high-performance ferrites.

Germany Market Analysis

The German WPT market, particularly the automotive segment, is driven by a profound emphasis on industrial efficiency, sustainability, and technological leadership. Demand is not merely for charging convenience but for WPT systems that enable sophisticated infrastructure and grid management. The country's "Charging Infrastructure Master Plan 2030" focuses on supporting advanced charging functions, including bidirectional charging (Vehicle-to-Grid, V2G). Since WPT is inherently easier to automate and ruggedise for two-way power flow than complex mechanical plug systems, this strategic focus is creating specific demand for WPT solutions that are V2G-compatible, high-power, and can seamlessly integrate with the smart grid. Furthermore, the German manufacturing sector’s pursuit of "Industrie 4.0" and fully automated production lines increases demand for robust, industrial-grade WPT systems for charging Autonomous Mobile Robots (AMRs) and specialised factory tools, where efficiency and the elimination of maintenance-heavy cables are paramount operational imperatives. This segment requires high-reliability, long-lifetime WPT components and drives R&D demand for resonant technology that can operate reliably through factory floor contaminants.

Brazil Market Analysis

The WPT market in Brazil is driven primarily by the high-volume demand from the local assembly of consumer electronics and the regulatory harmonisation efforts designed to reduce trade barriers. The demand is rooted in the increasing penetration of globally compatible mobile devices and the need for localised accessory manufacturing. A critical local factor is the regulatory posture of the National Telecommunications Agency (ANATEL). The agency's ongoing process to align its wireless regulations (e.g., Act No. 14158/2025, which updates spectrum use and compliance requirements) with international standards (FCC/ETSI) is a key catalyst for demand. This alignment reduces the need for costly, Brazil-specific product variants and streamlines the market entry and approval process for international WPT component and device manufacturers. This predictability encourages investment in local final assembly operations. While EV adoption is less mature than in North America or Europe, the reliance on high-volume, low-power WPT solutions for smartphones and tablets ensures a steady baseline demand for inductive coupling hardware compliant with global standards like Qi.

South Africa Market Analysis

The South African WPT market is in its exploratory phase, with demand driven by a long-term strategic pivot towards electric mobility and selective industrial applications. The key demand driver is the government's official strategy, detailed in the DTIC's "Electric Vehicle (EV) White Paper." This policy, which commits to a dual platform (ICE and EV) auto industry transition by 2035, is technology-agnostic regarding charging, thereby creating a clear policy window for WPT solutions to compete with conductive charging. This long-term regulatory commitment fuels demand for WPT systems from global automotive Tier 1 suppliers who are planning future assembly capacity. Separately, the demand from the vast mining and industrial sector, which utilises complex, often remote, machinery, is creating a niche market for ruggedised, high-power WPT for heavy equipment and remote sensor battery replenishment, where wired connections are prone to damage and downtime. This specialised industrial demand focuses on medium-range resonant systems designed for extreme durability and environmental sealing, driving the need for sophisticated component solutions verified by international industrial standards.

Wireless Power Transmission Market Competitive Environment and Analysis

The competitive landscape of the Wireless Power Transmission market is characterised by a strategic dichotomy: large, diversified semiconductor and passive component manufacturers competing on scale, integration, and material science mastery, and specialised technology licensors focusing on high-power resonant systems and intellectual property (IP). Component giants leverage their existing supply chain dominance and material science prowess, while IP-focused firms control the foundational high-power technology, forcing ecosystem engagement through licensing.

WiTricity Corporation

WiTricity operates as a pure-play technology licensor, strategically positioning itself at the apex of the high-power, resonant magnetic coupling segment. The company controls a foundational and extensive portfolio of patents crucial for efficient, position-agnostic WPT, particularly for Electric Vehicle (EV) charging. Its strategy is not to manufacture hardware but to establish licensing partnerships with Tier 1 automotive suppliers (e.g., supplying components to companies like TDK) and OEMs globally. A key strategic action was the establishment of a dedicated Japanese subsidiary in May 2024 and becoming a founding member of the Japan EV Wireless Power Transfer Council (WEV Alliance). This capacity addition aims to penetrate the highly sophisticated Japanese auto market, directly driving demand for resonant WPT components that comply with SAE J2954 and local Japanese standards. Its core product is its IP, which enables high-efficiency, multi-kilowatt power transfer required for commercial and passenger vehicle charging.

TDK Corporation

TDK Corporation is strategically positioned as a master of material science and a diversified component provider, dominating the passive component layer crucial for WPT efficiency. Established in 1935 to commercialise ferrite, TDK's core competence is in magnetic materials, which are non-negotiable for WPT coils and shielding. Its competitive edge is based on relentless innovation in miniaturisation and efficiency, targeting both the consumer (Qi) and automotive (Resonant) standards (it is a member of both WPC and AirFuel). The company’s products directly address system design challenges; for example, its innovative WCT38466-N0E0SST101 pattern coil achieves an industry-leading thickness of 0.76 mm. This ultra-thin profile directly accelerates its adoption by smartphone and automotive cabin OEMs where space constraints are severe. Furthermore, its acquisition of the RF power business from QEI Corporation in June 2025 strengthens its high-frequency power solutions, essential for advanced WPT and the broader AI-driven semiconductor equipment market.

Texas Instruments Incorporated

Texas Instruments (TI) maintains a strong competitive position by focusing on semiconductor integration and the development of complete reference designs for WPT systems. TI’s strategy is to simplify the WPT design process for Original Design Manufacturers (ODMs) and Original Equipment Manufacturers (OEMs), accelerating their time-to-market and reducing Bill of Materials (BOM) complexity. Its key products are highly integrated, two-chip solutions that comply with the widely adopted Qi standards. For instance, the bq50002 transmitter analogue front end, paired with the bq500511 digital controller, provides a complete, high-efficiency, Qi-compliant (WPC V1.2) solution that supports up to 5 W. This solution integrates critical features like Foreign Object Detection (FOD) and high-efficiency voltage regulation (>75% efficiency). By offering verified, robust, and low-power ICs, TI ensures its component sales are directly correlated with the high-volume demand for charging accessories, wearables, and in-car charging mats, leveraging the stability of the standardised consumer market.

Wireless Power Transmission Market Developments

Significant strategic and product developments in the 2024-2025 period underscore the WPT market's evolution toward higher power, better alignment, and industrial integration.

June 2024: Texas Instruments Announces Collaboration with Delta Electronics on EV Solutions

Texas Instruments (TI) confirmed a long-term strategic collaboration with Delta Electronics to advance next-generation onboard charging (OBC) and power solutions for Electric Vehicles (EVs). This is a foundational capacity/product development move that leverages TI's C2000™ microcontrollers and proprietary EMI filter products. The collaboration focuses on creating high-efficiency, reduced-size OBC systems. The primary outcome is to offer solutions that can reduce the charger size by 30% while achieving up to 95% efficiency. This development directly addresses the automotive industry's dual imperative of minimising component footprint within constrained vehicle chassis and maximising energy transfer efficiency, creating new, integrated circuit demand for high-power WPT and conductive charging control systems.

May 2024: WiTricity Corporation Establishes Japanese Subsidiary

WiTricity Corporation announced the establishment of its wholly-owned subsidiary in Tokyo, Japan, aimed at supporting and accelerating its commercial activities in the Japanese market for Electric Vehicle (EV) wireless power transfer. This strategic capacity addition directly supports WiTricity’s partnerships with major Japanese automotive manufacturers and Tier 1 suppliers. The local presence, coupled with WiTricity becoming a founding member of the Japan EV Wireless Power Transfer Council (WEV Alliance), formalises its commitment to driving the adoption and standardisation of high-power resonant WPT in a key global automotive production and technology market. The new subsidiary will promote EV wireless charging projects, directly translating into licensing demand for the company’s core technology.

Wireless Power Transmission Market Scope:

Wireless Power Transmission Market Segmentation:

By Component

Hardware

Software

By Technology

Inductive Coupling

Capacitive Coupling

Resonant Inductive Coupling

Others

By Range

Short

Medium

Long

By Application

Consumer Electronics

Healthcare

Automotive

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

Israel

UAE

Others

Asia Pacific

China

Japan

South Korea

India

Others