Report Overview

Surgical Glove Market Size, Highlights

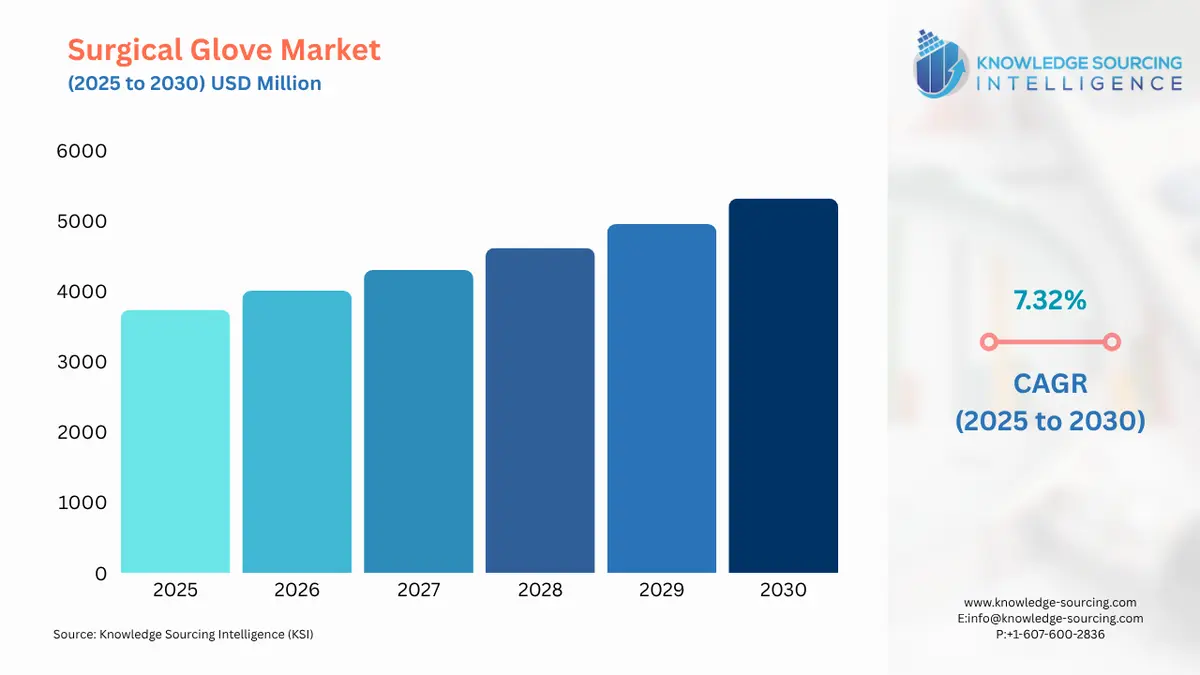

The surgical gloves market is projected to grow from US$3,735.536 million in 2025 to US$5,319.206 million in 2030 at a CAGR of 7.32%.

A surgical glove is a protective glove that medical professionals generally use during surgeries. The main purpose of a surgical glove is to act as a protective layer between the skin of the medical professionals and the patients. It also helps in controlling the contamination of the surgical site, including the patient. It prevents medical professionals from any risk of infections from exposure to any chemicals, hazardous materials, and bodily fluids.

Various market players are opting to promote sustainability in their surgical gloves production and with the ongoing practices to minimize medical waste, the demand for surgical gloves having highly ecofriendly content is gaining traction which has provided a new scope for the overall market expansion in the coming years.

What are the surgical gloves market growth drivers?

- The rising number of hospitals and healthcare centers has positively impacted the market growth.

The booming disease prevalence globally has increased the demand for effective healthcare infrastructure owing to which investments in hospitals, clinics, and healthcare centers are picking pace, especially in major economies worldwide. Hence, such an increase in the healthcare landscape will drive the market for healthcare equipment and accessories, including surgical gloves, The American Hospital Association, in its report, stated that the total number of hospitals in the nation grew significantly. In 2022, there were 6,093 hospitals in the nation, which grew to 6,129 in 2023.

- The growing scale of cosmetic surgical procedures is stimulating market growth.

Cosmetic surgeries are invasive medical procedures in which the physical appearance of the patient is altered or modified. The number of cosmetic surgeries is expected to increase further with the growing developments in technologies, boosting the global market for surgical gloves.

The International Society of Aesthetic Plastic Surgery, in its global report of 2023, stated that in the year, a total of 34.9 million esthetic procedures were performed worldwide, which increased by 3.4% from 2022. The organization further stated that of the total aesthetic procedures, 15.8 million were surgical procedures, and about 19.1 million were non-surgical procedures. Globally, the USA ranked top in aesthetic procedures, with over 6.1 million procedures, followed by Brazil with about 3.3 million procedures.

What are the restraints of the surgical gloves market?

- The high risk of infection from latex gloves is posing a challenge to their demand and overall market growth

Latex gloves cause various skin allergies such as skin itching, hives, and anaphylaxis which can further cause throat swelling. Medical personnel come in contact with patients with diverse disease histories and to minimize the infection spread among them, the usage of gloves with zero penetration is a must.

Latex-based gloves though offer high-performance benefits, but can be dangerous for personnel having latex allergy as it would lead to itching, running nose, and swelling. Hence, various efforts are being implemented to limit latex gloves usage and explore other alternatives in medical practices that can slow down the demand for such material gloves, thereby restraining the market growth.

Segment analysis of surgical gloves market:

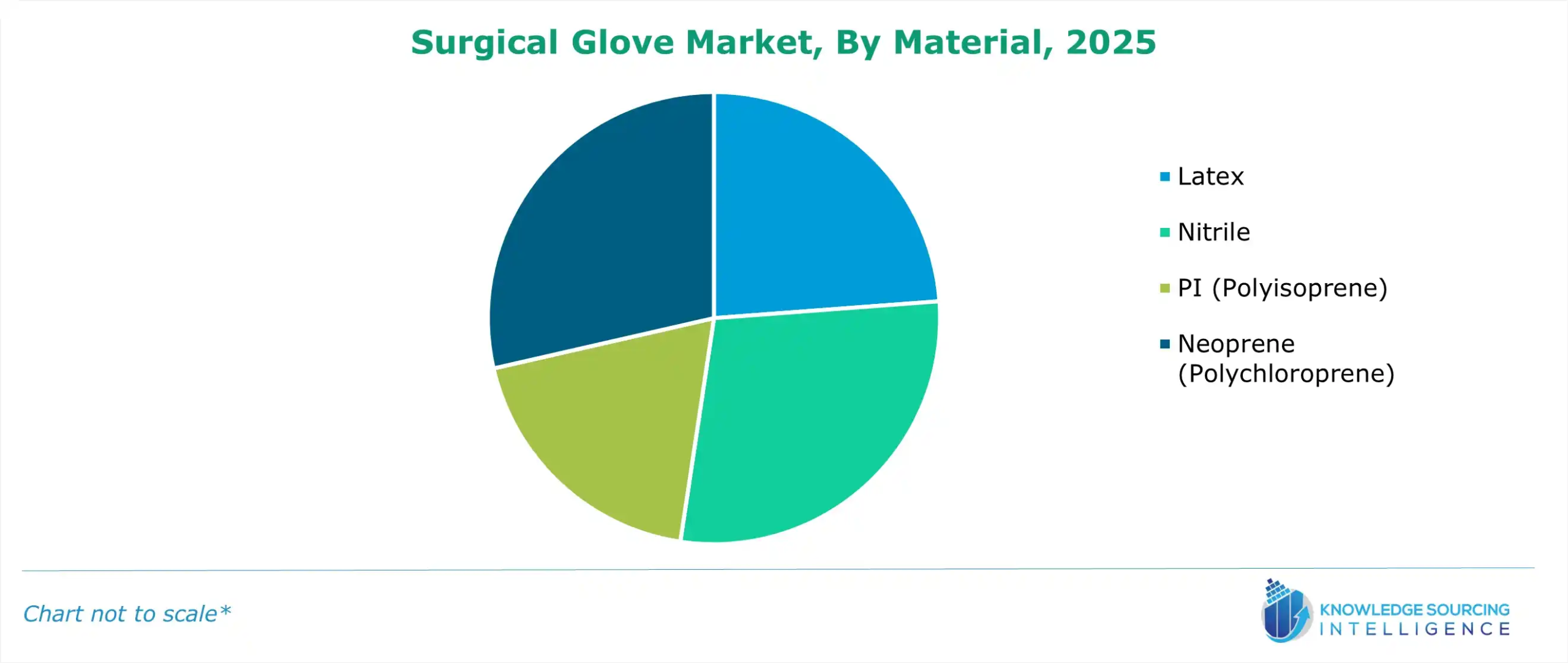

- The nitrile gloves based on the material will constitute a considerable market share.

By material, nitrile glove is estimated to hold a significant market share and are poised for a steady expansion owing to their high applicability in medical settings as they provide better protection against punctures, tears, and chemical exposures. The growing concern about minimizing the risk of allergic reactions for patients and healthcare professionals is propelling the demand for high-performance gloves and nitrile gloves contain no natural rubber latex proteins which makes them hypoallergenic.

According to Allergy & Asthma Network data, latex allergy is a rare condition among the general population, affecting 1-6%. However, it is more frequent among healthcare and dental care professionals, where rates are reported to be as high as 10–17% among healthcare workers and up to 33.8 % among dental care professionals. Moreover, as per the World Allergy Organization, contact urticaria is the most frequent early manifestation of latex allergy in sixty to eighty percent of healthcare workers suffering from latex allergy.

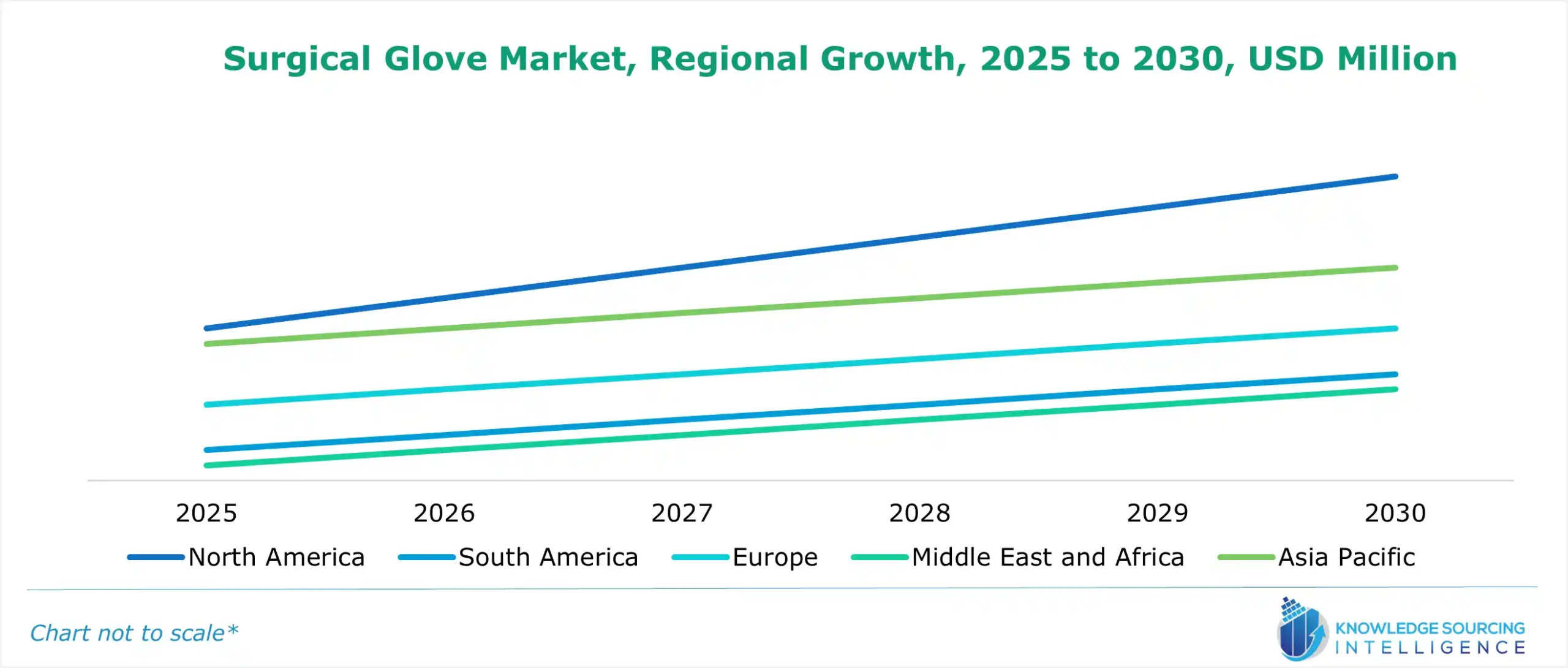

What are the key geographical trends shaping the surgical gloves market:

- North America will continue to be the dominant market shareholder during the forecast period.

Geographically, the senior care technologies market has been segmented into North America, South America, Europe, the Middle East, Africa, and the Asia Pacific.

During the forecast period, the North American region is anticipated to show significant growth fueled by the growing number of surgical procedures and hospital visits in major regional economies namely the United States and Canada. For instance, according to the American Hospital Association, the total number of admissions in the U.S. in 2022 was 33,356,853, which increased to 34,011,386 in 2023.

Likewise, as per the American Society of Plastic Surgeons (ASPS), the total number of cosmetic surgeries or plastic surgeries has grown significantly in the nation over the past few years. The organization stated that in 2022, a total of 1.498 million cosmetic surgery procedures were performed in the nation, which grew about 5% in 2023 with about 1.575 million procedures.

Additionally, the favorable investments in product launches in the American glove industry are expected to fuel market growth in the coming years. For instance, in April 2023, Armbrust American, a Texas-based company, started production of 100% American-made nitrile gloves. These gloves will be produced in Louisiana and include both FDA-approval and chemo-rated gloves with 501k and food-grade industrial gloves.

Recent developments in the surgical gloves market:

- In June 2024: Unigloves acquired Spain-based PPE manufacturer Nitrex which formed a part of the company’s effort to be one of the pioneers in hand protection. The acquisition expanded Nitrex's product line of gloves for healthcare and other industrial sectors in Spain, Portugal, France, and the Southern Europe region.

Surgical gloves market scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Surgical Glove Market Size in 2025 | US$3,735.536 million |

| Surgical Glove Market Size in 2030 | US$5,319.206 million |

| Growth Rate | CAGR of 7.32% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Surgical Glove Market | |

| Customization Scope | Free report customization with purchase |

Surgical gloves market is analyzed into the following segments:

- By Material

- Latex

- Nitrile

- PI (Polyisoprene)

- Neoprene (Polychloroprene)

- By End-User

- Hospital & Clinics

- Ambulatory Surgery Center

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East and Africa

- South Africa

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Taiwan

- Indonesia

- Others

- North America