Report Overview

Synchronous Condenser Market - Highlights

Synchronous Condenser Market Size:

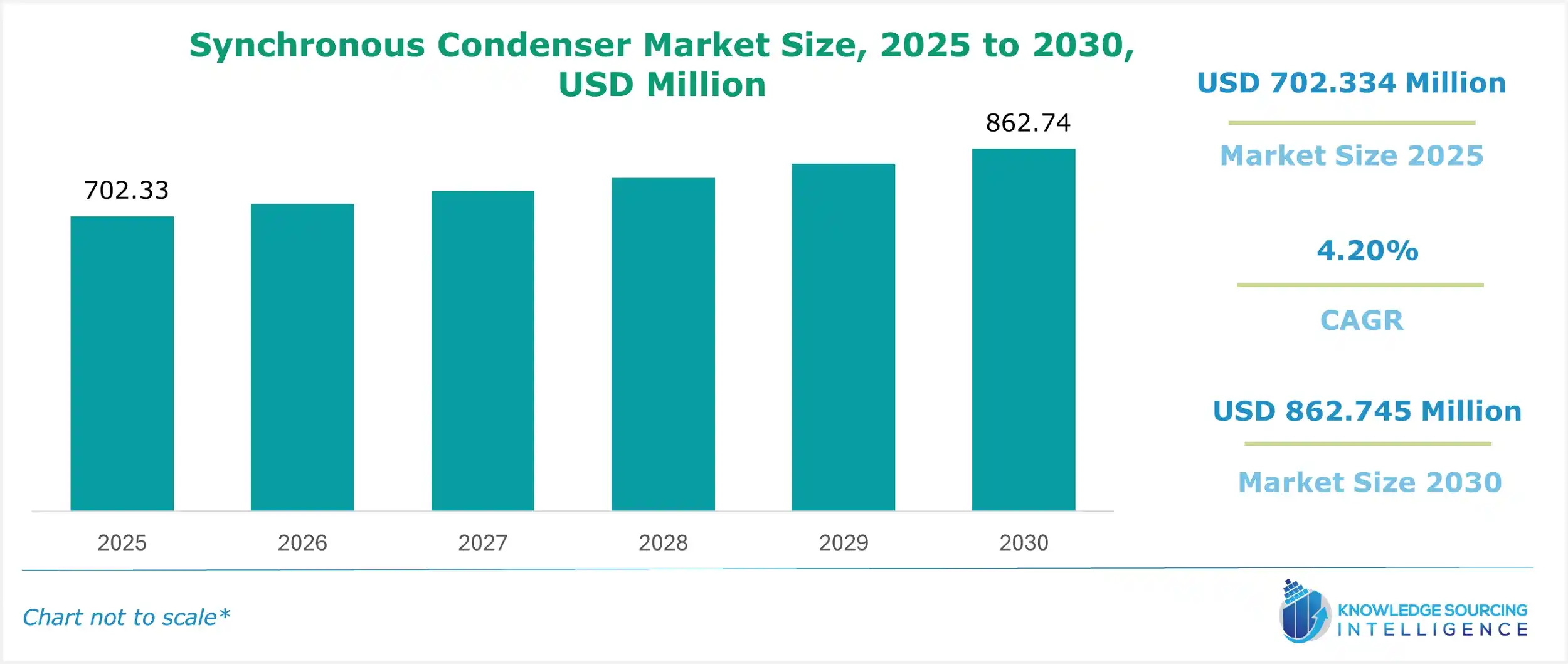

Synchronous Condenser Market is expected to expand at a 4.07% CAGR, reaching USD 892.477 million in 2031 from USD 702.334 million in 2025.

Synchronous Condenser Market Trends:

The synchronous condenser market is growing steadily, driven by the need for effective reactive power management in modern power systems. A synchronous condenser, a specialized synchronous motor operating without a mechanical load, generates or absorbs reactive power to stabilize voltage and enhance grid reliability. Unlike traditional generators, it consumes electrical power to regulate power flow, making it vital for power grid stability.

These devices are categorized as air-cooled condensers or water-cooled condensers, based on their cooling mechanisms. The rising integration of renewable energy sources, such as solar and wind power, is a primary driver of market growth. Renewable energy systems often introduce voltage fluctuations, requiring synchronous condensers to maintain grid stability and ensure efficient power transmission. This is particularly critical in regions with high renewable energy adoption, like Asia-Pacific and Europe.

Government policies promoting clean energy and grid modernization further boost demand. Advancements in condenser technology, including improved efficiency and compact designs, support market expansion. The synchronous condenser market is poised for growth as industries and utilities prioritize energy stability and sustainable power solutions to meet global renewable energy targets.

Synchronous Condenser Market Segmentation Analysis:

The growing integration of renewable energy drives the synchronous condenser market growth.

The rapid expansion of renewable energy sources, such as wind and solar power, has accelerated the demand for reactive power compensation and voltage regulation. Synchronous condensers have emerged as a critical solution for effectively managing the fluctuating reactive power requirements that come with integrating renewable energy into the grid. As a result, the synchronous condensers market is experiencing significant growth. According to the International Energy Agency, in 2021, renewable electricity generation expanded by almost 8%, reaching up to 8,300 TWh.

Rise in grid interconnection

The growing trend of grid interconnection has created a greater demand for effective reactive power management and voltage control. Synchronous condensers are pivotal in meeting these requirements as they provide essential reactive power support and enhance grid stability in interconnected networks. With their ability to improve power system performance and ensure voltage stability, synchronous condensers have become indispensable components in driving the growth of the global synchronous condenser market. According to the report of Renewable Energy World, the grid interconnection request grew by 40% as clean energy surges in 2022, including solar energy storage resources of nearly 2000 GW.

The rise in industrial sectors.

The growth of industries like manufacturing, mining, and transportation necessitates a reliable and stable power supply. Synchronous condensers play a crucial role in enhancing power system performance and ensuring voltage stability, making them indispensable for supporting industrial growth. As a result, the growth of the synchronous condensers industry is driven by their significance in meeting the power requirements of rapidly expanding industries. According to the Energy Information Administration, the industrial sector in the United States represented 35% of the country's overall energy consumption in 2021, both in terms of end-use energy consumption and total energy consumption, indicating its significant energy demand and consumption.

Synchronous Condenser Market Geographical Outlook:

Asia Pacific region is expected to dominate the market.

The synchronous condenser market in the Asia-Pacific region is experiencing significant growth due to the increasing integration of renewable energy sources, such as wind and solar power. This surge in renewables has created a higher demand for reactive power compensation and voltage regulation, which synchronous condensers can effectively provide. Additionally, ongoing grid modernization, aimed at improving power system reliability, stability, and efficiency, has further propelled the adoption of synchronous condensers. These factors have led to a remarkable expansion of the synchronous condenser market in the Asia-Pacific region.

Synchronous Condenser Market Growth Drivers:

The high initial investment is restraining the synchronous condenser industry's growth.

The high initial costs involved in installing and integrating synchronous condensers into power systems can hinder market growth. These costs include purchasing the necessary equipment, hiring engineering services, and developing the required infrastructure. For regions with limited financial resources or tight budgets, these expenses can discourage potential buyers from investing in synchronous condensers. In simpler terms, the upfront investment required can be a barrier for many buyers in adopting synchronous condensers, resulting in a restraint in the synchronous condenser market growth.

Synchronous Condenser Market Company Products:

GE Synchronous Condenser: This product, made by General Electric, has reactive power of 100 to 300+ MVAr and inertia of 250 to 2,500 MW with an added flywheel with the TEWAC cooling technique.

Mitsubishi Electric Synchronous Condensers: This product of Mitsubishi Electric is used to provide power factor correction and produce additional vars as needed, and is unaffected by high rotating inertia and electrical harmonics. Additionally, it can provide short-circuit power for the grid.

WEG's synchronous condensers: WEG designed this product to enhance voltage support, network inertia, and short circuit power capacity in electrical grids. These reliable and efficient solutions effectively improve stability and voltage regulation in power systems.

ANDRITZ Hydro synchronous condenser: ANDRITZ Synchronous Condensers offer a dependable, well-established, economical, and intelligent solution to meet requirements like maintaining the reliability of the grid, new regulatory requirements, a more diverse energy mix, and many more.

List of Top Synchronous Motor Companies:

ABB

Siemens AG

General Electric

Eaton Corporation

Fuji Electric Co., Ltd

Synchronous Condenser Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Synchronous Condenser Market Size in 2025 | USD 702.334 million |

Synchronous Condenser Market Size in 2030 | USD 862.745 million |

Growth Rate | CAGR of 4.20% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Synchronous Condenser Market |

|

Customization Scope | Free report customization with purchase |

Synchronous Condenser Market Segmentation:

By Cooling Type

Air Cooled Condenser

Water Cooled Condenser

By Power Rating Type

Up to 100 MVAR

100 – 200 MVAR

Above 200 MVAR

By End-User

Utility

Industrial

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others