Report Overview

Polyisoprene Gloves Market Report, Highlights

Polyisoprene Gloves Market Size:

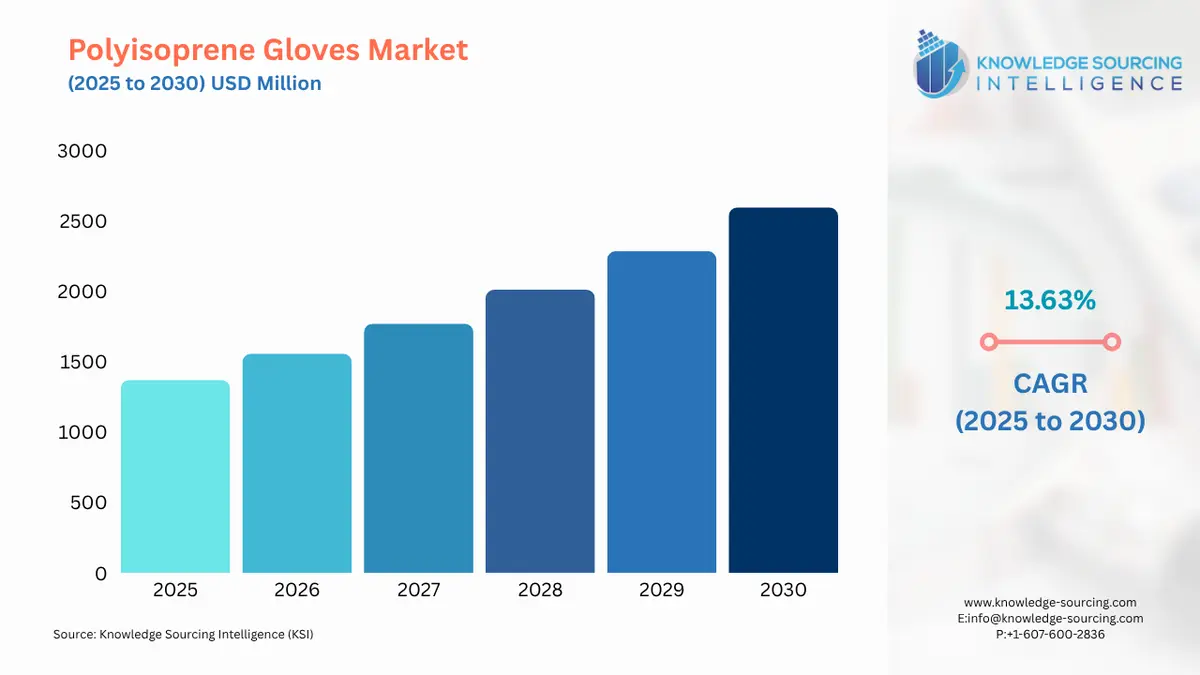

The Polyisoprene Gloves Market is expected to grow from USD 1,370.655 million in 2025 to USD 2,595.985 million in 2030, at a CAGR of 13.63%.

The polyisoprene gloves market occupies a specialized and critical niche within the broader medical gloves industry. Unlike traditional natural rubber latex gloves, polyisoprene gloves are manufactured from a synthetic polymer that replicates the molecular structure of natural latex, effectively providing the benefits of high elasticity, excellent fit, and superior tactile sensitivity without the risk of Type I hypersensitivity reactions. This unique material property makes polyisoprene gloves an indispensable choice for surgical and other high-precision medical applications where dexterity and barrier protection are paramount. The market's growth is fundamentally tied to the healthcare industry's increasing focus on patient and worker safety, with polyisoprene gloves serving as a premium solution to a long-standing occupational health challenge.

In-Depth Segment Analysis

- By Application: Surgical Procedures

The surgical procedures segment is the most critical application for polyisoprene gloves, driven by a unique convergence of technical requirements and safety imperatives. In an operating room, gloves are a barrier against bloodborne pathogens and a tool for precision. Surgeons require gloves that offer a high degree of tactile sensitivity and an anatomical fit to perform intricate and delicate tasks. Natural rubber latex historically provided this superior feel, but the risk of Type I allergic reactions in an operating room setting is unacceptable, as it endangers both the patient and the healthcare provider. Polyisoprene gloves directly solve this problem by chemically and physically mimicking the feel of natural rubber latex without the allergenic proteins. The market expansion is not driven by cost but by the non-negotiable need for a product that ensures both safety and performance. The sterile nature of polyisoprene gloves further reinforces their demand in this segment, as sterility is a fundamental requirement for all surgical interventions to prevent hospital-acquired infections. - By End-User: Hospitals

Hospitals represent the largest end-user segment for polyisoprene gloves, driven by their high volume of surgical and clinical activities and their need to adhere to strict safety protocols. Hospitals are the primary sites for a wide range of surgical procedures, from general surgery to specialized cardiothoracic and orthopedic operations. The sheer number of operations performed daily creates a high-volume, continuous need for sterile surgical gloves. Beyond quantity, the demand is also a function of hospital procurement policies, which are increasingly influenced by infection control and occupational health departments. These departments prioritize the safety of both patients and staff, leading them to mandate the use of non-latex gloves, particularly in sterile environments. Furthermore, large hospital networks often have centralized purchasing protocols that standardize the use of premium products like polyisoprene gloves across their system to ensure consistency in patient care and compliance with regulatory mandates. This institutional-level demand provides a stable and substantial market base for polyisoprene glove manufacturers.

Polyisoprene Gloves Market Growth Drivers vs. Challenges

- Drivers:

The polyisoprene gloves market growth is a direct result of a singular, powerful driver: the imperative to mitigate the risks associated with Type I latex allergies. Natural rubber latex contains proteins that can trigger severe allergic reactions in a significant portion of the population, a concern for both healthcare workers and patients. Organizations like the FDA and NIOSH have documented these risks, leading to a widespread shift away from powdered latex gloves and towards non-latex alternatives. Polyisoprene gloves directly address this medical need by providing a synthetic, hypoallergenic option that maintains the performance characteristics of natural latex. This trend is not a matter of preference but a medical necessity, which creates a consistent and non-cyclical demand for polyisoprene gloves in medical settings where allergic reactions could compromise patient care or worker safety.

Another critical growth driver is the continuous rise in the volume of surgical procedures performed globally. An aging population, coupled with advancements in medical science and technology, has led to a higher incidence of surgical interventions. Each surgical procedure creates a non-negotiable demand for sterile, high-performance gloves to ensure infection control and maintain a sterile field. Polyisoprene gloves, with their sterile, powder-free format, are a preferred choice in these environments due to their optimal comfort and dexterity. They allow surgeons and other operating room staff to perform intricate tasks with the tactile feel necessary for precision. This direct correlation between surgical activity and demand for polyisoprene gloves establishes a clear and measurable market driver.

- Challenges:

The polyisoprene gloves market faces significant challenges, primarily from intense competition and pricing pressures from alternative materials. The most prominent headwind comes from the nitrile gloves market. Nitrile gloves have a lower production cost and have become the standard for many examination and non-surgical procedures due to their strong barrier protection and resistance to chemicals. While polyisoprene gloves offer superior tactile sensitivity, nitrile gloves have become a highly effective and more cost-effective substitute for many routine tasks. This bifurcation of the market means polyisoprene gloves are largely relegated to premium, high-acuity applications, limiting their potential for widespread adoption across all medical settings.

However, this challenge simultaneously presents a key opportunity. The market for polyisoprene gloves is defined by its premium position. Manufacturers have the opportunity to capitalize on this by focusing on product innovation that further enhances the unique benefits of polyisoprene. This includes developing gloves with improved grip, moisture-wicking properties, and enhanced cuff security, all of which address specific pain points for surgeons and other medical professionals. Furthermore, there is an opportunity to expand the application of polyisoprene gloves beyond traditional surgery into other high-stakes environments, such as sterile compounding in pharmacies or handling sensitive materials in laboratories where both dexterity and a non-allergenic material are essential. The market's growth trajectory is dependent on its ability to articulate and deliver a clear value proposition that justifies its premium price point over more commoditized alternatives.

Polyisoprene Gloves Market Raw Material and Pricing Analysis

The polyisoprene gloves market is a physical product segment whose pricing is directly tied to the cost of its primary raw material: synthetic polyisoprene rubber. Unlike natural rubber, which is a commodity influenced by agricultural factors like weather and plantation output, synthetic polyisoprene is a petroleum-derived product. Its production cost is therefore heavily dependent on the price of crude oil and the broader petrochemical market. This dependency introduces a degree of price volatility that manufacturers must manage.

The pricing of polyisoprene gloves is also influenced by the specialized and energy-intensive manufacturing process, which includes precise dipping, vulcanization, and sterilization. These steps require significant capital investment and energy consumption. As a result, polyisoprene gloves command a premium price compared to natural latex and especially nitrile gloves. The premium is accepted in surgical settings where the unique performance attributes of polyisoprene are deemed essential. However, this price point acts as a barrier to entry in more general-purpose applications, where cost-conscious hospitals or clinics may opt for less expensive alternatives.

Polyisoprene Gloves Market Supply Chain Analysis

The global supply chain for polyisoprene gloves is concentrated and highly specialized. The key production hubs for synthetic polyisoprene rubber are located in regions with a strong petrochemical industry. Once the raw polymer is produced, it is shipped to manufacturing facilities, which are predominantly located in Southeast Asia, particularly in Malaysia and Thailand. These countries have a long history of rubber glove manufacturing and have developed the necessary infrastructure and expertise.

The supply chain faces logistical complexities and dependencies. A key dependency is the reliable supply of synthetic polyisoprene from petrochemical producers. Disruptions in the global petrochemical supply chain, whether due to geopolitical events or fluctuations in crude oil prices, can directly impact the cost and availability of the raw material. The final product, once manufactured, is shipped to distribution centers and healthcare providers worldwide. This final leg of the supply chain requires meticulous inventory management and robust logistics to ensure a consistent supply of sterile products to hospitals and clinics. The reliance on a limited number of manufacturing hubs in Asia also introduces a concentration risk, making the supply chain vulnerable to regional disruptions.

Polyisoprene Gloves Market Government Regulations

Government and health agency regulations are a critical growth determinant for polyisoprene gloves. These regulations are not merely guidelines; they are enforceable standards that directly shape the procurement decisions of healthcare institutions.

- Jurisdiction: United States

Key Regulation / Agency: U.S. Food and Drug Administration (FDA) & National Institute for Occupational Safety and Health (NIOSH)

Market Impact Analysis: In 2016, the FDA banned the use of powdered surgeon's gloves and powdered patient examination gloves, citing risks to patients and healthcare workers, including severe allergic reactions and a heightened risk of infection. NIOSH also provides guidance on preventing Type I latex allergies. These regulations directly created an imperative for healthcare providers to find non-powdered and non-latex alternatives, which propelled demand for polyisoprene gloves. The FDA’s clearance process for surgical gloves ensures that only products meeting stringent safety and performance standards can enter the market, reinforcing the market's focus on quality and reliability. - Jurisdiction: European Union

Key Regulation / Agency: Medical Devices Regulation (MDR) (EU) 2017/745

Market Impact Analysis: The EU MDR, which replaced the Medical Devices Directive, has tightened the requirements for the marketing and clinical evaluation of medical devices, including surgical gloves. Manufacturers must demonstrate conformity to ensure safety and performance. The regulation also requires a CE mark, which signals compliance with EU standards. This regulatory environment creates a high barrier to entry for new players and reinforces the demand for polyisoprene gloves that are certified and have a proven safety record. The emphasis on clinical data and post-market surveillance encourages the use of reliable, established products like polyisoprene gloves. - Jurisdiction: United Kingdom

Key Regulation / Agency: Medicines and Healthcare products Regulatory Agency (MHRA)

Market Impact Analysis: The MHRA is the UK’s governing body for medical devices. The agency's guidance and standards, which have been aligned with EU regulations, mandate that medical gloves must be fit for purpose and must not cause harm. The continued focus on patient and staff safety in UK healthcare, particularly in the National Health Service (NHS), drives the procurement of hypoallergenic alternatives to latex. This regulatory framework ensures that the demand for polyisoprene gloves remains strong as a premium, compliant option for surgical and high-risk procedures.

Polyisoprene Gloves Market Regional Analysis

- US Market Analysis: The US market for polyisoprene gloves is highly developed and mature, characterized by a strong emphasis on regulatory compliance and a high per-capita healthcare expenditure. The demand for polyisoprene gloves is particularly robust due to the FDA's ban on powdered gloves and the widespread awareness of latex allergies among healthcare providers. This has created a direct and persistent requirement for non-allergenic surgical glove alternatives. The country's advanced healthcare infrastructure, including numerous hospitals and ambulatory surgical centers, consistently consumes large volumes of high-performance gloves. The market is also driven by a growing number of surgical procedures stemming from an aging population and increasing rates of chronic disease. Competition is intense, with major domestic and international players vying for hospital and government contracts. The US market serves as a bellwether for premium medical glove trends.

- Brazil Market Analysis: Brazil's polyisoprene gloves market is an expanding segment, driven by the growth of its private healthcare sector and a rising focus on infection control. The market is concentrated in larger urban centers with advanced hospital systems. While the market is price-sensitive and faces competition from more affordable glove types, the professionalization of the healthcare sector and an increasing number of complex surgical procedures create a clear need for high-quality, non-latex gloves. Local regulations and hospital-specific procurement policies are the primary growth drivers. The market is an opportunity for international manufacturers to penetrate a key South American economy by emphasizing the safety and performance benefits of polyisoprene gloves and by building strong relationships with major hospital networks.

- Germany Market Analysis: Germany represents a key European market for polyisoprene gloves, defined by its high standards for medical products and a robust healthcare system. The demand for polyisoprene gloves is propelled by a national focus on occupational health and safety and the country's stringent compliance with the EU's Medical Devices Regulation. German healthcare providers prioritize product quality and reliability, making them willing to invest in premium solutions like polyisoprene gloves for surgical applications. The market is also influenced by a culture of innovation and a preference for products that contribute to a safer, more efficient clinical environment. The presence of a strong manufacturing base and a leading medical technology sector reinforces the demand for high-performance, specialized medical consumables.

- Saudi Arabia Market Analysis: The Saudi Arabian polyisoprene gloves market is undergoing significant expansion, fueled by the government’s Vision 2030, which includes substantial investments in healthcare infrastructure. New hospitals and specialized medical centers are being built to meet the needs of a growing population and to position the country as a medical tourism hub. These modern facilities are adopting international best practices and are procuring high-quality medical supplies, including non-latex surgical gloves. The demand for polyisoprene gloves is a function of the country's ambition to provide world-class healthcare, which necessitates the use of premium, certified products. The market is an emerging opportunity for manufacturers, particularly those who can provide products that meet both global quality standards and local regulatory requirements.

- Japan Market Analysis: Japan's polyisoprene gloves market is mature and technologically advanced. The market is driven by a healthcare system that values precision, quality, and patient safety above all else. The country's large elderly population and advanced medical capabilities result in a high volume of surgical procedures, creating a consistent need for high-performance gloves. The Japanese market has a strong preference for products from established, reputable manufacturers, with an emphasis on product reliability and innovation. Manufacturers who can offer gloves with enhanced ergonomic features and superior tactile properties are well-positioned. The market's expansion is also shaped by a domestic focus on technological excellence and a desire to minimize risk in all medical settings, making polyisoprene an ideal solution.

Polyisoprene Gloves Market Competitive Landscape

The competitive landscape of the polyisoprene gloves market is defined by a limited number of specialized manufacturers and large, diversified healthcare companies. Competition centers on product performance, regulatory compliance, brand reputation, and global distribution capabilities.

- Ansell Ltd.: Ansell is a global leader in protective solutions and a key player in the surgical gloves market. The company’s strategic positioning is to provide a comprehensive portfolio of surgical gloves, including polyisoprene and other synthetic alternatives. Ansell's key product line, the Gammex series, includes polyisoprene gloves engineered for surgical use, emphasizing comfort, fit, and tactile sensitivity. The company’s competitive advantage is its long-standing reputation for quality and its extensive R&D capabilities, which allow it to develop highly specialized products that meet the rigorous standards of the surgical environment.

- Molnlycke Health Care AB: Molnlycke is a prominent medical solutions company with a strong focus on wound care and surgical solutions. The company's strategic positioning in the gloves market is centered on its Biogel brand, a highly reputable line of surgical gloves. The Biogel PI Pro-Fit gloves are a polyisoprene product that is a preferred choice among surgeons due to their unique comfort and feel. Molnlycke's competitive edge is its deep relationships with healthcare professionals and its focus on providing integrated procedural solutions, with its gloves serving as a critical component. The brand’s strong reputation for quality and its focus on innovation reinforce its premium market position.

- Cardinal Health, Inc.: Cardinal Health is a global, integrated healthcare services and products company that operates as a key distributor and manufacturer. The company’s strategic position is to be a single-source provider for a wide range of hospital needs, including medical gloves. Cardinal Health offers a portfolio of gloves that includes polyisoprene surgical gloves, leveraging its extensive distribution network and long-standing customer relationships to penetrate the market. The company’s strength lies in its ability to provide a complete solution, from logistics to a diverse product line, making it a reliable partner for large hospital systems and group purchasing organizations.

- Recent Development: In July 2025, Ansell announced the expansion of its manufacturing capabilities to increase the global production of its surgical and examination gloves. This capacity addition is a direct response to the continuous demand for high-quality protective equipment in the healthcare sector and reinforces the company's commitment to meeting market needs for both polyisoprene and other synthetic glove types.

- Recent Development: In August 2025, Cardinal Health, Inc., confirmed the completion of its acquisition of a medical device company, Solaris Health. This strategic merger and acquisition is intended to integrate new product lines and technologies into Cardinal Health's existing portfolio, including its medical gloves business. The move is aimed at enhancing the company's competitive stance in the broader healthcare consumables market.

Polyisoprene Gloves Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1,370.655 million |

| Total Market Size in 2031 | USD 2,595.985 million |

| Growth Rate | 13.63% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Form, Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Polyisoprene Gloves Market Segmentation:

- By Form

- Powdered

- Powder-Free

- By Application

- Surgical Procedures

- Examination

- Others

- By End-User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America