Report Overview

Tantalum Electric Capacitor Market Highlights

Tantalum Electric Capacitor Market Size:

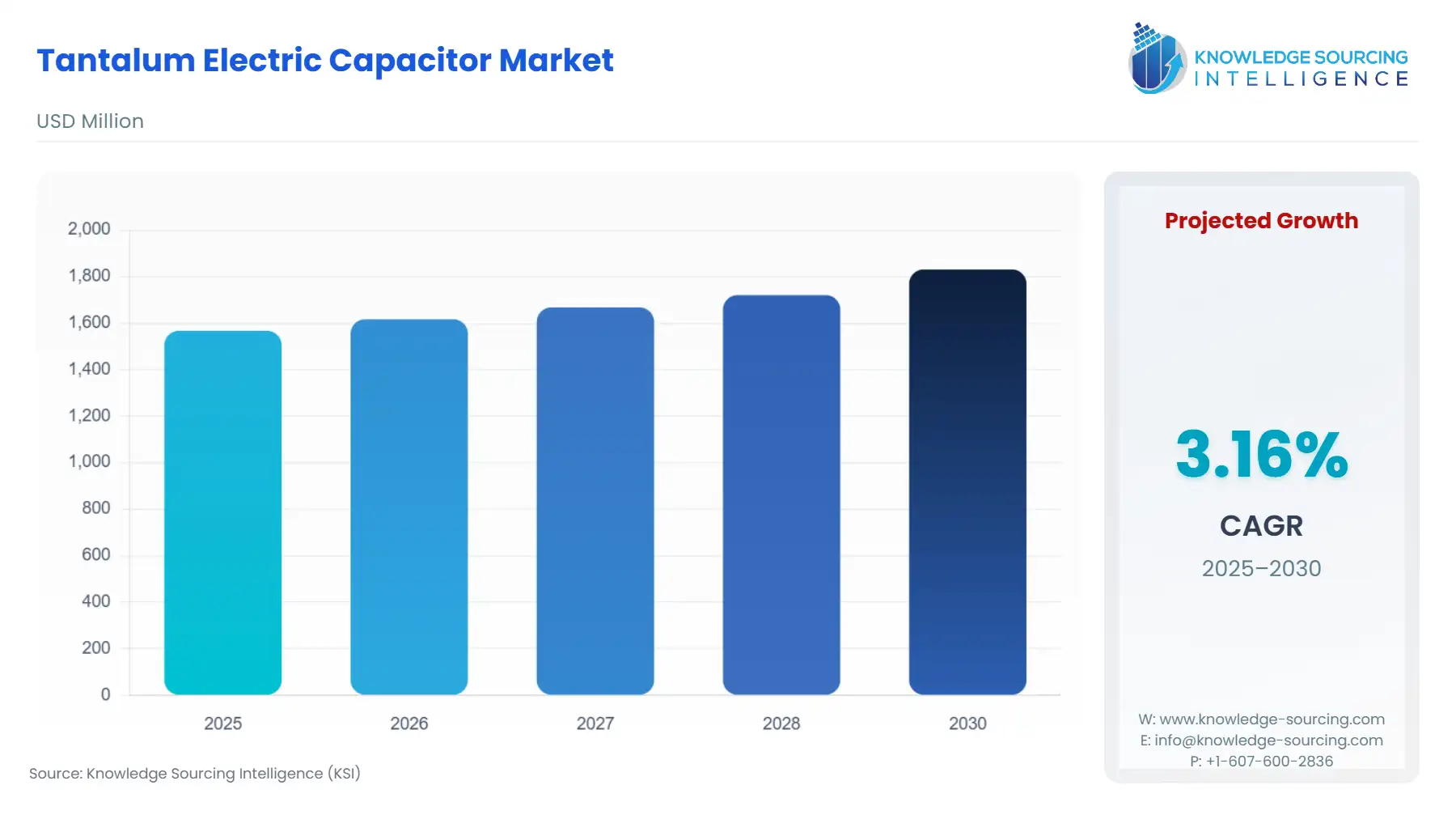

The Tantalum Electric Capacitor Market is expected to grow from US$1,567.051 million in 2025 to US$1,831.149 million in 2030, at a CAGR of 3.16%.

The tantalum electric capacitor market is characterized by a high-stakes dynamic where material scarcity intersects with escalating demand from strategic high-reliability sectors. Tantalum, an element prized for its high dielectric constant and exceptional volumetric efficiency, underpins the production of capacitors that are non-substitutable in applications requiring stable performance in harsh environments or extreme miniaturization. This foundational tension between finite supply and accelerating demand, particularly from automotive, defense, and advanced industrial electronics, dictates the competitive strategy and supply chain resilience initiatives of major market players. The market's future will be defined by advancements in materials efficiency, circular economy initiatives for critical minerals, and the geopolitical calculus of securing a resilient supply of the critical raw material.

Tantalum Electric Capacitor Market Analysis

- Growth Drivers

The primary growth catalyst is the ubiquity of advanced electronics across strategic sectors. Miniaturization in consumer electronics and industrial IoT requires components with high capacitance density, which solid tantalum capacitors uniquely deliver, directly increasing demand in portable devices. Furthermore, the Defense and Aerospace imperative drives the need for specialized wet tantalum capacitors, which offer superior stability and ripple current handling in critical avionic and radar systems (Taylor & Francis Online). The shift to high-voltage, compact power management in automotive systems similarly mandates the use of highly reliable tantalum units, creating a non-cyclical, performance-driven demand floor.

- Challenges and Opportunities

A critical market challenge is the supply chain concentration and material scarcity of tantalum, with a significant percentage of global mined production historically originating from the Democratic Republic of Congo (DRC) (USGS). This geopolitical risk translates directly into pricing volatility and potential growth disruption. The primary opportunity lies in enhanced recycling and circularity initiatives, which, if scaled, can mitigate raw material supply constraints and stabilize pricing, thereby safeguarding and potentially increasing demand by assuring long-term material availability (Taylor & Francis Online). Another key opportunity is the development of next-generation polymer tantalum capacitors, which address the fire-risk constraints of traditional types, opening new, high-growth demand avenues in medical and high-density computing.

- Raw Material and Pricing Analysis

Tantalum is designated as a critical raw material, with a limited global annual production volume, of which capacitor production historically consumes approximately 40% (Unipd). This creates an inherent volatility in pricing. The commodity's supply chain is uniquely complex, starting with the ore columbite-tantalite (coltan) and being geographically concentrated. Price fluctuations in Tantalum powder are directly passed through to capacitor manufacturers, influencing end-product pricing and thereby the price elasticity of demand, especially in high-volume, cost-sensitive segments like consumer electronics. Securing long-term supply agreements for qualified tantalum powder is therefore a core strategic imperative for major capacitor manufacturers.

- Supply Chain Analysis

The global tantalum capacitor supply chain is highly complex and characterized by vertical dependencies. The upstream segment is dominated by mining operations, primarily in Africa, and subsequent processing to convert coltan into capacitor-grade tantalum powder, which is a highly specialized, capital-intensive process. Asia-Pacific nations, particularly in East Asia, serve as the major production hubs for the final capacitor units, benefiting from established semiconductor ecosystems. The key logistical complexity is the management of "conflict minerals" compliance, which necessitates rigorous auditing and traceability systems to assure end-users—especially those in regulated sectors like Defense and Medical—that the material's sourcing meets ethical and legal standards, a factor that directly impacts product cost and market access.

- Government Regulations

Government regulations are fundamentally shifting how demand is framed, moving the focus from price-driven competition to supply chain security and ethics.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

Critical Raw Materials Act (CRMA, 2024) |

Directly drives diversification of supply chains away from single-source nations; prioritizes domestic processing and recycling, stimulating investment that reduces long-term supply risk for European-based OEMs, increasing their long-term security of demand (ÖFSE). |

|

United States |

Defense Critical Minerals Initiative |

Elevates tantalum to a material of national security importance; mandates robust sourcing and stockpiling, which creates a non-cyclical, reliable, high-margin demand stream from the Aerospace & Defense sector (Taylor & Francis Online). |

|

International |

Dodd-Frank Act (Section 1502) / EU Conflict Minerals Regulation |

Imposes mandatory due diligence on the sourcing of tantalum from conflict-affected and high-risk areas, significantly increasing compliance costs for manufacturers. This heightens the entry barrier, favoring large players, and places a premium on ethically sourced materials, which shifts demand toward compliant suppliers. |

Tantalum Electric Capacitor Market Segment Analysis

- By End-user: Aerospace & Defense

The Aerospace & Defense segment is a critical, high-value anchor for the Tantalum Electric Capacitor Market. The necessity here is for high-reliability, wet-slug tantalum capacitors and specialized solid molded parts that meet stringent military specifications (MIL-SPEC). The core growth driver is the non-negotiable need for system reliability in mission-critical applications, such as radar power supplies, flight control systems, and satellite communications (Taylor & Francis Online). Tantalum's inherent thermal stability and superior volumetric efficiency—offering the highest capacitance for a given volume and weight—make it the component of choice over ceramic or aluminum electrolytic alternatives in environments with extreme temperatures, high vibration, or where space and weight are strictly limited, directly ensuring sustained, premium demand regardless of economic cycles.

- By End-User: Consumer Electronics

The Consumer Electronics segment drives the largest volume-based demand for solid tantalum and polymer tantalum capacitors. This segment's growth is principally driven by two factors: product miniaturization and the proliferation of advanced portable devices (e.g., smartphones, tablets, wearable technology). The extremely small footprint and low equivalent series resistance (ESR) of surface mount tantalum capacitors are vital for filtering and decoupling functions in dense, high-speed digital circuits. The constant, accelerated cycle of new product launches and the move to 5G technology in mobile devices necessitate an increased number of high-frequency filtering components per unit, directly translating into mass-market, high-volume demand for next-generation polymer tantalum capacitors that can handle high current and maintain stability.

Tantalum Electric Capacitor Market Geographical Analysis

- US Market Analysis

The US market is a premium demand center dominated by the Aerospace & Defense and high-end Medical & Healthcare sectors. Local factors, including the Department of Defense’s push for domestic or ally-sourced critical minerals (Taylor & Francis Online) and stringent FDA/FAA quality mandates, create a high-barrier-to-entry market. The necessity is characterized by a strong preference for high-reliability, MIL-SPEC-qualified, wet tantalum capacitors for systems ranging from guided munitions to advanced avionics, prioritizing guaranteed performance and supply assurance over cost minimization.

- Brazil Market Analysis

The Brazilian market's profile is concentrated around its domestic aerospace and defense industry and a growing, although volatile, consumer electronics assembly sector. The local factor impacting demand is the historical reliance on imported finished goods. However, national industrial policies focused on technology transfer and domestic manufacturing for strategic sectors—such as Embraer's defense arm—are slowly creating a localized, specialized demand for imported, high-specification tantalum capacitors for use in domestically designed power modules and control systems.

- Germany Market Analysis

Germany represents a high-value European demand hub anchored by its dominant Automotive (especially luxury and industrial automation) and Industrial Power sectors. Local demand is heavily influenced by the European Union’s CRMA (ÖFSE), which places an administrative and strategic premium on ethical and diversified supply chains. This directly compels major German OEMs to partner with capacitor suppliers who can provide full-chain traceability and compliance, shifting demand toward established, reliable, large-scale manufacturers who can absorb the compliance cost.

- India Market Analysis

The Indian market is primarily propelled by the 'Make in India' initiative in electronics manufacturing and the sustained, substantial investment in its Defense and Space programs (e.g., ISRO). This national policy-driven approach is a direct growth factor, as it necessitates the localized sourcing or assembly of high-reliability components for strategic national projects, leading to a measured but growing demand for specialized, imported solid and wet tantalum capacitors for its burgeoning defense electronics industrial base.

- South Korea Market Analysis

The South Korean market is a major volume consumer led by the massive Consumer Electronics and 5G Infrastructure build-out. Local factors driving demand include the intense competitive pressure among global OEMs (like Samsung and LG) to continuously miniaturize and increase the functionality of their flagship devices. This competition directly fuels high-volume demand for next-generation polymer tantalum capacitors with ultra-low ESR and high volumetric efficiency, vital for stable power delivery in high-speed mobile processors and dense 5G communication base stations.

Tantalum Electric Capacitor Market Competitive Environment and Analysis

The tantalum electric capacitor market exhibits a highly concentrated competitive structure, dominated by a few large, integrated players that possess the requisite technology, supply chain control, and compliance certifications (e.g., MIL-SPEC) necessary for high-reliability segments. The primary competitive differentiator is not just pricing, but proven product stability and a secure, ethical supply of tantalum powder. This technological and supply chain barrier to entry insulates the established market leaders from smaller competitors.

- Yageo Corporation

Yageo Corporation, via its subsidiary Kemet, holds a strategic, vertically-integrated position in the market. Its strategic positioning is centered on offering a comprehensive portfolio that spans all major Tantalum capacitor types—solid, wet, and polymer—with a particular focus on the automotive and industrial sectors. Kemet's Tantalum division emphasizes its high reliability and adherence to strict quality standards, which allows Yageo to capture premium demand in high-end, mission-critical applications where failure is not an option.

- Vishay Intertechnology, Inc.

Vishay Intertechnology is a diversified, global leader in passive electronic components, with its Tantalum capacitor offerings being a core strategic pillar. The company leverages its wide geographical reach and broad product lineup to service both the high-volume (e.g., commercial-grade solid Tantalum) and high-reliability (e.g., MIL-Spec wet Tantalum) segments. Vishay’s competitive edge lies in its robust design and manufacturing expertise in complex packaging, allowing it to meet the arduous miniaturization requirements of the high-performance computing and medical industries.

Tantalum Electric Capacitor Market Developments

- July 2024: Vishay Intertechnology, Inc. - Vishay announced the release of new Solid Tantalum Molded Chip Capacitors specifically designed to deliver enhanced performance for arduous applications such as electronic detonation systems and other critical high-reliability military and industrial equipment. This product launch strategically reinforces the company’s focus on the non-commodity, high-margin, and highly regulated end-user segments.

Tantalum Electric Capacitor Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1,567.051 million |

| Total Market Size in 2031 | USD 1,831.149 million |

| Growth Rate | 3.16% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Mounting Type, End-User, Geography |

| Geographical Segmentation | Americas, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Tantalum Electric Capacitor Market Segmentation:

BY TYPE

- Wet Tantalum Capacitor

- Solid Tantalum Capacitor

- Polymer Tantalum Capacitor

BY MOUNTING TYPE

- Surface Mount

- Leaded/Through-Hole

BY END-USER

- Automotive

- Aerospace & Defense

- Consumer Electronics

- Power & Energy

- Medical & Healthcare

- Others

By Geography

- Americas

- Europe, the Middle East, and Africa

- Asia Pacific