Report Overview

Tonka Bean Market Size, Highlights

Tonka Bean Market Size:

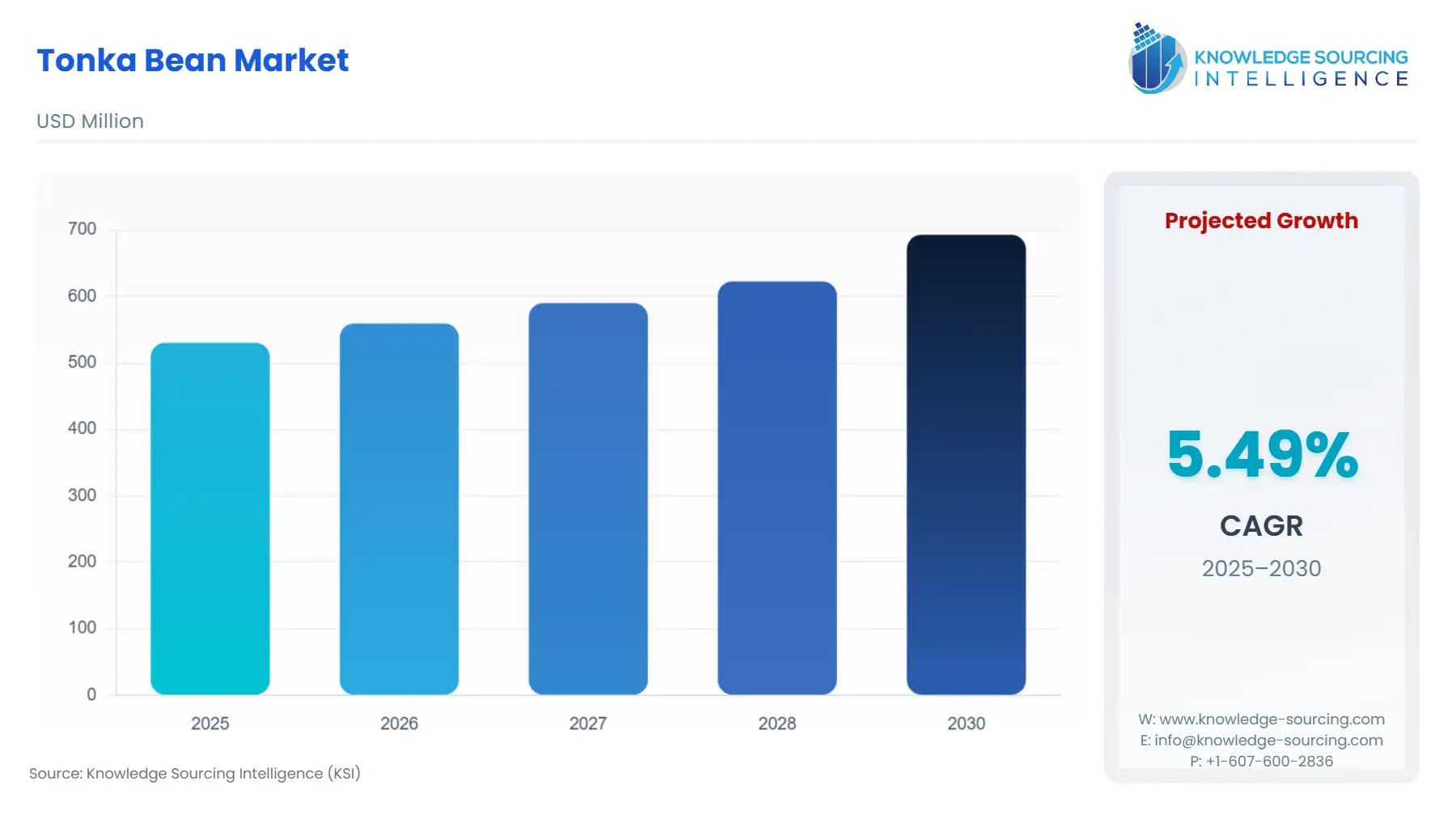

The Tonka Bean Market is projected to grow at a CAGR of 5.49% from 2025 to 2030, reaching a market size of US$693.083 million by 2030 from US$530.472 million in 2025.

This growth is propelled by increasing demand for natural and exotic ingredients, rising disposable incomes in emerging markets, and expanding applications in luxury fragrances, cosmetics, and gourmet foods. As consumers are increasingly demanding natural and exotic ingredients, the demand for tonka beans is growing in premium fragrances and cosmetics. Its demand is also increasing for gourmet foods and beverages. The rise in disposable income across the regions is leading to a gain in the market.

________________________________________

Tonka Bean Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The Tonka Bean Market is segmented by:

- Form: The market includes Whole Beans and Oil/Extracts. Oils/Extracts are in high demand due to the rising demand from the fragrance and cosmetic industries.

- Application: Major applications of tonka beans include Fragrances, Cosmetics, Food and Beverages, and Others (such as aromatherapy and pharmaceuticals). Fragrance leads the market while cosmetics have a considerable share. The food and beverages industry is gaining traction, however, it is limited by restrictions on use in foods. There are expanding applications in aromatherapy and pharmaceuticals; however, niche.

- End-user industry: The end-user segmentation covers Industrial Users, Individual Consumers, and the HoReCa (Hotels, Restaurants, and Cafés) sector. Industrial users, particularly in perfumery and cosmetics, account for the largest share, while the HoReCa segment is expanding due to increased interest in exotic and premium ingredients.

- Distribution Channel: he market is split into Online and Offline channels. Offline is further categorized into Business-to-Business (B2B), Supermarkets/Hypermarkets, and specialty Stores.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa and Asia-Pacific. The market is dominated by production in South America, while it is dominated by consumption in Europe, followed by North America. Asia-Pacific is growing at the fastest rate, while the Middle East and Africa hold a smaller but growing segment.

________________________________________

Top Trends Shaping the Tonka Bean Market:

1. Demand driven by use in niche and artisanal fragrances

- The tonka bean market has high market potential in niche and artisanal fragrances. The increasing demand from consumers for fragrances with exotic ingredients is driving the demand.

- For example, there is an increasing use of tonka beans in perfumes like Creed, Amouage, Le Labo, Myrrh & Tonka, Guerlain and many others where tonka beans are incorporated for their distinctive fragrances.

2. High-growth market in Europe

- The European market is a high-growth region for the tonka market in terms of consumption due to its dominance in luxury fragrances and cosmetics, where tonka beans are valued for their warm, versatile scent and moisturizing properties. The strong demand by the consumers, along with demand for natural nd clean-label products, is driving the market.

- The data by ITC suggests that the European imports of natural ingredients for cosmetics have increased from 404,793 tonnes in 2019 to 470,561 tonnes in 2023. The European cosmetic market is one of the major markets with euro 96 billion in 2023, holding the second position after the USA. According to Cosmetics Europe & Euromonitor International, European per capita spending on cosmetics was estimated to be €169 in 2023, growing at an average rate of 8.3%. Also, Europe is currently among the largest markets for natural and organic cosmetics. These data perfectly highlights the demand for comsetics and that too natuiral ingredients, offering key insights on the demand on tonka bean as well.

Tonka Bean Market Growth Drivers vs. Challenges:

Opportunities:

- Increasing demand for natural and exotic ingredients: According to the ITC trade Map, European imports of natural ingredients for cosmetics amounted to 470,561 tonnes (€2,221 million) in 2023, increasing annually by 5.5% in value and 3.6% in volume over the last five years. It highlights the growing demand for natural ingredients. As there is a global shift towards natural, sustainable and exotic ingredients, the tonka beans market is witnessing a robust demand, more particularly in luxury fragrances and cosmetics sectors.

As the seeds are valued for their unique aroma, which is often described as a blend of vanilla, almond and a hint of tobacco, and thus are high priced in high-end perfumes and natural skincare products. It offers warm, sensual and exotic scent, and it's used in various perfumes like Cuir sahib by BON PARFUMEUR or Jean Paul Gaultier where tonka beans blend with vanilla and lavender.

- Rising disposable income in emerging markets: Due to rising disposable income across many countries especially emerging markets like those of Asia-Pacific and some in south America, there is increasing demand for premium products such as natural and exotic ingredients in perfumes, aromatherapy and cosmetics, driving the tonka bean imports in countries of Asia-Pacific, leading the market to grow. As per the data by Fortune India, Mirae Mutual Fund and Economic Survey, India’s per capita income has decisively surpassed $2,000 and is closing in on the $2,500 threshold by 2026, which will increase the spending in luxury items as well, such as fragrances, cosmetics and premium foods, anticipated to give a boost to the demand for tonka beans.

Challenges:

- Regulatory restriction in some markets: One of the major challenges that limits the growth potential of the market is the regulatory restrictions imposed in some markets on its usage. The concerns over health and safety related to coumarin, a compound in tonka beans, which becomes toxic when used in high doses, have led to regulation by some governments restricting its use. For instance, the FDA has banned the use of tonka beans in food products as coumarin is not generally recognized as safe, prohibiting the legal sale of tonka beans for culinary purposes, limiting the market potential. In other markets like the European Union, it has strictly limited the allowable amount of coumarin in food products. The EU regulation No 1334/2008 restricts its usage in food products and it can be used as a flavouring additive only when its coumarin level remains below the maximum limit set for specific food categories. These restrictions reduce the demand and make its market confined to perfumes and cosmetics. Also, it increases the compliance and import challenges, restricting global trade and thus limiting the market.

- Sustainability concerns: As the international demand for tonka beans is increasing, it has led to unsustainable collection practices by the natives from the Dipteryx odorata tree, which are found in tropical forests primarily in the Amazon basin. Overharvesting and unethical sourcing in the native regions of South America pose a major sustainability concern, making the market susceptible to inconsistent supply in the long term.

________________________________________

Tonka Bean Market Regional Analysis:

________________________________________

Tonka Bean Market Competitive Landscape:

The market is fragmented, with some major key players Beraca Ingredientes Naturais S.A., Givaudan S.A., Firmenich S.A., Symrise AG, Cooperativa dos Fruticultores da Amazônia Ltda (COOPERFRUTAS), Albert Vieille SAS (Givaudan S.A.), Cerbatana C.A., BioBrazil Botanicals, Robertet S.A., and Aromatic Fragrances International.

- Product Launch: In June 2024, Oraculum, a Czech niche fragrance brand, launched Arabesque that incorporates tonka bean as a base with other ingredients like carrot seeds, fig, Iris, poppy flower and others.

________________________________________

Tonka Bean Market Segmentation:

By Form

- Whole Beans

- Oil/Extracts

By Application

- Fragrances

- Cosmetics

- Food and Beverages

- Others (aromatherapy, pharmaceuticals, etc.)

By End-User Industry

- Industrial Users

- Individual Consumers

- HoReCa

By Distribution Channel

- Online

- Offline

- Business-to-Business

- Supermarkets/Hypermarkets

- Specialty Stores

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others