Report Overview

UAE Advanced Battery Market Highlights

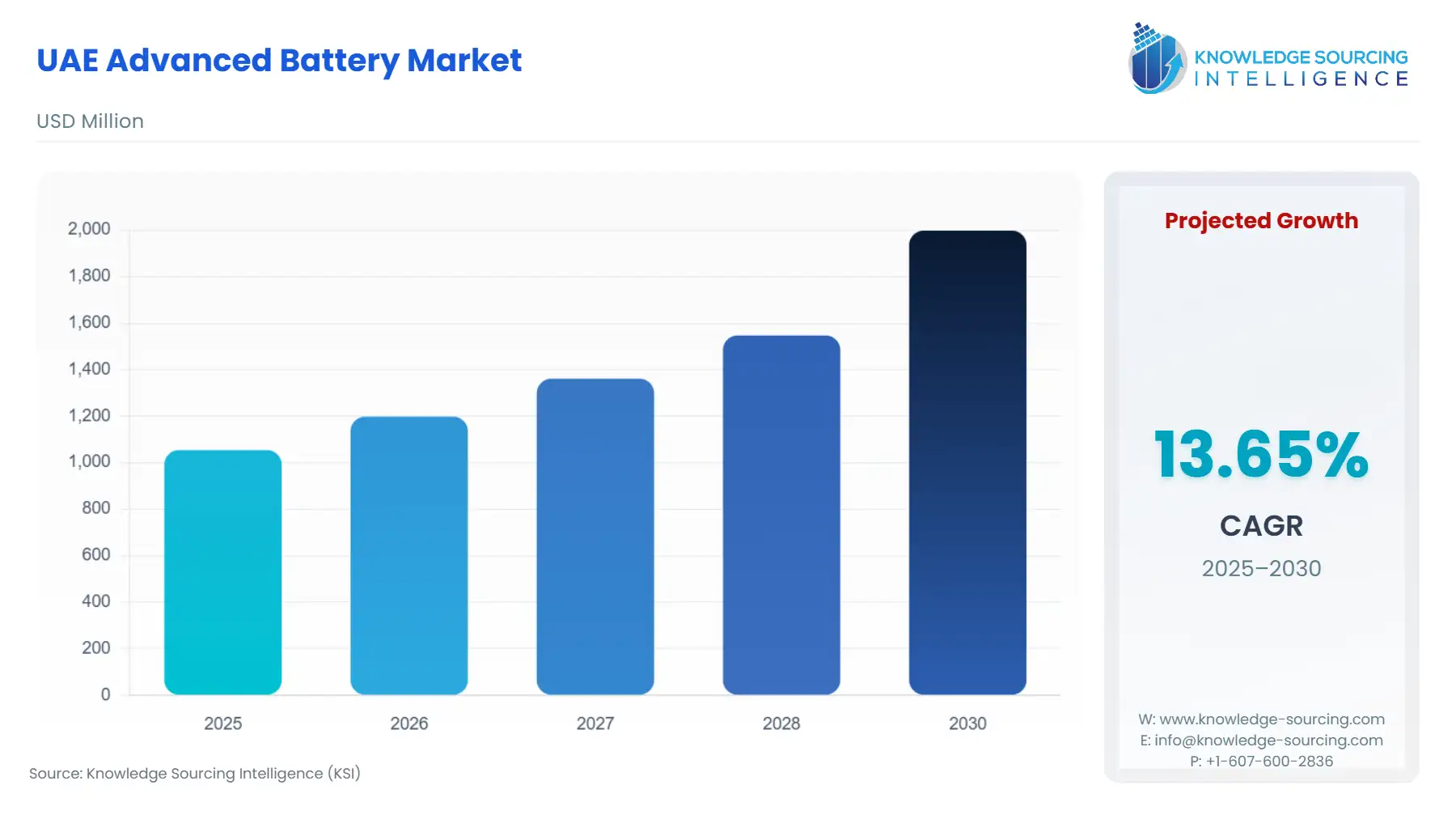

UAE Advanced Battery Market Size:

The UAE Advanced Battery Market is forecast to grow at a CAGR of 13.65%, attaining USD 1.998 billion in 2030 from USD 1.054 billion in 2025.

The UAE advanced battery market is experiencing robust growth driven by the rapid adoption of electric vehicles (EVs), increased demand for energy storage solutions, and government-backed sustainability initiatives.

UAE Advanced Battery Market Analysis:

Growth Drivers:

Several key factors are driving the rapid growth of the advanced battery market in the UAE.

- Electric Vehicle (EV) Adoption: The UAE government has heavily invested in the promotion of EVs as part of its vision to reduce carbon emissions. The introduction of subsidies, infrastructure development such as EV charging stations, and regulatory support for cleaner technologies has directly increased the demand for high-performance advanced batteries, particularly lithium-ion batteries. This is crucial as lithium-ion technology is integral to EV applications due to its high energy density and long lifespan.

- Energy Storage Systems (ESS) Demand: With the UAE’s aggressive push for renewable energy—particularly solar—there is a rising need for energy storage solutions to manage the intermittency of renewable sources. Advanced batteries are essential in energy storage, which enables efficient distribution and usage of renewable power. Residential, commercial, and utility-scale energy storage solutions have driven the demand for batteries that can store and dispatch power reliably.

- Government Regulations & Initiatives: The UAE’s sustainability initiatives, like the Dubai Clean Energy Strategy 2050 and UAE Vision 2021, emphasize the transition to clean energy sources. Such government policies have spurred demand for batteries across various sectors, not only for EVs but also for renewable energy storage and industrial applications, promoting market growth.

- Technological Innovations: As technologies such as solid-state and sodium-ion batteries emerge, they provide enhanced safety, longer life cycles, and better performance compared to conventional lithium-ion batteries. These innovations are stimulating demand for next-generation battery technologies as industries look for higher efficiency and lower costs.

Challenges and Opportunities:

Despite the significant growth prospects, the UAE advanced battery market faces several challenges.

- Raw Material Sourcing and Pricing: Advanced battery manufacturing relies heavily on raw materials such as lithium, cobalt, and nickel, which are subject to price fluctuations and supply chain vulnerabilities. The market is susceptible to geopolitical risks and scarcity of essential materials, which could hinder growth.

- Technological Barriers: While lithium-ion batteries dominate, emerging technologies such as solid-state and sodium-ion batteries face challenges in scaling up for commercial use. Research and development in these areas need to address performance issues, manufacturing costs, and integration with existing systems.

However, the market also presents significant opportunities.

- Domestic Production and Self-Sufficiency: There is a significant opportunity for the UAE to invest in the domestic production of advanced batteries, reducing reliance on imports and creating a self-sustaining ecosystem for EVs, renewable energy storage, and other applications. Initiatives such as Khalifa University’s battery research center are essential steps in this direction.

- Growth in Industrial and Commercial Applications: Beyond consumer electronics and EVs, advanced batteries are increasingly used in industrial applications, such as motive power in forklifts and stationary applications for uninterrupted power supplies. As industries modernize and adopt green technologies, the demand for advanced batteries in these segments will increase.

Supply Chain Analysis:

The global supply chain for advanced batteries faces several complexities, such as the procurement of raw materials (like lithium, nickel, and cobalt), which are concentrated in specific regions (e.g., Chile, the DRC). Logistics challenges also arise from the need to transport these materials over long distances to battery production facilities, many of which are based in Asia. Any disruptions in this supply chain—such as mining strikes, trade restrictions, or logistical inefficiencies—can lead to increased costs and delays in production.

In the UAE context, while the country does not yet have substantial raw material reserves, it serves as a regional hub for battery manufacturers due to its strategic location and strong trade links with China, Japan, and South Korea, where major battery manufacturers are based. As the UAE moves toward local production of batteries, this will likely lead to greater control over the supply chain and reduce dependency on foreign imports.

UAE Advanced Battery Market Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| UAE | Dubai Clean Energy Strategy 2050 | Provides incentives for clean energy adoption, indirectly driving demand for advanced batteries, particularly in energy storage systems and electric vehicles. |

| UAE | UAE Vision 2021 | Focuses on sustainability and low-carbon development, fueling long-term growth in the renewable energy and electric vehicle sectors, both reliant on advanced battery technologies. |

| UAE | Dubai Electricity and Water Authority (DEWA) Regulations | DEWA’s focus on renewable energy and smart grids encourages the use of advanced batteries for energy storage, especially at the residential and utility scale. |

UAE Advanced Battery Market Segment Analysis:

- By Application – Electric Vehicles (EVs): The adoption of electric vehicles (EVs) in the UAE is a primary driver for the advanced battery market. The UAE government’s support for EVs, particularly through subsidies, tax exemptions, and the development of EV charging infrastructure, is accelerating the demand for advanced batteries. Lithium-ion batteries, known for their energy density and efficiency, are expected to remain the dominant choice in the automotive sector due to their ability to meet the high-performance requirements of EVs. With increasing consumer preference for sustainable transportation options and global pressure to reduce carbon emissions, the EV market in the UAE is projected to expand significantly. In addition, the introduction of new models by both local and international manufacturers, such as Tesla and BYD, is likely to further propel demand.

- By End-User – Industrial (Motive Power): In the industrial sector, motive power applications, including forklifts, warehouse robots, and electric industrial vehicles, are gaining traction. Advanced batteries are increasingly used in these applications due to their reliability, longer lifespan, and cost-effectiveness over traditional lead-acid batteries. This segment is expected to see steady growth as industries across the UAE transition to electric and automated machinery, driven by a desire to reduce operating costs and minimize environmental impact.

UAE Advanced Battery Market Competitive Analysis:

The competitive landscape in the UAE’s advanced battery market is defined by a combination of local and international players.

- Dubai Electricity and Water Authority (DEWA): DEWA is at the forefront of the UAE's energy transition. Its initiatives in smart grids, renewable energy, and energy storage systems are key growth drivers for advanced batteries in the region.

- Masdar: A leader in sustainable energy, Masdar’s focus on clean technology solutions, including solar power and energy storage, aligns with the growing demand for advanced batteries, particularly in the commercial and industrial segments.

- LG Energy Solution Ltd.: As a global leader in battery technology, LG Energy Solution has a growing presence in the UAE market, supplying lithium-ion batteries for electric vehicles and energy storage solutions.

Recent Market Developments:

- January 2025: Masdar and EWEC unveiled a groundbreaking 5.2GW solar PV facility paired with 19GWh battery storage in Abu Dhabi, UAE, marking the world's first large-scale renewable energy plant delivering round-the-clock power. This initiative supports the UAE's net-zero goals by integrating advanced lithium-ion batteries for grid stability and renewable integration, enhancing energy security amid rising demand.

- January 2025: UAE's Masdar selected CATL as the primary supplier for the 19GWh battery energy storage system (BESS) in its Abu Dhabi mega-project, utilizing CATL's Tener solution for high-density storage. This partnership, alongside Jinko and JA Solar for PV modules, boosts the UAE's renewable capacity to 1GW dispatchable power, reducing fossil fuel reliance and positioning the emirate as a clean energy leader.

UAE Advanced Battery Market Segmentation:

- BY TECHNOLOGY

- Lithium-ion Batteries

- Lead-acid Batteries

- Solid-state Batteries

- Nickel-metal Hydride (NiMH) Batteries

- Flow Batteries

- Sodium-ion Batteries

- Others

- BY CAPACITY

- Low Capacity (<50 Ah)

- Medium Capacity (50-200 Ah)

- High Capacity (>200 Ah)

- BY MATERIAL

- Cathode Material

- Anode Material

- Others

- BY APPLICATION

- Automotive

- Electric Vehicles

- Hybrid Electric Vehicles

- Plug-in Hybrid Electric Vehicles

- Energy Storage Systems

- Residential

- Commercial & Industrial

- Utility-scale

- Consumer Electronics

- Industrial

- Motive Power

- Stationary

- Medical

- Aerospace & Defense

- Others

- Automotive

- BY SALES CHANNEL

- OEM

- Aftermarket