Report Overview

Global Air Batteries Market Highlights

Air Batteries Market Size:

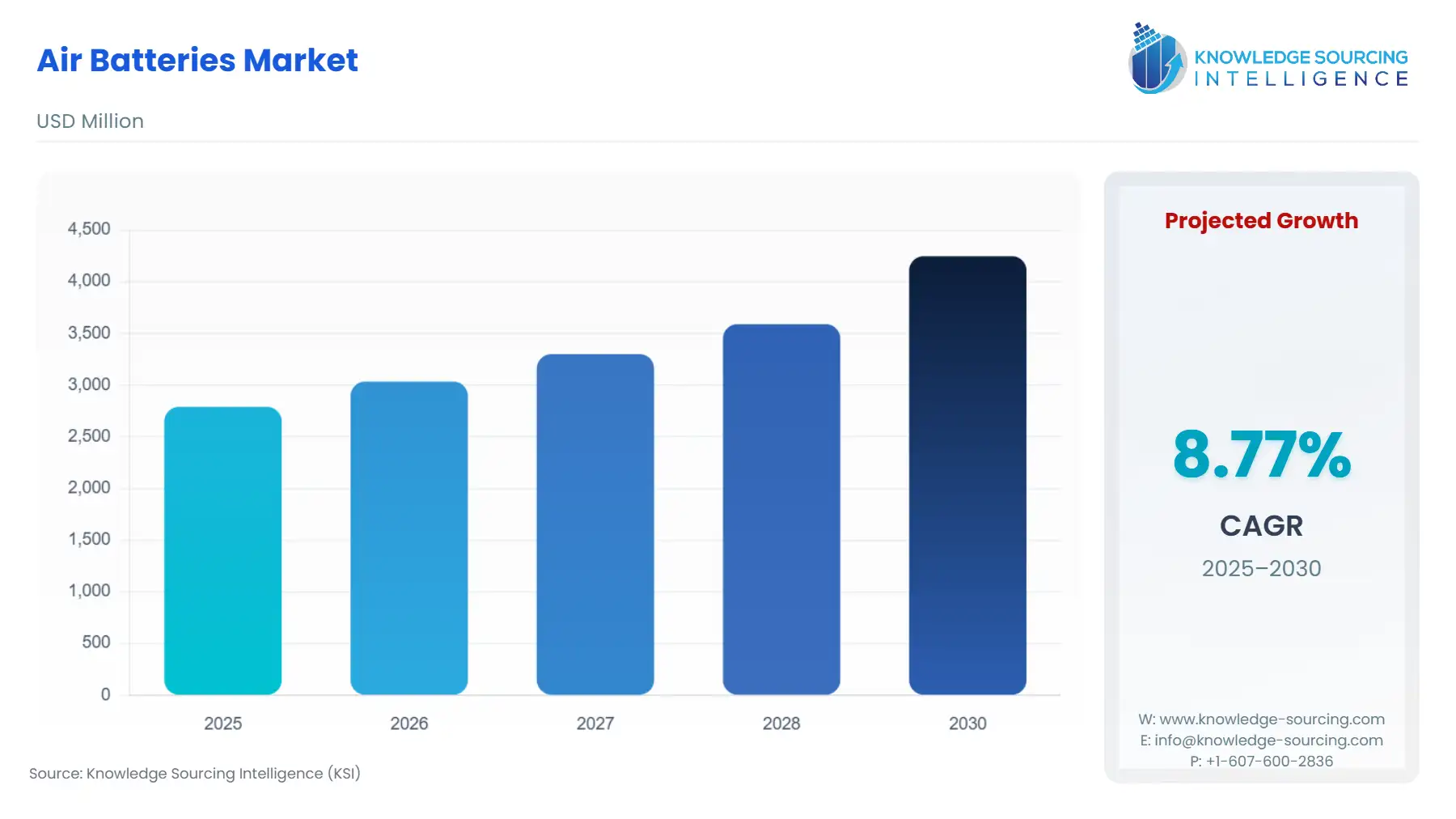

The Global Air Batteries Market will grow from USD 2.790 billion in 2025 to USD 4.248 billion in 2030, registering a 8.77% compound annual growth rate (CAGR).

Global Air Batteries Market Key Highlights

The Global Air Batteries Market is an emergent segment within the broader electrochemical energy storage sector, positioned for disruption due to its fundamental reliance on ambient air as a core reactant and abundant metals as anodes. This unique architecture delivers a significantly higher theoretical energy density and potentially lower manufacturing costs than incumbent technologies. The market is bifurcating into two distinct paths: primary (non-rechargeable) cells maintaining strong traction in portable, low-power medical and consumer electronics, and secondary (rechargeable) systems, which are rapidly transitioning from research-phase pilot projects to commercial viability in utility-scale stationary power applications. This strategic shift is fundamentally driven by the global imperative for long-duration energy storage (LDES) and the subsequent need for alternatives that mitigate the supply chain and thermal runaway risks associated with lithium-ion batteries.

Global Air Batteries Market Analysis

Growth Drivers

The global transition to a decentralized, renewables-heavy power grid is the primary catalyst, directly accelerating the need for air batteries. Increased deployment of intermittent solar and wind generation necessitates long-duration storage—defined as 8 to 100 hours—to ensure grid stability and peak-shifting capabilities. Air battery chemistries, such as Zinc-Air, are inherently suited for this LDES role due to the low cost and high abundance of zinc, creating a direct demand signal from utility and independent power producer sectors seeking cost-effective, multi-day storage solutions. Furthermore, the commercial and industrial (C&I) sector's need for fire-safe battery backup systems amplifies market pull, as the aqueous electrolyte and non-flammable metal anode architecture of these batteries addresses key safety constraints in urban and corporate installations.

Challenges and Opportunities

The central challenge constraining demand for rechargeable air batteries is their historical deficiency in cycle life and round-trip efficiency when compared to mature lithium-ion systems. While the abundance of raw materials lowers cell cost, the current requirement for complex air-breathing cathode structures and sophisticated electrolyte management systems often increases the overall system-level balance of plant (BOP) cost. This technical hurdle currently suppresses large-scale adoption in applications requiring high throughput. Conversely, the opportunity lies in leveraging non-flammable chemistries and earth-abundant materials—Zinc, Iron, and Aluminum. This factor presents a compelling value proposition to utilities and governments that prioritize geopolitical supply chain security and project safety, creating a niche demand for air batteries in highly regulated environments like data center backup and critical infrastructure.

Raw Material and Pricing Analysis

The Air Batteries Market, being a physical product, benefits significantly from the low and stable pricing of its key raw materials. Zinc, a primary anode material, is highly abundant and geographically diversified, preventing the price volatility endemic to the Lithium-ion supply chain. The cost of metallic zinc has historically been significantly lower than that of battery-grade lithium carbonate or cobalt, directly translating into a lower manufacturing cost basis for the cell. This material cost stability provides a critical buffer against economic pressures for LDES providers, enabling competitive long-term pricing and bolstering demand from utility-scale project developers who prioritize predictable input costs over multi-decade deployment timelines. Iron and Aluminum, for their respective air battery types, follow a similar trend of high global abundance and stable commoditized pricing.

Supply Chain Analysis

The air battery supply chain exhibits a decoupled structure relative to lithium-ion systems, creating intrinsic resilience. Anodes rely on ubiquitous, mature metal mining and refining networks (Zinc, Iron, Aluminum), which are geographically dispersed across North America, Australia, and parts of Asia, reducing single-region dependency. The key logistical complexity rests in the cathode and electrolyte components. The "air-breathing" cathode requires sophisticated noble metal or carbon-based catalyst manufacturing, which is highly concentrated among specialized chemical firms. Logistical complexities also arise in the final system integration phase for utility-scale systems, which involves transporting large-scale, modular storage units from specialized pack assembly hubs, currently concentrated in North America and select European countries with established LDES development programs.

Government Regulations

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

European Union | EU Battery Regulation (EU 2023/1542) - Fully effective by August 2025. | Increases Demand for Traceable, Sustainable Air Batteries: Mandates minimum recycled content, strict due diligence on raw material sourcing, and the introduction of a digital 'Battery Passport' by 2027. This favors air batteries, which often utilize more easily recyclable and abundant metals, creating demand for compliant, sustainable-profile products over competitors reliant on problematic supply chains. |

United States | Inflation Reduction Act (IRA) of 2022 - Section 45X Advanced Manufacturing Production Credit. | Catalyzes Domestic Manufacturing Demand: The tax credit incentivizes the domestic production of battery cells and components. This creates a powerful financial driver for companies to establish manufacturing facilities for air batteries (such as zinc-air) within the US, reducing reliance on foreign supply chains and directly increasing the domestic availability and competitiveness of air battery products. |

India | National Programme on Advanced Chemistry Cell (ACC) Battery Storage | Accelerates Domestic Capacity and Technology Demand: Offers direct financial incentives for setting up large-scale ACC manufacturing in India. While technology-agnostic, the strong governmental push for indigenous manufacturing attracts and funds development for non-lithium chemistries, specifically driving R&D and pilot-scale demand for locally sourced and produced air battery systems suitable for the rapidly expanding grid storage market. |

In-Depth Segment Analysis

By Application: Stationary Power

The Stationary Power segment is the most significant demand accelerator for secondary (rechargeable) air batteries. The core growth driver is the escalating operational requirement for grid-scale energy services that cannot be economically met by short-duration battery chemistries. Specifically, the necessity for capacity firming and transmission deferral compels utilities to seek long-duration storage systems capable of discharging for 8 to over 100 hours. Zinc-Air and Iron-Air technologies offer a direct technical fit for this profile. Their inherent material abundance directly translates to a lower capital expenditure ($/kWh) for LDES projects, creating a superior Total Cost of Ownership (TCO) compared to upscaled lithium-ion solutions in the long-duration domain. Furthermore, the non-flammable, aqueous electrolyte design is a critical safety differentiator for installations in densely populated or environmentally sensitive areas, reducing permitting complexity and insurance costs. This direct correlation between LDES performance requirements, safety imperatives, and cost-structure advantages fundamentally drives the commercial demand for air batteries in utility and grid operator procurement cycles.

By Metal Type: Zinc

Zinc-based air batteries (Zinc-Air) command the largest share of the market, driven by two distinct demand centers: primary miniature batteries and emerging large-scale rechargeable systems. In the primary market, Zinc-Air batteries hold a near-monopoly in hearing aid devices due to their unmatched volumetric energy density and flat discharge profile. This consistent, medical-grade demand forms a stable, high-value commercial base. The secondary demand for rechargeable Zinc-Air is catalyzed by the metal's exceptionally high theoretical energy density, low material cost, and benign environmental profile. For grid-scale energy storage, companies are leveraging Zinc-Air's capability to separate energy capacity (zinc metal) from power capacity (air cathode), allowing for system scalability with a low marginal cost per additional hour of storage. This unique scalability factor, combined with the global abundance of zinc, is translating into industrial demand for pilot projects focused on multi-day reserve capacity and ancillary grid services.

Geographical Analysis

US Market Analysis (North America)

The US market for air batteries is primarily shaped by the federal government’s strategic push for domestic, non-lithium energy storage. State-level mandates, particularly in California and New York, demand multi-hour storage to support massive renewable energy portfolios, which creates an urgent market pull for LDES technologies. The Department of Energy’s funding initiatives, coupled with the IRA’s domestic manufacturing tax credits, are generating a substantial demand for US-assembled and sourced air battery systems, driven by the imperative to reduce supply chain dependency on Asian manufacturers. This focus directly encourages utility-scale developers to evaluate zinc-air and iron-air systems that can meet long-duration requirements while complying with domestic content requirements.

Brazil Market Analysis (South America)

The Brazilian market is primarily influenced by the need to stabilize its vast, geographically dispersed grid and integrate growing solar and wind capacity, particularly in the Northeast region. The market pull for air batteries is currently concentrated in off-grid and remote applications, where the batteries’ low-maintenance, robust nature, and local raw material availability (zinc and iron) offer a more practical alternative to imported, high-CapEx technologies. The lack of stringent, pre-defined domestic lithium supply chain regulations allows new chemistries like zinc-air to gain traction quickly in pilot programs focused on energy access and rural electrification, as opposed to direct EV competition.

Germany Market Analysis (Europe)

Germany's market growth is overwhelmingly driven by the Energiewende—the national transition to renewable energy—and the stringent EU Battery Regulation. The country requires massive, safe, and easily recyclable stationary storage to manage grid frequency and balance peak supply fluctuations from offshore wind. The EU regulation’s emphasis on supply chain due diligence, minimal hazardous substances, and recyclability acts as a powerful demand filter, favoring inherently safer, abundant-metal air batteries over lithium-ion in new utility procurement tenders. This requirement is strongest from large industrial players seeking behind-the-meter storage to manage high energy consumption costs and participate in grid services.

Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi market for air batteries is fueled by the ambitious Vision 2030 megaprojects, which include massive renewable energy installations (solar PV) that necessitate long-duration storage. The necessity is centered on utility-scale, non-flammable solutions that can withstand the extreme high-temperature environment of the Arabian Peninsula. Air batteries, which operate effectively in a broader temperature range than many conventional batteries and offer a high energy-to-power ratio for sustained discharge, are uniquely positioned. The strategic imperative is to diversify energy sources and build reliable grid infrastructure in a region historically reliant on thermal generation.

China Market Analysis (Asia-Pacific)

China's need for air batteries is a calculated move toward technological diversification and LDES dominance. While Li-ion is mature, the government’s push for non-lithium alternatives for long-duration storage—including Iron-Air and Zinc-Air—is codified in national energy policy targets. Its necessity originates from state-owned utilities and grid operators who are constructing pilot plants and GWh-scale demonstrations to de-risk and validate air battery performance for extended discharge cycles. This requirement is less about material scarcity and more about establishing a future technological leadership position in the LDES segment of the global energy transition.

Competitive Environment and Analysis

The Global Air Batteries Market exhibits a bifurcated competitive structure: a mature, consolidated segment for primary (non-rechargeable) zinc-air batteries, dominated by companies like Energizer Holdings Inc., and an emerging, highly dynamic segment for rechargeable, grid-scale solutions, characterized by specialized technology developers. Competition in the utility-scale space centers on validating long cycle life, high round-trip efficiency, and successful deployment of demonstration projects.

Company Profiles

Phinergy

Phinergy is strategically positioned at the intersection of energy density and sustainability, specializing in high-performance Aluminum-Air and Zinc-Air systems. The company focuses on the energy segment of the market, primarily offering its aluminum-air battery as a high-density, emergency backup power solution. Phinergy’s core product, the Aluminum-Air battery, is characterized by its ability to deliver long-duration energy via a mechanical recharge process (metal replacement), which is appealing for remote or critical infrastructure applications. Verifiable details from the company’s official publications focus on pilot projects that demonstrate multi-day power capability and highlight the non-flammable nature of the technology, addressing critical safety and operational concerns for C&I end-users.

Zinc8 Energy Solutions Inc.

Zinc8 Energy Solutions Inc. positions itself as a pure-play LDES provider, focusing exclusively on its rechargeable zinc-air flow battery technology for grid-scale and microgrid applications. The company’s strategic objective is to offer an economically competitive alternative to multi-day lithium-ion storage. Their key verifiable product feature is the ability to decouple energy capacity from power capacity, allowing for energy duration to be increased simply by adding more zinc storage capacity (electrolyte tank size). Official company news frequently highlights collaborations with utility and government entities in North America to deploy demonstration projects, solidifying their market strategy of targeting large, centralized, long-duration energy storage procurement.

Energizer Holdings Inc.

Energizer Holdings Inc. is a dominant force in the primary battery market and derives significant, consistent revenue from its Zinc-Air product line, which is primarily sold for consumer and medical applications, most notably hearing aids. The company’s competitive edge is built upon its global distribution network, brand recognition, and a proven product with exceptionally high energy density required for miniaturized electronics. Their strategy is maintenance of market share in the primary segment, focusing on incremental improvements in cell performance and shelf life. Verifiable data emphasizes the reliability and global accessibility of their long-lasting primary zinc-air cells.

Recent Market Developments

October 2025: Archer Aviation acquired Lilium GmbH's patent assets for

€18 million, covering innovations in advanced air mobility. The portfolio includes key intellectual property for ducted fans, propeller systems, high-voltage systems, and battery management, significantly strengthening Archer's technology base for its electric vertical takeoff and landing (eVTOL) aircraft development.

€18 million, covering innovations in advanced air mobility. The portfolio includes key intellectual property for ducted fans, propeller systems, high-voltage systems, and battery management, significantly strengthening Archer's technology base for its electric vertical takeoff and landing (eVTOL) aircraft development.August 2025: Phinergy announced the commercial launch of an enhanced Aluminum-Air backup power system designed for data center applications. The company highlighted that the new product, the Phoenix Air System, delivers a 72-hour continuous power supply in a containerized format. This product targets the growing need for non-diesel, non-lithium reliable backup power in critical infrastructure, emphasizing the fire safety and high energy density of the Aluminum-Air chemistry.

Global Air Batteries Market Segmentation

By Metal Type

Zinc

Lithium

Iron

Aluminum

By Battery Type

Primary batteries

Secondary (Rechargeable) batteries

By Application

Electric vehicle

Stationary power

Military Electronics

Energy storage

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others