Report Overview

Battery Electrolyte Market Size, Highlights

Battery Electrolyte Market Size:

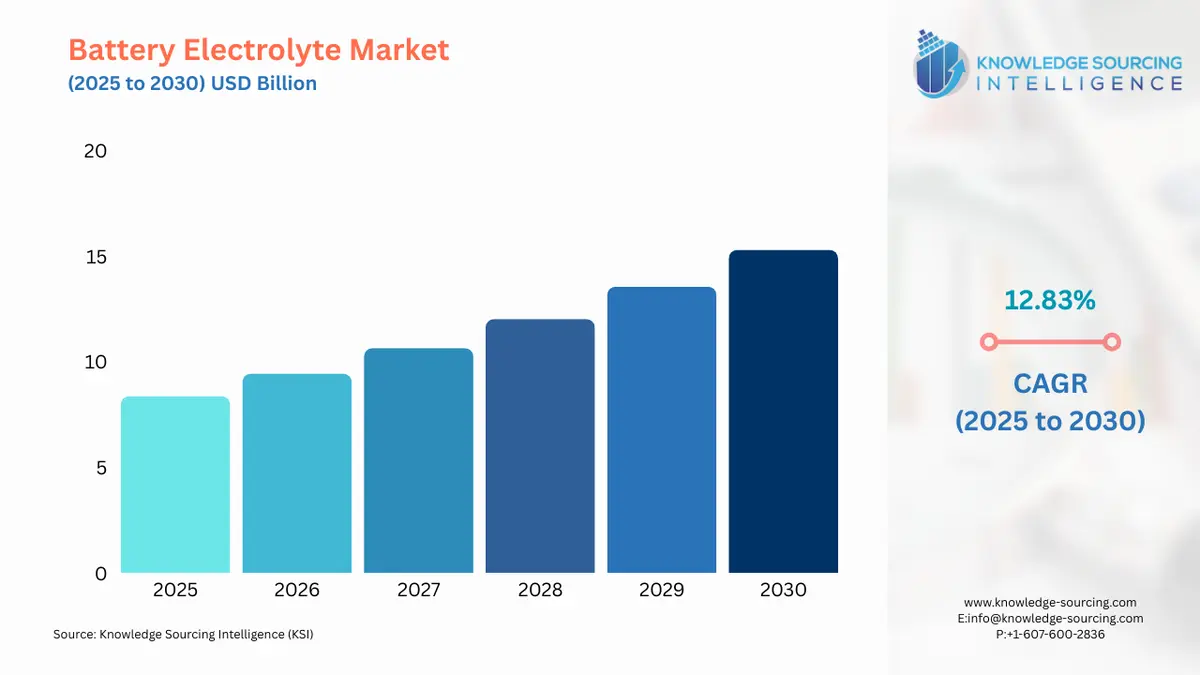

The battery electrolyte market is set to witness robust growth at a CAGR of 12.83% during the forecast period to be worth US$15.302 billion in 2030 from US$8.369 billion in 2025.

Battery Electrolyte Market Trends:

With the rising adoption of electric vehicles and the surge in renewable energy storage, the battery electrolyte market is on the upswing. The major market trends are improvements in electrolyte structures for better performance and safety, and a movement toward solid-state electrolytes. It envisions rising investment in environmentally friendly production. Asia-Pacific leads in production, while North America and Europe are attracting high demand due to strict regulations for greener technologies. Innovation and strategic collaboration overcome the challenges of supply chain limitations.

Battery Electrolyte Market Growth Drivers:

- Increasing Adoption of Electric Vehicles (EVs) Creating demand for battery electrolytes:

The increased population of motorized vehicles fosters high adoption of electric vehicles with sophisticated battery technology, driving the battery-electrolyte market growth. According to the International Energy Agency, EV sales have also increased battery demand by 40% during 2023; 95% of this growth is associated with higher sales, while larger sizes make up the rest at 5%.

- Growing adoption of renewable storage is driving the battery electrolyte market expansion:

Increasing attention to renewable energy storage creates demand for advanced battery technologies to efficiently manage and store energy. According to the International Energy Agency, rising demand for batteries has significantly increased lithium, cobalt, and nickel consumption. In 2023, lithium demand reached 140 kt, representing 85% of the total; cobalt grew 15% to 150 kt; and nickel demand surged 30% to nearly 370 kt.

Battery Electrolyte Market Segmentation Analysis by Type

- Lead Acid: The lead-acid battery electrolyte market is driven by its affordability and wide usage in automotive and backup power systems. Market trends show growth as innovations enhance battery life and recycling efficiency.

- Lithium-ion: It is characterized by high demand for EVs and portable electronics. Another trend includes the development of novel electrolyte formulations with improved energy density and safety and the enablement of next-generation technologies.

- Others: The increasing adoption of nickel-cadmium & nickel-metal electrolytes for stationary renewable energy storage is driving the market growth because of scalability and long cycle life, particularly as they suit big-scale applications that support grid stability trends.

Battery Electrolyte Market Geographical Outlook:

The battery electrolyte market report analyzes growth factors across the following five regions:

- North America: The presence of established companies, especially in the US and Canada, with continued investment in leading-edge battery technologies, like innovation in electrolyte solutions, is expected to drive the regional market.

- South America: This is a promising market, with increasing digitalization and, therefore, growing interest in energy storage solutions. Among the most important countries with expanding infrastructure and technological progress is Brazil.

- Europe: The European market is growing rapidly, with the top three countries being Germany, the UK, and France. A strong regulatory framework and government support for sustainable energy solutions are helping the market develop fast.

- Middle East and Africa: The demand for battery electrolytes in the Middle East and Africa will grow due to the rise in their economy and an upsurge in energy storage demands. The region includes some of the largest countries, the UAE and South Africa, focusing on the localization of energy.

- Asia-Pacific: The region holds significant growth opportunities in the high markets, mainly China, India, and Japan. Higher internet usage and economic development increase demand for energy storage solutions.

List of Top Battery Electrolyte Companies:

- 3M Co.

- NEI Corporation

- Guangzhou Tinci Materials Technology Co., Ltd

- Mitsubishi Chemical Holdings Corporation

These companies are actively working on their innovations in the battery electrolyte market. 3M Co., NEI Corporation, Guangzhou Tinci Materials Technology Co., Ltd, and Mitsubishi Chemical Holdings Corporation are making pivotal changes to make efficient, safe electrolytes for the batteries.

Battery Electrolyte Market Latest Developments:

- January 2026: ProLogium unveiled its "Superfluidized All-Inorganic Solid-State Battery" at CES 2026, featuring a non-flammable superfluidized electrolyte designed to eliminate thermal runaway risks in EVs and humanoid robots.

- December 2025: Enchem signed a five-year, 1.5 trillion KRW contract with CATL to supply 350,000 tons of electrolyte between 2026 and 2030, marking the largest order in the company's history.

- December 2025: Mitsubishi Chemical Group reached an agreement to transfer its lithium-ion battery electrolyte manufacturing assets in the U.S. and UK to Green E Origin SARL, effective March 31, 2026.

- November 2025: Asahi Kasei licensed its novel acetonitrile-containing electrolyte technology to EAS Batteries, enabling the scheduled March 2026 launch of an ultra-high-power LFP cell with 60% higher specific power.

- February 2025: UBE Corporation commenced construction of its first large-scale U.S. facility in Louisiana, targeting a July 2026 completion to produce 140,000 tons of DMC and EMC electrolyte solvents annually.

Battery Electrolyte Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Battery Electrolyte Market Size in 2025 | US$8.369 billion |

| Battery Electrolyte Market Size in 2030 | US$15.302 billion |

| Growth Rate | CAGR of 12.83% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Battery Electrolyte Market |

|

| Customization Scope | Free report customization with purchase |

Battery Electrolyte Market Segmentation:

- By Type

- Lead Acid

- Lithium-ion

- Others

- By Chemistry Type

- Solid Electrolyte

- Liquid Electrolyte

- By End-User Industry

- Automotive

- Energy & Utilities

- Consumer Electronics

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others

- North America