Report Overview

UAE Corporate Wellness Market Highlights

UAE Corporate Wellness Market Size:

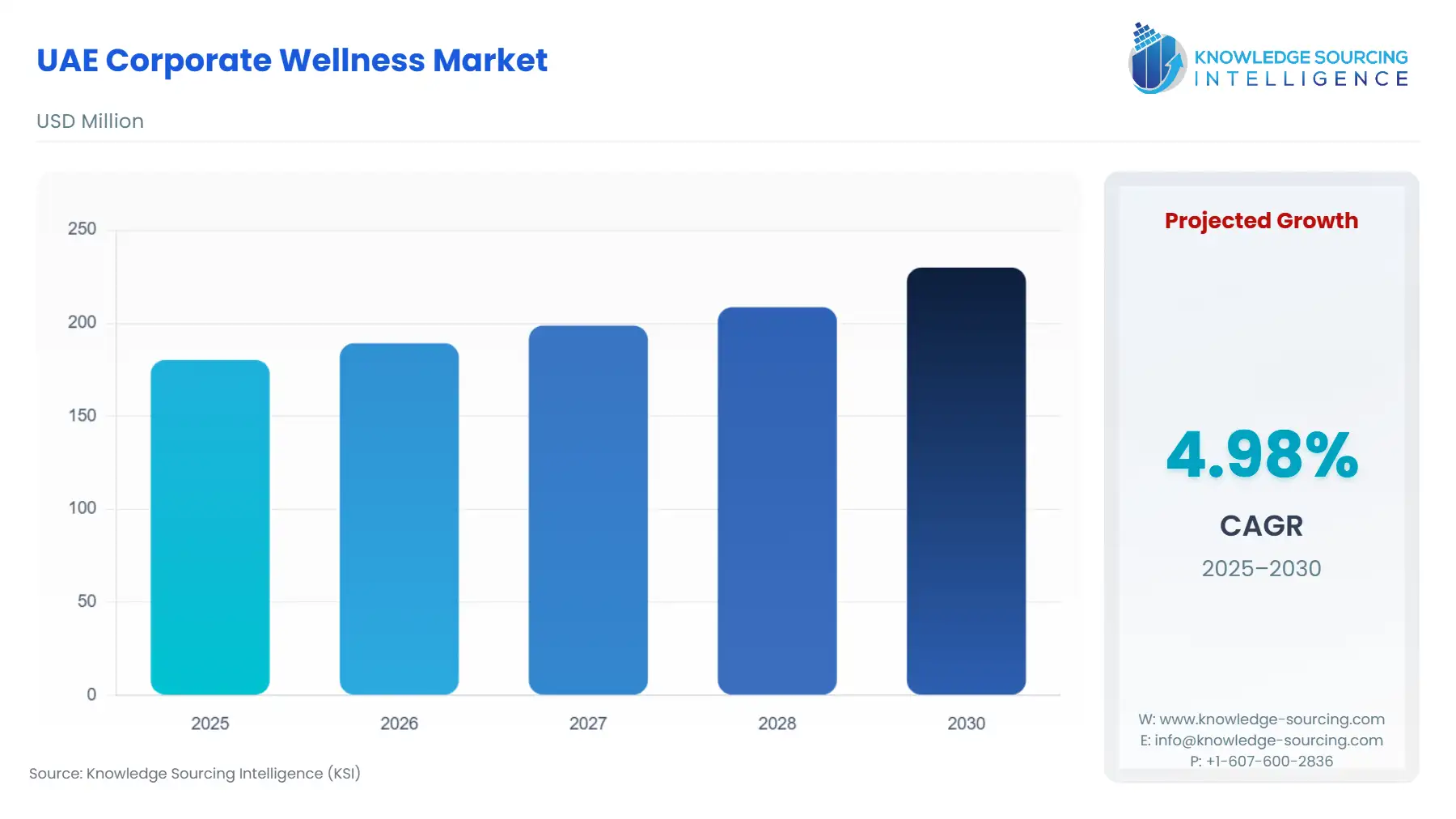

The UAE Corporate Wellness market is forecast to grow at a CAGR of 5.0%, reaching USD 241.5 million in 2031 from USD 189.2 million in 2026.

Corporate wellness has gained significance in the UAE, with companies recognizing the pivotal link between employee well-being and success. Numerous UAE businesses are now embracing comprehensive wellness programs that encompass physical fitness, mental health support, and holistic well-being initiatives. These endeavors prioritize fostering a harmonious work-life equilibrium and commonly include offerings like fitness facilities, stress management workshops, mindfulness sessions, and health evaluations. Also, female participation in the labor force population in the United Arab Emirates is increasing presently. For instance, the labor force participation rate for females in 2019 was 54%, and in 2021 it increased to 55%.

In the fiercely competitive corporate sector of the UAE, such wellness programs not only serve as magnets for top talent but also bolster employee engagement, effectiveness, and overall job contentment. Work-related stress is frequently increasing in the country, which is raising the need for corporate wellness programs. For instance, according to the American Institute of Stress, 40% of employees in Dubai say that their jobs are highly stressful and cause diseases like high blood pressure, insomnia, headaches, anxiety, and depression. Such initiatives for employees are expected to contribute to the long-term viability of employees in the organization.

UAE Corporate Wellness Market Growth Drivers:

Increasing demand for corporate wellness services among employees.

The demand for corporate wellness among employees is increasing as corporate employees are demanding vacations to de-stress their minds from daily work. The increasing demand for work-life balance in the country is also one of the reasons fueling the market for corporate wellness in the country. Additionally, long hours put in by employees at work are leading to increasing obesity in the population. For instance, according to the International Diabetes Federation, 8,057,100 people in the United Arab Emirates are suffering from diabetes is 12.3% of adults in the country be suffering from this disease in 2021. Hence, to get relief from daily stress, people need to cooperate in wellness.

According to the International Diabetes Federation (IDF), the number of people suffering from diabetes in 2021 was 990.9 per 1000. In the coming years, it is expected to increase. Hence, people aged 20-79 years are rapidly experiencing diseases such as obesity, diabetes, and mental stress in the country. Therefore, these reasons are expected to increase the market for UAE corporate wellness in the projected period.

Growing need for stress management

Corporate wellness initiatives are in greater demand as they improve workers' general health and happiness. Additionally, by implementing a corporate wellness program, employers indirectly support a healthy workplace and help reduce the stress of employees, which improves the standing of their companies. Further, the UAE government frequently implements new initiatives to treat mental health concerns and lessen the stigma surrounding them. By providing employees with access to mental health treatments and assistance as needed, it has developed several projects for expatriates and Emiratis.

Additionally, according to the National Library of Medicine, in the Arab region, only 39.5% of hospitals have a formalized wellness program. For hospital employees, mental health services were offered to 20.9% of the employees, and stress management to 23.3% of the healthcare employees.

Several companies in the region provide services for stress management. For instance, Indus Health Plus offers stress management workshops. Corporate wellness programs assist employees in building trust in the company and working in a healthier atmosphere by offering workshops on managing stress and mental health, yoga, aerobics, and other activities.

Additionally, the American wellness center offers stress management services to people in Dubai. The business evaluates both psychological and physical symptoms that could result from a major occurrence and then develops treatment suggestions, offers counseling, and teaches the employee and his team personal skills like coping mechanisms. Further, in October 2021, the Theqa initiative was introduced by Emirates Health Services (EHS) to assist healthcare professionals (HCPs) who have experienced trauma as a result of their involvement in an unplanned bad patient occurrence. This is a component of the EHS's strategy to enhance workplace well-being, raise awareness of the value of psychological and mental health, and provide a work environment where workers feel empowered to advance their intellectual, physical, and psychological well-being.

Additionally, in November 2022, the first genuinely comprehensive health and employee engagement platform for the Middle East, essentially UAE and Saudi Arabia, called VIWELL, was unveiled at HRSE KSA, the premier HR Summit and Expo for the region.

Rising healthcare costs

The UAE, with a highly developed healthcare system, has one of the most expensive healthcare systems in the world. The cost burden affects individuals as well as businesses. Public commitment towards the healthcare sector remains an important growth stimulant within the UAE healthcare market as such public expenditure accounts for over two-thirds of total health spending. In the 2022 federal budget, it is estimated that 8.4% is allocated towards health care of the overall USD 15.8 billion (AED 58.931 billion) provided towards public spending. While this does not constitute total government expenditure in the UAE, it remains a good indicator of the fiscal stance of the UAE.

By investing in the well-being of employees, various companies might be able to reduce healthcare costs in the long run. Wellness programs help employees engage in healthy habits like regular exercise, healthy diets, and stress management. These programs can considerably reduce the risk of chronic diseases, lower absenteeism rates, and improve general employee productivity. Companies can prevent costly medical treatments and insurance claims by preventing health issues and promoting early intervention.

Additionally, wellness initiatives can boost employee morale and job satisfaction. When one feels valued and supported in the workplace, they get motivated and are more efficient. This healthy impact on the well-being of employees can generate higher job performance, diminished turnover, and a generally healthier company culture.

UAE Corporate Wellness Market Key Developments:

Oct 2025: Healthy Minds Club, a mental-wellbeing platform for individuals and organizations, officially launched in the UAE to build corporate mental resilience.

July – Sep 2025: Dubai’s “Our Flexible Summer” initiative implements reduced working hours for government employees to boost work-life balance—two schedule options offered.

Jan 2025: The UAE mandatory health insurance scheme was extended to cover all private-sector workers across all emirates, raising the baseline for employer-driven wellness strategy.

UAE Corporate Wellness Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

UAE Corporate Wellness Market Size in 2025 | US$180.269 million |

UAE Corporate Wellness Market Size in 2030 | US$229.883 million |

Growth Rate | CAGR of 4.98% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

List of Major Companies in UAE Corporate Wellness Market |

|

Customization Scope | Free report customization with purchase |

UAE Corporate Wellness Market Segmentation:

By Type

Weight Management & Fitness

Smoking Cessation

Stress Management

Others

By Enterprise Size

Small

Medium

Large