Report Overview

UK Canned Pea Market Size:

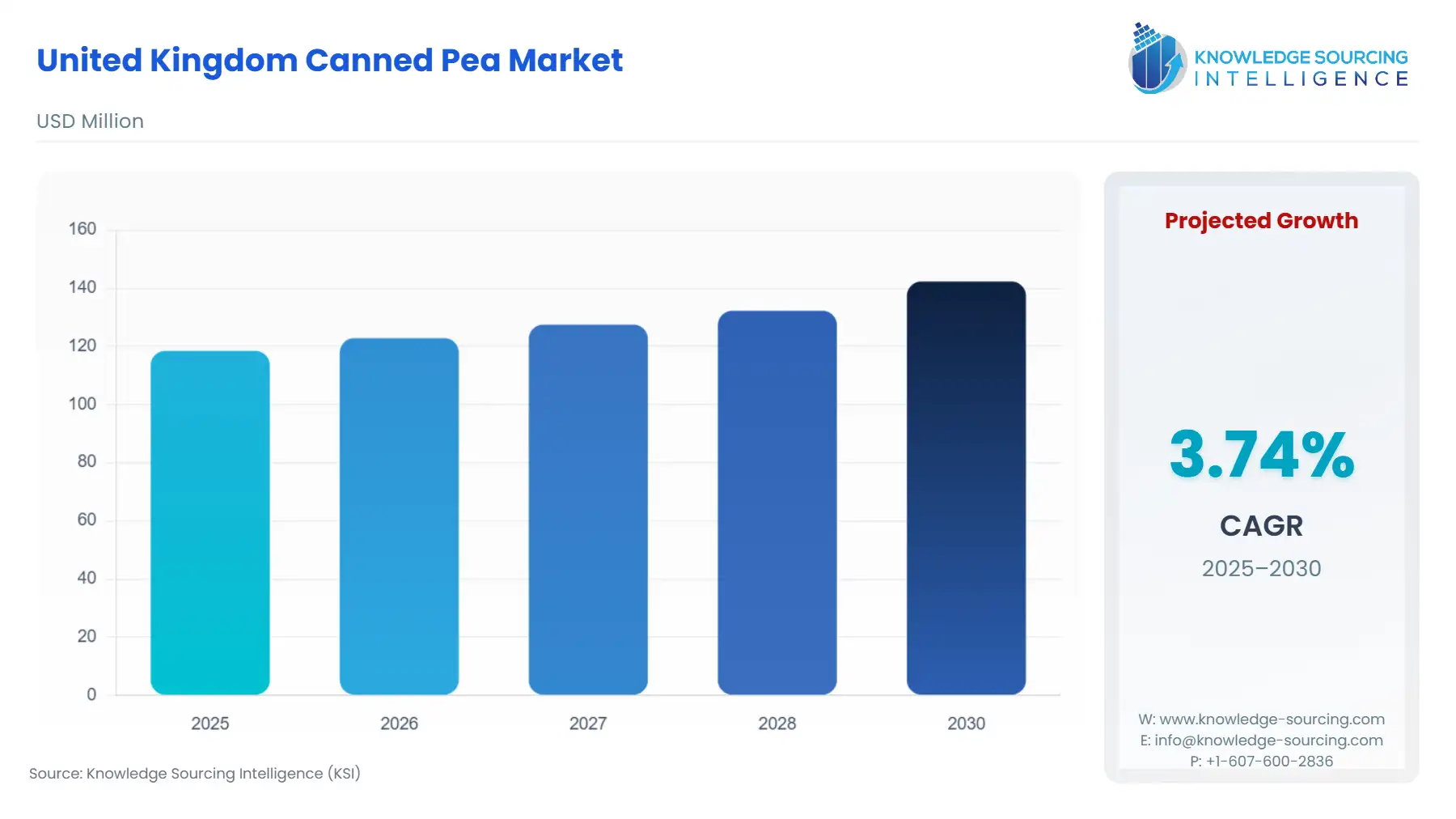

The UK canned pea market is estimated to attain a market size of USD 142.341 million by 2030, growing at a 3.74% CAGR from a valuation of USD 118.472 million in 2025.

The market is forecast to grow as canned peas are offered at comparatively low price when contrasted with fresh or frozen alternatives, especially during economic hard times such as the cost-of-living crisis in the country. In October 2022, the survey done by Princes Group in collaboration with KICR reported that about 31 percent of British consumers planned to step up their purchases of canned goods because of their affordability and long shelf life Additionally, high inflation acts well for canned products in comparison to other grocery sectors like fresh products, and is expected to contribute to propelling the demand for canned pea in the UK.

UK Canned Pea Market Overview & Scope

The UK canned pea market is segmented by:

- Product Type: The UK canned pea market is segmented by product type into sweet peas, mushy peas, and others. The sweet pea category is forecasted to attain a greater market share. Rising health awareness and the shift towards plant-based diets have further supported market growth, with canned sweet peas offering a nutritious, affordable, and easy-to-store protein and fiber source.

- Distribution Channel: By distribution channel, the UK canned pea market has been segmented into offline and online. The offline channel is further divided into supermarkets/ hypermarkets and grocery stores. The online category of the distribution channel segment is projected to grow at a faster rate owing to the growth in e-commerce across the region.

- End User: By end-user, the UK canned pea market has been segmented into household, food service, and others. The household segment is expected to have a significant market share. The growing demand for convenient and long-shelf-life food options has driven the need for canned vegetables including pea thereby positively impacting the canned pea demand in the United Kingdom.

- Region: By region, the UK canned pea market has been segmented into England, Scotland, Wales, and Northern Ireland. England region is expected to hold a significant market share. This is fuelled by an increase in urban population, which drives the rising demand for convenience foods, which is expected to promote the market growth. Moreover, the rise in health awareness and the expansion of retail options in the country are also promoting the market growth.

Top Trends Shaping the UK Canned Pea Market:

- Rise in Plant based Food Product Demand

There is a rising boost for plant-based items, inclusive of canned peas, due to the growing popularity of vegan and flexitarian food choices in the UK. The clean-label trend supporting foods that are natural and minimally processed lends additional push to pea products, the growth of which has been witnessed due to the demand for pea starch and pea protein.

UK Canned Pea Market Growth Drivers vs. Challenges:

Drivers:

- Growing Population and Rising Demand for Convenience Foods: A rise in population in the country is expected to boost the overall food requirement, especially which are affordable, easy to prepare, and have a longer shelf life, such as canned peas, which is a popular food product in the country. The rise in busy lifestyles among UK consumers is growing the necessity for ready-to-use food products, which leads to growing demand for canned peas as they demand minimal preparation time and are an ideal food product for quick meal options.

The UK’s convenience food demand is growing, especially among younger age groups such as Gen Z and millennials, who rate convenience and minimal prep as a top priority when choosing food products. Canned peas are a direct beneficiary of this trend, as there is no washing, shelling, and long cooking time involved in their preparation; they can be just heated and ready to consume, which is rising in demand for busy consumers and working families in the country.

Additionally, according to the World Health Organization (WHO) data, the population in the United Kingdom was reported as 68.682 million in 2023, which is predicted to rise to 72.4 million by 2034. Further, it is estimated to increase by 9.9 percent to 75.505 million by 2050 from 2023 data.

A similar trend was reported by the UK Office for National Statistics, which stated that by mid-2036, the population in the country will be about 73.7 million. Moreover, the increase in population will also lead to a rise in demand for retail stores expansion, which are a major distributing channel for canned peas in the country, which will promote the market growth.

- Expansion of Online Distribution Channel: The online distribution is witnessing steady growth, driven by changing consumer purchasing habits and the convenience offered by e-commerce platforms. As more consumers turn to online grocery shopping for its ease, variety, and time-saving benefits, retailers have expanded their digital presence to cater to this demand. The availability of canned peas through major online supermarkets and delivery services has improved accessibility, especially for customers in urban areas and those seeking bulk purchases.

Additionally, the rise in health-conscious and plant-based consumers has prompted online retailers to highlight the nutritional benefits and versatility of canned peas through targeted marketing. Likewise growing digital footprint is expected to support continued expansion of the canned pea market in UK by offering consumers reliable way to purchase pantry staples like canned peas.

According to Ofcom’s “Connected Nations UK Report 2024”, full-fibre network coverage in the UK is expanding rapidly, now reaching 69% of households—equivalent to 20.7 million out of the country’s 30.1 million homes. This marks a 12-percentage point increase, or an additional 3.6 million premises, between September 2023 and July 2024. Urban areas continue to lead in adoption, with 71% of residential premises having access to full-fibre, compared to 52% in rural areas, highlighting an ongoing disparity in connectivity between densely and sparsely populated regions.

The growth in e-commerce reflects a broader consumer shift towards online grocery shopping and in the UK, this trend has led to increased online sales of canned vegetables, including peas, as consumers seek convenient, shelf-stable food options that can be easily ordered and delivered. Retailers are expanding their digital platforms to meet this demand, making canned peas more accessible to a wider audience.

Furthermore, the positive value performance of canned food has been significantly influenced by price inflation. While food prices in the UK continue to rise, the rate of inflation is gradually easing. As per Office for National Statistics, in January 2024, year-on-year food prices rose by 7%, a slight decline from the 8% increase recorded in December 2023. This slowdown suggests a potential easing of cost pressures, which may impact the value growth of canned food in the coming months.

Challenges:

- Price Volatility and Alternatives: The price volatility in the country is witnessed due to dependence of pea on the weather, along with import reliance coupled with other economic attributes such as exchange rates and regulations. Additionally, the alternatives for canned pea like fresh pea and other vegetables which have similar health benefit can also limit its growth in the country.

UK Canned Pea Market Competitive Landscape:

The market is fragmented, with many notable players, including B&G Foods, Del Monte Foods Corporation II Inc, Kraft Heinz, Inc, Valeo Foods, Tesco.com, Princes Group, and Kiril Mischeff, among others.

- B&G Foods, Inc.: B&G Foods, Inc., is a branded foods holding company located in New Jersey, USA. The company sells a wide range of canned vegetables, including peas, with an emphasis on quality and sustainability that appeals to health-conscious consumers. The company has a major canned pea brand under it, which is the Green Giant brand, which has a global presence included including the United Kingdom. Green Giant's canned peas are mostly sweet peas, harvested at their peak ripeness and canned to preserve flavor and nutrients. They focus on sustainability with recyclable material packaging coupled with the use of non-BPA cans.

UK Canned Pea Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| United Kingdom Canned Pea Market Size in 2025 | US$118.472 million |

| United Kingdom Canned Pea Market Size in 2030 | US$142.341 million |

| Growth Rate | CAGR of 3.74% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | England, Scotland, Wales, Northern Ireland |

| List of Major Companies in the United Kingdom Canned Pea Market |

|

| Customization Scope | Free report customization with purchase |

UK Canned Pea Market Segmentation:

By Product Type

By Distribution Channel

- Offline

- Supermarkets/Hypermarkets

- Grocery Stores

- Online

By End User

- Household

- Food Service

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland