Report Overview

US Additive Manufacturing Market Highlights

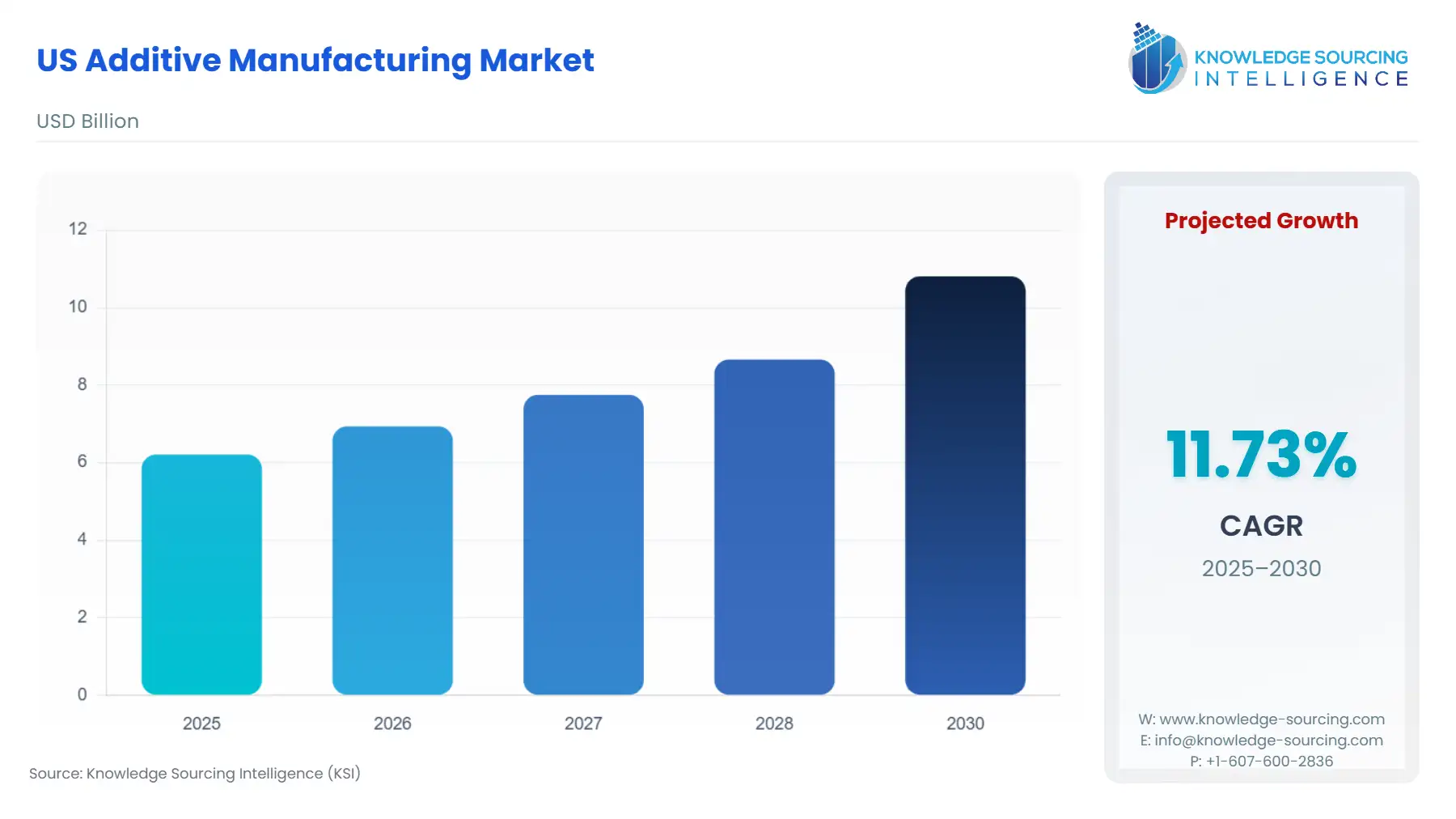

US Additive Manufacturing Market Size:

The US Additive Manufacturing Market is anticipated to rise at a CAGR of 11.73%, achieving USD 10.811 billion in 2030 from USD 6.209 billion in 2025.

The US Additive Manufacturing (AM) market is transitioning from a prototyping-centric industry to one increasingly focused on serial production of end-use parts, underpinned by an aggressive push toward supply chain resilience. This evolution is structurally supported by federal policy aimed at national defense modernization and re-shoring of critical manufacturing capacity. The market dynamics reflect a complex interplay between mature polymer-based technologies serving design and tooling applications and high-growth metal AM segments penetrating mission-critical domains such as aerospace and medical devices. The core challenge for industry participants remains the industrialization of AM processes, necessitating a focused effort on material science, quality control, and the development of a technically proficient workforce capable of managing the specialized digital thread required for AM operations.

US Additive Manufacturing Market Analysis

- Growth Drivers

The primary growth catalyst is the national defense modernization imperative. The Department of Defense’s (DoD) Additive Manufacturing Strategy explicitly seeks to leverage AM's capacity for rapid iteration and decentralized production to enhance material readiness and reduce dependence on long, fragile supply chains for obsolete hardware. This strategic requirement directly increases demand for metal AM hardware, specialized materials, and engineering services necessary to qualify parts for deployment on platforms ranging from submarines to aerospace systems.

A second critical driver is the need for personalized medical devices. The successful regulatory qualification of 3D-printed orthopedic and dental components by the FDA, often in alignment with ISO-specific standards, validates the technology for high-value serial production. This process minimizes qualification risk for medical device OEMs, creating direct, verifiable demand for metal powder bed fusion systems and biocompatible materials like titanium alloys for patient-specific implants.

- Challenges and Opportunities

The market faces significant capital expenditure constraints. The industrial-grade AM systems required for high-throughput, quality-controlled production necessitate substantial upfront investment, which acts as a major barrier to adoption for small and medium-sized US manufacturers. This restraint suppresses broader market expansion despite the potential for superior geometric complexity and part consolidation.

The main opportunity lies in accelerated standards development and professional training. The lack of universally accepted industry-wide guidelines for part-to-part consistency, material performance data, and non-destructive testing methodology for additively-manufactured components is a persistent hurdle. Organizations like the National Institute of Standards and Technology (NIST) and America Makes are actively working to establish these standards. Successful standardization will dramatically reduce the qualification costs and time associated with new parts, directly stimulating demand by lowering the adoption risk for end-users in regulated industries like aerospace and defense.

- Raw Material and Pricing Analysis

Additive manufacturing equipment is a physical product; thus, a raw material analysis is critical. The supply chain for AM is fundamentally bifurcated into metal and polymer powders. Metal powder price volatility, particularly for high-performance alloys like Nickel (Ni) alloys (e.g., Inconel) and titanium, presents a pricing headwind. These materials are complex to produce to the precise spheroidicity and particle size distribution required for laser and electron beam powder bed fusion processes. The high cost of feedstock, and the need for rigorous quality control to mitigate contamination, keep the cost-per-part high and reduce the demand for true mass production applications. Companies are investing in closed-loop powder recycling systems to mitigate material consumption and offset these price swings.

- Supply Chain Analysis

The AM supply chain is less reliant on global production hubs for finished parts than traditional manufacturing, but it maintains a dependency on a global network for specialized components. Key dependencies include the global supply of specialized high-power lasers, optics, and complex electromechanical motion control systems used in AM hardware, which often originate from Europe and Asia. Logistical complexity in the US is centered on securing the "digital thread," ensuring that digital design files and process parameters—the true 'product' of AM—are securely transmitted, controlled, and versioned across the supply chain, especially within the highly regulated defense industrial base.

US Additive Manufacturing Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

US Federal |

DoD Additive Manufacturing Strategy (2021) |

Mandates the integration of AM into sustainment and acquisition, creating a direct, long-term requirement for qualified AM hardware, materials, and services, specifically for on-demand spare part production. |

|

US Federal |

CMMC / DFARS 252.204-7012 |

Requires defense contractors to implement strict security controls (e.g., FedRAMP Moderate) for managing Controlled Unclassified Information (CUI). This significantly increases demand for AM software solutions that provide secure, compliant digital thread management. |

|

US Federal |

FDA (Food and Drug Administration) |

Establishes regulatory pathways for 3D-printed medical devices (e.g., implants and surgical guides), which, when aligned with ISO standards, validate AM for high-reliability medical production, spurring demand in the Healthcare sector. |

US Additive Manufacturing Market Segment Analysis:

- By Technology: Selective Laser Sintering (SLS)

SLS technology, predominantly a polymer powder bed fusion process, is driven by its ability to produce highly complex, durable, end-use parts without the need for intricate support structures. This capability makes it an efficient solution for rapid tooling, jigs, and fixtures in the automotive and general industrial sectors. The high packing density within the build chamber allows manufacturers to consolidate numerous unique parts into a single build job, substantially reducing labor and machine time per part. This operational efficiency directly propels demand from companies seeking to replace expensive, long-lead-time injection molding tools and low-volume production runs. The increasing availability of high-performance polymer materials, such as Nylon 12 and its composites, further solidifies SLS's role as a cost-effective alternative to injection molding for volumes in the tens of thousands, directly increasing its market adoption.

- By End-User Industry: Aerospace & Defense

The Aerospace and Defense sector is the most resource-intensive end-user segment due to the critical need for lightweighting, part consolidation, and supply chain surety. Air Force and Navy programs are actively qualifying additively-manufactured metal parts—such as turbine components, heat exchangers, and airframe structures—to reduce the weight of flight-critical systems, which directly translates to fuel efficiency gains and expanded mission range. Furthermore, AM’s capability to print obsolete components on-demand directly addresses the diminishing manufacturing sources and material shortages (DMSMS) challenges plaguing legacy platforms. This mandates the purchase of high-end metal AM systems (e.g., Electron Beam Melting and Direct Metal Laser Sintering) and the associated qualification services, creating a sustained, high-value demand signal regardless of broader economic fluctuations.

US Additive Manufacturing Market Competitive Analysis:

The US AM market is a competitive landscape dominated by established players that offer full-stack solutions, encompassing hardware, materials, and software. Competition is intense in both the mature polymer segment and the high-growth industrial metal sector, with firms distinguishing themselves through material science advancements and application-specific qualifications.

- 3D Systems Corporation: The company maintains a strong strategic position through its diversified portfolio, particularly its focus on the high-margin Healthcare sector. In 2024, 3D Systems announced the availability of new materials, including DuraForm PA12 Black and DuraForm TPU 90A, and new production platforms like the PSLA 270 full solution. This focus on launching a broader range of high-performance materials and integrated hardware/software/post-processing systems aims to accelerate customers' ability to move from prototyping to true serial production, thereby capturing more recurring material and service revenue.

- Stratasys: Stratasys holds a dominant position in the polymer AM segment, leveraging its proprietary Fused Deposition Modeling (FDM) and PolyJet technologies. The firm's strategy is centered on vertical market penetration through purpose-built systems. For instance, the J5 Digital Anatomy 3D printer, unveiled in 2024, directly targets the medical market with realistic, patient-specific anatomical models for pre-operative planning. This product launch directly addresses the demand for point-of-care manufacturing within hospitals and research institutions, emphasizing ease of use and a compact footprint to expand the user base beyond central service bureaus.

US Additive Manufacturing Market Developments

- June 2024: Stratasys announced the launch of its J5 Digital Anatomy 3D printer at RAPID + TCT 2024. This new system is specifically engineered for the medical market, offering high-fidelity, multi-material anatomical models and targeting hospitals and medical device manufacturers to improve surgical planning and training.

- November 2024: 3D Systems introduced a suite of new products and materials at Formnext 2024. Key launches included the PSLA 270 full solution, which integrates post-processing equipment (Wash 400/Wash 400F and Cure 400) with their Stereolithography platform, and a range of new materials for its polymer portfolio, including DuraForm PA CF and DuraForm FR 106.

- November 2024: 3D Systems announced the availability of a variety of new polymer materials for its Selective Laser Sintering (SLS) platform, including DuraForm PA12 Black and DuraForm TPU 90A. These materials expand the application space for end-use, functional parts across the automotive and consumer goods sectors.

US Additive Manufacturing Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 6.209 billion |

| Total Market Size in 2031 | USD 10.811 billion |

| Growth Rate | 11.73% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Technology, End-Use Industry |

| Companies |

|

US Additive Manufacturing Market Segmentation:

- BY COMPONENT

- Hardware

- Software

- Services

- Material

- BY TECHNOLOGY

- Selective Laser Sintering (SLS)

- Laser Sintering (LS)

- Electron Beam Melting (EBM)

- Fused Disposition Modelling (FDM)

- Stereolithography (SLA)

- BY END-USER INDUSTRY

- Aerospace & Defense

- Healthcare

- Automotive

- Construction

- Consumer

- Others