Report Overview

US AI in Weather Highlights

US AI in Weather Prediction Market Size:

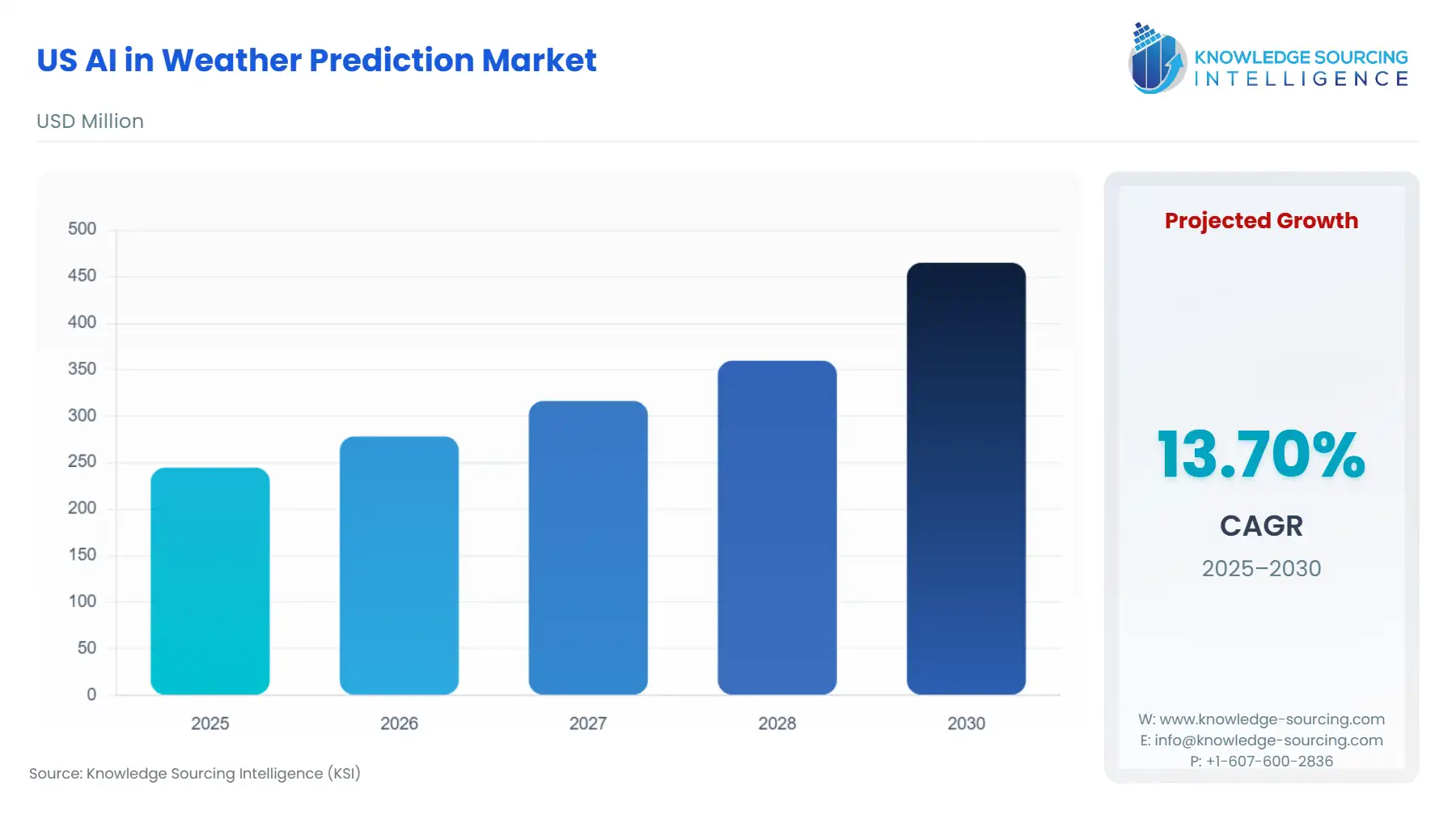

The US AI in Weather Prediction Market is expected to grow at a CAGR of 13.70%, reaching USD 464.943 million in 2030 from USD 244.707 million in 2025.

The US AI in Weather Prediction market is transitioning from a nascent technology concept to a mission-critical operational imperative across various weather-sensitive economic sectors. The fundamental shift is driven by the acknowledged limitations of traditional Numerical Weather Prediction (NWP) models in delivering the high-resolution, low-latency, and probabilistic forecasts necessary to manage modern climate volatility. The integration of advanced Machine Learning (ML) and Deep Learning (DL) methodologies enables the processing of petabyte-scale, multi-source atmospheric data from ground sensors, radar, and growing commercial satellite constellations.

US AI in Weather Prediction Market Analysis:

Growth Drivers

The escalating financial consequences of weather-related disruptions directly fuel demand for AI solutions. The increasing frequency of high-impact weather events necessitates advanced tools capable of generating extended-lead-time, probabilistic forecasts. This environment compels industries like insurance, agriculture, and defense to procure sophisticated AI models that enable preemptive risk mitigation and resource allocation. Furthermore, the commercial availability of proprietary, high-resolution atmospheric data from space-based platforms is a key catalyst. This new data stream is essential for training cutting-edge Deep Learning models, enabling vendors to deliver previously unachievable forecast accuracy and granularity, thereby stimulating immediate demand from end-users seeking a competitive operational advantage.

Challenges and Opportunities

A primary constraint on market growth is the prevailing skepticism regarding AI model explainability and performance in novel, high-stakes weather scenarios, which inhibits broad adoption by risk-averse end-users like government agencies. However, this challenge simultaneously creates a crucial opportunity. The market is increasingly demanding hybrid solutions that integrate the interpretability of traditional physics-based models with the speed and accuracy of AI. Developing highly robust, validated models with transparent uncertainty quantification represents a significant competitive opportunity to capture demand, especially within the regulatory-intensive Aviation and Government sectors. Another opportunity lies in extending AI capabilities into the sub-seasonal to seasonal (S2S) forecasting domain, providing long-range, actionable climate risk intelligence.

Supply Chain Analysis

The US AI in Weather Prediction market supply chain is entirely digital and relies on three core components: data acquisition, cloud computing infrastructure, and algorithmic development expertise. Data acquisition, the initial dependency, is complex, sourcing from publicly-funded systems (e.g., NOAA satellites, ground radar) and proprietary commercial constellations (e.g., Spire Global, Tomorrow.io). Logistical complexity centers not on physical transport, but on high-speed, low-latency data transmission and assimilation across hybrid cloud environments. The final key dependency is on a highly specialized, globally limited talent pool of atmospheric scientists, data engineers, and machine learning specialists. Key production hubs are concentrated in US technology clusters, particularly in the Boston and Silicon Valley areas, which possess the necessary computational resources and human capital to develop and scale these intensive Deep Learning models.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| United States | National Oceanic and Atmospheric Administration (NOAA) / Weather Act | NOAA's explicit mandate to advance the state of weather forecasting, combined with public-private partnership initiatives like the Earth Prediction Innovation Center (EPIC), creates a stable, high-demand procurement channel for validated AI and ML capabilities. It standardizes data formats and encourages competition. |

| United States | Federal Aviation Administration (FAA) / Advisory Circulars and Safety Standards | The FAA's stringent safety requirements for weather data used in flight-critical operations mandates rigorous verification and validation (V&V) of all predictive models. This constraint raises the barrier to entry for AI vendors but drives demand for highly assured, provably reliable AI-enhanced systems. |

| United States | Department of Energy (DOE) / Grid Modernization Initiative | The DOE's focus on grid resilience against extreme weather events, particularly for renewable energy integration, drives direct demand from energy utilities for AI systems. These solutions optimize load forecasting and renewable asset output prediction, crucial for grid stability under regulatory scrutiny. |

US AI in Weather Prediction Market Segment Analysis:

By Technology: Deep Learning

The Deep Learning (DL) segment is experiencing a pivotal demand acceleration because these models, unlike traditional Machine Learning (ML) approaches, can directly model the complex, non-linear dynamics of the atmosphere without reliance on a predefined set of atmospheric physics equations. This capability is paramount in solving two critical growth challenges: reducing forecast latency and enhancing spatial resolution. DL models, particularly those based on convolutional and graph neural networks, can process multi-petabyte datasets of satellite imagery and radar returns far faster than legacy NWP models, delivering 'nowcasts' and short-range forecasts in minutes versus hours. This speed directly translates to increased demand from end-users, such as logistics and insurance firms, where a 15-minute increase in lead time for a severe weather event can avert millions in losses, making the DL model's capability an operational imperative. The launch of new commercial remote sensing satellites, like those from Spire Global and Tomorrow.io, provides the unprecedented, proprietary data volumes required to continually train and refine these highly data-intensive DL architectures, establishing a feedback loop that fuels sustained need for the technology.

By End-User: Energy and Utilities

The Energy and Utilities segment is exhibiting a significant demand surge, fundamentally restructuring its operational approach around AI-driven weather intelligence. The drivers are twofold: the imperative for reliable grid management and the rapid integration of intermittent renewable energy sources (wind and solar). Fluctuations in solar irradiance and wind speed directly impact generation capacity, making highly accurate, high-frequency AI forecasts indispensable for resource planning. For example, a utility must precisely forecast the power ramp-up or ramp-down for a solar farm hours in advance to maintain grid stability. AI models, particularly those trained on localized microclimate data and real-time sensor information, are uniquely positioned to provide this accuracy, directly displacing less reliable traditional forecasting methods. Furthermore, the escalating threat of extreme weather—from wildfires to tropical storms—to physical infrastructure compels utilities to use AI-powered models for predictive maintenance, asset hardening, and pre-positioning of crews, creating a consistent, high-value demand for predictive resilience platforms.

US AI in Weather Prediction Market Competitive Environment and Analysis:

The US AI in Weather Prediction market's competitive landscape is defined by the tension between established technology giants leveraging scale and nascent, specialized space-to-cloud companies with proprietary data assets. Competition centers on model performance (accuracy, resolution, and lead time) and the ability to integrate actionable insights directly into enterprise operational workflows.

IBM / The Weather Company

A market incumbent with foundational strength derived from its ownership of The Weather Company's vast historical data archive and brand trust. The company strategically integrates its meteorological data and AI capabilities through the broader IBM watsonx platform, aiming to provide AI-driven, vertical-specific solutions across aviation, energy, and media. This positioning leverages their established enterprise relationship to embed weather intelligence as a core decision-making component within their clients' existing IT infrastructure. The company’s Global High-Resolution Atmospheric Forecasting (GRAF) system demonstrates a commitment to foundational model development.

Tomorrow.io

A highly disruptive competitor, Tomorrow.io’s strategic positioning is predicated on its vertical integration, moving from proprietary data capture to AI-driven insights. They own and operate a constellation of commercial weather satellites, including the recently launched microwave sounders. This unique, proprietary data gives their Resilience Platform a distinct advantage in training Deep Learning models for severe weather and global coverage in areas traditional systems underserve. Their focus on the Resilience Platform as a comprehensive, actionable solution for enterprises and governments positions them as a mission-critical risk mitigation partner rather than just a data provider.

Spire Global

Spire Global leverages a vast, multi-purpose satellite constellation to gather proprietary Radio Occultation (RO) and other atmospheric data. Their strategy emphasizes data-as-a-service, positioning themselves as a foundational data supplier for AI model developers and governments. The company strategically collaborates with key technology players, such as its partnership with NVIDIA, to accelerate the integration of their unique RO data with advanced AI frameworks like NVIDIA Earth-2. This positioning drives demand by providing high-quality, globally consistent atmospheric inputs that are crucial for training superior AI weather models across multiple downstream sectors.

US AI in Weather Prediction Market Recent Developments:

- January 2025: Tomorrow.io announced a significant advancement in its global precipitation forecasting capabilities, integrated into its NextGen platform. The enhancement delivered up to 2.5km resolution with a 5-minute refresh rate globally, and improved forecasting accuracy by an additional 10%, offering up to 30 additional minutes of lead time for extreme weather compared to industry standards. This development, powered by their growing constellation of microwave sounders, increases demand by directly addressing the high-value requirement for enhanced warning time and accuracy in weather-sensitive sectors like insurance and transportation.

- August 2024: Tomorrow.io announced the successful launch of its first two microwave sounder satellites, a crucial step in its constellation expansion. The sounders are designed to provide unprecedented sub-hourly global atmospheric measurements of temperature, humidity, and precipitation. This capacity addition is a critical growth driver, as the proprietary, high-resolution data stream is necessary for training and initializing the next generation of highly accurate, AI-driven weather prediction models, securing a long-term data advantage for the company.

- March 2024: Spire Global announced a collaboration with NVIDIA to integrate Spire's proprietary Radio Occultation (RO) data and data assimilation (DA) capabilities with NVIDIA Earth-2 Cloud APIs. The objective is to leverage AI to accelerate climate and weather predictions, delivering differentiated forecast products that are computationally prohibitive for traditional models. This strategic product enhancement directly increases the utility of Spire's data for customers in energy, commodity trading, and maritime sectors, driving demand for their advanced forecast products with lower latency and extended lead times.

US AI in Weather Prediction Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 244.707 million |

| Total Market Size in 2031 | USD 464.943 million |

| Growth Rate | 13.70% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Services, End-User |

| Companies |

|

US AI in Weather Prediction Market Segmentation:

- BY TECHNOLOGY

- Machine Learning

- Deep Learning

- Others

- BY SERVICES

- Weather Forecasting

- Climate Modeling

- Severe Weather Prediction

- Others

- BY END-USER

- Aviation

- Marine

- Agriculture

- Energy and Utilities

- Transportation and Logistics

- Others