Report Overview

Vegan Food Market - Highlights

Vegan Food Market Size:

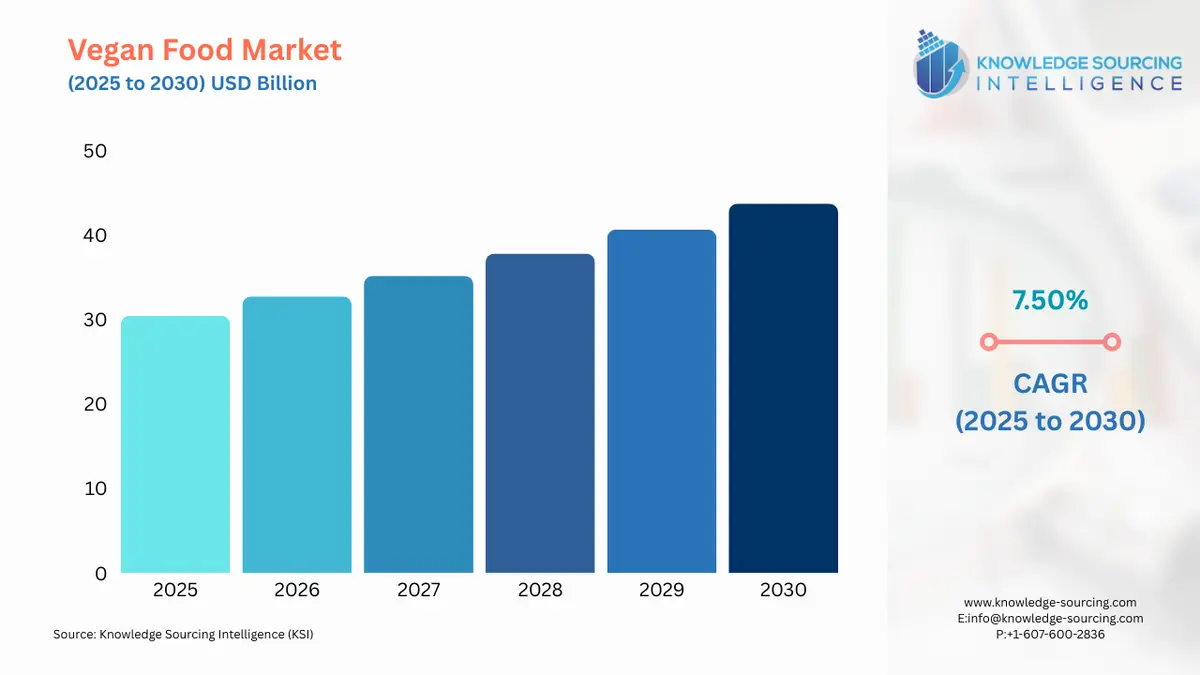

The Vegan Food Market is expected to grow at a CAGR of 7.50%, reaching USD 43.700 billion in 2030 from USD 30.433 billion in 2025.

The vegan food market is experiencing a significant transformation, moving from a niche category to a mainstream component of the global food industry. This evolution is propelled by a confluence of factors, including evolving consumer values, technological advancements in food production, and a more structured regulatory environment. The market's growth trajectory is characterized by a diversification of products beyond traditional soy and tofu, now encompassing sophisticated meat and dairy alternatives that closely mimic their animal-based counterparts.

Vegan Food Market Analysis

- Growth Drivers:

The primary catalysts for the vegan food market's expansion are directly linked to shifts in consumer behavior and consciousness. A heightened awareness of personal health and wellness is a core driver. As public knowledge about the health implications of diets high in red and processed meats increases, consumers are actively seeking alternatives. Vegan products, often perceived as healthier, cholesterol-free, and rich in fiber, directly fulfill this demand. For example, research indicates a growing consumer belief that plant-based foods offer a superior nutritional profile, which in turn motivates purchasing decisions. The demand for plant-based milks and cheeses is a direct response to rising rates of lactose intolerance and a general preference for dairy-free options.

Ethical and environmental considerations also exert a powerful influence on demand. Consumers are increasingly connecting their food choices with animal welfare and climate change. The livestock industry is a significant contributor to greenhouse gas emissions and resource consumption. This awareness has spurred a movement toward sustainable eating, with vegan food products positioned as a viable solution. This trend is not confined to a small group of committed vegans; it is widely embraced by "flexitarians"—individuals who primarily consume a non-vegetarian diet but are actively reducing their meat and dairy intake. The availability of high-quality plant-based meat and dairy alternatives, which replicate the sensory experience of animal products, directly facilitates this transition for flexitarian consumers, thereby expanding the total addressable market.

- Challenges and Opportunities:

The vegan food market faces several significant challenges. A primary obstacle is the perception of taste and texture. Despite considerable technological progress, some consumers still find that vegan products, particularly meat and cheese alternatives, do not fully replicate the taste, mouthfeel, or culinary satisfaction of their animal-based counterparts. This can lead to a negative first-time experience that deters repeat purchases. Another challenge is the price point. Vegan products, especially highly processed alternatives, are often more expensive than their traditional counterparts, creating a barrier to entry for price-sensitive consumers. This cost disparity can be attributed to the specialized ingredients and manufacturing processes required.

Conversely, these challenges present clear growth opportunities. The taste and texture gap represents a major opportunity for innovation. Companies that can develop and commercialize products with improved sensory attributes will capture significant market share. The price issue can be addressed through economies of scale and technological advancements in ingredient sourcing and production. As manufacturing processes become more efficient and the supply chain matures, the cost of production will decline, enabling greater price parity with conventional foods. Furthermore, there is an opportunity to expand market penetration in developing regions where a large portion of the population is already vegetarian. Educating these consumers on the benefits of a fully vegan diet and providing culturally relevant product offerings could unlock immense demand.

- Raw Material and Pricing Analysis:

The supply chain for vegan food is dependent on a diverse array of plant-based raw materials, including soy, peas, wheat, and various nuts and seeds. The prices of these commodities are subject to the same global market forces as other agricultural products, including weather patterns, crop yields, and geopolitical events. For example, fluctuations in the price of soybeans, a key source for many tofu and meat alternative products, directly impact the final product's cost. The Food and Agriculture Organization (FAO) of the United Nations reports monthly changes in the international prices of a basket of food commodities, which includes cereals and vegetable oils. These indices provide a general indicator of the pricing trends for some of the foundational ingredients in the vegan food sector. The industry's reliance on a specific set of raw materials creates a vulnerability to supply shocks, which can be a constraint on pricing stability. Manufacturers mitigate this risk by diversifying their ingredient sourcing and investing in research and development to explore new protein sources like chickpeas, lentils, and fungi, which can offer both supply stability and novel product attributes.

- Supply Chain Analysis:

The global supply chain for vegan food is a complex network spanning raw material sourcing, processing, and distribution. Key production hubs for plant-based protein ingredients are located in agricultural powerhouses such as the United States, Brazil, and China. From these regions, materials like soy and pea protein isolates are transported to manufacturing facilities worldwide. The logistical complexities are heightened by the need for specialized storage and transport, particularly for perishable items like refrigerated meat and dairy alternatives. A significant challenge, especially in developing markets like India, is the underdeveloped cold chain infrastructure. The lack of low-cost, temperature-controlled transportation limits a company's ability to distribute its products widely to smaller retail stores and across different states. This dependency on a robust and reliable cold chain is a critical determinant of market scalability and reach. Furthermore, the supply chain is also dependent on a network of food technology firms that provide specialized ingredients and processing solutions, a dependency that can influence production costs and time-to-market.

Vegan Food Market Government Regulations:

The regulatory landscape for vegan food is still evolving, but key jurisdictions have begun to establish formal guidelines. These regulations are crucial for ensuring consumer trust and preventing mislabeling.

- India: Food Safety and Standards (Vegan Foods) Regulations, 2022 (FSSAI) - This regulation provides a legal definition for "vegan food" and establishes strict labeling and display requirements. It mandates that products must not contain any animal ingredients, including milk, honey, or eggs, and that food business operators must take precautions to prevent cross-contamination. This formalization strengthens consumer confidence, leading to a direct increase in demand by offering a clear, verifiable standard for vegan products.

- European Union: Directive 2011/96/EU (and related guidelines) - The EU has focused on accurate labeling and ingredient transparency. While there is no single, harmonized legal definition for "vegan" across all member states, the framework prohibits misleading claims and requires clear allergen information. This regulatory environment pushes manufacturers to be transparent, which builds consumer trust. It also helps to prevent consumer confusion, thereby supporting a more stable and predictable market for genuine vegan products.

- United States: U.S. Food and Drug Administration (FDA) - The FDA has not yet established a formal definition for "vegan" or "plant-based." The agency regulates specific claims like "high in protein" and "cholesterol-free" and provides guidance on the labeling of plant-based milk alternatives. The lack of a uniform federal standard creates a fragmented market where voluntary third-party certifications (like The Vegan Society's Vegan Trademark) become more important for validating product claims. This reliance on non-governmental bodies demonstrates the market's imperative for a reliable source of verification to maintain demand.

Vegan Food Market Segment Analysis

- By Product: Meat & Seafood Alternatives

The meat and seafood alternatives segment is a primary catalyst for the vegan food market's growth, with demand directly influenced by the quality of product innovation. This segment's demand drivers are distinct from those of traditional vegan products like tofu. Modern consumers are not just seeking a vegetarian option; they are looking for a direct, like-for-like replacement for animal meat. This growth is driven by technological advancements that allow manufacturers to replicate the texture, flavor, and sensory experience of conventional meat products. The use of advanced protein isolation techniques, combined with ingredients like pea and soy protein, enables the creation of products such as burgers, sausages, and chicken nuggets that appeal to flexitarian consumers who are hesitant to give up the taste of meat. The strategic launch of these products in quick-service restaurants and mainstream grocery stores directly increases consumer exposure and trials, which is critical for converting curious consumers into regular purchasers. The ethical and environmental motivations of consumers further propel this segment's demand, as it provides a tangible way for them to reduce their carbon footprint without sacrificing familiar culinary experiences.

- By Distribution Channel: Supermarkets/Hypermarkets

The supermarket and hypermarket channel serves as a critical demand driver for the vegan food market due to its widespread accessibility and product visibility. Unlike specialized health food stores, these large-format retailers place vegan products directly alongside their conventional counterparts, normalizing their presence and making them readily available to the average consumer. This strategy is vital for capturing the flexitarian demographic. The convenience of one-stop shopping drives this growth. Consumers can purchase their preferred vegan milks, cheeses, and meat substitutes during their regular grocery run. Retailers’ strategic decisions to dedicate more shelf space to plant-based products, often in high-traffic sections, significantly increase consumer awareness and encourage impulse purchases. The competitive environment within this channel also fosters innovation, as brands must differentiate themselves through packaging, price, and product quality to stand out on crowded shelves. The success of this distribution channel is directly correlated with its ability to integrate vegan products seamlessly into the mainstream shopping experience, effectively lowering the barrier to entry for new consumers.

Vegan Food Market Regional Analysis

- United States (North America): The United States is a mature market for vegan food, driven by a strong convergence of health-consciousness, environmental concerns, and a well-developed retail infrastructure. The market growth is particularly robust for highly processed meat and dairy alternatives. It benefits from a high degree of product innovation, with startups and established food giants alike launching new products. The widespread availability of vegan options in mainstream supermarkets, chain restaurants, and fast-food outlets directly propels consumer demand. Furthermore, the market is influenced by extensive media coverage and social media trends, which normalize and promote plant-based diets. The presence of a large and affluent consumer base that is willing to pay a premium for products perceived as healthier and more sustainable is a key demand driver.

- Brazil (South America): Brazil's vegan food market is emerging, with demand driven by a growing awareness of health and wellness, particularly in major urban centers. As a country with a strong agricultural base, Brazil possesses a natural advantage in sourcing key raw materials like soybeans and grains. The rise is currently concentrated on dairy alternatives and traditional plant-based foods, but interest in meat substitutes is growing. Challenges remain, including price sensitivity among a large segment of the population and a cultural preference for meat-centric cuisine. However, the expanding middle class and the increasing influence of global health trends are creating a strong foundation for future demand. The key to growth lies in making vegan products more affordable and accessible beyond the major metropolitan areas.

- United Kingdom (Europe): The UK is at the forefront of the vegan food movement in Europe, with demand driven by a high proportion of individuals actively reducing their animal product consumption. The market is highly innovative, with a diverse range of products available across all food categories. The annual "Veganuary" campaign, which encourages people to try a vegan diet in January, has become a significant cultural event that directly stimulates demand and new product trials. The UK's well-established retail sector, with major supermarkets actively marketing their own-brand vegan lines and in-store promotions, is a major demand catalyst. Consumer demand is also influenced by stringent food labeling standards, which provide a high degree of transparency and consumer trust.

- South Africa (Middle East & Africa): South Africa's vegan food market is in its nascent stage, with demand concentrated among a small but growing group of health-conscious and environmentally aware consumers. The growth is primarily focused on whole-foods plant-based diets, though an increasing number of Western-style meat and dairy alternatives are becoming available. The key drivers are health trends, concerns about animal welfare, and the influence of international food trends. However, the market faces significant headwinds, including price sensitivity, limited cold chain infrastructure outside of major cities, and a dominant food culture heavily based on meat. The primary opportunity lies in catering to the urban youth demographic and leveraging a growing interest in sustainable living.

- India (Asia-Pacific): The Indian vegan food market is poised for significant growth, with a unique set of demand drivers. With a large vegetarian population, the market is not about replacing meat but rather providing alternatives for dairy products and expanding the range of plant-based options. The Food Safety and Standards Authority of India (FSSAI) has formalized regulations for vegan foods, which is a major catalyst for consumer trust. This growth is driven by a rising health consciousness, an increase in disposable income in urban areas, and an expanding interest in international food trends. Challenges include a lack of specialized cold chain logistics and a cultural attachment to dairy products like paneer and ghee. The market's success will depend on its ability to produce high-quality, culturally relevant products at an accessible price point.

Vegan Food Market Competitive Landscape

The competitive landscape of the vegan food market is dynamic, featuring a mix of established food and beverage corporations and innovative startups. Major players are expanding their presence through strategic acquisitions and product diversification, while startups leverage new technologies to create novel products.

- Beyond Meat, Inc.: Beyond Meat, Inc. is a prominent player known for its plant-based meat substitutes designed to mimic the taste and texture of conventional beef, pork, and poultry. The company’s strategic positioning is centered on mainstream consumer appeal, placing its products in grocery stores, restaurants, and foodservice channels. This approach targets not only vegans and vegetarians but also the much larger market of flexitarian consumers. The Beyond Burger, a flagship product, is formulated with a combination of pea protein isolate, canola oil, and other plant-based ingredients to replicate the appearance and cooking experience of ground beef. This focus on sensory replication is central to its demand-driven strategy.

- Vitasoy International Holdings Ltd.: Vitasoy International Holdings Ltd. is a major company based in Hong Kong specializing in plant-based beverages and food. The company’s core strategic positioning is to leverage its long-standing brand recognition and deep market penetration in the Asia-Pacific. Its product portfolio includes a range of soy milk, tofu, and other soy-based products. Unlike companies focused on meat alternatives, Vitasoy’s strategy is rooted in traditional plant-based foods that have been a staple in Asian diets for decades. The company’s strong supply chain and distribution network across Asia are key competitive advantages, enabling it to meet the sustained demand for affordable, nutritious, and familiar soy products.

- Danone S.A.: Danone S.A., a global food and beverage giant, has established a significant presence in the vegan market through its portfolio of dairy alternatives under brands like Alpro and Silk. Danone's strategic approach is to enter the market from a position of strength in the dairy sector, leveraging its existing distribution channels and brand recognition. The company’s strategy is focused on offering a wide variety of plant-based milks (almond, soy, oat, coconut), yogurts, and creams to cater to the diverse preferences of consumers seeking dairy-free options. This diversified product line positions Danone to capture different consumer segments and mitigate risks associated with reliance on a single product type.

Vegan Food Market Recent Developments

- August 2025: Arla Foods Ingredients announced it is showcasing protein juice drink solutions for the South American market. This development, sourced from the company's official press releases, indicates a strategic focus on expanding its functional ingredient portfolio in a high-growth region.

- September 2024: The Vegan Society announced that its Vegan Trademark had surpassed 70,000 product registrations across 68 countries. This milestone, reported directly by the organization, highlights the increasing global adoption of formal vegan certification and the growing number of companies seeking to validate their product claims, which in turn boosts consumer confidence and market expansion.

- August 2024: Beyond Leather, a brand specializing in a leather alternative made from apple waste, received The Vegan Society's Vegan Trademark certification. This event, verified through The Vegan Society's press releases, demonstrates a continued focus on material innovation and official certification to enhance consumer trust and product integrity.

Vegan Food Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Vegan Food Market Size in 2025 | USD 30.433 billion |

| Vegan Food Market Size in 2030 | USD 43.700 billion |

| Growth Rate | CAGR of 7.50% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Vegan Food Market |

|

| Customization Scope | Free report customization with purchase |

Vegan Food Market Segmentation:

- By Product Type

- Vegan Dairy

- Milk

- Ice cream

- Yogurt

- Cheese

- Butter

- Others

- Vegan Meat

- Tofu

- Tempeh

- Seitan

- Quorn

- RTC

- Others

- Vegan Eggs

- Vegan Bakery

- Vegan Confectionery

- Other Vegan Foods

- Vegan Dairy

- By Source

- Almond

- Soy

- Oat

- Wheat

- Rice

- Others

- By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Channels

- Others

- By End-User

- Retail

- Food Service

- By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Our Best-Performing Industry Reports:

Navigation:

- Vegan Food Market Size:

- Vegan Food Market Key Highlights:

- Vegan Food Market Analysis

- Vegan Food Market Government Regulations:

- Vegan Food Market Segment Analysis

- Vegan Food Market Regional Analysis

- Vegan Food Market Competitive Landscape

- Vegan Food Market Recent Developments

- Vegan Food Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 18, 2025