Report Overview

Video Editing Software Market Highlights

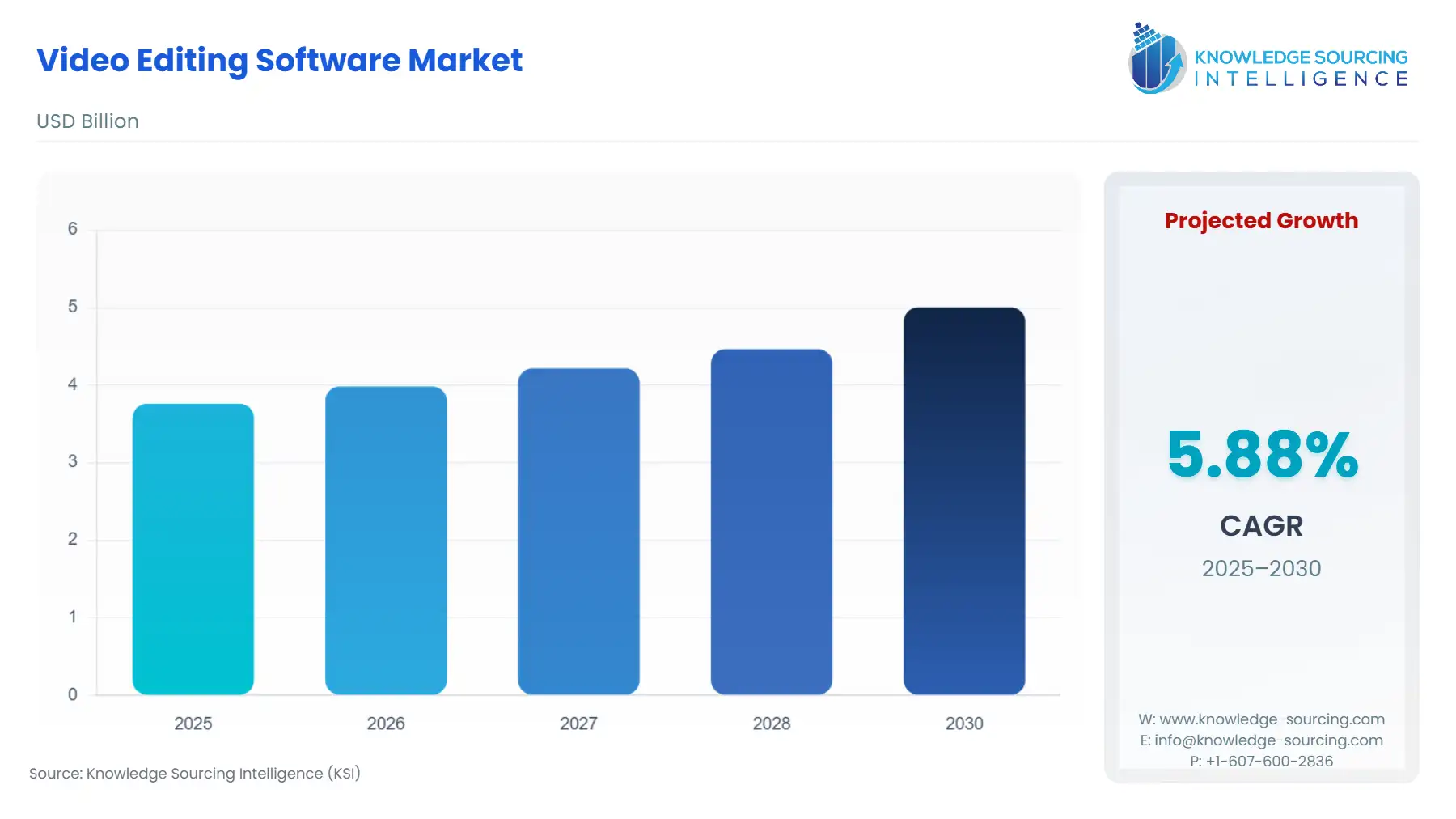

Video Editing Software Market Size:

The Video Editing Software Market is expected to grow from US$3.762 billion in 2025 to US$5.005 billion in 2030, at a CAGR of 5.88%.

The Video Editing Software Market is navigating a profound transformation, moving beyond traditional film and television post-production into a ubiquitously utilized tool across virtually every digital sector. This shift is not merely linear growth but an expansive redefinition of the market's total addressable audience, driven by the monetization of online content, the imperative for businesses to engage through rich media, and the emergence of creator-driven economies. Software providers must respond to the dual demands of professional-grade features—specifically in high-fidelity 4K and 8K workflows—and the need for intuitive, accelerated editing processes tailored for rapid content deployment across social and digital platforms. The convergence of cloud infrastructure and generative AI is now reshaping the competitive dynamics, prioritizing platforms that can embed intelligent automation into the core editing experience.

Video Editing Software Market Growth Drivers:

- The dramatic surge in demand for video editing software is principally propelled by the massive commercialization of online short-form content. Platforms prioritizing video, such as TikTok and Instagram Reels, require businesses and individual creators to publish content with high frequency and professional polish. This necessity directly elevates demand for software featuring template-based workflows, automated reformatting for varying aspect ratios, and mobile compatibility, enabling rapid production and deployment. Concurrently, the integration of generative AI features, which automate time-consuming tasks like object removal or clip extension, drastically reduces labor hours, making advanced video production scalable and thereby increasing the purchase imperative for professional editing suites.

Challenges and Opportunities:

- The primary market challenge is the rapid commoditization of entry-level editing tools, which risks eroding the pricing power for basic software features. This saturation limits demand growth in the personal segment to feature parity upgrades rather than net new user acquisition. However, this creates a significant opportunity: the need for specialized, high-computational features like 3D video, multi-user collaboration, and complex VFX workflows remains strong. The market opportunity lies in professional solutions that embed proprietary AI models capable of solving high-level post-production pain points, thus commanding a premium and protecting margins against the backdrop of an otherwise competitive landscape.

Supply Chain Analysis:

The video editing software supply chain is fundamentally intangible, focusing on intellectual property and secure digital distribution rather than physical logistics. Key "production hubs" are the R&D centers in regions like the United States and Canada, where core platform architecture and complex algorithms, including proprietary AI models, are developed. Logistical complexity centers on seamless, low-latency, cross-border digital delivery of cloud services and timely software updates to a global user base. The primary dependency is on high-performance cloud infrastructure providers (e.g., Amazon Web Services, Microsoft Azure, Google Cloud) for computational power to run AI-intensive rendering and collaborative cloud-based editing environments.

Video Editing Software Market Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| European Union | General Data Protection Regulation (GDPR) | Increases demand for On-Premises or Cloud-Based solutions that guarantee data residency within the EU borders. Forces vendors to implement granular consent mechanisms and robust data transfer accountability, thereby increasing the development cost and complexity for pan-European cloud offerings. |

| China | Cybersecurity Law, Data Security Law | Creates an absolute demand for highly localized, often partnered, software instances where data storage, processing, and operational control are strictly maintained within the country. This limits the cross-border flow of project files and user metadata, favoring domestic or compliant international providers. |

| United States | Federal Trade Commission (FTC) / State-level Privacy Laws | Imposes compliance overheads on software that handles consumer data, particularly in the personal and small commercial segments. The lack of a single federal standard increases fragmentation, requiring vendors to build flexible data handling protocols into their applications to manage multi-state consumer data requests. |

________________________________________________________________

Video Editing Software Market Segment Analysis:

- By Application: Commercial Segment Analysis

The Commercial application segment represents the market's highest growth and revenue concentration, driven by the mandate for businesses of all sizes to maintain a persistent and high-quality video presence. This segment’s growth is specifically catalyzed by the shift from occasional video production to an always-on content marketing strategy, necessitated by competitive digital advertising. This trend creates demand not just for editing tools, but for integrated video production ecosystems. Commercial users require advanced features such as Frame.io integration for rapid client review and approval cycles, sophisticated team collaboration features for simultaneous project access, and granular user management for enterprise deployment. Critically, the rise of e-commerce video and corporate training content further fuels demand for features that offer brand kit consistency (colors, fonts, logos) and one-click export to multiple e-commerce and internal platforms. The economic driver here is the direct correlation between professional video output and key performance indicators like e-commerce conversion rates and internal training efficiency, making the software a critical operational investment rather than a discretionary creative tool.

- By Type: Cloud-Based Segment Analysis

The Cloud-Based segment exhibits the most dynamic growth, primarily due to its ability to democratize access to high-end editing power and facilitate remote, real-time collaboration. The core growth driver is the move away from capital expenditure on high-specification workstation hardware to a flexible operational expense model. For small-to-medium enterprises and global post-production houses alike, Cloud-Based solutions enable instant project scaling without hardware provisioning delays. This model supports global, distributed teams, a necessity accelerated by recent shifts in work-from-home policy. Cloud-Based platforms specifically increase demand for features like automated backup, version control, and instant preview sharing. Furthermore, the cloud architecture is essential for deploying computationally intensive AI-powered features, as the heavy-lifting of rendering and machine learning model execution is offloaded from the local machine to the server farm, increasing demand for software that is intrinsically tied to a high-capacity cloud environment.

________________________________________________________________

Video Editing Software Market Geographical Analysis

- United States Market Analysis (North America)

The US market is the global leader in demand, characterized by a massive independent creator economy and the headquarters of major media and technology companies. Its necessity is driven by the professional segment's need for 8K/HDR compliance and, increasingly, AI-integration for workflow efficiency (e.g., Generative Extend), as seen in official releases from major vendors. The market's high computational demand is sustained by a mature ecosystem of hardware and cloud infrastructure, prioritizing solutions that integrate seamlessly with professional camera formats and high-speed storage networks.

- Brazil Market Analysis (South America)

The Brazilian market growth is characterized by a strong appetite for mobile video creation, driven by high social media penetration and a focus on localized, Portuguese-language content marketing. The primary growth factor is the cost-effectiveness and accessibility of software. This favors freemium models and low-cost subscription services that perform adequately on less powerful hardware or on mobile devices. The market's infrastructure challenges occasionally drive demand for robust offline editing capabilities despite the overall trend toward cloud services.

- Germany Market Analysis (Europe)

The German market exhibits conservative, compliance-driven demand, heavily influenced by the General Data Protection Regulation (GDPR). Commercial entities prioritize data sovereignty, which translates into an elevated demand for on-premises solutions or Cloud-Based offerings that explicitly guarantee data residency and processing within German or EU data centers. Professional demand is high for specialized software in the automotive and engineering sectors for technical video documentation, requiring precise metadata handling and archival features.

- Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi market’s expansion is fundamentally shaped by government investment in digital infrastructure and media diversification initiatives. High-quality content production is an imperative, driving demand for high-end, professional editing suites to support new local broadcasting and streaming services. The need for cloud services is growing, but is highly sensitive to local government regulatory approval for data handling, necessitating localized cloud regions from major international vendors.

- Japan Market Analysis (Asia-Pacific)

Japanese demand is unique, with a strong focus on high-fidelity, technologically advanced video formats (e.g., 8K) driven by consumer electronics companies and national broadcasters. The market shows persistent demand for both traditional, stable on-premises software for broadcast work and new, AI-integrated tools for the massive YouTuber and corporate explainer video segments. Software must excel in Japanese language support and highly precise subtitling/captioning workflows to capture significant market share.

________________________________________________________________

Video Editing Software Market Competitive Analysis:

The Video Editing Software Market features a concentrated competitive landscape at the high-end professional tier, dominated by established vendors, while the entry-level and mobile markets are highly fragmented. Competition centers on the deployment speed and efficacy of new generative AI capabilities and the strength of the vendor's surrounding creative ecosystem.

- Adobe Inc. maintains its strategic positioning as the industry standard, leveraging the deeply integrated Creative Cloud ecosystem. Its flagship product, Adobe Premiere Pro, serves as the backbone for countless commercial and professional post-production workflows. A key strategic move, verified in its official newsroom, was the introduction of Generative Extend in beta in October 2024. This AI-powered feature allows editors to seamlessly add or lengthen frames in video clips, fundamentally addressing a critical, time-intensive problem in editing, reinforcing its dominance by dramatically improving workflow efficiency. The integration of its proprietary Firefly Video Model positions Adobe to convert manual, hours-long tasks into automated functions, strengthening its professional market moat.

- Apple Inc. anchors its competitive strategy on a tightly controlled hardware-software ecosystem centered around its custom Apple Silicon architecture. Their primary offering, Final Cut Pro, targets professional and prosumer editors who prioritize speed and seamless integration with other Apple devices. The company's focus is on performance and workflow optimization, exemplified by the June 2024 release of Final Cut Pro 10.8, which introduced the Enhance Light and Colour effect utilizing machine learning for automated image correction, and Smooth Slo-Mo using an AI-enhanced algorithm on Apple silicon Macs. This strategy creates a strong lock-in effect for users operating within the macOS and iPadOS ecosystems, where its products deliver unparalleled performance.

________________________________________________________________

Video Editing Software Market Developments

- April 2025: Adobe Inc. launched Generative Extend in 4K resolution and with support for vertical video, now generally available in Premiere Pro. The feature, powered by the Firefly Video Model, instantly generates and expands the length of video and audio clips to cover timing gaps or smooth transitions, delivering unparalleled flexibility in timeline adjustments and directly addressing the professional need for fast, high-quality, social-first content creation.

- April 2025: Avid Technology, Inc. announced a partnership with CuttingRoom to power Avid's next-generation web-based editor, initially integrating the cloud-native technology into Avid's Wolftech News product. This move is designed to deliver a significant leap forward in collaborative, browser-enabled editing to meet the demands of the fast-paced news landscape, enabling news teams to capture, create, and publish video content from anywhere via a streamlined, AI-enhanced workflow.

- October 2024: Adobe Inc. announced the beta availability of Premiere Pro's first set of Firefly-powered video editing workflows, including Generative Extend (beta). This development addressed a common challenge by allowing video professionals to generate new frames at the beginning or end of a clip, simplifying the process of fine-tuning edits, holding shots longer, or covering transitions with commercially safe, Firefly-trained AI media.

Video Editing Software Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Video Editing Software Market Size in 2025 | US$3.762 billion |

| Video Editing Software Market Size in 2030 | US$5.005 billion |

| Growth Rate | CAGR of 5.88% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Video Editing Software Market |

|

| Customization Scope | Free report customization with purchase |

Video Editing Software Market Segmentation:

- By Type

- On-Premises

- Cloud-Based

- By Application

- Personal

- Commercial

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Thailand

- Others

- North America