Report Overview

Wastewater Aeration Systems Market Highlights

Wastewater Aeration System Market Size:

The wastewater aeration systems market is anticipated to reach USD 22.634 billion in 2025 to USD 28.805 billion by 2030 with a CAGR of 4.94%.

Wastewater Aeration System Market Highlights

- Energy-efficient blowers reduce power consumption while maintaining optimal oxygen levels for treatment.

- Advanced diffusers ensure uniform air distribution, enhancing microbial activity and treatment efficiency.

- Automated controls adjust aeration rates in real-time, minimizing waste and operational costs.

- The critical need in industries like food & beverage, pharmaceuticals, and textiles to treat high-strength organic wastewater is driving the wastewater aeration system market’s growth.

Wastewater Aeration System Market Trends:

The wastewater aeration systems market is experiencing significant growth, driven by regulatory pressures, rapid urbanization, and an increasing focus on sustainability. Companies that prioritize innovation, retrofitting existing systems, and expanding into emerging markets are well-positioned to gain a competitive edge in this evolving landscape.

In December 2024, Southland Holdings, Inc., a leading provider of specialized infrastructure construction services, announced that its subsidiary, Oscar Renda Contracting, secured a $60 million contract to construct a new wastewater treatment plant in the Southwest in the USA. This project included building advanced infrastructure such as new headworks, an influent pump station, an extended aeration basin, an administration building, a utility water station, and renovations to the crew building. This initiative highlights the growing demand for modern wastewater treatment facilities incorporating energy-efficient and sustainable aeration systems.

The wastewater aeration systems market is also witnessing robust growth, driven by increasing private sector investments, particularly through Public-Private Partnerships (PPPs) in wastewater management projects. These collaborations are fostering innovation and expanding the adoption of advanced aeration technologies to address growing environmental challenges and urbanization.

Further strengthening the market, in February 2024, Newterra Inc. acquired the aeration and mixing assets of Aeromix Systems Inc., a division of Fluence Corporation. This acquisition expanded Newterra’s wastewater treatment portfolio with renowned brands like Tornado, Hurricane, and Twister. Specializing in treating organic wastewater for industrial and municipal applications, Newterra’s move underscores the growing demand for efficient aeration systems that meet stringent environmental standards.

Aging water infrastructure in developed economies is a pressing challenge, driving the need to upgrade wastewater treatment plants and boosting growth in the wastewater aeration systems market. Many treatment facilities built decades ago are struggling to meet modern regulatory standards for effluent quality and operational efficiency. Stricter environmental regulations necessitate the modernization of aeration systems to enhance nutrient removal and reduce pollution.

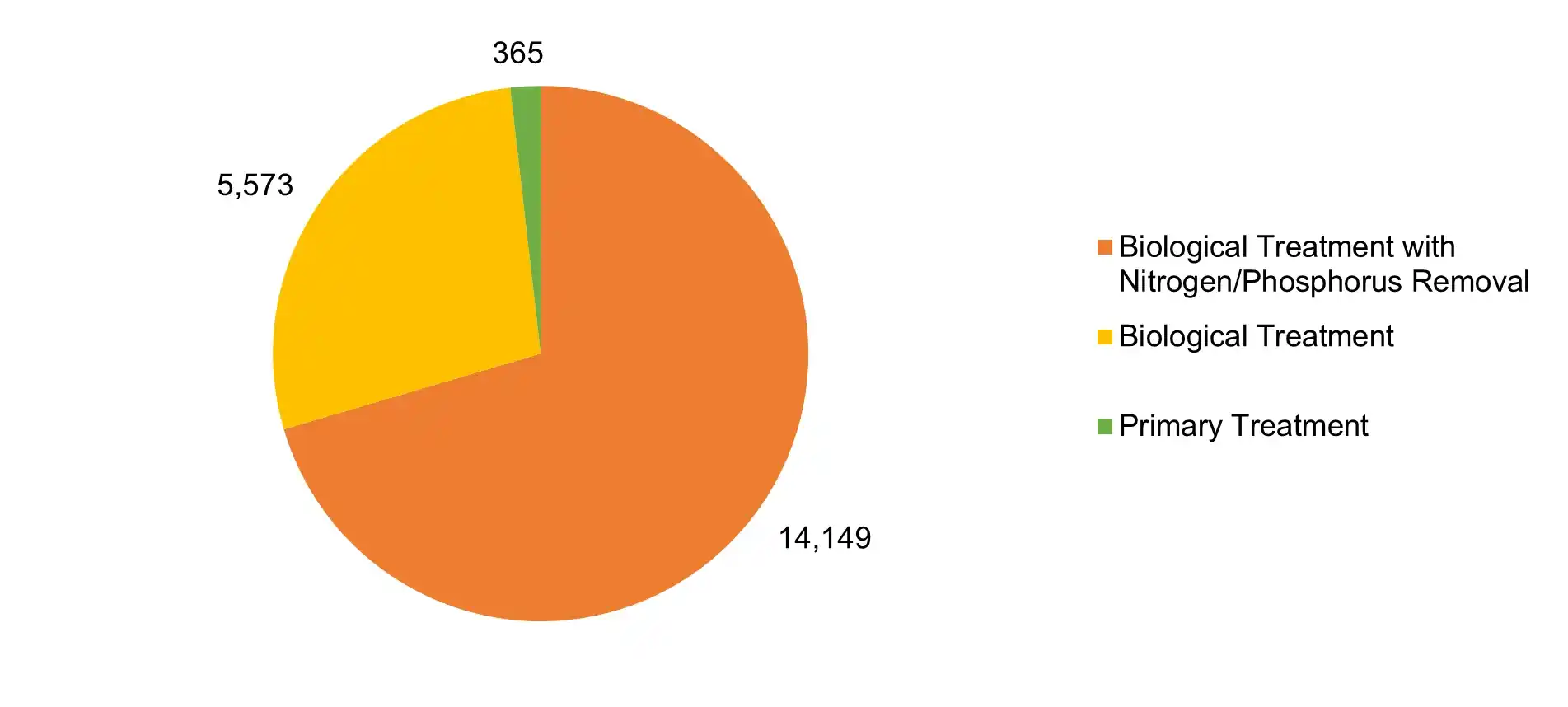

Aligning with this, in Europe, 82% of urban wastewater is collected and treated according to EU standards, with households and industries generating 544.4 million population equivalents of wastewater daily, equivalent to approximately 108.85 million cubic meters or 1,087 million bathtubs. This wastewater is treated across 20,087 plants before discharge, with biological treatment facilities playing a pivotal role in meeting compliance requirements.

Type of Treatment Facility, in the European Union, 2024

Source: European Union

Moreover, the growing scarcity of freshwater resources is fueling the demand for wastewater treatment. In 2022, 292 million people had limited access to water services or relied on improved sources that required more than 30 minutes to collect water. Additionally, 296 million individuals obtain water from unprotected wells and springs, while 115 million people rely on untreated surface water from lakes, ponds, rivers, and streams. This highlights the urgent need for innovative solutions to ensure safe and reliable access to clean water for vulnerable populations.

The growing global water scarcity is primarily driving the demand for wastewater aeration systems. By 2025, nearly half the world’s population is expected to live in water-stressed regions, with 1.8 billion people facing "absolute water scarcity.” According to the 2022 WHO/UNICEF JMP report, 411 million people in Africa still lack basic drinking water services, while 779 million lack basic sanitation, and 839 million lack basic hygiene. This issue is particularly severe in regions like the Middle East and Africa, where per capita water availability remains critically low.

Increased investment in wastewater treatment facilities and reservoirs globally further fuels the demand for mobile solutions. For instance, significant investments in infrastructure projects, like the Winnipeg Sewer Treatment plant, highlight the growing recognition of the need for adaptable water treatment technologies.

Aeration is a vital component in wastewater treatment, as it introduces oxygen to support microorganisms in breaking down organic pollutants, thereby enhancing water quality and ensuring compliance with environmental standards.

Amidst global efforts to manage dwindling water resources, initiatives like India's AMRUT 2.0 mission are gaining prominence. This mission focuses on preserving water bodies and promoting a circular water economy. In a significant step towards responsible water management, the Technology Development Board (TDB) supported M/s Bariflo Labs Private Limited in Odisha for their project, "Development and Commercialization of Intelligent Water Body Management System (IWMS)-TAMARA."

The TDB allocated 89 lakhs for this 150 lakh project, which features a smart aeration system enhanced with sensors and IoT technology in August 2023. This innovative approach improves traditional water and wastewater treatment methods and ensures that water bodies and aquaculture ponds remain clean and healthy.

- Urbanization and Smart City Projects

Global urbanization is propelling the wastewater aeration system market, as expanding urban populations intensify pressure on water infrastructure. According to the United Nations, 68% of the global population is expected to live in urban areas by 2050, driven significantly by regions like Asia-Pacific, including India and China. This demographic shift increases wastewater volumes from residential, commercial, and industrial activities, necessitating advanced treatment systems. Wastewater aeration systems, essential for oxygenating water to support the degradation of microbial pollutants, are vital to meeting stringent environmental regulations.

Smart city initiatives further accelerate market growth by integrating cutting-edge technologies into urban water management. These projects prioritize sustainable infrastructure, with wastewater treatment as a core component. For example, India’s Smart Cities Mission, launched to develop 100 smart cities, emphasizes advanced water and wastewater management, including IoT-enabled systems for real-time monitoring of aeration processes. Such technologies enhance energy efficiency and operational reliability, aligning with sustainability goals. The mission focusing on urban water infrastructure is expected to drive significant investments through 2030, boosting demand for these systems.

In China, the Sponge City initiative, targeting flood resilience and water recycling, incorporates advanced wastewater treatment technologies, including aeration systems, to support urban sustainability. By 2025, China aims to expand this program to 80% of its major cities, amplifying market opportunities. These initiatives underscore the role of smart technologies in optimizing wastewater treatment. With rising urbanization and smart city projects, the wastewater aeration system market is expected to grow robustly, driven by the need for scalable, efficient, and technology-driven solutions to address urban water challenges.

Wastewater Aeration System Market Segmentation Analysis:

- The Brush Aerators segment is rising considerably

By type, the wastewater aeration systems market has been segmented into surface aerators, diffused aerators, and hybrid devices. The market for brush aerators is growing steadily, primarily led by the increasing global demand for effective and economical wastewater treatment technologies. With industrialization and urbanization spreading, especially in developing countries, there is a growing requirement for strong wastewater management systems. Currently, 55% of the world population lives in cities, which is expected to grow to 68% by 2050, as per UN estimates. Urbanization means the long-lasting movement of a human population away from rural areas to cities and, when combined with the growth of the total world population, will add another 2.5 billion people to city dwellings by 2050. 90% of this increase is expected in Asia and Africa.

Brush aerators, with their mechanical simplicity, ruggedness, and high oxygen transfer efficiency, are popular in municipal and industrial wastewater treatment facilities. Their capacity to provide fluctuating loads and function well in oxidation ditches and lagoons makes them a popular choice in the event of fluctuating waste levels in a given area.

Advances in technology and greater design efficiency are also driving market growth. Advanced brush aerators are being designed with energy-saving motors, corrosion-proof materials, and modular designs that facilitate quick installation and maintenance. For instance, ECS House Industries, Inc. is the leading manufacturer of floating brush aeration equipment in the United States and abroad. The floating brush aerator offers many advantages over other types of surface aeration equipment. Moreover, Smith & Loveless' horizontal LOOP Brush Aerators provide premium oxygen transfer and mixing over various flow conditions. The company designed LOOP Brush Aerators to provide the greatest efficiency and cost-effective service.

These innovations assist in reducing operating costs, increasing product life, and enhancing overall treatment efficiency, further making brush aerators more attractive to plant owners seeking long-term dependability. Furthermore, hybrid system development involving the integration of surface aeration with diffused aeration continues to drive demand higher by adding performance in complex treatments.

Environmental compliance and sustainability targets are also strong drivers of this market. Regulators from worldwide are strengthening wastewater discharge regulations and encouraging more environmentally friendly, energy-saving practices with their technologies. As a result, industries and municipalities are capitalizing on upgrades in treatment facilities, including the use of brush aerators, to ensure compliance and enhance environmental performance.

- The Oil and Gas sector is growing significantly

By end-user, the wastewater aeration systems market is segmented into municipal and industrial. The wastewater aeration systems market for the oil and gas sector is growing considerably, led by rising environmental regulations and a commitment from the industry to sustainable business practices. Governments worldwide are imposing stricter standards for wastewater discharge, leading oil and gas companies to implement sophisticated treatment technologies. Aeration systems are pivotal in these systems by enabling the reduction of organic pollutants by improving the level of oxygen, ensuring environmental compliance, and reducing the ecological footprint.

Furthermore, in November 2023, the Environment Protection Agency (EPA) declared the Feminization of WIFIA, which stands for Water Infrastructure Finance and Innovation Act, and set down a loan value of US$45 million to the “South Sarpy Wastewater System Project” which was intended to offer a central wastewater treatment facility in Sarpy County. The stringent environmental regulations implemented by local regulatory organizations and the government to handle industrial wastewater are another factor that has a substantial influence on the market during the forecast years.

In addition to this, increased oil and gas exploration activities, especially in areas with water scarcity, have also driven the demand for efficient wastewater management systems. As per the World Energy Balances, Norway accounted for 52% of the regional share of European natural gas production in 2023. This was followed by the United Kingdom, which accounted for 15%.

Since production operations produce huge amounts of water, effective treatment systems are necessary to meet the demand. Aeration technologies are part of these systems and facilitate the discharge or reuse of treated water. This strategy solves environmental issues and aids in water conservation, which is particularly vital in dry climates where the water supply is scarce.

- The United States is expected to lead the market expansion

The ongoing industrial development and operations expansion have increased the scale of wastewater generation in the United States, accelerating the demand for required technologies and infrastructure for treating such water. Moreover, with the constant population growth, the per capita water consumption is also growing in the country, which will further increase the reliance on the public water supply system.

As per the U.S Water Supply and Distribution Factsheet, as of 2024, the country has 145,648 public water systems from which community water systems accounted for 34% of the total strength. With a high reliance on public water supply, the need to provide clean water through such a system will accelerate the usage of aeration systems, thereby improving the market expansion.

Additionally, various operators of water services, such as Veolia, are undertaking water treatment projects in the United States, which is also driving the demand for wastewater aeration systems. In April 2024, it announced that it had reached a new milestone in the treatment of PFAS (Polyfluoroalkyl Substances) chemicals in American drinking water, with over 30 company sites detecting no PFAS-regulated chemicals in the water supplied.

Wastewater Aeration System Market Key Developments:

- Fluence Corporation’s SmartAerator™ TORNADO®: In 2024, Fluence Corporation introduced the SmartAerator™ TORNADO®, a surface aeration system with integrated smart controls for energy optimization. Designed for urban wastewater facilities, it uses automated adjustments to aeration intensity based on real-time water quality data, supporting smart city goals of resource efficiency. The system is particularly relevant for municipalities in India’s Smart Cities Mission, where scalable wastewater solutions are critical.

- Sulzer’s Advanced Aeration System Upgrade: In 2023, Sulzer, a key player in fluid engineering, launched an upgraded version of its HST™ turbocompressor series, tailored for wastewater aeration. The system features enhanced energy efficiency and IoT compatibility, enabling remote monitoring and predictive maintenance. This development caters to the needs of smart city wastewater treatment plants, particularly in Europe and Asia, where regulatory compliance and sustainability are prioritized.

By Type

- Surface Aerators

- Brush Aerators

- Propeller Aerators

- Diffused Aerators

- Fine Bubble Aerators

- Coarse Bubble Diffusers

- Hybrid Devices

- Jet Aerators

- Turbines

By Method

By End-user

- Municipal

- Industrial

- Chemical

- Food And Beverages

- Oil And Gas

- Pulp And Paper

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- Italy

- France

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Others