Report Overview

Workplace Cobot Integration Services Highlights

Workplace Cobot Integration Services Market Size:

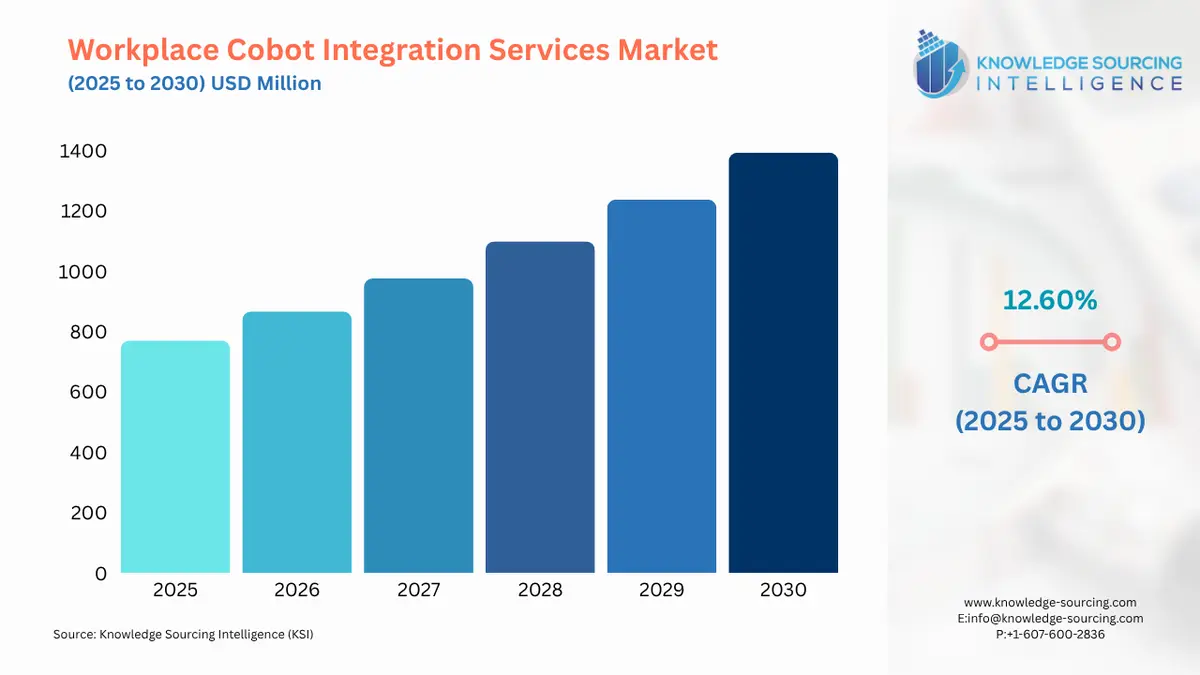

The Workplace Cobot Integration Services Market is anticipated to grow at a CAGR of 12.60%, increasing to USD 1,393.307 million in 2030 from USD 769.759 million in 2025.

Workplace Cobot Integration Services Market Key Highlights:

- Cobots are rapidly entering small and medium enterprises, making automation more accessible due to their affordability, safety, and ease of deployment.

- AI, sensors, and digital twin simulations are now standard in cobot integration, enabling smarter, faster, and safer workplace automation.

The workplace cobot integration services market is centered around helping companies successfully integrate collaborative robots in their operations. Unlike traditional industrial robots, cobots are designed to work closely alongside humans safely, making them appropriate for all sorts of industries - from automotive and electronics to healthcare and logistics. The cobot integration services involve consulting, systems design, system installation, training for employees, and ongoing maintenance, all aspects that ensure that the cobots fit smoothly into the workplace. As workplace automation grows with the rise of increasing efficiencies and reducing worker strain, has increased the need for services that will allow companies to introduce collaborative robots into their operations successfully. The workplace cobot integration services market marks the movement towards the human–robot collaboration being part of day-to-day workplaces.

Workplace Cobot Integration Services Market Overview & Scope:

The workplace cobot integration services market is segmented by:

- Service Type: The market is segmented into consulting, system design & engineering, installation & deployment, training & skill development, maintenance & support. Consulting primarily involves understanding the work process workflows, calculating ROI, and determining where the cobots will fit best within the workflows. Systems design and engineering allow for custom setups catered specifically to the phenomenological nature of the industry or sector. Systems installations and deployments involve on-site installations, calibrations, and any necessary safety precaution assessments and compliance. Training equips employees with the tools and knowledge to work safely and effectively with cobots. The maintenance and support entail updates, investigating any troubleshooting or performing optimisations on operational performance. The combination of integration services facilitates reducing risks for companies adopting cobots, maximising productivity and efficiency, and guarantees peak performance reliability over the long term, which is the most valuable aspect of workplace cobot integration.

- By Robot Type: The market is segmented into collaborative robots (cobots), industrial robots, and mobile robots. Industrial robots are also described here because in many workplaces where Cobots are being used, they are also delivering heavy-duty industrial robot automation.

- By Payload Capacity: The market is segmented into Up to 5 kg, 5–10 kg, and Above 10 kg. Cobots that can handle up to 5 kg capacity are used for light duties such as assembly of small components, packaging, and laboratory automation. Cobots that can handle between 5-10 kg serve mid-range cobot functions such as machine tending and assembly of electronics. Cobots that have a payload capacity of 10 kg or more lend themselves to heavier applications in automotive production, metalworking, and machining. System integrators are forced to implement different integration strategies based on the payload range, as the safety standard, workspace requirements and staff training are significantly varied based on the payload category.

- By Component: The market is broken down into hardware, software, and services. Software covers programming platforms, tools for optimizing the workflow, artificial intelligence, and analytics related systems that have advanced cobots operational capabilities and adaptability to workplace use. Services represent the consulting, installation, training and maintenance side in which cobots require to ensure they can be deployed and ensure performance over the course of the system's use. This segmentation encapsulates the layers of strategic implementation needed for cobot use, when considering that each component needs to be integrated in such a way which allows for robots to safely, efficiently, productively interact in human-centered environments.

- Application: The market is segmented into assembly & production, machine tending, packaging & palletizing, quality inspection, welding, gluing & dispensing, pick & place, processing, logistics & warehousing tasks. Assembly and production tasks can relate to repetitive manufacturing operations. Machine tending relates to how cobots ensure a machine can run efficiently with appropriate loading and unloading time. Packaging and palletizing facilitate the logistics chain, while quality inspection relies on a cobots precision and on-board sensors. Welding, gluing, and dispensing requires accuracy and or complete control of the materials.

- End-User Industry: The market is segmented into Automotive, Electronics & Semiconductors, Healthcare & Pharmaceuticals, Food & Beverage, Metals & Machining, Plastics & Polymers, Logistics & Warehousing, Furniture & Equipment Manufacturing, Others. Electronics and semiconductors deploy them in precision tasks like circuit assembly. Healthcare and pharmaceuticals benefit from cobots in lab automation, packaging, and sterile handling.

- Region: Geographically, the market is expanding at varying rates depending on the location.

Top Trends Shaping the Workplace Cobot Integration Services Market

- AI and digital twin-enabled integration

Integration service providers are experimenting more with artificial intelligence and are increasingly using digital twin simulations to design cobots with the option to test and design a best-fit solution remotely before even installing the cobots. Service providers claim that actually testing before using cobots has reduced or removed errors during the installation process, reduced downtime, and ensured robots were configured to suit the needs of the workplace and not wasted time configuring unnecessarily, which enables a more speedy and low-cost integration of cobots in the workplace. - Shift toward flexible and modular cobot systems

The workplace is increasingly asking for more cobots that can be quickly reprogrammed and redeployed to do anything from packaging to machine-tending tasks without having cobots perform that job for years on end. Integration service providers are shifting towards modular system designs and simplified interfaces, making it possible to deploy new cobots for different tasks without a heavy reinvestment, identifying bottlenecks and accommodating changing production requirements.

Workplace Cobot Integration Services Market Growth Drivers vs. Challenges

Drivers:

- Rising demand for human–robot collaboration: More workplaces are installing cobots -robots designed to work closely with human operators without needing a cage or separation of any kind- because they can now safely cohabitate with humans so small and medium enterprises can have access to robotics without caged robots. The integration services are key -growing quickly too, and big service providers will need us- they help ensure seamless deployment, assure compliance to safety standards and train the workforce to work safely with cobots, which has been a big demand from service providers.

- Workplace automation for efficiency and safety: Particularly in manufacturing, healthcare, and logistics industries, workers are under pressure to help improve efficiency and reduce on-the-job incidents and accidents. Cobots help by eliminating or mitigating repetitive strain injuries and will improve speed and accuracy across the workplace. Integration services seek to assure that the robots integrate well with productivity goals in the workplace, ensure that safety certification to workplace standards has been achieved, or create a customised workflow tailored for a workplace, thus driving market growth.

Challenges:

- High upfront integration and customization costs: Physical robots employing AI software and incorporating advanced sensors are distinctly more expensive than other available technologies. Small to medium enterprises may find it a prohibitive financial consideration when access to a robot may improve emotional support in their respective settings, slowing market penetration.

Workplace Cobot Integration Services Market Regional Analysis

- Asia-Pacific: Asia-Pacific is becoming the fastest-growing market for workplace collaborative robot (cobot) integration services. Several factors are driving this: strong industrial activity in China, Japan, South Korea, and India; a strong base of advanced manufacturing and cobot adoption in the Region; and rapid acceptance of Industry 4.0 practices. The region has large-scale manufacturing hubs, with governments supporting the development of automation as an opportunity to join Industry 4.0. Meanwhile, Japan and South Korea are driving the collaboration between intelligent machines and humans with added levels of precision in areas like electronics and robotics. India is also seeing growth in demand for cobots, especially in automotive and logistics applications. Service providers are focusing on the needs of their clients for affordable deployment, customised solutions, and training for workers, making it a core growth engine for cobots in the Asia-Pacific region.

Workplace Cobot Integration Services Market Key Development:

- Universal Robots reached an important milestone of 100,000 cobots sold around the world: At events like Collaborate India 2025 in Bengaluru, Universal Robots showcased many different recent developments in cobot technology and add-ons, including artificial intelligence-driven vision systems, autonomous mobile robots (AMRs), and the new PolyScope X control software. This is a strong indicator of not only the incredible adoption of cobot systems but also the increasing need for integration services in developing economies like India.

Workplace Cobot Integration Services Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 769.759 million |

| Total Market Size in 2031 | USD 1,393.307 million |

| Growth Rate | 12.60% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Service Type, Robot Type, Payload Capacity, Region |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Workplace Cobot Integration Services Market Segmentation:

- By Service Type

- Consulting

- System Design & Engineering

- Installation & Deployment

- Training & Skill Development

- Maintenance & Support

- By Robot Type

- By Payload Capacity

- Up to 5 kg

- 5–10 kg

- Above 10 kg

- By Component

- Hardware

- Software

- Services

- By Application

- Assembly & Production

- Machine Tending

- Packaging & Palletizing

- Quality Inspection

- Welding, Gluing & Dispensing

- Pick & Place

- Processing

- Logistics & Warehousing Tasks

- By End-User Industry

- Automotive

- Electronics & Semiconductors

- Healthcare & Pharmaceuticals

- Food & Beverage

- Metals & Machining

- Plastics & Polymers

- Logistics & Warehousing

- Furniture & Equipment Manufacturing

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America