Report Overview

Flexible Manufacturing Robotics Market Highlights

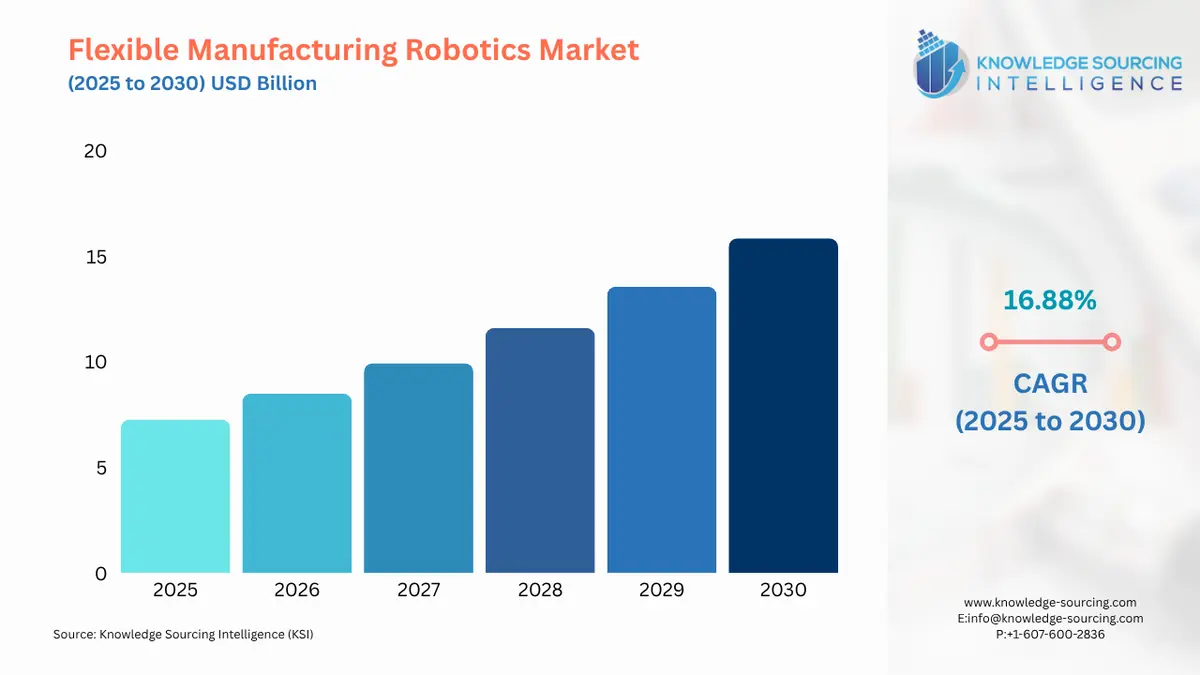

Flexible Manufacturing Robotics Market Size:

The Flexible Manufacturing Robotics Market is expected to grow at a CAGR of 16.88%, reaching USD 15.843 billion in 2030 from USD 7.263 billion in 2025.

Flexible Manufacturing Robotics Market Key Highlights:

- One of the key factors driving the demand for flexible manufacturing robots is the growing global competition and increasing product turnover rate. Rise in automation across the industries is also driving the market.

- There are advancements in robotic programming and technology, and the growth of AI-Powered Collaborative Robots (Cobots).

The rapid industrialization in emerging economies and growth towards automation in the manufacturing sector are driving the demand for robots. The growing global competition and increasing product turnover rate, due to shorter consumer attention spans, demand for greater customization, the need to offer competitive prices, and the rapid advancement in technology, is leading manufacturers to increasingly demand flexible robotics systems.

Flexible Manufacturing Robotics Market Overview & Scope:

The Flexible Manufacturing Robotics Market is segmented by:

- Robot Type: By robot type, the market is segmented into collaborative robots, modular robots, autonomous mobile robots (AMR), and smart robots.

- Application: By application, it is segmented into assembly and production line operations, material handling and logistics, packaging and palletizing, inspection and quality control, welding, cutting, and machining, and others.

- End-User Industry: By end-user industry, the market is segmented into automotive, electronics and semiconductors, consumer goods and packaging, healthcare, aerospace and defense, and others.

- Region: Regionally, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia-Pacific is the largest and fastest-growing region. Robust manufacturing ecosystems and a strong base in the automotive and electronics markets are the key factors for growth. The growing government push for automation is also driving the region’s growth. Additionally, a robust manufacturing base, rising industrialization and others are driving the market.

Top Trends Shaping the Flexible Manufacturing Robotics Market:

- Advancements in Robotic Programming and Technology

The market is experiencing advancement in technology. During the coming years, this technological progress will be in high momentum. There is growing rapid technological progress in robotic programming, tool changers, and vision systems that is significantly enhancing the flexibility of manufacturing operations. At the same time, there is growth in user-friendly interfaces, offline programming, and hand-guided programming for collaborative robots. For instance, KUKA KR10 R1100 can switch tooling within a minute with a tool changer. - AI-Powered Collaborative Robots (Cobots)

Cobots are increasingly used for their flexibility, small size and safety measures. There is now an increasing trend towards the integration of AI in cobots, driving the demand for AI-powered cobots. They are increasingly equipped with AI-based vision systems, boosting their quality and flexibility. Companies like Techman Robot offer AI-powered Cobots such as TMSS 900mm/5Kg, TM14S 1100mm/14 kg, TM5S 900mm/5Kg and many others.

Flexible Manufacturing Robotics Market Growth Drivers vs. Challenges:

Drivers:

- Rising Global Competition and Product Turnover: One of the key factors driving the demand for flexible manufacturing robots is the growing global competition and increasing product turnover rate. Due to shorter consumer attention spans, demand for greater customization, the need to offer competitive prices, and the rapid advancement in technology, the product turnover rate is higher. This is leading manufacturers to adopt flexible automation that can adapt to product, process, or volume changes. For example, ABB 200-20 multipurpose robots are widely in demand for their ability to perform different production-related tasks. Another product, FANUC LR Mate 200ic, can be reprogrammed and redeployed for the new project, saving manufacturers time and money.

- Rise in Demand for Automation across industries: The ongoing industrial revolution 4.0 and growing global emphasis on productivity and cost-efficiency are leading industries to adopt robots. Various sectors, such as automotive, electronics, general manufacturing, and aerospace, are shifting towards flexible manufacturing robotic solutions to adapt to variable tasks and support mixed-model production lines, and reduce downtime. Moreover, governments across nations are also pushing for automation, again driving the market adoption of robotics.

Challenges:

- High upfront capital cost and complex integration: The high initial cost is the major factor restraining the growth of the market. Apart from high initial cost, these robots also need investment in integration, training, which is a key barrier for companies, especially in small and medium enterprises. This acts as a key restraint factor for the market growth.

Flexible Manufacturing Robotics Market Regional Analysis:

- North America: North America has a significant presence in the market, driven by the growing adoption of Industry 4.0 technologies, including AI, IoT, and data analytics for real-time monitoring and optimization. At the same time, the strong demand from automotive and aerospace sectors, with companies like Tesla and Boeing investing in flexible automation for model variations and scale-ups. At the same time, the increasing need for operational efficiency and cost reduction by the manufacturers is driving the market.

- Asia-Pacific: Asia-Pacific holds a dominant share in the market and is growing. The market dominates due to high application in growing end-use industries such as automotive and electronics in this region. Also, this region has very fast growth in robot adoption, driven by being a manufacturing hub, growing automation, and the government's push for automation. Rising labor costs are also a key factor, driving the growing adoption of robots in paints and coating systems.

Flexible Manufacturing Robotics Market Competitive Landscape:

The Flexible Manufacturing Robotics Market is moderately consolidated, with dominance of large robotics companies in terms of scale and installed base, such as FANUC, ABB, KUKA, Yaskawa, Kawasaki and others. However, there is a growing number of niche players in emerging areas like cobots, modular robotics, and AI-enabled robots such as Universal Robots, Flexiv, Techman Robots and others. These niche players are driving the future growth.

Flexible Manufacturing Robotics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Robot Type, Application, End-User Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

| Report Metric | Details |

| Flexible Manufacturing Robotics Market Size in 2025 | USD 7.263 billion |

| Flexible Manufacturing Robotics Market Size in 2030 | USD 15.843 billion |

| Growth Rate | CAGR of 16.88% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Flexible Manufacturing Robotics Market |

|

| Customization Scope | Free report customization with purchase |

Flexible Manufacturing Robotics Market Segmentation:

- By Robot Type

- Collaborative Robots

- Modular Robots

- Autonomous Mobile Robots (AMR)

- Smart Robots

- By Application

- Assembly & Production Line Operations

- Material Handling & Logistics

- Packaging & Palletizing

- Inspection and Quality Control

- Welding, Cutting, and Machining

- Others

- By End-User Industry

- Automotive

- Electronics & Semiconductors

- Consumer Goods and Packaging

- Healthcare

- Aerospace and Defense

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America