Ionomer Resins Market expected to reach USD 3.127 billion by 2030

Ionomer Resins Market Trends & Forecast

According to a research study published by Knowledge Sourcing Intelligence (KSI), the ionomer resins market will expand from USD 2.507 billion in 2025 to USD 3.127 billion in 2030 at a CAGR of 4.52% during the forecast period.The Ionomer resins market is driven by the increasing packaging industry, demand for lightweight materials, expansion of the automotive sector, and demand for solar cell manufacturing. Ionomer Resins have transparency and heat-sealing capabilities, which are suitable for food packaging, pharmaceutical packaging, and flexible films. In November 2023, SK functional polymer started to market the IONIATM ionomers product range in the EMEA region. The IONIATM ionomers are made through a brand-new process developed by SK Geo Centric, SKFP's mother company based in South Korea. This new technique has extremely low gel levels and is very well adapted to film production. They are suitable for flexible film applications as sealing layers or abrasion-resistant layers. IONIATM ionomers are sodium- or zinc-based with a melt index ranging from 1.3 to 15. It is designed to be easily processed by blown/cast extrusion as well as extrusion coating & lamination. The IONIATM ionomers are currently produced in the SKGC Tarragona plant in Spain and are sold globally. SURLYN Ionomers by Dow are used for many packaging applications. SURLYN Ionomers support rigid packaging applications. SURLYN Ionomers are ethylene acid copolymers. Most of the mechanical properties of SURLYN Ionomers are directly related to their acid content and level of neutralization. SURLYN Ionomers use bio-based and circular feedstocks. Furthermore, the ionomer resins are a class of thermoplastic polymers known for their durability and biocompatibility, making them valuable in the medical field. Products such as GC FujiCEM Evolve, a radiopaque resin-reinforced glass ionomer cement in a syringe delivery with a tack-cure feature and high radiopacity, are used by dentists. It can be used for cementation of a variety of substrates and different types of indirect restorations. Besides, in September 2022, Kerr Dental announced the relaunch of Nexus RMGI, a resin-modified glass ionomer luting cement featuring Smart Response Ion Technology. Nexus RMGI is formulated for easy cleanup, bond strength, great color stability, and provides sustained ion release to help prevent secondary caries. Features like Smart Response Ion Technology, One-Peel Cleanup, and the bond strength combined in Nexus RMGI to provide users with a luting cement for faster work. As the automotive industry's demand for ionomer resins in applications like bumpers, trims, and protective equipment, the growth of the automotive industry will drive the demand for ionomer resins. According to the International Organization of Motor Vehicle Manufacturers (OICA), the automotive vehicle production surged by 10%, Asia-Pacific witnessed 10% growth, and Europe saw 13% growth in 2023. ? View a sample of the report or purchase the complete study at: Ionomer Resins Market Report

Ionomer Resins Market Report Highlights

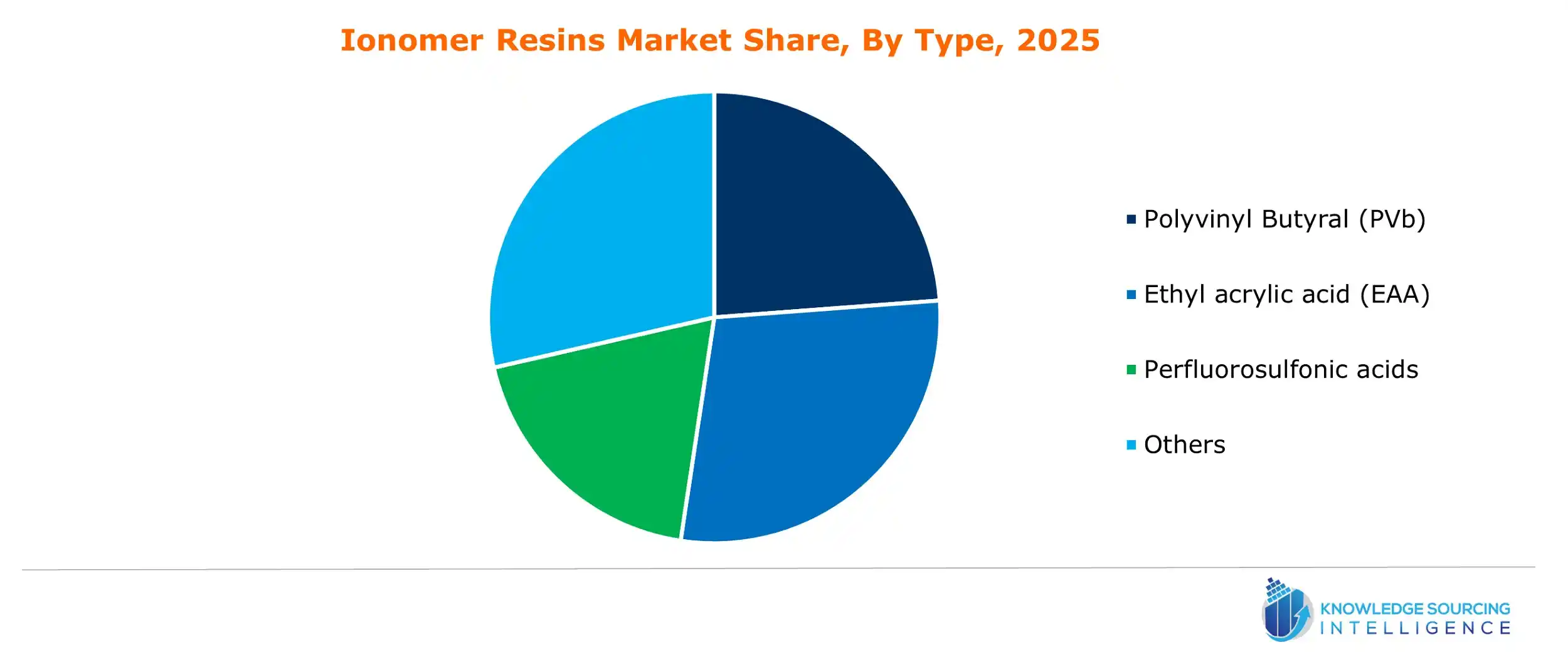

- By type, the ionomer resins market is segmented into polyvinyl butyral, ethyl acrylic acid, perfluorosulfonic acids, and others. Rising demand from the automobile industry and the increasing photovoltaic industry are expected to drive the polyvinyl butyral market. Moreover, the growth of green building and construction applications is leading to the growth of polyvinyl butyral demand. Ethyl acrylic acid is used in packaging films, coatings, and adhesives for food and beverages. The growth of the food and beverages industry will lead to increased demand of ethyl acrylic acid.

- By end-user industry, the ionomer resins market is segmented into food and beverage, medical, automotive, electronics, and others. According to the German Electrical and Electronic Manufacturers' Association, Asia witnessed the largest share of the electronics market globally, thus, ionomer resins in the electronics industry will grow. According to the OICA (International Organization of Motor Vehicle Manufacturers), the production of the automobile was 93,546,599, which has increased by 10% in 2023. The ionomer resins are helping manufacturers close in on the goal of zero-emission energy.

- Asia Pacific will be the fastest-growing market during the forecast period, driven by huge population, industrialization and urbanization and investment in countries like China and India. Major demand is from the electronics and automotive applications.

- North America is anticipated to see considerable growth. The rising consumption of fast food in North America is boosting demand for ionomer resins in food packaging applications. Further, rising usage of innovative packaging solutions for cosmetics is driving demand for ionomer resins.

Report Coverage:

| Report Metric | Details |

| Ionomer Resins Market Size in 2025 | US$2.507 billion |

| Ionomer Resins Market Size in 2030 | US$3.127 billion |

| Growth Rate | CAGR of 4.52% |

| Drivers |

|

| Restraints |

|

| Segmentation |

|

| List of Major Companies in Ionomer Resins Market |

|

Ionomer Resins Market Drivers and Restraints

Drivers:- Rising demand from the packaging industry: Ionomer resins are utilised in general food packaging, pharmaceutical packaging, personal care packaging, etc. There are multiple benefits associated with the use of ionomer resins, such as low seal initiation temperature, oil barrier, high clarity, flex crack resistance, etc. With the growing demand in the food and beverage industry worldwide, the demand for ionomer resins is likely to increase.

- Rising Demand in Automotive: Ionomers create protective layers in the automotive coatings, preventing corrosion, abrasion, and chemical exposure. Ionomers can form smooth, uniform coatings. Further, these are used in the fuel cell membranes and electrode formulations, which are helping manufacturers close in on the goal of zero-emission energy.

- Competition from Substitutes: The ionomer resins market faces key challenges from its substitutes. It has easy substitutes such as high-density polyethene (HDPE), low-density polyethene (LDPE), polypropylene (PP), polyethene terephthalate (PET), and other thermoplastic resins. This leads to easy adoption of these substitutes, limiting the adoption of ionomer resins.

- High Production Costs: It is one of the key factors that affect the market growth. Ionomer resins are produced using specialized polymerization processes and advanced compounding technologies, which results in the production cost going higher. Also, its dependency on high-quality feedstocks makes the market volatile and increases the production cost. This is accompanied by the availability of cheaper substitutes, making market demand very volatile.

Ionomer Resins Market Development

- Strategic Collaboration: In June 2025, Ionomer Innovations and Jolt Solutions entered into a strategic collaboration. This partnership integrates Ionomr’s hydrocarbon-based membranes and ionomers with Jolt’s nickel-based activated electrode.

- Product Portfolio Expansion: In February 2024, SK Functional Polymers added IONIA Ionomers under its product range. IONIA® ionomers are produced by the reaction of PRIMACORTM EAA and metal ions, have superior scratch resistance, high mechanical strength, seal through properties, outstanding clarity, and adhesive properties similar to EAA.

Ionomer Resins Market Segmentation

Knowledge Sourcing Intelligence has segmented the global Ionomer Resins Market based on type, end-user industry, and region: Ionomer Resins Market, By Type- Polyvinyl Butyral (PVb)

- Ethyl acrylic acid (EAA)

- Perfluorosulfonic acids

- Others

- Food and Beverage

- Medical

- Automotive

- Electronics

- Others

- North America

- U.S.

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa (MEA)

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Ionomer Resins Market Key Players

- Dow Chemicals

- 3M

- Japan Polyethylene Corporation

- JMC Corporation

- AGC Chemicals Americas, Inc.

- Honeywell International Inc.

- Asahi Kasei

- Solvay

- SK Functional Polymer

About Knowledge Sourcing Intelligence (KSI)

Knowledge Sourcing Intelligence (KSI) is a market research and consulting firm headquartered in India. Backed by seasoned industry experts, we offer syndicated reports, customized research, and strategic consulting services. Our proprietary data analytics framework, combined with rigorous primary and secondary research, enables us to deliver high-quality insights that support informed decision-making. Our solutions empower businesses to gain a competitive edge in their markets. With deep expertise across ten key sectors, including ICT, Chemicals, Semiconductors, and Healthcare, we effectively address the diverse needs of our global clientele.Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Press Releases

Pain Management Drugs Market expected to reach USD 116.412 billion by 2030

Recently

Organic Acids Market expected to reach USD 21.582 billion by 2030

Recently

Enterprise Artificial Intelligence (AI) Market expected to reach USD 83.850 billion by 2030

Recently

Non-Woven Adhesive Tape Market expected to reach USD 3,124.230 million by 2030

Recently