Report Overview

Global Blister Packaging Market Highlights

Blister Packaging Market Size:

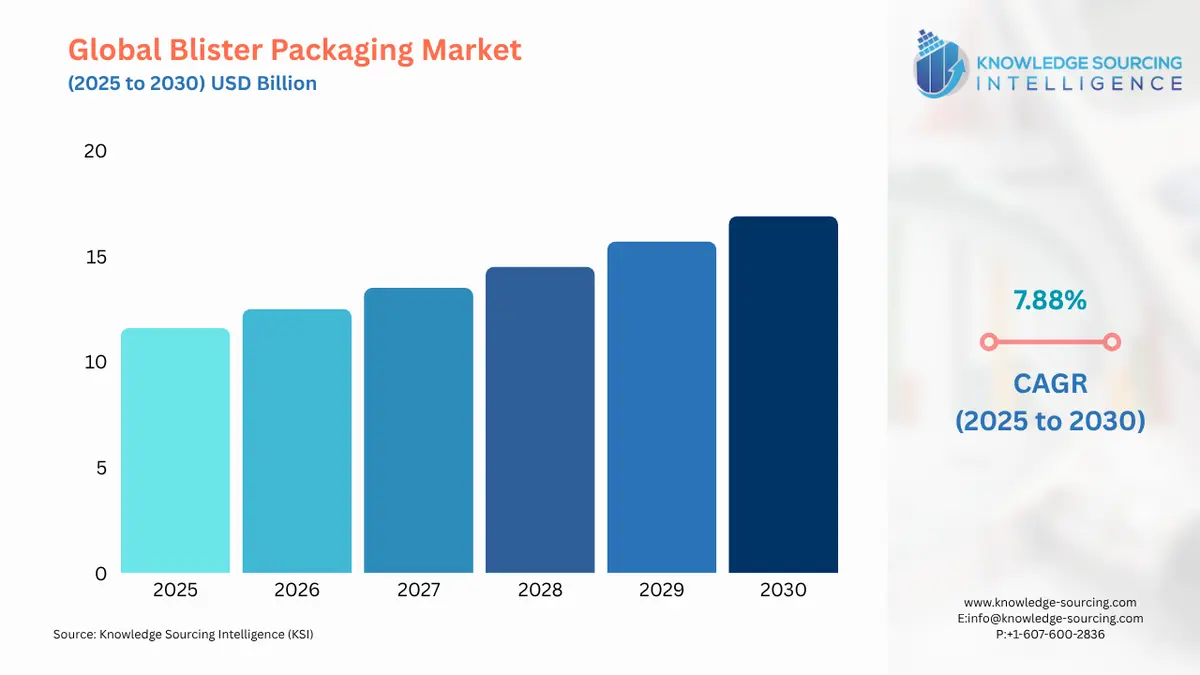

The global blister packaging market will grow at a CAGR of 7.88% from USD 11.565 billion in 2025 to USD 16.902 billion in 2030.

Blister Packaging Market Trends:

The global blister packaging market is growing as it has become a more feasible choice due to the increased demand for product security from manufacturers, customers, and regulatory organizations. Further, most consumers store their medications in a temperature-variable environment that can be hazardous, which makes the packaging necessary for quality management and increased shelf life. In addition, cutting-edge blister technology, such as radio frequency identification tags with a seal applied outside the package, is expanding due to the ability to offer personal security throughout supply chains.

The market is also anticipated to rise due to consumer demand for practical and simple-to-use packaging products and growing requirements for compliance with safety laws. Additionally, there is a rising demand for personal care and pharmaceutical goods in industrialized regions like America, Asia, Europe, and others, where consumer spending on medical and personal care items is rising significantly.

Blister Packaging Market Growth Drivers:

- The global blister packaging market is driven by rising adoption in healthcare sector

The global blister packaging market is primarily driven by its growing adoption in the healthcare sector, where specialized packaging solutions ensure that pharmaceutical products reach patients safely without tampering or contamination. Specialized packing choices enable pharmaceutical manufacturing firms to deliver medical items to patients without tampering with them or causing any damage. One of the choices for keeping medicinal goods secure, dry, and free of as many outside pollutants as feasible is blister packaging.

There are many options for pharmaceutical packaging, including stoneware, glass storage, and plastic bottles and containers. Blister packaging effectively transports and packages medical necessities. In addition, packaging shields the medications from impacts, heat, and wet environments, extending their shelf life and improving transportation capabilities.

Further, the expenditure on medicines is increasing with the global consumption of specialty drugs. The demand for packaging is directly driven by the fact that the manufacture of medications is always growing to keep up with the identification of new ailments and treatments. As they have tamper-free, leak-proof packaging solutions that may be used for bulk operations to achieve quick and reliable packing, flexible alternatives to packaging, like blister packaging, are gaining popularity.

- The blister packaging preserves the integrity of the product, fueling its use in various industries

Blister packaging's main objective is to preserve the integrity of the product. However, efforts are still being made in all facets of the packaging business to save costs throughout the packaging process. To assure the optimum protection for pharmaceutical applications like tablets and capsules, Amcor's Polybar barrier film product families offer a wide range of moisture barriers in addition to strong crush resistance. They use various materials, including Aclar, COC, PE, PVC, and PVDC.

Furthermore, with a maximum output of 600 blisters and 350 cartons per minute, the Noack Unity 600 blister packaging line from ROMACO GROUP increased its productivity and reduced emissions in packaging packs for the pharmaceutical and nutraceutical industries. In April 2023, MAX Solutions, Inc., a unique, specialized packaging platform, presented MAX EcoblisterTM, a cutting-edge, greener option to plastic blister packs.

Blister Packaging Market Restraints:

Pharmaceutical packaging suppliers are searching for more easily recyclable materials as environmental regulations tighten. Most blister packaging uses many materials, including PVC, PVDC, etc. Unfortunately, these also involve single-use plastics that are harmful to the environment and cannot be reused or composted. To assist the recyclability of blister packages, businesses are creating new recycled thermoformed plastic methods and materials. In addition, many companies are developing novel recyclable packaging materials for blister packaging.

Blister Packaging Market Segment Analysis:

- Based on material, the PVC segment is expected to witness robust growth.

PVC blister packaging is a kind of packaging composed of a thermoformed PVC plastic shell or blister and cardboard printed as a purse. Among the many uses of polymer, the most common are within the pharmaceuticals, medical equipment, food and beverage, and consumer goods industries. The outstanding qualities of PVC blister packaging compared to other forms of packaging include its capabilities of excellent product visibility, resistance against tampering, and, to some extent, being less affected by environmental factors.

The PVC blister packaging market has continued to grow steadily due to healthcare industry growth, e-commerce and home delivery services thriving industry expansion, convenience and portability regarding consumers' needs, advancements in blister packaging technologies, and an expanding number of developing markets. Nevertheless, the restrictions caused by environmental issues and government rules can prevent the PVC blister packaging market from being stocked in the long term.

Blister Packaging Market Geographical Outlook:

- Asia Pacific is anticipated to account for a major global blister packaging market share.

Global blister packaging has been classified by geography into North America, the Middle East, Africa, Europe, Asia Pacific, and South America.

The market is anticipated to grow significantly in the Asia Pacific region, especially in India. The Indian blister packaging is expected to grow with substantial growth predicted for the upcoming years. This movement, which is a result of many factors, can be due to the growing age population of the Indian population. People in India have extended life expectancy with breakthroughs in medical technology and the healthcare system.

Furthermore, blister packaging is a widespread fabrication procedure used in the pharmaceutical industry in the North American region. It protects from contamination, and especially for elderly individuals with weakened immune systems, it also guards against tampering. For example, Amcor, a global leader in creating and producing innovative and environmentally safe packaging solutions, was appointed the "Recyclable Packaging" winner at Packaging Europe's 2022 Sustainability Awards. The firm has been honored for its Amcor HealthCare™ AmSky™ Blister technology, a revolutionary thermoformed blister technology devoid of vinyl and aluminum. This recycle-ready solution is a more environmentally friendly and low-carbon alternative to the most popular form of healthcare packaging.

Blister Packaging Market Key Developments:

- In April 2025, Amcor, a global leader in developing and producing responsible packaging solutions, announced that it secured a commercial order of AmSky™ Blister System with the launch of the new TheraBreath Invigorating Icy Mint chewing gum.

- In May 2025, SUDPACK Medica unveiled a mono-polypropylene blister solution for dietary supplement packaging. This packaging aligns with the Packaging and Packaging Waste Regulation’s recyclability requirements while maintaining contact safety and product performance.

- In October 2024, Bayer launched a first-of-its-kind product in the healthcare industry, polyethylene terephthalate (PET) blister packaging on its renowned brand, Aleve.

- In October 2023, PA Consulting (PA), the firm that brings innovation to life, and PulPac, the Swedish R&D and IP company that developed Dry Moulded Fibre, announced that Bayer's Consumer Health division had joined the Blister Pack Collective.

Blister Packaging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Blister Packaging Market Size in 2025 | US$11.565 billion |

| Blister Packaging Market Size in 2030 | US$16.902 billion |

| Growth Rate | CAGR of 7.88% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Blister Packaging Market |

|

| Customization Scope | Free report customization with purchase |

Blister Packaging Parket Segmentation:

- By Type

- Compartment

- Slide

- Wallet

- By Material

- PVC

- PVDC

- PP

- Others

- By Technology

- Cold-Form

- Thermoformed

- By End-User

- Consumer Goods

- Food

- Pharmaceuticals

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America