Report Overview

Personal Care Packaging Market Highlights

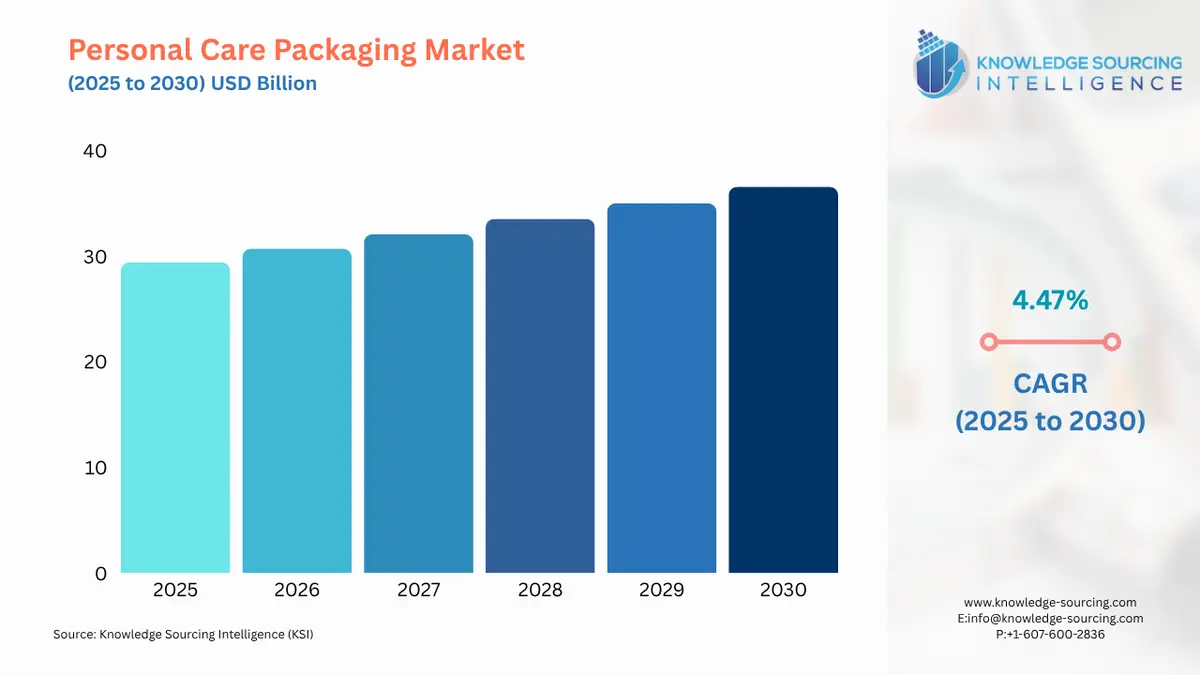

Personal Care Packaging Market Size:

Personal Care Packaging Market is expected to grow at a 4.34% CAGR, increasing from USD 29.399 billion in 2025 to USD 37.926 billion in 2031.

Personal care packaging is an important part of the personal care industry. Skincare, body care, nail care, hair care, and other personal care items are packaged using a variety of packaging materials. Personal care product packaging provides increased product protection and is a sustainable and cost-effective option. The growing consumer preference for self-care and personal hygiene is a major driver of the worldwide personal care packaging industry. Furthermore, the rising demand for environmentally friendly packaging among manufacturers and consumers would create profitable prospects for the market throughout the forecast period.

Personal Care Packaging Market Trends:

The personal care packaging market is the business that manufactures packaging materials for personal care products including cosmetics, skincare, hair care, and other similar items. The personal care sector is expanding rapidly, owing to reasons such as changing customer tastes, an aging population, and rising disposable incomes. This increases demand for personal care packaging solutions that safeguard and preserve these items. Urbanization and changing lifestyle patterns fuel demand for handy, on-the-go personal care products, necessitating new and portable packaging solutions. Moreover, the prevalence of social media platforms is encouraging people to embrace their self-care requirements, which is increasing demand for grooming products. Rising skin concerns among the population are increasing demand for skincare products that are tailored to their needs, resulting in significant sales of personal care packaging items. Furthermore, the growing influence of social media on beauty standards has had a huge impact on people's attitudes toward cosmetic procedures and skincare. Market participants have been focusing on the development of sustainable and eco-friendly packaging solutions in response to changing customer preferences or behavior toward packaging.

Personal Care Packaging Market Growth Drivers:

Growth of e-commerce is a primary market driver: The global e-commerce market has experienced substantial expansion, which has changed the packaging industry. There is a market for safe and aesthetically pleasing personal care packaging that may be sold online. Companies are modifying their packaging tactics to accommodate their virtual customers' inclinations, acting as a market driver.

Rising trend of personal grooming is aiding the market growth: Personal grooming and beautification regimens are becoming increasingly important as a result of urbanization and changing lifestyles. The need for a broad range of personal care products and, therefore, their packaging, is increased by this trend which is boosting growth.

Integration of technology is another market driver: Integration of technology into packaging, such as smart packaging features or QR codes for product information, improves the customer experience and fulfills the expectations of tech-savvy consumers. Packaging that improves the complete user experience, from opening to dispensing, leads to consumer happiness. User-friendly designs, ergonomic features, and straightforward packaging solutions are appreciated by consumers thus creating demand.

The rising demand for sustainable packaging alternatives is fueling market growth: With increased consumer awareness of environmental issues, there is a noticeable increase in demand for sustainable and green packaging solutions for personal care goods. The growing customer desire for green or eco-friendly packaging technologies has improved business prospects. Manufacturers have responded by developing reusable, refillable, and recyclable packaging for skincare, haircare, body care, and dental care items. The inefficient and time-consuming disintegration of plastic packaging, as well as rising landfill trash, have all led to increased demand for green packaging, bolstering market growth. As a result, major disturbances in ecological life cycles are encouraging the development of green personal care packaging solutions, which is driving market growth.

Availability of customizable packaging is boosting market growth: Customers are increasingly interested in personalized and customizable items. Packaging that allows for personalization or customization, such as distinctive artwork or personalized inscriptions, can strengthen consumer connections. Manufacturers are now providing customization as per the requirement which is eventually boosting the market growth.

List of Top Personal Care Packaging Companies:

AmPrima® PE Plus, Amcor Plc: AmPrima® PE Plus recycle-ready flow wrap provides an excellent moisture barrier and long-lasting hermetic seals to safeguard wet wipe goods without sacrificing performance. It is comprised of Mono PE film and is intended to be recycled using existing retail drop-offs or curbside recycling where accessible.

RIGID TUBES, WestRock Company: WestRock is a prominent supplier of bespoke rigid tube packaging to the premium drink, health and beauty, confectionery, and gourmet food sectors.

They are professionals in creating luxury rigid tube packaging that quickly expresses the value and quality of the goods inside.

Personal Care Packaging Market Segmentation Analysis:

Prominent growth is anticipated in the skincare sector under the application segment.

The skin care category under the application segment is poised to expand significantly and capture a major market share over the forecast period. This market is expanding because of consumers' increasing need for a variety of skincare products, including face creams, body lotions, sunscreens, cleansers, and moisturizers. The demand for skin care goods among women and Gen Z consumers is being driven by the expanding social media trends surrounding health-promoting and self-care items. Products for skin care provide several advantages, including defense against UV radiation, aging, pollution, and a host of other contaminants. The category will develop as a result of the increased lifetime value of skincare products brought about by hectic lifestyles and growing job stress.

Personal Care Packaging Market Geographical Outlook:

The North American region is expected to hold a significant share of the personal care packaging market.

The North American region is likely to capture a major market share and is anticipated to expand with a significant CAGR over the forecast period. The North American market's expansion can be linked to the thriving beauty and personal care sector, as well as the existence of important manufacturers. The region's rising demand for organic and natural beauty products is prompting producers to use sustainable packaging methods, which is boosting market expansion. The growing popularity of herbal skin care and hair care products, particularly among the Gen Z and millennial demographic groups, is driving market expansion in North America. Further, brands are experimenting with customization and personalization in packaging to engage with consumers on a more personal level which is positively influencing the market dynamics. Packaging that allows for one-of-a-kind designs or personalized inscriptions can help to strengthen the brand-consumer relationship.

Personal Care Packaging Market Segmentation

By Material Type

Metal

Glass

Plastic

Others

By Capacity

Up to 50 ml

50 to 100 ml

Greater than 100 ml

By Packaging Type

Bottles & Jars

Tubes & Stick Pack

Sachet & Pouches

Others

By Application

Skincare

Haircare

Oralcare

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others

Our Best-Performing Industry Reports:

Navigation:

Personal Care Packaging Market Scope:

Report Metric Details Total Market Size in 2026 USD 29.399 billion Total Market Size in 2031 USD 36.584 billion Growth Rate 4.47% Study Period 2021 to 2031 Historical Data 2021 to 2024 Base Year 2025 Forecast Period 2026 – 2031 Segmentation Application, Packaging Format, Capacity, Geography Geographical Segmentation North America, South America, Europe, Middle East and Africa, Asia Pacific Companies - Amcor Plc

- WestRock Company

- Mondi Group

- Sonoco Products Company

- Gerresheimer Ag

Page last updated on: September 26, 2025