Advanced Driver-Assistance System (ADAS) Market Report, Size, Share, Opportunities, And Trends By Type (Automatic Emergency Braking, Parking Assistance, Blind Spot Detection, Traffic Sign Recognition, Collision Warning, Lane Departure Warning), By Technology (Radar, LiDAR, Camera, Ultrasonic), By Vehicle Type (Passenger Cars, Commercial Vehicles), And By Geography - Forecasts From 2025 To 2030

Comprehensive analysis of demand drivers, supply-side constraints, competitive landscape, and growth opportunities across applications and regions.

Description

Advanced Driver-Assistance System (ADAS) Market Size:

The Advanced Driver-Assistance System (ADAS) market will grow at a CAGR of 25.44% from USD 31.989 billion in 2025 to USD 99.345 billion in 2030.

Advanced Driver-Assistance System (ADAS) Market Highlights:

- Enhancing vehicle safety: ADAS technologies are reducing accidents with advanced sensors.

- Driving EV integration: Electric vehicles are adopting AI-powered ADAS systems rapidly.

- Leading in North America: Advanced infrastructure is fueling ADAS market growth.

- Advancing sensor precision: Radar and LiDAR are improving obstacle detection accuracy.

- Supporting regulatory compliance: Strict safety mandates are boosting ADAS adoption globally.

- Promoting autonomous features: AI is enabling smarter lane and parking assistance.

- Reducing traffic fatalities: Collision avoidance systems are saving lives on roads.

To learn more about this report, request a free sample copy

Advanced Driver-Assistance System (ADAS) Market Trends:

The advanced driver-assistance systems (ADAS) market is driven by electronic technologies that enhance vehicle safety and driving functions. Utilizing sensors, cameras, and radars, ADAS detects obstacles, pedestrians, and blind-spot hazards, significantly reducing accidents and saving lives. Key features include adaptive cruise control, lane departure warnings, and automatic emergency braking, all contributing to improved vehicle safety and road safety.

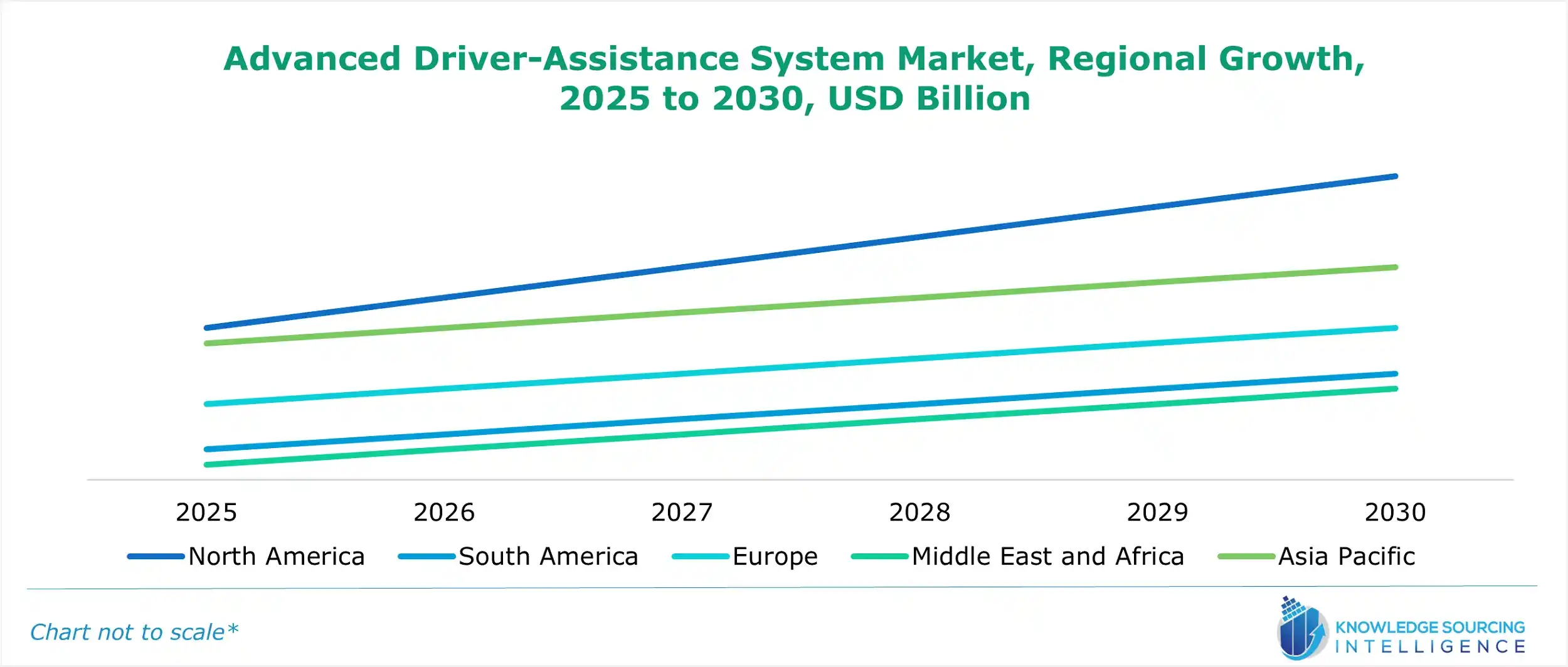

The market's growth is fueled by rising traffic accidents, stringent government regulations, and increasing demand for electric vehicles (EVs). OEMs (original equipment manufacturers) and advancements in automotive automation through R&D are major contributors. North America and Europe dominate due to strict safety mandates, while the Asia-Pacific (APAC) region is experiencing rapid growth driven by population increases, rising disposable income, and growing adoption of connected vehicles.

The integration of artificial intelligence (AI) and machine learning in ADAS enhances system efficiency, further boosting market demand. However, high costs and technological complexities may pose challenges. Continued innovation, supportive policies, and expanding EV adoption are expected to drive the ADAS market forward, with significant growth projected in the coming years, particularly in emerging markets like APAC.

Advanced Driver-Assistance System (ADAS) Market Growth Drivers:

-

Demand for accident prevention

With the number of global road accidents increasing, some countries have made it a mandatory measure for driver safety. According to the World Health Organization (WHO), approximately 1.3 million people die each year due to road traffic crashes. Furthermore, around 20-50 million more people suffer non-fatal injuries. Around 90% of these accidents happen in low-end, middle-income countries.

The prime factors in road accidents are human errors like speeding, not using helmets, seat belts, child restraints, blind spots, and unsafe vehicles. In addition, unsafe road infrastructure and inadequate laws and regulations are some of the structural reasons for accidents. However, the use of ADAS can prevent most accidents with systems like blind-spot detection, automatic emergency braking, pedestrian detection, and lane departure warning, amongst others.

-

Increasing use of electric vehicles

With the rising concern for the environment and climate change, the demand for electric vehicles and eco-friendly vehicles has increased significantly. This increase in demand is expected to positively impact the advanced driver-assistance systems market. Many nations, especially in the regions of Europe and North America, are systematically imposing a ban on the use of fossil-fueled cars. For instance, Britain has set a target to become net-zero emissions by the year 2050.

Furthermore, the European Union has imposed a ban on new petrol and diesel cars from the year 2035. In Norway, electric cars account for 60% of the monthly car sales. The country has set a target of 2025 to stop sales of fossil fuel-powered cars. In the United States of America, the state of California proposes to ban new gasoline-powered passenger cars and trucks from 2035. Moreover, the world’s most populous country, China, has a rising demand for electric vehicles.

Advanced Driver-Assistance System (ADAS) Market Restraint:

-

Cost and technological complexity as restraints

The integration of ADAS systems substantially increases the cost of vehicles, rendering them less accessible to price-sensitive consumers. This expense is particularly pronounced for advanced systems, such as those reliant on LiDAR technology.

The amalgamation of diverse sensors, software, and algorithms necessitates sophisticated engineering skills to achieve seamless integration. This intricacy often results in prolonged development periods and elevated development expenditures.

Advanced Driver-Assistance System (ADAS) Market Segment Analysis:

-

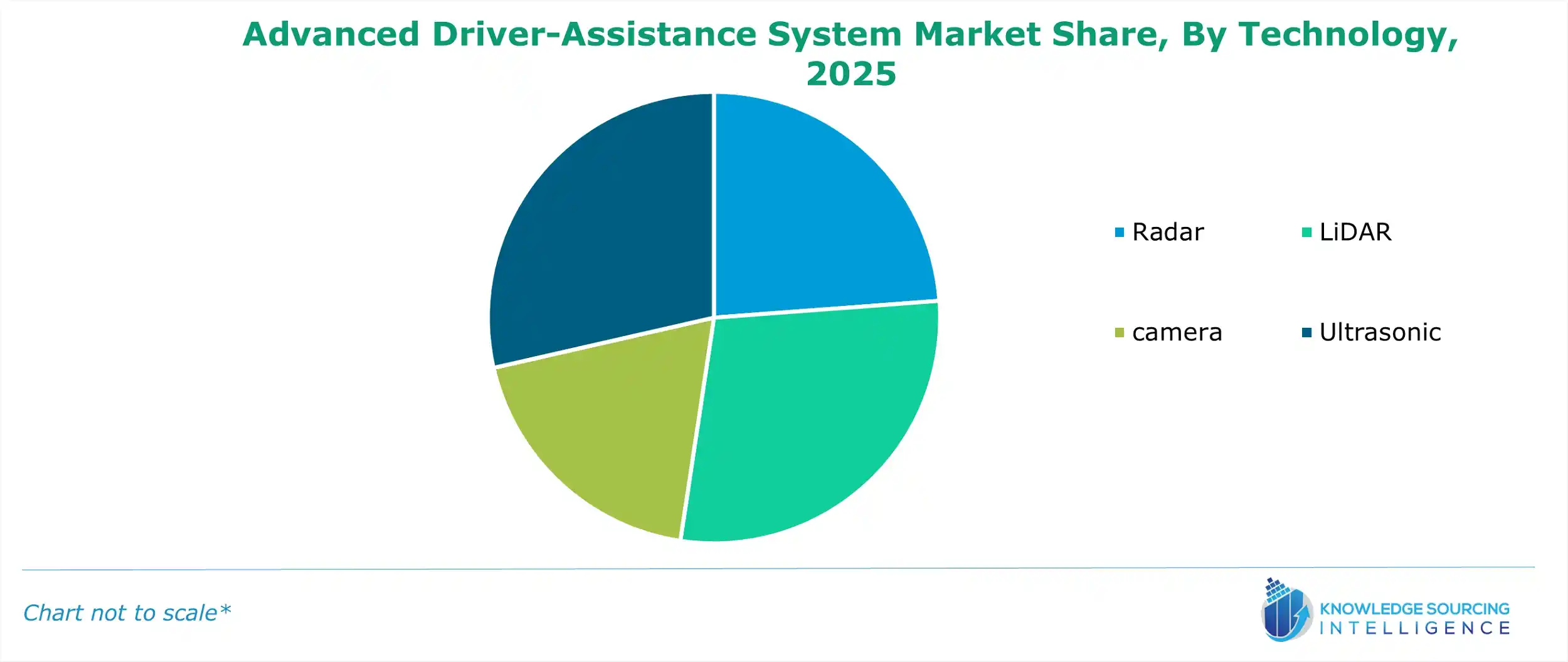

The Advanced Driver-Assistance System (ADAS) market by technology is segmented into Radar, LiDAR, Camera, and Ultrasonic technologies:

The segmentation of the Advanced Driver-Assistance System (ADAS) market by technology includes Radar, LiDAR, Camera, and Ultrasonic technologies. Radar technology encompasses features such as adaptive cruise control, blind spot detection, and collision avoidance systems.

LiDAR technology offers functionalities for Autonomous Driving Systems, lane departure warning, and parking assistance systems. Camera technology provides capabilities for lane departure warning, traffic sign recognition, pedestrian detection, and automatic emergency braking.

Ultrasonic technology involves park assist systems, blind spot detection, and object proximity sensors.

To learn more about this report, request a free sample copy

.

Advanced Driver-Assistance System (ADAS) Market Geographical Outlook:

-

North America is anticipated to hold a significant share Advanced Driver-Assistance System (ADAS) market

The Advanced Driver-Assistance System (ADAS) market is experiencing robust growth, with North America anticipated to hold a significant share due to its early adoption of innovative technologies. ADAS, encompassing features like adaptive cruise control, lane departure warnings, collision avoidance, and automated parking, enhances vehicle safety and driver convenience, driving demand in the region.

North America benefits from advanced infrastructure and superior connectivity, enabling seamless integration of ADAS functionalities. The United States and Canada lead due to strong consumer demand for safety technologies and automotive innovation. The region’s robust regulatory framework, including safety standards set by the National Highway Traffic Safety Administration (NHTSA), supports ADAS adoption. Additionally, government incentives and R&D investments in autonomous driving and smart mobility fuel market growth.

The automotive industry in North America is supported by major players like Tesla, General Motors, and Ford, who integrate AI-powered ADAS systems leveraging sensors, cameras, and radar technology. These systems enhance road safety and align with consumer preferences for connected vehicles. Urbanization and traffic congestion further drive demand for intelligent transportation solutions.

Globally, the Asia-Pacific, led by China and Japan, is a fast-growing market due to electric vehicle (EV) adoption and smart city initiatives. However, North America remains dominant, propelled by technological advancements, infrastructure readiness, and consumer trust in ADAS technologies, ensuring sustained market leadership in vehicle safety and autonomous driving.

To learn more about this report, request a free sample copy

.

Advanced Driver-Assistance System (ADAS) Market Developments:

- March 2023- Launch Tech UK unveiled its latest passenger car advanced driver assistance systems (ADAS) calibration equipment, ADAS PRO+ and ADAS Mobile. Innovations in vehicle connectivity ushered in safety enhancements and driver assistance features for motorists. With ongoing advancements in this technology, which were increasingly becoming standard in vehicles, the demand for calibration equipment had been steadily increasing.

- March 2023- BYD forged a partnership with NVIDIA to develop mainstream software-defined vehicles based on NVIDIA DRIVE. The collaboration entailed extending BYD's utilization of the NVIDIA DRIVE Orin™ centralized compute platform to a wider range of its NEVs. This enhanced partnership saw BYD expanding its adoption of DRIVE Orin across multiple models within its next-generation Dynasty and Ocean series of vehicles.

List of Top Advanced Driver-Assistance System (ADAS) Companies:

- Robert Bosch GmbH

- Continental AG

- Aptiv

- Valeo

- Autoliv Inc.

Advanced Driver-Assistance System (ADAS) Market Scope:

| Report Metric | Details |

| Market Size Value in 2025 | USD 31.989 billion |

| Market Size Value in 2030 | USD 99.345 billion |

| Growth Rate | CAGR of 25.44% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segments Covered |

|

| Companies Covered |

|

| Regions Covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Customization Scope | Free report customization with purchase |

Advanced Driver-Assistance System (ADAS) Market Segmentation:

- By Type

- Automatic emergency braking

- Parking Assistance

- Blind Spot Detection

- Traffic sign recognition

- Collision Warning

- Lane departure warning

- By Technology

- Radar

- LiDAR

- camera

- Ultrasonic

- By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Others

- North America

Frequently Asked Questions (FAQs)

Advanced Driver-Assistance System (ADAS) Market was valued at USD 31.989 billion in 2025.

The advanced driver-assistance system (ADAS) market is expected to reach a market size of USD 99.345 billion by 2030.

The global advanced driver-assistance system (ADAS) market is expected to grow at a CAGR of 25.44% during the forecast period.

North America is anticipated to hold a significant share of the Advanced Driver-Assistance System (ADAS) market.

The major factor anticipated to drive the growth of the Advanced Driver-Assistance System (ADAS) market is the increasing focus on vehicle safety and regulatory mandates.

Table Of Contents

1. INTRODUCTION

1.1. Market Overview

1.2. Market Definition

1.3. Scope of the Study

1.4. Market Segmentation

1.5. Currency

1.6. Assumptions

1.7. Base, and Forecast Years Timeline

1.8. Key benefits to the stakeholder

2. RESEARCH METHODOLOGY

2.1. Research Design

2.2. Research Process

3. EXECUTIVE SUMMARY

3.1. Key Findings

3.2. Analyst View

4. MARKET DYNAMICS

4.1. Market Drivers

4.2. Market Restraints

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

4.5. Analyst View

5. ADVANCED DRIVER-ASSISTANCE SYSTEM (ADAS) MARKET BY TYPE

5.1. Introduction

5.2. Automatic emergency braking

5.2.1. Market opportunities and trends

5.2.2. Growth prospects

5.2.3. Geographic lucrativeness

5.3. Parking Assistance

5.3.1. Market opportunities and trends

5.3.2. Growth prospects

5.3.3. Geographic lucrativeness

5.4. Blind Spot Detection

5.4.1. Market opportunities and trends

5.4.2. Growth prospects

5.4.3. Geographic lucrativeness

5.5. Traffic sign recognition

5.5.1. Market opportunities and trends

5.5.2. Growth prospects

5.5.3. Geographic lucrativeness

5.6. Collision Warning

5.6.1. Market opportunities and trends

5.6.2. Growth prospects

5.6.3. Geographic lucrativeness

5.7. Lane departure warning

5.7.1. Market opportunities and trends

5.7.2. Growth prospects

5.7.3. Geographic lucrativeness

6. ADVANCED DRIVER-ASSISTANCE SYSTEM (ADAS) MARKET BY TECHNOLOGY

6.1. Introduction

6.2. Radar

6.2.1. Market opportunities and trends

6.2.2. Growth prospects

6.2.3. Geographic lucrativeness

6.3. LiDAR

6.3.1. Market opportunities and trends

6.3.2. Growth prospects

6.3.3. Geographic lucrativeness

6.4. Camera

6.4.1. Market opportunities and trends

6.4.2. Growth prospects

6.4.3. Geographic lucrativeness

6.5. Ultrasonic

6.5.1. Market opportunities and trends

6.5.2. Growth prospects

6.5.3. Geographic lucrativeness

7. ADVANCED DRIVER-ASSISTANCE SYSTEM (ADAS) MARKET BY VEHICLE TYPE

7.1. Introduction

7.2. Passenger Cars

7.2.1. Market opportunities and trends

7.2.2. Growth prospects

7.2.3. Geographic lucrativeness

7.3. Commercial Vehicle

7.3.1. Market opportunities and trends

7.3.2. Growth prospects

7.3.3. Geographic lucrativeness

8. ADVANCED DRIVER-ASSISTANCE SYSTEM (ADAS) MARKET BY GEOGRAPHY

8.1. Introduction

8.2. North America

8.2.1. By Type

8.2.2. By Technology

8.2.3. By Vehicle Type

8.2.4. By Country

8.2.4.1. United States

8.2.4.1.1. Market Trends and Opportunities

8.2.4.1.2. Growth Prospects

8.2.4.2. Canada

8.2.4.2.1. Market Trends and Opportunities

8.2.4.2.2. Growth Prospects

8.2.4.3. Mexico

8.2.4.3.1. Market Trends and Opportunities

8.2.4.3.2. Growth Prospects

8.3. South America

8.3.1. By Type

8.3.2. By Technology

8.3.3. By Vehicle Type

8.3.4. By Country

8.3.4.1. Brazil

8.3.4.1.1. Market Trends and Opportunities

8.3.4.1.2. Growth Prospects

8.3.4.2. Argentina

8.3.4.2.1. Market Trends and Opportunities

8.3.4.2.2. Growth Prospects

8.3.4.3. Others

8.3.4.3.1. Market Trends and Opportunities

8.3.4.3.2. Growth Prospects

8.4. Europe

8.4.1. By Type

8.4.2. By Technology

8.4.3. By Vehicle Type

8.4.4. By Country

8.4.4.1. Germany

8.4.4.1.1. Market Trends and Opportunities

8.4.4.1.2. Growth Prospects

8.4.4.2. France

8.4.4.2.1. Market Trends and Opportunities

8.4.4.2.2. Growth Prospects

8.4.4.3. UK

8.4.4.3.1. Market Trends and Opportunities

8.4.4.3.2. Growth Prospects

8.4.4.4. Spain

8.4.4.4.1. Market Trends and Opportunities

8.4.4.4.2. Growth Prospects

8.4.4.5. Others

8.4.4.5.1. Market Trends and Opportunities

8.4.4.5.2. Growth Prospects

8.5. Middle East and Africa

8.5.1. By Type

8.5.2. By Technology

8.5.3. By Vehicle Type

8.5.4. By Country

8.5.4.1. Saudi Arabia

8.5.4.1.1. Market Trends and Opportunities

8.5.4.1.2. Growth Prospects

8.5.4.2. Israel

8.5.4.2.1. Market Trends and Opportunities

8.5.4.2.2. Growth Prospects

8.5.4.3. Others

8.5.4.3.1. Market Trends and Opportunities

8.5.4.3.2. Growth Prospects

8.6. Asia Pacific

8.6.1. By Type

8.6.2. By Technology

8.6.3. By Vehicle Type

8.6.4. By Country

8.6.4.1. China

8.6.4.1.1. Market Trends and Opportunities

8.6.4.1.2. Growth Prospects

8.6.4.2. Japan

8.6.4.2.1. Market Trends and Opportunities

8.6.4.2.2. Growth Prospects

8.6.4.3. India

8.6.4.3.1. Market Trends and Opportunities

8.6.4.3.2. Growth Prospects

8.6.4.4. South Korea

8.6.4.4.1. Market Trends and Opportunities

8.6.4.4.2. Growth Prospects

8.6.4.5. Others

8.6.4.5.1. Market Trends and Opportunities

8.6.4.5.2. Growth Prospects

9. COMPETITIVE ENVIRONMENT AND ANALYSIS

9.1. Major Players and Strategy Analysis

9.2. Market Share Analysis

9.3. Mergers, Acquisition, Agreements, and Collaborations

9.4. Competitive Dashboard

10. COMPANY PROFILES

10.1. Robert Bosch GmbH

10.2. Continental AG

10.3. Aptiv

10.4. Valeo

10.5. Autoliv Inc.

10.6. DENSO Corporation

10.7. Magna International Inc

10.8. HELLA GmbH & Co. KGaA

10.9. Mobileye

10.10. Delphi Automotive

List of Tables

Table 1: Research Assumptions

Table 2: Advanced Driver-Assistance System (ADAS) Market, Key Findings

Table 3: Global ADAS Market, By Type, USD Billion, 2020 to 2030

Table 4: Global ADAS Market, By Technology, USD Billion, 2020 to 2030

Table 5: Global ADAS Market, By Vehicle Type, USD Billion, 2020 to 2030

Table 6: Global ADAS Market, By Geography, USD Billion, 2020 to 2030

Table 7: North America ADAS Market, By Type, USD Billion, 2020 to 2030

Table 8: North America ADAS Market, By Technology, USD Billion, 2020 to 2030

Table 9: North America ADAS Market, By Vehicle Type, USD Billion, 2020 to 2030

Table 10: North America ADAS Market, By Country, USD Billion, 2020 to 2030

Table 11: South America ADAS Market, By Type, USD Billion, 2020 to 2030

Table 12: South America ADAS Market, By Technology, USD Billion, 2020 to 2030

Table 13: South America ADAS Market, By Vehicle Type, USD Billion, 2020 to 2030

Table 14: South America ADAS Market, By Country, USD Billion, 2020 to 2030

Table 15: Europe ADAS Market, By Type, USD Billion, 2020 to 2030

Table 16: Europe ADAS Market, By Technology, USD Billion, 2020 to 2030

Table 17: Europe ADAS Market, By Vehicle Type, USD Billion, 2020 to 2030

Table 18: Europe ADAS Market, By Country, USD Billion, 2020 to 2030

Table 19: Middle East and Africa ADAS Market, By Type, USD Billion, 2020 to 2030

Table 20: Middle East and Africa ADAS Market, By Technology, USD Billion, 2020 to 2030

Table 21: Middle East and Africa ADAS Market, By Vehicle Type, USD Billion, 2020 to 2030

Table 22: Middle East and Africa ADAS Market, By Country, USD Billion, 2020 to 2030

Table 23: Asia Pacific ADAS Market, By Type, USD Billion, 2020 to 2030

Table 24: Asia Pacific ADAS Market, By Technology, USD Billion, 2020 to 2030

Table 25: Asia Pacific ADAS Market, By Vehicle Type, USD Billion, 2020 to 2030

Table 26: Asia Pacific ADAS Market, By Country, USD Billion, 2020 to 2030

Table 27: ADAS Market, Strategy Analysis of Key Players

Table 28: ADAS Market, Mergers, Acquisitions, Agreements, and Collaborations

Table 29: Robert Bosch GmbH, Products and Services

Table 30: Continental AG, Products and Services

Table 31: Aptiv, Products and Services

Table 32: Valeo, Products and Services

Table 33: Autoliv Inc., Products and Services

Table 34: DENSO Corporation, Products and Services

Table 35: Magna International Inc, Products and Services

Table 36: HELLA GmbH & Co. KGaA, Products and Services

Table 37: Mobileye, Products and Services

Table 38: Delphi Automotive, Products and Services

List of Figures

Figure 1: Global ADAS Market Size, USD Billion, 2020 to 2030

Figure 2: Global ADAS Market Segmentation

Figure 3: Market Drivers Impact

Figure 4: Porter’s Five Forces Analysis: Bargaining Power of Suppliers

Figure 5: Porter’s Five Forces Analysis: Bargaining Power of Buyers

Figure 6: Porter’s Five Forces Analysis: Threat of New Entrants

Figure 7: Porter’s Five Forces Analysis: Threat of Substitutes

Figure 8: Porter’s Five Forces Analysis: Competitive Rivalry in the Industry

Figure 9: Global ADAS Market, Industry Value Chain Analysis

Figure 10: Global ADAS Market Share (%), By Type, 2025 and 2030

Figure 11: Global ADAS Market Attractiveness by Type, 2030

Figure 12: Global ADAS Market, By Type, Automatic Emergency Braking, USD Billion, 2020 to 2030

Figure 13: Global ADAS Market, By Type, Parking Assistance, USD Billion, 2020 to 2030

Figure 14: Global ADAS Market, By Type, Blind Spot Detection, USD Billion, 2020 to 2030

Figure 15: Global ADAS Market, By Type, Traffic Sign Recognition, USD Billion, 2020 to 2030

Figure 16: Global ADAS Market, By Type, Collision Warning, USD Billion, 2020 to 2030

Figure 17: Global ADAS Market, By Type, Lane Departure Warning, USD Billion, 2020 to 2030

Figure 18: Global ADAS Market Share (%), By Technology, 2025 and 2030

Figure 19: Global ADAS Market Attractiveness by Technology, 2030

Figure 20: Global ADAS Market, By Technology, Radar, USD Billion, 2020 to 2030

Figure 21: Global ADAS Market, By Technology, LiDAR, USD Billion, 2020 to 2030

Figure 22: Global ADAS Market, By Technology, Camera, USD Billion, 2020 to 2030

Figure 23: Global ADAS Market, By Technology, Ultrasonic, USD Billion, 2020 to 2030

Figure 24: Global ADAS Market Share (%), By Vehicle Type, 2025 and 2030

Figure 25: Global ADAS Market Attractiveness by Vehicle Type, 2030

Figure 26: Global ADAS Market, By Vehicle Type, Passenger Cars, USD Billion, 2020 to 2030

Figure 27: Global ADAS Market, By Vehicle Type, Commercial Vehicle, USD Billion, 2020 to 2030

Figure 28: Global ADAS Market Share (%), By Geography, 2025 and 2030

Figure 29: Global ADAS Market Attractiveness by Geography, 2030

Figure 30: North America ADAS Market, USD Billion, 2020 to 2030

Figure 31: North America ADAS Market Share (%), By Country, 2025 and 2030

Figure 32: North America ADAS Market Attractiveness, By Country, 2030

Figure 33: United States ADAS Market, USD Billion, 2020 to 2030

Figure 34: Canada ADAS Market, USD Billion, 2020 to 2030

Figure 35: Mexico ADAS Market, USD Billion, 2020 to 2030

Figure 36: South America ADAS Market, USD Billion, 2020 to 2030

Figure 37: South America ADAS Market Share (%), By Country, 2025 and 2030

Figure 38: South America ADAS Market Attractiveness, By Country, 2030

Figure 39: Brazil ADAS Market, USD Billion, 2020 to 2030

Figure 40: Argentina ADAS Market, USD Billion, 2020 to 2030

Figure 41: Rest of South America ADAS Market, USD Billion, 2020 to 2030

Figure 42: Europe ADAS Market, USD Billion, 2020 to 2030

Figure 43: Europe ADAS Market Share (%), By Country, 2025 and 2030

Figure 44: Europe ADAS Market Attractiveness, By Country, 2030

Figure 45: Germany ADAS Market, USD Billion, 2020 to 2030

Figure 46: France ADAS Market, USD Billion, 2020 to 2030

Figure 47: UK ADAS Market, USD Billion, 2020 to 2030

Figure 48: Spain ADAS Market, USD Billion, 2020 to 2030

Figure 49: Rest of Europe ADAS Market, USD Billion, 2020 to 2030

Figure 50: Middle East and Africa ADAS Market, USD Billion, 2020 to 2030

Figure 51: Middle East and Africa ADAS Market Share (%), By Country, 2025 and 2030

Figure 52: Middle East and Africa ADAS Market Attractiveness, By Country, 2030

Figure 53: Saudi Arabia ADAS Market, USD Billion, 2020 to 2030

Figure 54: Israel ADAS Market, USD Billion, 2020 to 2030

Figure 55: Rest of Middle East and Africa ADAS Market, USD Billion, 2020 to 2030

Figure 56: Asia Pacific ADAS Market, USD Billion, 2020 to 2030

Figure 57: Asia Pacific ADAS Market Share (%), By Country, 2025 and 2030

Figure 58: Asia Pacific ADAS Market Attractiveness, By Country, 2030

Figure 59: China ADAS Market, USD Billion, 2020 to 2030

Figure 60: Japan ADAS Market, USD Billion, 2020 to 2030

Figure 61: India ADAS Market, USD Billion, 2020 to 2030

Figure 62: South Korea ADAS Market, USD Billion, 2020 to 2030

Figure 63: Rest of Asia Pacific ADAS Market, USD Billion, 2020 to 2030

Figure 64: Global ADAS Market Share Analysis (2024)

Figure 65: Robert Bosch GmbH, Financials, 2022-2024

Figure 66: Robert Bosch GmbH, Segment Revenues, 2022-2024

Figure 67: Robert Bosch GmbH, Geographical Revenue, 2022-2024

Figure 68: Robert Bosch GmbH, Key Developments

Figure 69: Continental AG, Financials, 2022-2024

Figure 70: Continental AG, Segment Revenues, 2022-2024

Figure 71: Continental AG, Geographical Revenue, 2022-2024

Figure 72: Continental AG, Key Developments

Figure 73: Aptiv, Financials, 2022-2024

Figure 74: Aptiv, Segment Revenues, 2022-2024

Figure 75: Aptiv, Geographical Revenue, 2022-2024

Figure 76: Aptiv, Key Developments

Figure 77: Valeo, Financials, 2022-2024

Figure 78: Valeo, Segment Revenues, 2022-2024

Figure 79: Valeo, Geographical Revenue, 2022-2024

Figure 80: Valeo, Key Developments

Figure 81: Autoliv Inc., Financials, 2022-2024

Figure 82: Autoliv Inc., Segment Revenues, 2022-2024

Figure 83: Autoliv Inc., Geographical Revenue, 2022-2024

Figure 84: Autoliv Inc., Key Developments

Figure 85: DENSO Corporation, Financials, 2022-2024

Figure 86: DENSO Corporation, Segment Revenues, 2022-2024

Figure 87: DENSO Corporation, Geographical Revenue, 2022-2024

Figure 88: DENSO Corporation, Key Developments

Figure 89: Magna International Inc, Financials, 2022-2024

Figure 90: Magna International Inc, Segment Revenues, 2022-2024

Figure 91: Magna International Inc, Geographical Revenue, 2022-2024

Figure 92: Magna International Inc, Key Developments

Figure 93: HELLA GmbH & Co. KGaA, Financials, 2022-2024

Figure 94: HELLA GmbH & Co. KGaA, Segment Revenues, 2022-2024

Figure 95: HELLA GmbH & Co. KGaA, Geographical Revenue, 2022-2024

Figure 96: HELLA GmbH & Co. KGaA, Key Developments

Figure 97: Mobileye, Financials, 2022-2024

Figure 98: Mobileye, Segment Revenues, 2022-2024

Figure 99: Mobileye, Geographical Revenue, 2022-2024

Figure 100: Mobileye, Key Developments

Figure 101: Delphi Automotive, Financials, 2022-2024

Figure 102: Delphi Automotive, Segment Revenues, 2022-2024

Figure 103: Delphi Automotive, Geographical Revenue, 2022-2024

Figure 104: Delphi Automotive, Key Developments

Companies Profiled

Robert Bosch GmbH

Continental AG

Aptiv

Valeo

Autoliv Inc.

DENSO corporation

Magna International Inc

HELLA GmbH & Co. KGaA

Delphi Automotive

Related Reports

| Report Name | Published Month | Download Sample |

|---|---|---|

| Video Surveillance Market Report: Size, Share, Forecast 2030 | April 2025 | |

| Collision Avoidance System Market Trends 2025-2030 | Free Sample | April 2025 | |

| Radar Security Market Insights: Size, Share, Trends, Forecast 2030 | July 2025 | |

| Dash Cam Market Insights: Size, Share, Trends, Forecast 2030 | January 2025 |