Report Overview

3D Printed Nanocellulose Market Highlights

3D Printed Nanocellulose Market Size:

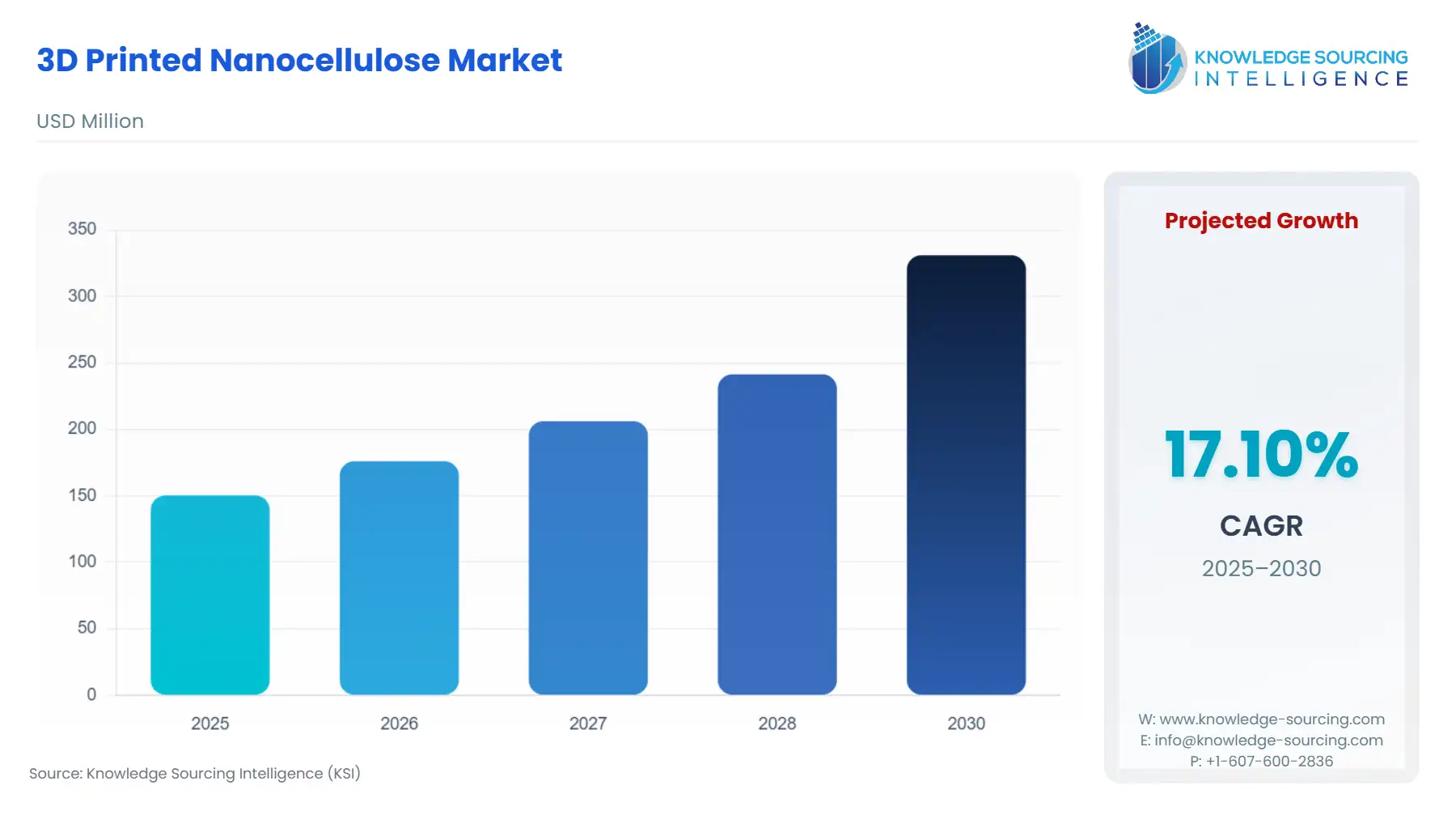

The 3D Printed Nanocellulose Market is projected to rise at a CAGR of 17.10%, reaching USD 331.111 million in 2030 from USD 150.384 million in 2025.

The 3D Printed Nanocellulose Market represents a high-growth convergence point between advanced materials science and additive manufacturing. Nanocellulose, derived from abundant renewable resources, offers unique attributes such as exceptional mechanical strength, high surface area, and tunable rheology, positioning it as a transformative bio-ink material. This market is shifting from purely academic research to commercial-scale applications, driven by an imperative for sustainable, high-performance alternatives to fossil-fuel-derived polymers. Its commercial traction is particularly pronounced in high-value, high-specification sectors like regenerative medicine and flexible electronics, where its unique physical and biological properties create entirely new product possibilities unattainable with conventional materials.

3D Printed Nanocellulose Market Analysis:

- Growth Drivers

The global push for biodegradable and renewable materials acts as a powerful catalyst, directly increasing demand for nanocellulose-based bio-inks, especially in packaging and composites, where it functions as a lightweight, high-strength additive. The increasing adoption of 3D bioprinting across biomedical research and drug development labs also substantially propels market expansion. Nanocellulose's superior biocompatibility and adjustable rheological properties make it an ideal, non-toxic scaffolding material, facilitating the precise, layer-by-layer fabrication of complex cellular structures for tissue models and implants. Furthermore, continuous process innovation that reduces the energy consumption and overall cost of nanocellulose fibrillation is making the raw material economically feasible for broader industrial applications, thus lowering the barrier to entry for 3D printing manufacturers.

- Challenges and Opportunities

The primary constraint facing market expansion is the inherent challenge of scaling up nanocellulose production from pilot to industrial volumes while maintaining consistent quality and low-cost input, which creates price pressure on bio-ink manufacturers. A key opportunity, however, lies in the functionalization of nanocellulose. Chemical modification techniques, such as the incorporation of conductive materials, unlock demand in the electronics sector for flexible sensors and energy storage components. Another significant opportunity is the development of standardized 3D printing protocols and equipment specifically optimized for nanocellulose inks. Establishing these standards will mitigate the current need for highly specialized printing systems, accelerating the commercialization pathway for advanced nanocellulose products.

- Raw Material and Pricing Analysis:

The 3D Printed Nanocellulose Market is centered on a physical product: the bio-ink or composite material. The primary raw material, cellulosic pulp, is abundant, sourced mainly from wood and other biomass. This abundance provides a long-term supply stability advantage over petroleum-based alternatives.

However, the high capital and energy intensity of the fibrillation processes—specifically, mechanical grinding or chemical treatment for Nanofibrillated Cellulose (NFC) and acid hydrolysis for Nanocrystalline Cellulose (NCC)—represent a major cost component. Currently, the pricing of high-purity, print-ready nanocellulose bio-inks is situated at a premium compared to traditional synthetic polymers, limiting high-volume adoption. Future price normalization depends critically on commercializing more energy-efficient extraction technologies and achieving continuous, high-volume production scale, directly impacting end-product affordability and broader market expansion.

- Supply Chain Analysis:

The nanocellulose supply chain is fragmented but vertically integrated in some core producer regions. Production hubs are typically located near major forestry operations, with significant centers in North America (Canada, US), Northern Europe (Finland, Sweden), and Asia-Pacific (Japan, China), leveraging regional wood pulp resources.

A critical logistical complexity stems from the need to transport Nanofibrillated Cellulose (NFC) as a high-water-content hydrogel, which increases shipping weight and cost. To mitigate this, companies are focusing on developing high-solids, transport-efficient intermediate products, such as hydrophobic or dried powders, for easier distribution to dispersed 3D printing manufacturers globally. The supply chain's efficiency hinges on collaboration between pulp producers and specialty chemical companies that conduct the final rheological modifications necessary for 3D printability.

3D Printed Nanocellulose Market Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| European Union (EU) | Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) Regulation & Biocidal Products Regulation (BPR) | REACH requires extensive toxicological and safety data for nanomaterials, including nanocellulose. This regulatory hurdle elevates the cost and time for product commercialization, slowing market entry but simultaneously creating demand for highly characterized, safe materials for biomedical use. |

| United States (US) | Food and Drug Administration (FDA) & Environmental Protection Agency (EPA) / Toxic Substances Control Act (TSCA) | The FDA's regulatory framework for Medical Devices (specifically 3D bioprinted scaffolds) and Drug Delivery Systems necessitates rigorous biocompatibility testing for nanocellulose-based products. This regulatory stringency drives demand for Bacterial Nanocellulose (BNC), which already exhibits proven clinical-grade purity and safety profiles. |

| Asia-Pacific (Japan) | Ministry of Economy, Trade and Industry (METI) | METI's long-term material science initiatives and government-industry consortiums actively promote nanocellulose industrialization. This supportive regulatory and funding environment stimulates local production and increases regional demand by lowering R&D risks for automotive and packaging applications. |

3D Printed Nanocellulose Market Segment Analysis:

- By End-User: Biomedical & Healthcare The Biomedical & Healthcare sector is the most demand-intensive application for 3D printed nanocellulose. The material's primary growth driver is its unique confluence of properties, namely non-toxicity, inherent biodegradability, and excellent mechanical similarity to native extracellular matrices. This makes it an indispensable bio-ink for high-precision tissue engineering scaffolds. Its necessity spikes directly in the areas of orthopedic and soft tissue repair, where researchers leverage its structural integrity to print complex, porous structures that support cell proliferation and differentiation. Furthermore, the capacity of nanocellulose to form stable hydrogels at low concentrations, coupled with its shear-thinning behavior, makes it perfectly suited for extrusion-based bioprinting of drug delivery systems, allowing for the precise encapsulation and controlled release of active pharmaceutical ingredients. The stringent regulatory standards in this sector, particularly for implantables, further create a premium demand for high-purity, animal-free nanocellulose, such as Bacterial Nanocellulose (BNC).

- By Nanocellulose Type: Bacterial Nanocellulose (BNC) Bacterial Nanocellulose (BNC) drives specific demand within the market due to its distinct, superior properties compared to plant-derived alternatives (NFC, NCC). BNC is synthesized by specific bacteria, leading to a highly pure cellulose structure free from lignin and hemicelluloses, which are typically found in wood pulp. This purity is the core growth catalyst, as it minimizes the need for harsh chemical purification steps and positions BNC as the material of choice for sensitive biomedical applications. Its ultrafine fibril network and high crystallinity translate into exceptional mechanical strength and water-holding capacity, creating a strong demand for BNC as an advanced material for wound dressings and temporary skin substitutes. The material's ability to be manufactured in situ into specific shapes or membranes, combined with its favorable rheology for bioprinting, further isolates its demand profile in high-value medical device manufacturing and advanced laboratory research.

Geographical Analysis:

- US Market Analysis (North America) The US market for 3D printed nanocellulose is dominated by robust R&D spending from both academic institutions and private biotechnology firms, creating a high, early-stage demand. The existence of advanced bioprinting infrastructure and a strong venture capital environment, particularly in California and Massachusetts, encourages rapid prototyping and commercialization of new nanocellulose bio-inks for complex tissue models and diagnostics. Regulatory support, such as the USDA BioPreferred Program, subtly promotes the adoption of bio-based materials, further stimulating demand in the packaging and construction sectors.

- Brazil Market Analysis (South America) Brazil's market is characterized by a strong domestic forestry industry and agricultural base, providing an abundant, low-cost supply of raw cellulosic biomass. However, market expansion is currently constrained by lower capital investment in advanced manufacturing technologies like 3D printing. The primary growth catalyst remains in the Nanofibrillated Cellulose (NFC) segment, which is leveraged as a rheology modifier and strength enhancer in coatings, paints, and lower-value commodity composite materials. The imperative to develop sustainable domestic materials serves as a future demand driver for technical paper and packaging applications.

- Germany Market Analysis (Europe) Germany is a European demand hub, propelled by its world-leading automotive and industrial manufacturing sectors, which have a strong focus on lightweighting and sustainable composites. Strict EU directives on carbon emissions and the eventual phase-out of certain single-use plastics directly increase demand for high-performance nanocellulose composites to replace traditional plastics in auto parts. Furthermore, a strong chemical and materials science heritage supports the sophisticated functionalization and production of specialized Nanocrystalline Cellulose (NCC) for high-end industrial adhesives and structural components.

- Saudi Arabia Market Analysis (Middle East & Africa) The Saudi Arabian market is currently nascent, with demand largely confined to government-funded research institutes and new, large-scale industrial projects under the national economic diversification plans. The primary requirement is focused on environmental applications, such as advanced filtration membranes for water treatment, where nanocellulose’s high surface area and absorption properties are critical. The lack of a mature, localized supply chain for high-purity nanocellulose bio-inks necessitates reliance on imports, which constrains the rapid development of a domestic 3D printing ecosystem.

- Japan Market Analysis (Asia-Pacific) Japan exhibits a mature nanocellulose market profile, driven by decades of consistent investment from major paper and chemical corporations. Its necessity is exceptionally strong in the Electronics sector, leveraging nanocellulose's high transparency and low thermal expansion for flexible displays and advanced electronic substrates. The need for Nanofibrillated Cellulose (NFC), particularly phosphorylated CNF developed by local companies, is also robust in consumer goods for high-viscosity products like cosmetics and paints, where its unique rheological properties are valued. This market is characterized by a strong governmental and corporate commitment to biomass utilization.

3D Printed Nanocellulose Market Competitive Environment and Analysis:

The competitive landscape is defined by large pulp and paper companies leveraging decades of cellulose expertise and specialized biotechnology firms focused on high-value, low-volume biomedical applications. Competition centers on production cost reduction, intellectual property surrounding fibrillation and functionalization, and establishing supply chain partnerships with 3D printer manufacturers.

- UPM UPM (UPM-Kymmene Corporation) is strategically positioned as a major integrated player in the market, leveraging its immense scale in forest resources and pulp production to ensure supply security. The company focuses on the high-value Biomedical sector with products like GrowInk and GrowDex, which are non-animal-derived nanocellulose hydrogels engineered for 3D cell culture and bioprinting. Their strategy involves rigorous quality management, exemplified by ISO 13485 certification for their nanofibrillar cellulose, which directly addresses the stringent quality demands of the biomedical segment. UPM's move into high-purity, clinical-grade materials creates a competitive moat against general pulp producers.

- Oji Holdings Corporation Oji Holdings Corporation, a leading player in the Asia-Pacific region, concentrates its strategy on technological differentiation in the Nanofibrillated Cellulose (NFC) segment. Oji utilizes a proprietary phosphorylation method to efficiently manufacture high-quality CNF with enhanced transparency and thixotropy, exemplified by products like AUROVISCO (CNF Slurry) and AUROVEIL (CNF Sheet). Their focus is on high-performance industrial applications, including lightweight composites for the automotive sector and advanced paper packaging, positioning them to capture demand in markets seeking replacements for carbon black and plastic barriers.

- CELLINK (BICO Group AB) CELLINK is a pure-play bioconvergence company that strategically targets the 3D bioprinting segment. Their core positioning is in developing and commercializing bio-inks and 3D bioprinters, making them a crucial downstream customer for nanocellulose raw material suppliers. Their product portfolio includes Nanofibrillated Cellulose (NFC) bio-ink, often in partnership with raw material producers like UPM, demonstrating a strategy of collaborating to ensure a stable supply of high-purity, pre-validated bio-materials for their installed base of bioprinters. This focus on the final printable product accelerates R&D and clinical translation for end-users.

3D Printed Nanocellulose Market Developments:

- October 2024: UPM Biomedicals launched FibGel™, an injectable nanofibrillar cellulose hydrogel specifically designed for permanent implantable medical devices. The product is manufactured from birch wood cellulose and water under ISO 13485 standards, directly addressing the demand for a stable, non-degradable, and animal-free material solution for soft tissue repair and orthopedics.

- April 2024: Oji Holdings Corporation completed the acquisition of Walki Holding Oy, a Finnish company specializing in sustainable packaging materials. This strategic M&A activity directly expands Oji's capacity and technological portfolio in environmentally friendly paper and barrier packaging, increasing the internal demand for Oji's nanocellulose as a key material component in its newly integrated sustainable packaging segment.

- February 2024: Researchers from Chalmers University of Technology and the Wallenberg Wood Science Center announced the successful upscaling and testing of a 3D-printed hydrogel material made of nanocellulose and algae for green architectural applications. This development demonstrates a novel capacity addition, proving the material's viability when dried for large-scale construction components such as room dividers and wall panels using much less energy than conventional methods.

3D Printed Nanocellulose Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 150.384 million |

| Total Market Size in 2031 | USD 331.111 million |

| Growth Rate | 17.10% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Nanocellulose Type, 3D Printing Type, End-User Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

3D Printed Nanocellulose Market Segmentation:

- BY NANOCELLULOSE TYPE

- Bacterial Nanocellulose (BNC)

- Nanofibrillated Cellulose (NFC)

- Nanocrystalline Cellulose (NCC)

- BY 3D PRINTING TYPE

- Stereolithography (SLA)

- Selective Laser Sintering (SLS)

- Fused Deposition Modeling (FDM)

- Digital Light Process (DLP)

- Multi Jet Fusion (MJF)

- Others

- BY END-USER INDUSTRY

- Food and Packaging

- Biomedical & Healthcare

- Electronics

- Automotive

- Others

- BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others