Report Overview

5G Active Antenna Unit Highlights

5G Active Antenna Unit (AAU) Market Size:

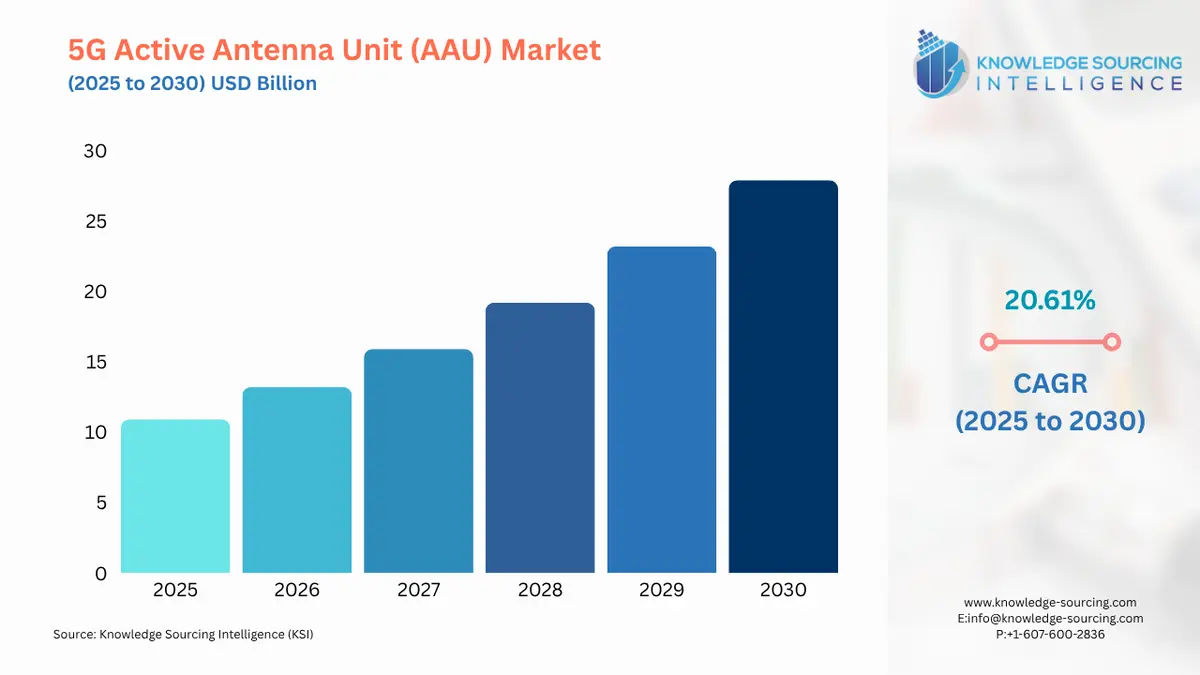

The 5G active antenna unit (AAU) market will grow from USD 10.948 billion in 2025 to USD 27.942 billion in 2030 at a CAGR of 20.61%.

5G Active Antenna Unit (AAU) Market Growth Drivers:

- Favorable investments and partnerships in Massive MIMO are propelling the market expansion.

Massive MIMO (Multiple-Input Multiple-Output) forms a core component of 5G and 4G/LTE networks, offering better network coverage by improving the average throughput, cell edge, and spectral efficiency. The boom in wireless high-speed connectivity demand is simultaneously driving the demand for modern network infrastructure, thereby positively impacting the massive MIMO scope of usage.

Market players to address the growing 5G connectivity demand are investing in new product developments and strategic collaboration with telecom operators, for instance, in February 2024, Ericsson announced that the company achieved the milestone of deploying 100,000 massive MIMO 5G radios for Airtel across the latter’s 12 sites in India. The company shares 25 years of partnership with Ericsson, and ever since its 5G services launch, both parties have been working to accelerate 5G deployment.

Consequently, active business initiatives such as investments, expansion of product offerings, and partnerships can be witnessed owing to their increased benefits. For instance,

- In June 2024, NEC Corporation developed a compact millimeter-wave distributed antenna by building a radio-over-fiber system. The antenna's cost-effectiveness and ability to transmit high-frequency signals make it ideal for underground malls, high-rise buildings, indoor facilities, factories, and other obstacle-laden environments.

- In February 2024, Mavenir expanded its “OpenBeam” portfolio by launching next-generation “mMIMO 32TRX Active Antenna Units (AAUs)”. These offer exceptional energy efficiency and are designed to support Uplink Performance Improvement, which enables operators to minimize their latency and bandwidth, especially in urban areas.

Increasing Data Traffic

The transition from 4G to 5G has propelled the overall data traffic, thereby increasing the sector and positively impacting the demand for base station antennae to bolster the effective transmission of traffic to the airwaves. The mobile data traffic is on the boom, and with the increase in user net-surging rate, followed by the growing 5G subscription, the overall volume will witness an upward trajectory. According to Ericsson’s “Mobility Report”, by subscription, 5G will be the leading mobile access technology by 2028. By 2029, the global subscription will account for 58% of the total mobile subscriptions, with overall strength reaching up to 5.3 billion.

Major economies, namely the United States, China, and the European Union have shown massive early adoption of advanced network infrastructure to bolster 5G deployments and are expected to witness significant growth in subscription rates in the coming years. According to the Mobile Economy China 2024, by 2030, 5G technology will add up to US$260 billion to China’s GDP, accounting for 23% of the overall annual economic impact of smartphones & mobiles in the country’s economy.

5G Active Antenna Unit (AAU) Market Geographical Outlook:

The global 5G AAU market comprises major countries undertaking various measures to secure their 5G network. Consequently, many nations have undertaken multiple steps that have complemented the overall market growth. For instance:

|

DATE |

TYPE |

DETAILS |

|

February 2023 |

Partnership |

Nokia won a 10-year extension over its existing 5G network deal with Antina Pte, enabling the former to deploy its new 5G standalone network in Singapore. The other associated products include massive MIMO adaptive antennas, 5G base stations, and dual-band remote radio heads ( RRH) |

|

August 2022 |

Partnership |

China Unicom Beijing, in collaboration with Huawei, commercialized the latter’s “64T64R MetaAAU” in the Tong Zhou district, where the demand for 5G services is constantly rising. The breakthrough technology would meet the requirements for developing gigabit high-quality 5G networks. |

List of Top 5G Active Antenna Unit (AAU) Companies:

Some of the leading players in the market include Huawei and ZTE, among others. The product offerings of the major corporation include the following:

|

COMPANY NAME |

PRODUCT NAME |

DESCRIPTION |

|

Huawei |

64T64R MetaAAU |

The product is an upgrade over Huawei’s “MetaAAU” series that adopts ELAA (Extremely Large Active Antenna) technology for optimal performance. The massive MIMO solution delivers strong coverage by providing a high-quality gigabit 5G network. |

|

Nokia |

AirScale Massive MIMO radios |

Nokia’s “AirScale Massive MIMO” radios portfolio provides a diverse range of products supporting various frequencies. It is designed for network performance, energy efficiency, and space, thereby facilitating the rolling out of a high-performance 5G service. The portfolio covers products under both 64TRX and 32TRX configurations. |

5G Active Antenna Unit (AAU) Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| 5G Active Antenna Unit (AAU) Market Size Value in 2025 | US$10.948 billion |

| 5G Active Antenna Unit (AAU) Market Size Value in 2030 | US$27.942 billion |

| Growth Rate | CAGR of 20.61% from 2025 to 2030 |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segments Covered |

|

| Companies Covered |

|

| Regions Covered | Americas, Europe, Middle East and Africa, Asia Pacific |

| Customization Scope | Free report customization with purchase |

5G Active Antenna Unit (AAU) Market Segmentation:

- By Architecture

- Antenna Unit (AU)

- Radio Unit (RU)

- By Band

- Sub-6 GHz

- mmWave

- By Deployment

- Urban

- Rural

- By Geography

- Americas

- United States

- Others

- Europe, Middle East, and Africa

- Germany

- UK

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Others

- Americas