Report Overview

5G NR RAN Market Highlights

5G NR RAN Market Size:

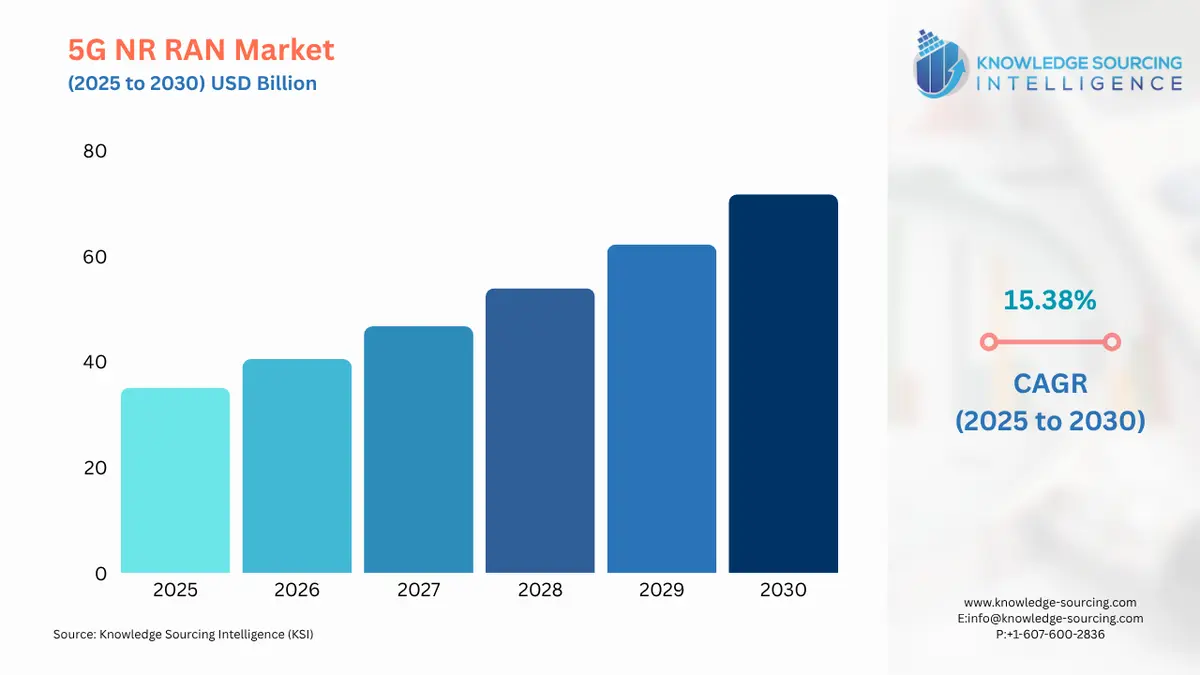

The 5G NR RAN market is expected to grow at a CAGR of 15.38% from US$35.079 billion in 2025 to US$71.720 billion by 2030.

5G NR RAN Market Trends:

Some of the factors driving the global 5G NR RAN market growth include key organizations placing more emphasis on research and development activities and the increasing demand for low-latency bandwidth connections. Additionally, the market will grow during the forecast period due to the strong deployment of a 5G radio access network (RAN) with numerous small cells and macrocell base stations worldwide.

To lower overall infrastructure costs and network complexity, mobile network operators (MNOs) and network service providers are rapidly adopting centralized RAN and virtual RAN (VRAN). Additionally, the RAN allows businesses and mobile network providers using private 4G or private 5G to provide network-slicing solutions. These solutions allocate resources to specific businesses so that they can divide network usage within a public mobile network. Due to users' preference for 5G RAN solutions and technological advancements, the industry is growing significantly.

Further, the industry participants are forming strategic alliances and working together to expand the market for their goods and services and their availability across a range of geographies. For instance, in June 2023, Intel Corporation announced its strategic agreement with Telefonaktiebolaget LM Ericsson and Hewlett-Packard Enterprise Development LP. The companies planned to utilize Intel vRAN Boost technology to demonstrate Ericsson’s Cloud RAN solution on 4th generation Intel Xeon Scalable processors.

This achievement marks a significant milestone in the overall total marketing of an HPE ProLiant DL110 server-based cloud RAN solution. This joint effort will enhance network capacity, improve greater efficiency in terms of energy consumption, and provide greater flexibility and scalability for communication service providers.

One??? of the main factors driving the 5G NR RAN market is the exponential growth in global data consumption and the increasing demand for digital services that require substantial bandwidth. The rising popularity of smartphones, high-definition streaming, cloud gaming, virtual reality (VR), augmented reality (AR), and video conferencing has made it essential for mobile networks to deliver faster speeds and more stable connections than ever before. Existing 4G/LTE networks are struggling to keep up with this massive increase in traffic, especially at peak times or in highly populated areas of ???cities. The??? International Telecommunication Union (ITU) projects that there will be 5.5 billion internet users by 2024, representing 68% of the world’s population. Thus, the number of people using the Internet has risen from 53% in 2019, with 1.3 billion people estimated to have gained internet access during that ???period.

5G NR RAN Market Growth Drivers:

- Booming 5G Deployment

The rise in popularity of modern communication networks has resulted in the rapid adoption and deployment of 5G technology, along with a growing demand for high-speed bandwidth. Large countries are heavily investing in network construction and implementing the necessary plans. As a result, rising expenditures for 5G technology are also evident. In October 2023, the Minister of Innovation, Science and Industry, as a way of supporting 5G deployment in rural areas, announced “The Spectrum Outlook 2023 to 2027”. Meanwhile, the 3800 MHz auction took place in October 2023 as expected, marking it as the third to enable 5G.

In 2028, 5G is expected to outpace other forms of mobile access technologies in terms of subscriptions. Nearly 5.6 billion subscriptions are projected by 2029, reflecting 60% of all mobile subscriptions. Projections show that North America will account for approximately 90% of 5G penetration by 2029, while the Gulf Cooperation Council (GCC) will rank second at 89% and Western Europe will occupy the third spot at 86%.

Globally,??? the expansion of 5G is still ongoing. Over 340 networks have been deployed worldwide. In 2024, the global 5G coverage of the population has increased by 55 percent. The coverage is expected to grow from 45 percent in 2024 to about 85 percent by 2030 for the area outside of mainland ???China.

Moreover, NR RAN helps manage resources across radio locations and offers low latency with seamless connectivity, mobility, and optimal network security. The growing 5G deployment is expected to increase demand for RANs. Thus, it creates a connection between the user's devices, such as laptops and smartphones, and the main network, eliminating superfluous network complexity that would slow down internet speed.

- Advancements in Technology

Technological advancements are further driving the 5G NR RAN market ahead. Major innovations such as massive MIMO, beamforming, and carrier aggregation are significantly expanding network capacity and coverage in dense areas in urban regions. Network slicing, which will be achieved through 5G NR RAN, offers operators opportunities to create varied network slices for applications ranging from IoT to AR/VR. Edge computing enables reduced latency and real-time applications based on 5G NR RAN.

In addition, AI and ML algorithms are further enhancing the performance of the network and automating tasks. Cloud-native technologies are further driving the adoption of 5G NR RAN, thereby offering flexible and scalable network deployments. Such technological advancements are together pushing the demand for 5G NR RAN solutions since they allow operators to offer better network performance, innovative services, and operational efficiency.

In addition, AI and ML algorithms are further enhancing the performance of the network and automating tasks. Cloud-native technologies are further driving the adoption of 5G NR RAN, thereby offering flexible and scalable network deployments. Such technological advancements are together pushing the demand for 5G NR RAN solutions since they allow operators to offer better network performance, innovative services, and operational efficiency.

5G NR RAN Market Segmentation Analysis

- By Technology: Massive MIMO

The global 5G NR RAN market, by technology, has been segmented into massive MIMO and non-massive MIMO. Massive Multiple-Input Multiple-Output (Massive MIMO) is a highly significant technology in today’s wireless communications, particularly for the 5G New Radio (NR) RAN. This technology employs a large number of antennas, usually 64, 128, or even more, connected to base stations to transmit and receive signals to and from multiple users at the same time. Massive MIMO is a major growth driver in the 5G NR RAN Market, as it helps address the challenges posed by limited frequency spectrum available for communication and the ever-increasing data needs of applications such as the IoT, AR/VR, self-driving cars, and fixed wireless access (FWA). Its implementation has also resulted in the hardware investments in advanced radio units (RUs), antennas, and baseband units (BBUs), contributing to the creation of a multi-billion-dollar market ecosystem.

According to the latest predictions of Ericsson's report entitled 'Mobile subscriptions outlook 2025', the global mobile data traffic is expected to grow exponentially. By 2030, 5G subscriptions are estimated to account for two-thirds of all subscriptions. Moreover, the number of 5G subscriptions is estimated to increase from 2.9 billion in 2025 to 6.3 billion in 2030. This segment is expected to grow as this technology supports 5G, wireless densification of the smart cities, automation of industries, and FWA, which has significantly reduced last-mile expenses, as evidenced by Reliance Jio's AirFiber trials of 2025.

In addition, Massive MIMO is gaining recognition as a key technology in this market because of its compatibility with Open RAN, Cloud RAN, and AI/ML, which enable vendors to not only co-exist but also save energy by sharing resources. Moreover, the companies in the industry are clearing the major barriers to Massive MIMO adoption, such as supply chain vulnerabilities, cost pressures, and sustainability demands. For instance, Tejas Networks on October 8, 2025, introduced its 64T64R Massive MIMO radio, designed in India and known as Ojas64, during the India Mobile Congress 2025 event in New Delhi. It offers 320 W output power due to an integrated high-performance 5G macro radio, supporting multi-gigabit speeds and providing double-digit spectral efficiency with a considerable reduction in the carbon footprint.

5G NR RAN Market Geographical Outlook:

- Americas: the US

Geography-wise, the market of 5G NR RAN is divided into the Americas, Europe, the Middle East, and Africa, and the Asia Pacific. The increasing demand for modern communication networks and high-speed bandwidth, and rising investments in 5G technology are major factors boosting market growth in the projected period. For instance, 5G Americas is invested in developing a connected wireless community while leading 5G development for all the Americas.

Strategic partnership and collaboration among the 5G NR RAN players in the United States NR RAN market are expected to propel the market growth in the projected period. For instance, in March 2025, Qualcomm Technologies, Inc. announced that its Dragonwing Cellular Infrastructure platforms for 5G Open RAN (O-RAN) solutions are gaining significant momentum with leading network operators and infrastructure providers worldwide. Viettel, Vietnam's largest mobile network operator, has deployed a live 5G O-RAN Massive MIMO network using Dragonwing Cellular Infrastructure platforms. In addition, NTT DOCOMO, INC., Japan's largest mobile network operator, is using the high performance and power efficiency of Qualcomm Dragonwing X100 Accelerator Cards for its nationwide 5G vRAN network deployment.

Additionally, the growing deployment of 5G is a major market driver, as NR RAN helps provide low latency, smooth mobility, connectivity, and ultimate network security. For instance, according to CTIA, by the end of 2023, the U.S. had nearly 216 million active 5G devices, a 34% increase over 2022.

Moreover, U.S. wireless connections continue to grow, reaching 579M in 2024. 5G devices, therefore, make up nearly half of these connections, up from 39% in 2023. Ranging from smartwatches and smartphones to environmental sensors and autonomous robots, more than 259M 5G devices blanketed the nation in 2024, an increase of 43M over 2023.

5G NR RAN Market Key Developments:

- In November 2024, at the "5G Open RAN Connect" conference, Viettel announced the availability of its Open RAN (O-RAN) 5G Network, which hosts key equipment developed in-house. It's the world's first O-RAN 5G network using Qualcomm Technologies' 5G RAN platforms. Vietnam-based Viettel will deploy over 300 sites across many provinces by early 2025 and expects thousands more throughout 2025 and beyond based on expansion plans nationwide and overseas. This makes Viettel one of the most vocal advocates in the O-RAN community and one of the largest carriers to bring commercial O-RAN networks.

- In February 2024, Mavenir, the leader in transforming networks into clouds, announced new developments on its OpenBeam massive MIMO (mMIMO) portfolio, powered by the Qualcomm QRU100 5G RAN platform, as a continuation of the product launch update that has been done in previous years. The company has further expanded the OpenBeam portfolio with the low-power next-generation 32TRX mMIMO variant alongside a high-power 32TRX AAU.

List of Top 5G NR RAN Companies:

- Fujitsu

- Samsung

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co., Ltd.

- Qualcomm Technologies

5G NR RAN Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

5G NR RAN Market Size in 2025 |

US$35.079 billion |

|

5G NR RAN Market Size in 2030 |

US$71.720 billion |

| Growth Rate | CAGR of 15.38% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Americas, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in 5G NR RAN Market |

|

| Customization Scope | Free report customization with purchase |

5G NR RAN Market Segmentation:

- By Technology

- Massive MIMO

- Non-Massive MIMO

- By Spectrum Band

- Sub-6-Ghz

- mmWave

- By Architecture

- Centralized RAN

- Virtual RAN

- Open RAN

- By Deployment

- Standalone

- Non-Standalone

- By Geography

- Americas

- By Technology

- By Spectrum Band

- By Architecture

- By Deployment

- By Country

- United States

- Others

- Europe, Middle East and Africa

- By Technology

- By Spectrum Band

- By Architecture

- By Deployment

- By Country

- Germany

- United Kingdom

- Others

- Asia Pacific

- By Technology

- By Spectrum Band

- By Architecture

- By Deployment

- By Country

- China

- Japan

- South Korea

- Others

- Americas