Report Overview

Acne Treatment Market - Highlights

Acne Treatment Market Size:

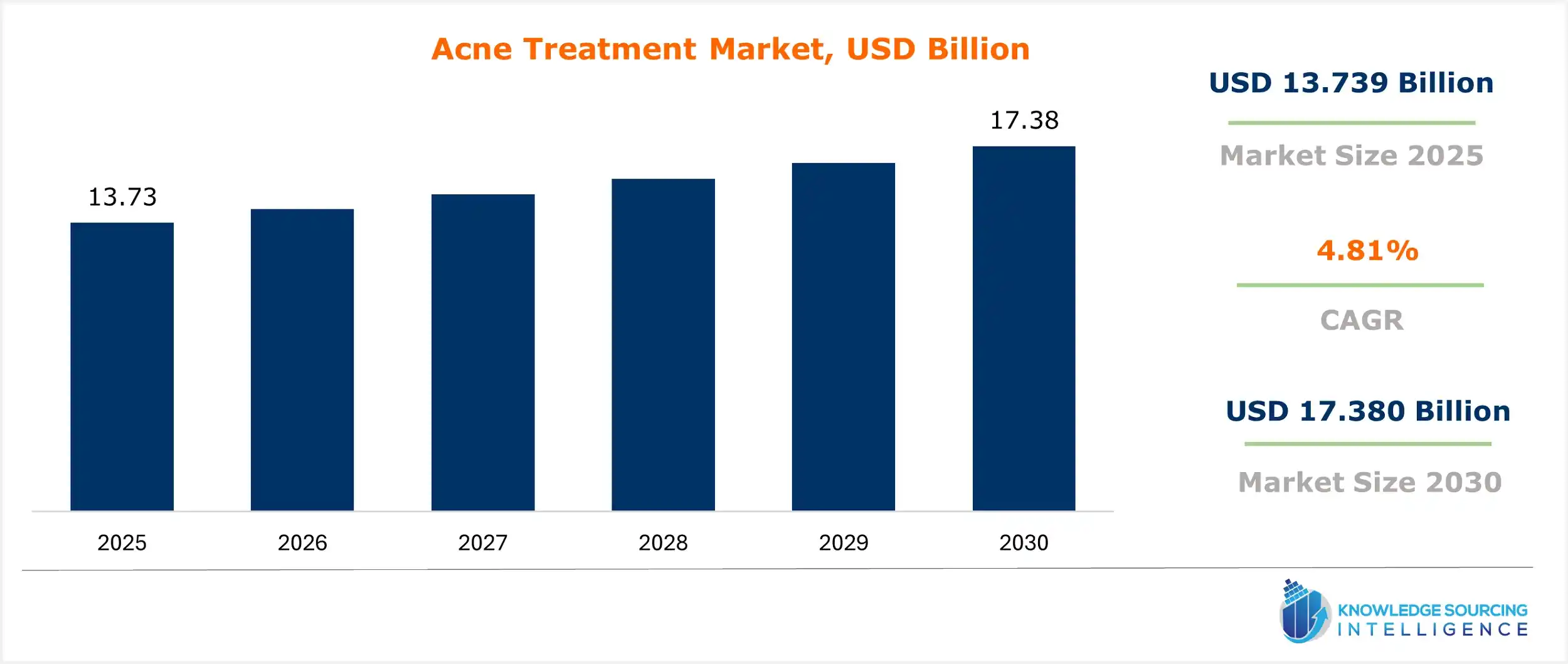

The acne treatment market is estimated to attain a market size of USD 17.380 billion by 2030, growing at a 4.81% CAGR from a valuation of USD 13.739 billion in 2025.

Acne Treatment Market Introduction:

This market is driven by diverse therapeutic measures, including a broad array of treatments for inflammation, blackheads, whiteheads, and pimples. Treatment of acne differs depending on the severity of acne and its characteristics. Depending upon the severity of acne, over-the-counter drugs can be used in the treatment of mild to moderate acne, or, for very severe acne, oral administration of drugs prescribed by physicians is dispensed. Chemical peels and microdermabrasion are methods, as well as laser-based therapies, which may be focused on treating acne lesions and skin amelioration is also a type of treatment procedure widely adopted globally.

Diverse factors act to increase the growth and adoption of the acne treatment market. Primarily, the growing prevalence of acne is one of the major factors propelling the market. The rising prevalence of acne results from various causes, including environmental factors, stress, hormone fluctuation, poor eating habits, etc. All these attributes create a higher demand for efficient treatment options.

Secondly, an increasing inclination towards skincare and personal hygiene leads to ever-increasing demand for acne treatment products and services that are sustainable and animal cruelty-free. For instance, in June 2025, Jan Marini Skin Research, a major company in the skin care industry, officially rebranded to Marini SkinSolutions. The new brand focuses on the company's commitment to transformative skincare results and expands product offerings with premium, eco-friendly, fully recyclable packaging and a cruelty-free commitment.

Acne Treatment Market Overview:

The increasing prevalence of acne in adults and adolescents, expanding knowledge of skincare, and rising demand for over-the-counter (OTC) and prescription-based therapies are all contributing factors to the robust expansion of the global acne treatment market. Numerous health statistics state that acne is among the most prevalent dermatological disorders in the world. Approximately 50 million Americans suffer from acne each year, making it the most common skin ailment in the country. Acne is becoming more common in all age groups due to several factors, including stress, poor diet, hormone imbalances, and excessive makeup use.

Furthermore, new treatment alternatives such as topical retinoids, antibiotics, laser therapy, and chemical peels are available to customers due to the developments in dermatology and aesthetics, giving them faster-acting and more effective solutions. The market is expanding as a result of customers, particularly younger demographics, actively seeking treatment for even moderate forms of acne due to the growing influence of social media and beauty standards. Additionally, as the e-commerce industry grows, acne treatment solutions are becoming more widely available, and large pharmaceutical firms are investing heavily on research and development to create new and combination therapies that are more effective and have fewer adverse effects.

Improved healthcare infrastructure, increased disposable incomes, and increased awareness of dermatological health are all contributing to the notable growth of emerging economy markets. Nonetheless, the market is confronted with obstacles like the high expense of certain sophisticated treatment methods, possible adverse drug reactions, and the psychological toll of recurrent acne, which may influence treatment compliance. Despite these challenges, ongoing innovation, a rise in dermatological consultations, and a growing need for customized skincare products are driving the global market for acne treatments to develop significantly. For instance, adult women between the ages of 20 and 40 visit the dermatology clinic most frequently for acne. According to Yale Medicine clinical trial data, acne affects 50% of women in their 20s, 33% of women in their 30s, and 25% of women in their 40s.

Acne Treatment Market Opportunities:

The growing prevalence of acne problems, along with the rising adolescent population, is rapidly aiding the acne treatment market growth, thereby providing an opportunity for market players to enhance the customer experience. Moreover, the problem of acne also happens from bad diet, poor hygiene, and sanitation, which are also prevailing in adults. These factors, causing the higher prevalence of acne, further provide a phenomenal opportunity for market players to enter the acne treatment market.

Acne Treatment Market Drivers:

- The growing prevalence of acne globally is anticipated to propel the acne treatment market.

The growing prevalence of acne due to factors such as changing lifestyles, genetics, and irregular routine is a major growth factor in the acne treatment market. According to the National Library of Medicine, eighty percent of teenagers worldwide suffer from acne in 2023; of them, 20% have moderate-to-severe acne. Furthermore, adult acne is a growing issue that affects 40% of people, according to current estimates. Moreover, according to the American Academy of Dermatology Association (AADA), around 15% of women are affected by acne annually, which further widens the acne treatment market size.

- The rising adolescent population is predicted to positively impact the market.

The major cause of clogging and acne development is age, as teenagers and younger adults are more affected by acne. The rising global adolescent population, causing more acne, indicates that the acne treatment market will grow in the coming years. According to UNICEF, there were 1.3 billion adolescents worldwide in April 2022, making up almost 16% of the total world population. Moreover, acne may cause emotional and psychological problems in a person. The growing teenage population, along with the severe emotional impact of acne, is expected to bolster the acne treatment market size.

- Technological advancements and related programs might increase the market.

The acne treatment market is always changing due to technological breakthroughs that enhance the efficacy, safety, and patient experience of various treatment choices. To maximize the therapeutic benefits of active compounds while minimizing side reactions, novel formulations make use of cutting-edge delivery technologies and components to improve the penetration of active compounds into the skin.

For example, the tailored distribution of essential components, like salicylic acid or retinoids, to certain acne-affected skin regions is made possible by microencapsulation and nanotechnology, which improves results and minimizes adverse effects. Furthermore, non-invasive options for treating acne are provided by developments in laser and light-based treatments, which target bacteria, inflammation, and sebum production while encouraging skin regeneration.

- Increased awareness of skincare and dermatological health

Growing awareness of dermatological and skincare issues is a major factor propelling the global market for acne treatments. Social media platforms, health blogs, online dermatological portals, and influencers with a skincare focus have all made information widely available to consumers, who have grown much more proactive and knowledgeable about maintaining good skin in recent years. Due to the expanding body of knowledge, people today view acne as a medical illness that necessitates preventive care and professional treatment, rather than just a cosmetic concern.

Myths surrounding acne have also been debunked through educational campaigns by dermatologists, pharmaceutical firms, and skincare brands, which encourage consumers to seek early and appropriate treatment rather than ignoring the problem or depending only on home remedies. The growth of skincare awareness campaigns emphasizing the significance of skin health for general well-being, which normalizes discussions about acne and lessens stigma, is another factor supporting the rise. Customers are more likely to spend money on over-the-counter and prescription acne treatment products with clinically proven efficacy as a result of growing media attention and the emergence of the "skin-first" beauty movement.

Users now find it simpler to adhere to evidence-based treatment regimens due to the availability of personalized skincare plans based on skin types and the severity of acne. The need to treat breakouts as soon as possible has also increased due to consumers' growing concerns about the long-term consequences of untreated acne, including pigmentation and scarring.

Increased demand for preventive and maintenance products, such as cleansers, exfoliants, toners, and serums made especially to treat acne-prone skin, has resulted from this growing awareness. This heightened awareness has also led to an increase in dermatological consultations. As a result, product innovation, brand engagement, and consumer trust are all rising, which will eventually support the acne treatment industry's overall growth. According to the L'Oréal 2023 annual report, the beauty market is divided into the following categories: 10% hygiene goods, 21% haircare, 17% makeup, 12% fragrances, and 40% skincare.

Acne Treatment Market Restraints:

Apart from all the growth factors, a few side effects of acne treatments are expected to limit the acne treatment market growth. The common side effects of topical acne drugs are dryness and irritation, which are temporary. The more serious side effects can occur in the case of oral medications, such as indigestion or dizziness caused by antibiotics.

Moreover, acne treatment medications can increase the risk of blood clots and high blood pressure in women taking birth control pills. Serious side effects from oral isotretinoin (a drug for severe acne) are possible, particularly if a woman becomes pregnant while taking it. According to reports, babies born to mothers who used isotretinoin during pregnancy had serious birth defects.

Acne Treatment Market Geographical Outlook:

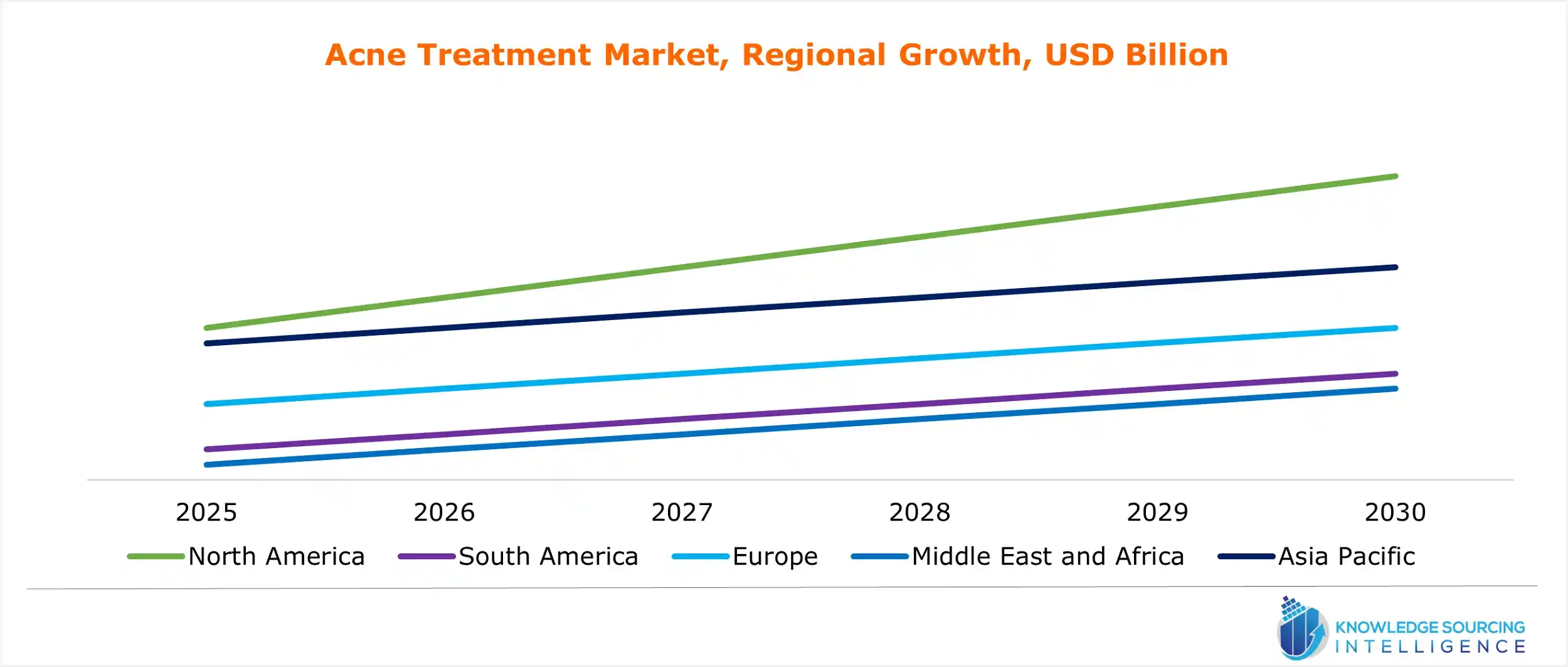

- North America is predicted to account for a significant share of the acne treatment market.

North America is expected to hold a significant share of the acne treatment market during the forecast period. The factors attributed to such a share are a huge number of acne-affected people, along with higher adoption of acne treatments. For instance, nearly 50 million Americans are affected by acne annually, and it is the most common skin condition in the US, as per the AADA. The estimates of the AADA suggest that around 85% of people get affected with at least minor acne and are aged between 12-24 years.

Moreover, the presence of major market players such as Obagi, Skinmedica, and Colorescience further contributes significantly to the acne treatment market growth through product launches and easy accessibility.

The growing pollution in the United States has impacted the lifestyle of people, especially the younger generation, who are more fit and self-conscious. Likewise, the growing working culture has increased the overall stress level in the country, thereby further impacting other physical activities of the people. Such an increase in stress level, followed by hormonal imbalance, has become one of the main causes for skin-related disease, including acne, in the United States.

Hence, according to the American Academy of Dermatology Association, acne is one of the most common skin conditions, affecting nearly 50 million people in the United States. Additionally, the same source also stated that young adults aged 12 to 24 years are more prone to such skin-condition with several cases being reported in females having high frequency.

Given the strong presence of the young population, the prevalence of skin acne is also anticipated to grow in the United States. For instance, according to the U.S Census Bureau, in 2023, the total strength of people aged less than 18 years stood at 77.189 million, while the population aged 18 to 24 years reached 33.553 million. Moreover, the same source also specified that the population aged 25 to 64 years reached nearly 172.281 million in the same year.

However, the ongoing development to bolster skin treatment has led to innovations, with concerned authorities such as the FDA approving new products. For instance, in October 2023, the US Food and Drug Administration approved Bausch Health Companies Inc.’s ‘CABTREO’ topical gel, which includes benzoyl peroxide and is designed for treating acne vulgaris in patients aged 12 years and older.

Acne Treatment Market Developments:

- In October 2023, The U.S. Food and Drug Administration (FDA) approved the New Drug Application for CABTREOTM (clindamycin phosphate, adapalene, and benzoyl peroxide) Topical Gel 1.2%/0.15%/3.1%, indicated for the topical treatment of acne vulgaris in patients twelve years of age and older, according to a statement made by Bausch Health Companies Inc. and its dermatology division, Ortho Dermatologics.

- In July 2023, a part of Crown Laboratories, Inc., Crown Therapeutics announced the release of their PanOxyl 10% Benzoyl Peroxide Acne Treatment Bar. PanOxyl has brought back their well-loved product in response to customer demand, offering a potent remedy for acne sufferers and encouraging smoother, healthier skin.

- In May 2023, the award-winning portfolio of PanOxyl® is being expanded with the introduction of its new PM Balancing Repair Moisturiser and the reformulation of its current AM Oil Control Moisturiser, as announced by Crown Therapeutics, a part of Crown Laboratories.

List of Top Acne Treatment Companies:

- Johnson & Johnson

- L'Oréal

- Unilever

- The Estée Lauder Companies Inc.

- Phytomer

Acne Treatment Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Acne Treatment Market Size in 2025 | USD 13.739 billion |

| Acne Treatment Market Size in 2030 | USD 17.380 billion |

| Growth Rate | CAGR of 4.81% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Acne Treatment Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation:

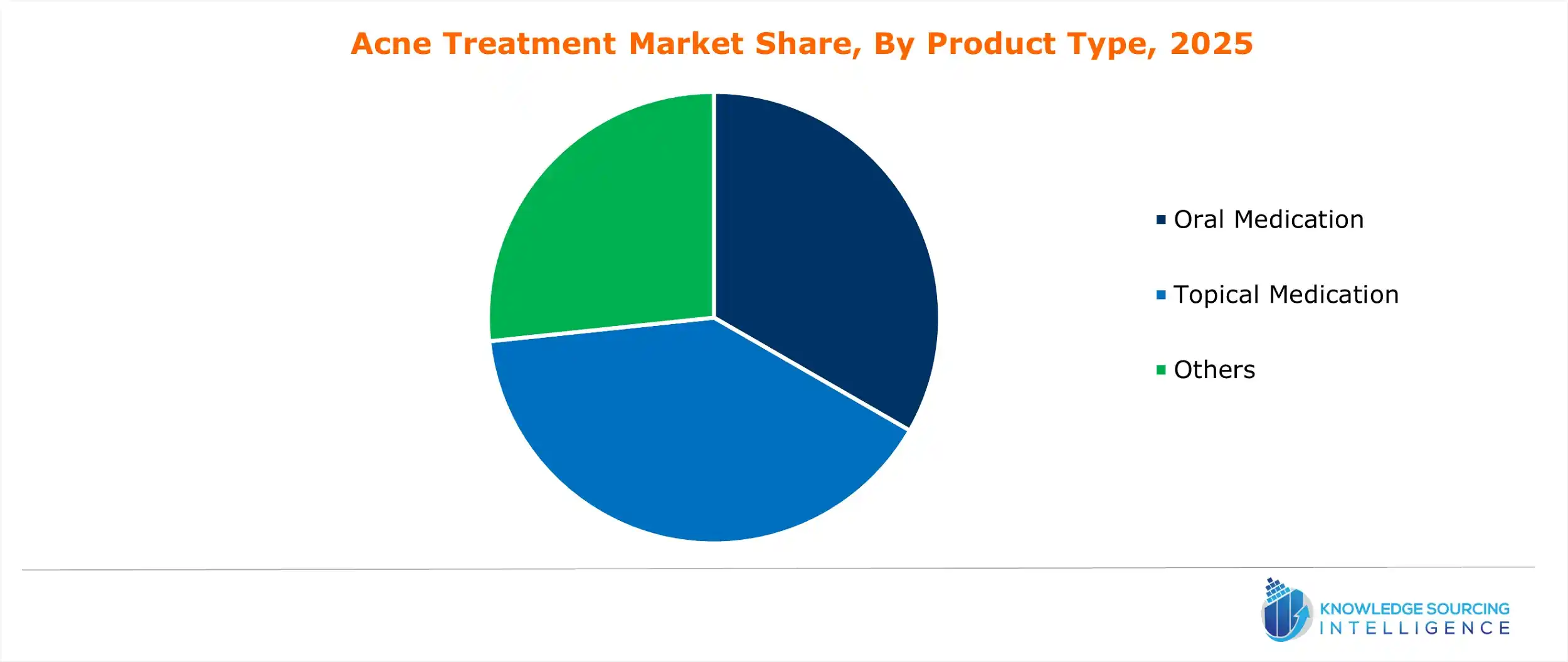

- By Product Type

- Oral Medication

- Topical Medication

- Others

- By Acne Type

- Non-inflammatory

- Inflammatory

- By Distribution Channel

- Online

- Offline

- By Age

- Up to 12 years

- 12 to 25 years

- Greater than 25 years

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America

Navigation

- Acne Treatment Market Size:

- Acne Treatment Market Highlights:

- Acne Treatment Market Introduction:

- Acne Treatment Market Overview:

- Acne Treatment Market Opportunities:

- Acne Treatment Market Drivers:

- Acne Treatment Market Restraints:

- Acne Treatment Market Geographical Outlook:

- Acne Treatment Market Developments:

- List of Top Acne Treatment Companies:

- Acne Treatment Market Scope:

Page last updated on: September 12, 2025