Report Overview

Aerosol Cans Market Report, Highlights

Aerosol Cans Market Size:

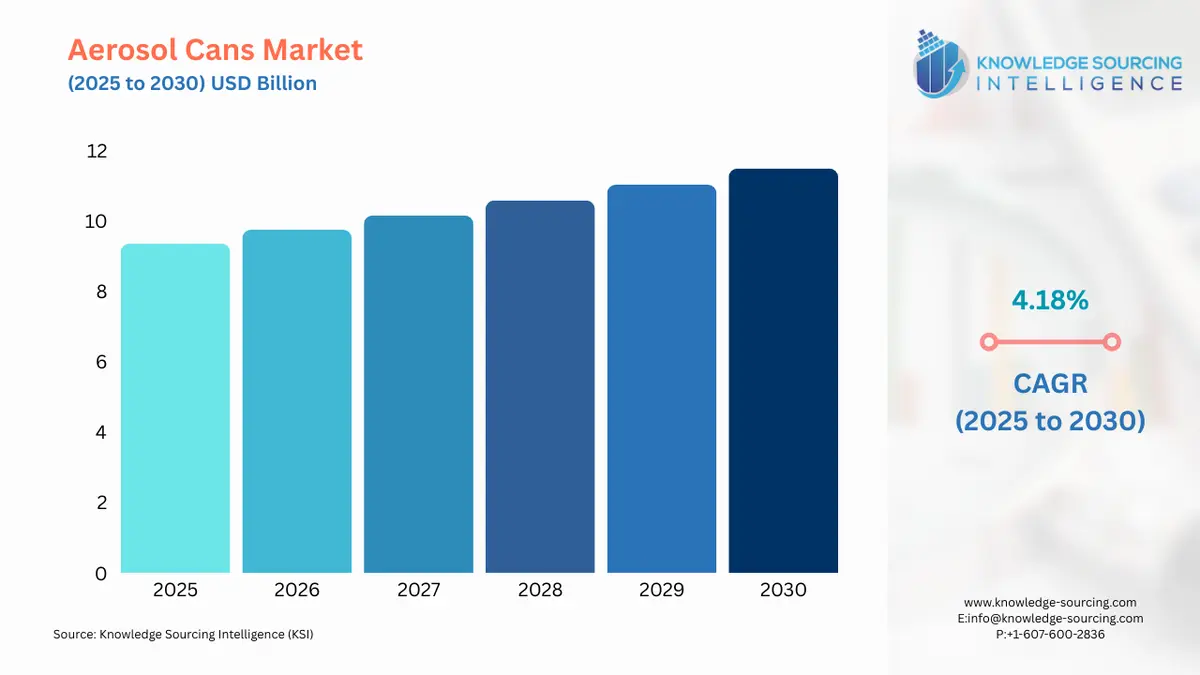

The aerosol cans market is expected to grow at a CAGR of 4.18%, reaching USD 11.490 billion in 2030, up from USD 9.361 billion in 2025.

Aerosol Cans Market Overview:

The growing demand for various products, such as deodorants, hair sprays, hair mousse, dry shampoos, insecticides, air fresheners, cleaning supplies, lubricants, and medical sprays, is expected to propel the global aerosol market.

The aerosol cans market is pivotal in packaging, leveraging aerosol valve technology and actuator innovation to deliver precise dispensing solutions across personal care, household, and industrial applications. Precision spray technology ensures controlled, efficient product release, minimizing waste, while compressed air aerosols offer eco-friendly alternatives to traditional propellants, aligning with sustainability goals. Advanced dispensing solutions enhance user experience in products like deodorants, paints, and medical sprays. The market supports various industries with customizable, hygienic packaging. This market thrives on innovation, environmental focus, and consumer convenience.

Additionally, businesses like S. C. Johnson & Son, Inc. have been working tirelessly to advertise the repellent's uses and advantages. Consequently, the demand for aerosols in the home market has risen due to increasing repellent usage. The United States' adoption of the Montreal Protocol and the growing use of the Clean Development Mechanism in the domestic manufacturing sector are expected to limit consumer demand for goods that release volatile organic compounds (VOCs). As a result, it is expected that regulatory inclination toward restricting VOC emissions will limit the demand for aerosols due to their HFC composition.

Aerosol Cans Market Trends:

The aerosol cans market is evolving with personal care aerosol packaging driving demand for sustainable, user-friendly designs in deodorants and cosmetics. Household cleaning aerosols prioritize eco-friendly propellants and ergonomic actuators for enhanced usability. Automotive spray products, like paints and lubricants, emphasize precision and durability. Pharmaceutical aerosol delivery advances with metered-dose inhalers for improved drug administration. Food aerosol packaging, such as whipped cream dispensers, focuses on hygiene and convenience. Industrial spray cans support applications like adhesives and coatings with robust, high-performance designs. These trends reflect a shift toward sustainability, precision, and versatility, catering to diverse industry needs and consumer expectations.

Aerosol Cans Market Growth Drivers:

- Rising concerns over hygiene

Human needs have greatly influenced the rise in the amount of substances utilized for various purposes, including the health of individuals in residential areas and commercial buildings. This market is expanding because of the unmatched experience that the cans offer and the propellant, which makes it simpler to dispense the product. The fast pace of urbanization, shifting lifestyles, and rising expenditure on these goods have made consumers more aware of the need to keep their surroundings tidy and sanitary. Consequently, the demand for green cleaning products is increasing. There is a constant increase in the popularity of all-natural household cleaners as people become more concerned about their well-being and the surrounding environment.

- The recyclability of aluminum cans is also leading to market growth

Brands looking to further their circular initiatives now tend to favor metal packaging. The main benefit of metal is that it can be recycled repeatedly without losing its purity or quality. The demand for aluminum cans in the global market is driven by the fact that these cans are made of high-purity aluminum. These cans offer superior packaging and a competitive advantage over other packaging types due to their high value, effectiveness, and unique metal properties. Additionally, recycling aluminum saves 97% of the greenhouse gas emissions produced during the primary production process and uses 95% less energy than manufacturing aluminum from raw materials. Furthermore, using recycled metal to make aluminum cans is 20 times more energy-efficient than other materials.

- High demand from the cosmetic industry

In the personal care and cosmetics sector, aerosol cans are widely utilized for items like body mists, hairsprays, deodorants, and shaving foams. The market for cosmetics and personal care products is expanding due to rising disposable income in emerging markets, which allows consumers to spend more on these items. Nearly half of all cans produced worldwide are used in deodorants and perfumes, which continue to be the most significant and dominant market for these cans. These are frequently positioned in the high-price range because of the material's inherent premium quality, opulent feel, and compelling visual appearance, allowing for persuasive product differentiation at the point of sale. Furthermore, aerosols provide all the convenience consumers anticipate from packaging, along with excellent quality and safety standards, especially in the premium segment.

The demand for these cans in the body care and cosmetics sectors is further driven by the marketing strategies and opportunities that sophisticated printing techniques provide for positioning brand product images in an impactful and visually appealing way.

- Expanding automotive industry

The growing automotive industry is boosting the demand for aerosol sales globally. Industrial aerosols are significantly used in the automotive sector for things like lubrication, degreasing engines, polishing vehicles, and reducing friction and wear.

Data from the International Organization of Motor Vehicle Manufacturers (OICA) indicates global passenger car sales reached approximately 63.8 million in 2023, with projections for 2024 suggesting a modest increase to around 65 million due to economic recovery and supply chain stabilization. The growing automotive production and sales will continue to accelerate the demand for aerosol cans for a wide range of automotive applications.

- Adoption of the Modern retail format

The retail sector is going through a transformation, especially in emerging economies like China, India, Brazil, and South Korea. Factors such as rising disposable incomes, changing lifestyles, hectic work-life, and expanding urbanization drive the demand for convenient and fast shopping solutions. This further drives the trend of online shopping retailers and modern trade outlets, especially supermarkets and hypermarkets.

Both existing and new player in the retail sector are experimenting with new retail formats to provide convenience to their customers. Rising modern trade trends are driving the FMCG companies to improve the packaging of their products to appeal to the customer within the limited shelf space available in the outlets. This pressure companies to go for technology advancement in the aerosol can industry, which is fuelling the global aerosol cans market growth.

Aerosol Cans Market Restraints:

- Growing environmental concerns

Rising global warming, increasing awareness about environmental sustainability issues, and strict government regulation will hinder the global aerosol cans market growth. Aerosol cans have hazardous content and propellant, making them dangerous for the environment. The commonly used aerosol propellants, such as propane, carbon dioxide, and butane, are greenhouse gases that contribute to global warming and smog formation.

Moreover, every year, individual fleet maintenance facilities and auto repair discard thousands of aerosol cans as trash, taking up valuable landfill space. Extreme temperature and moisture can cause cans to break or rust, resulting in the release of content that can potentially harm air, land, and water. To ensure safety, governments worldwide have imposed strict regulations for the use of aerosol cans. For instance, the EPA (Environmental Protection Agency) in the United States has various policies related to puncturing, venting, crushing, and shredding of aerosol cans. The strict government regulation hampers the aerosol cans market growth.

Aerosol Cans Market Segment Analysis:

- The aluminium aerosol cans segment is expected to grow substantially

By type of material, the global aerosol can market is segmented into aluminum, steel, glass, and plastic. The aluminum aerosol cans market is estimated to witness a high growth rate during the forecast period due to the rising demand for lightweight packaging and the increase in disposable income. The excellent properties of aluminum, such as being lightweight, portable, and easy to carry, make aluminum aerosol cans popular among consumers, as with rising living standards, people are prioritizing convenience over cost.

Moreover, FMCG companies are highly adopting aluminum aerosol cans as they extend the shelf life and are safe to be dispensed in various products. The recyclability property of aluminum aerosols is one of the major factors that are expected to augment the market growth because people are becoming more concerned about the sustainable environment. The growing industries such as paint, cosmetics and personal care, alcoholic beverages, and many more, combined with their increase in spending, are further expected to augment the aluminum aerosol cans market growth.

However, factors like the high cost of manufacturing aluminum aerosol cans because of an increase in power tariffs, ongoing geopolitical tensions, and sanctions that restrain specific regions from trading will hamper the aluminum aerosol cans market.

Moreover, the growing need to minimize cost and maximize efficiency owing to the competitive market has led plastic to be one of the major raw materials used for manufacturing aerosol cans, as it is cheap, has good barrier properties, is a pressure-resistant material, and has less energy-intensive production. With continuous development and innovation, providers have come up with a recyclable plastic aerosol can, which, in turn, is expected to augment the plastic aerosol cans market growth.

Additionally, with the rising demand for lightweight and convenient packaging, the demand for glass aerosol cans is decreasing. Although steel aerosol can hold a small share, its demand is increasing in response to the growth of the pharmaceutical and deodorant industries.

- The personal care & cosmetics segment will experience significant market growth

The aerosol cans market is segmented by industry vertical into personal care and cosmetics, food and beverage, healthcare, automotive, and others. The growing global aging population is the major driver of the aerosol cans market within the personal care and cosmetics industry, as aged people, especially women, tend to demand anti-aging products to look youthful. Substantial increase in demand for products such as deodorants, shampoos and conditioners, hair color sprays, and body sprays, due to growing awareness regarding personal hygiene and rising disposable incomes and living standards, is further fuelling the demand for aerosol cans.

Aerosol Cans Market Key Developments:

- In October 2023, Colep Packaging and Envases Group signed a joint venture agreement to build an aerosol packaging plant in Mexico. This agreement will enable closer client service in North and Central America.

List of Top Aerosol Cans Companies:

- Ball Corporation

- Crown Holdings Inc.

- Nampak Ltd.

- CCL Container

- Exal Corporation

Aerosol Cans Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Aerosol Cans Market Size in 2025 | USD 9.361 billion |

| Aerosol Cans Market Size in 2030 | USD 11.490 billion |

| Growth Rate | CAGR of 4.18% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Aerosol Cans Market |

|

| Customization Scope | Free report customization with purchase |

Aerosol Cans Market Segmentation:

By Type of Can:

The Aerosol Cans Market is analyzed by type, including:

- Straight Wall

- Necked In

- Shaped

By Type of Material:

The report segments the market by material types, such as:

- Aluminum

- Steel

- Glass

- Plastic

By Propellant Type:

The market is further evaluated based on propellant types, including:

- Liquefied Gas Propellant

- Compressed Gas Propellant

By Industry Vertical:

The report explores the Aerosol Cans Market across key industry verticals, such as:

- Personal Care and Cosmetic

- Food and Beverage

- Healthcare

- Automotive

- Others

Aerosol Cans Market Segmentation by regions:

The study also analysed the Aerosol Cans Market into the following regions, with country-level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and the Rest of South America)

- Europe (Germany, UK, France, Spain, and the Rest of Europe)

- Middle East and Africa (Saudi Arabia, UAE, and the Rest of the Middle East and Africa)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Our Best-Performing Industry Reports:

Navigation

- Aerosol Cans Market Size:

- Aerosol Cans Market Key Highlights:

- Aerosol Cans Market Overview:

- Aerosol Cans Market Trends:

- Aerosol Cans Market Growth Drivers:

- Aerosol Cans Market Restraints:

- Aerosol Cans Market Segment Analysis:

- Aerosol Cans Market Key Developments:

- List of Top Aerosol Cans Companies:

- Aerosol Cans Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 24, 2025